Gold Drifts Lower Despite Record U.S. Debt Ever Sold in a Week

Commodities / Gold & Silver 2009 Oct 28, 2009 - 05:25 AM GMTBy: GoldCore

Gold closed trading at $1,037.20/oz. In euro and GBP terms gold is trading at €700/oz and £634/oz. Gold's short term frothiness after sharp gains has led to profit taking and an expected correction back down to previous resistance at the $1,030/oz level.

Concerns regarding the sustainability of the recent recovery are increasing after yesterday's poor consumer confidence number (and last week's poor jobs and housing data). Concerns about the health of the US consumer and wider US economy are likely to lead to the dollar remaining under pressure in the medium and long term which bodes well for gold. As does the fact that there is a growing realisation that governments cannot print money forever. At some stage in the coming months, the extraordinary stimulus and debt monetization seen internationally will have to end and this may derail the fragile global economic recovery.

Concerns regarding the sustainability of the recent recovery are increasing after yesterday's poor consumer confidence number (and last week's poor jobs and housing data). Concerns about the health of the US consumer and wider US economy are likely to lead to the dollar remaining under pressure in the medium and long term which bodes well for gold. As does the fact that there is a growing realisation that governments cannot print money forever. At some stage in the coming months, the extraordinary stimulus and debt monetization seen internationally will have to end and this may derail the fragile global economic recovery.

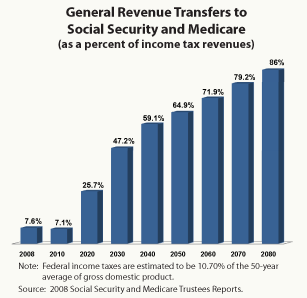

This week's record issuance of US Treasuries (the greatest amount of debt ever sold in one week) will test international appetite for US debt. The net debt increase of $153 billion is so high it will exceed the current authorized federal debt limit of $12.1 trillion (upcoming vote to raise the federal debt ceiling to $13 trillion and this does not include the US' massive unfunded liabilities of Medicare and Social Security). Support for gold will come from continuingly high oil prices and the dollar remaining under pressure and support is currently seen at $1,027.70/oz and resistance at $1,050.50/oz.

Silver

Silver is trading at $17.08/oz. In euro and GBP terms silver is trading at €11.23/oz and £10.17/oz.

Platinum Group Metals

Platinum is trading at $1,317/oz while rhodium and palladium are trading at $1,800/oz and $325/oz respectively.

This update can be found on the GoldCore blog here.

The Bullion Services Team

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.