Commodity Trading Report for Gold, Silver, Crude Oil and Natural Gas

Commodities / Commodities Trading Oct 22, 2009 - 01:08 AM GMTBy: Chris_Vermeulen

Precious Metals – Gold GLD fund – Silver SLV Fund – PM Stocks GDX Fund

Precious Metals – Gold GLD fund – Silver SLV Fund – PM Stocks GDX Fund

We could start to see a shift between the price relationship between gold and the broad market. I pointed this out last week mentioning that gold and silver are starting to hold up in value while stocks sell off on big days. For example, Wednesday’s sell-off in equities did not have much effect on precious metals. This is what we want to see. It means money is moving out of stocks and into gold and silver bullion as a safe haven.

These three charts of GLD, SLV and GDX show Wednesday’s price action as gold and silver moved higher while precious metal stocks sold down with the rest of the market. This is generally a bearish indicator for gold and silver but because I am starting to see this happen more often and traders are ready for the market to top any day, I am seeing this as a bullish indicator. If the market starts to slide I have a feeling investors will be dumping a lot more money into gold and silver.

Gold, Silver, Precious Metals Stocks

Energy – Oil USO Fund – Energy Stocks XLE Fund

We are seeing a similar pattern in the energy sector. Oil had a nice move higher today while energy stocks sold off. Stocks are starting to fall out of favor.

Energy Oil Stocks

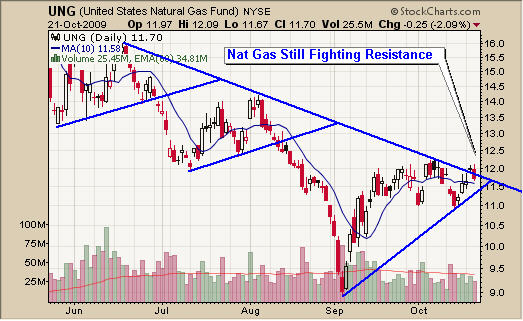

Natural Gas – UNG Fund

Natural gas is still in a bear market and trading under a major resistance trend line. This commodity could go either way so I am going to wait for the odds to be more on my side before jumping on board with a long or a short trade.

Natural Gas UNG Fund

Mid-Week Gold, Silver, Oil and Nat Gas Conclusion:

The market is starting to look and feel top heavy with many indicators and price action patterns giving cross signals. While the market could continue to rocket higher with new money getting dumped in from average investors because of solid 3rd quarter earnings, we must be cautious by tightening our stops and take some profits off the table. Until we get a short term oversold market condition I am trading very conservatively.

Waiting for a good trade is crucial in trading. If you always want to trade and force positions when the market is choppy you end up with lower probability trades.

If you would like to receive my Free Weekly Trading Reports like this please visit my website: www.TheGoldAndOilGuy.com

To Your Financial Success,

By Chris Vermeulen

Chris@TheGoldAndOilGuy.com

Please visit my website for more information. http://www.TheGoldAndOilGuy.com

Chris Vermeulen is Founder of the popular trading site TheGoldAndOilGuy.com. There he shares his highly successful, low-risk trading method. For 6 years Chris has been a leader in teaching others to skillfully trade in gold, oil, and silver in both bull and bear markets. Subscribers to his service depend on Chris' uniquely consistent investment opportunities that carry exceptionally low risk and high return.

This article is intended solely for information purposes. The opinions are those of the author only. Please conduct further research and consult your financial advisor before making any investment/trading decision. No responsibility can be accepted for losses that may result as a consequence of trading on the basis of this analysis.

Chris Vermeulen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.