Gold Calls the World Bankers’ Bluffs

Commodities / Gold & Silver 2009 Oct 26, 2009 - 01:57 AM GMTBy: Graham_Summers

In Friday’s essay we discussed the frightening chart of the US dollar index. In particular we focused on the manner in which the Dollar has broken critical support (76) and is on its way to its all time low of 72. Below that… and we’re in uncharted territory.

In Friday’s essay we discussed the frightening chart of the US dollar index. In particular we focused on the manner in which the Dollar has broken critical support (76) and is on its way to its all time low of 72. Below that… and we’re in uncharted territory.

Long-time readers know that I’m no fan of Ben Bernanke. But Bailout Ben is in no way unique in his thinking (though he has managed to spend more money than WWI, WWII, and the New Deal combined).

Indeed, virtually every central bank in the world has engaged in a massive printing orgy. Australia, Canada, China, Germany, Korea, Russia, even South Africa and Turkey have all engaged in Stimulus plans in one form or another.

They’ve also all done Gold a HUGE favor by devaluing their currencies via massive money printing. This is most obvious in the US, where Gold has broken $1,000 an ounce (a crucial line of resistance) and hit an all-time nominal high relative to the US dollar (note: I am using the Gold etf (GLD) as a proxy for gold in the charts).

As you can see, Gold has been on a tear relative to the US dollar starting in November of last year (2008). In terms of world currencies, Gold has made the most aggressive moves again the US dollar. Many thought it was simply the result of Bailout Ben’s Quantitative Easing Program…

But then, something strange happened in October. Gold ALSO started breaking above critical resistance levels in the Japanese Yen:

The Euro:

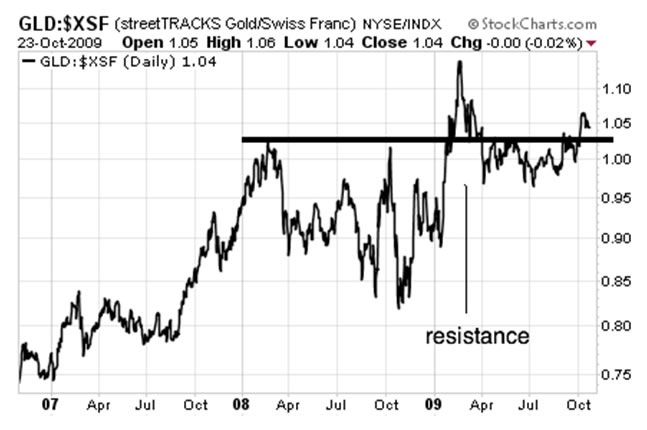

The historically “gold-backed” Swiss Franc:

And even the “commodity-friendly” Canadian Dollar:

For those doubters, the message is clear: what’s going on with Gold today is no longer about Bailout Ben’s profligate monetary policy. We are seeing a full-blown flight from paper around the world.

Gold has called the World Bankers’ bluffs.

Gold has effectively stated “you CANNOT print money like madmen and NOT damage your currency. People WILL seek a currency that CANNOT be devalued.”

To be blunt, Gold’s moves against some of the stronger currencies (Yen, Euro) are not as pronounced as those against the US Dollar (they’ve yet to hit an all-time high). However, ALL of the above charts show Gold breaking above critical historical points of resistance. Most importantly, this is happening ACROSS THE BOARD.

This is a major sign that Gold is likely entering the next leg up. The story here is no longer about flight from the US Dollar. It is now about a worldwide flight from paper money.

The implications of this are enormous. We might actually be seeing the first signs of a global currency crisis brewing here. For certain the Dollar’s status as world reserve currency is now in question. But Gold’s moves could also be telling us that NO paper money is to be trusted.

Something BIG is brewing here. And I’m already showing readers how to profit from the coming Gold explosion as investors around the world flee paper money for the one currency that CAN’T be devalued: GOLD.

While most investors buy bullion or the Gold ETF, I’ve found a unique way to buy 700+ million ounces of gold with ONE INVESTMENT. Even more incredibly, this investment currently values these incredible reserves at a measly $188 an ounce (less than one fourth the current market price).

I’ve detailed everything in a FREE Special Report How to Buy Gold For $188 an Ounce. Swing by www.gainspainscapital.com/gold.html to get your copy today!

Good Investing!

Graham Summers

Graham Summers: Graham is Senior Market Strategist at OmniSans Research. He is co-editor of Gain, Pains, and Capital, OmniSans Research’s FREE daily e-letter covering the equity, commodity, currency, and real estate markets.

Graham also writes Private Wealth Advisory, a monthly investment advisory focusing on the most lucrative investment opportunities the financial markets have to offer. Graham understands the big picture from both a macro-economic and capital in/outflow perspective. He translates his understanding into finding trends and undervalued investment opportunities months before the markets catch on: the Private Wealth Advisory portfolio has outperformed the S&P 500 three of the last five years, including a 7% return in 2008 vs. a 37% loss for the S&P 500.

Previously, Graham worked as a Senior Financial Analyst covering global markets for several investment firms in the Mid-Atlantic region. He’s lived and performed research in Europe, Asia, the Middle East, and the United States.

© 2009 Copyright Graham Summers - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Graham Summers Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.