Gold Bull Market, First the Slaughter and then the Feast

Commodities / Gold & Silver 2009 Oct 27, 2009 - 05:32 AM GMTBy: Ronald_Rosen

In spite of all the hype or perhaps because of it the “Golden Bull” is about to be slaughtered. Once death is assumed, resurrection will take place and the true feast will begin!

In spite of all the hype or perhaps because of it the “Golden Bull” is about to be slaughtered. Once death is assumed, resurrection will take place and the true feast will begin!

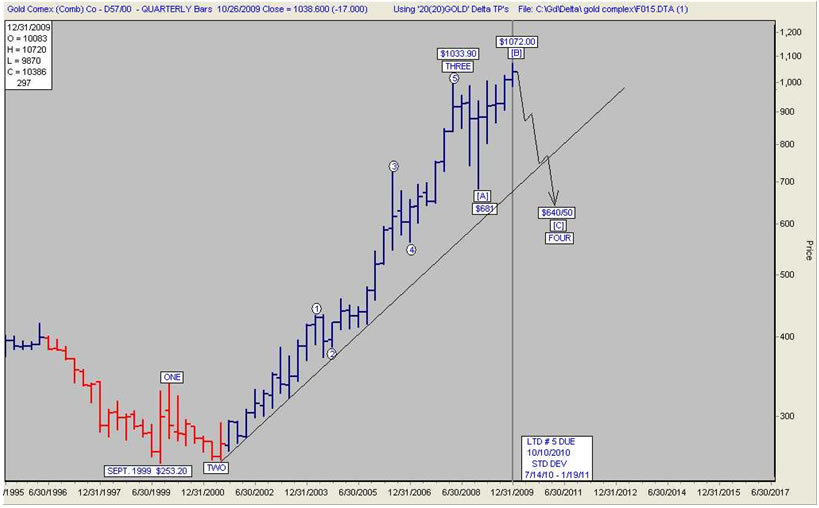

“Far more common, however, is the variety called an expanded flat, which contains a price extreme beyond that of the preceding impulse wave. In expanded flats, wave B of the 3-3-5 pattern terminates beyond the starting level of wave A, and wave C ends more substantially beyond the ending level of wave A.” E. W. P. expanded flat

GOLD QUARTERLY CHART

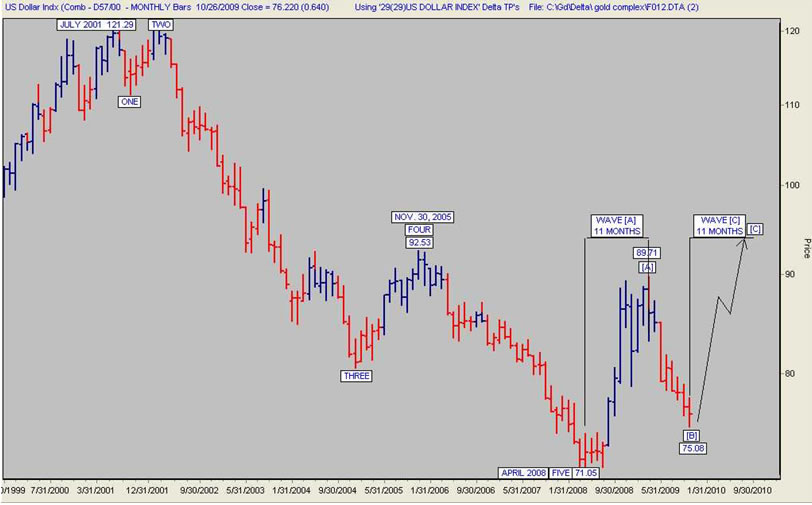

The U. S. Dollar Index gave back .786 of its [A] leg rise when it bottomed at 75.11. It would be normal if the [C] leg is approximately as big as the [A] leg. The [A] leg rose 18.66 points. The [B] leg bottomed at 75.11. 18.66 plus 75.11 gives us a probable [C] leg high of 93.77.

U. S. DOLLAR INDEX WEEKLY

If the [C] leg up of the U. S. Dollar Index reaches the 93.77 level it will surpass the high of 92.53 made in November 30, 2005. If this occurs, and I expect that it will, the precious metal shares may very well be below bargain basement prices. The gloom and doom towards the precious metals complex should be huge. However, since this is very early on in the probable decline let’s not get too excited. We have a long way to go on the downside before any bargains arrive.

U. S. DOLLAR INDEX MONTHLY

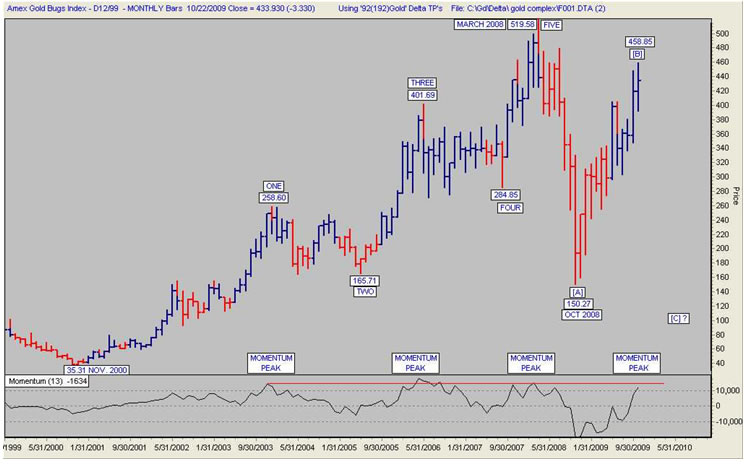

The HUI appears to have completed the B leg up of a ZIG-ZAG formation. At the bottom of this monthly chart of the HUI you can see that the momentum indicator has reached a level that has produced tops on four previous occasions since the bull market in the HUI began in November 2000. The [C] leg in the HUI should bottom below the [A] leg. The [A] leg bottomed at 150.27. Below 150.27 and the gold shares should be selling at bargain prices. That will be when the gold feast begins. Bargain prices galore for the precious metal shares should be prevalent.

TO THE FEAST!

TO THE FEAST!

HUI MONTHLY

Subscriptions to the Rosen Market Timing Letter with the Delta Turning Points for gold, silver, stock indices, dollar index, crude oil and many other items are available at: www.wilder-concepts.com/rosenletter.aspx

By Ron Rosen

M I G H T Y I N S P I R I T

Ronald L. Rosen served in the U.S.Navy, with two combat tours Korean War. He later graduated from New York University and became a Registered Representative, stock and commodity broker with Carl M. Loeb, Rhodes & Co. and then Carter, Berlind and Weill. He retired to become private investor and is a director of the Delta Society International

Disclaimer: The contents of this letter represent the opinions of Ronald L. Rosen and Alistair Gilbert Nothing contained herein is intended as investment advice or recommendations for specific investment decisions, and you should not rely on it as such. Ronald L. Rosen and Alistair Gilbert are not registered investment advisors. Information and analysis above are derived from sources and using methods believed to be reliable, but Ronald L. Rosen and Alistair Gilbert cannot accept responsibility for any trading losses you may incur as a result of your reliance on this analysis and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Individuals should consult with their broker and personal financial advisors before engaging in any trading activities. Do your own due diligence regarding personal investment decisions.

Ronald Rosen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.