The Summer Pause That Refreshes the Stock Market

Stock-Markets / Technical Analysis Jul 09, 2007 - 05:33 PM GMTBy: Hans_Wagner

There is a Wall Street phrase that “Sell in May and go Away” that means that most of the money tends to be made between November and May. There are actual studies that have shown if one were fully invested in the market from November to May and then moved their money into safe interest bearing instruments like CDs, they make more money than staying invested in the market throughout the year. Now that we are entering the heart of summer, we need to consider if 2007 will follow a similar pattern.

There is a Wall Street phrase that “Sell in May and go Away” that means that most of the money tends to be made between November and May. There are actual studies that have shown if one were fully invested in the market from November to May and then moved their money into safe interest bearing instruments like CDs, they make more money than staying invested in the market throughout the year. Now that we are entering the heart of summer, we need to consider if 2007 will follow a similar pattern.

The chart below from Chart of the Day , illustrates the average monthly gain of the S&P 500 (the largest companies) and the Russell 2000 (the smaller companies). As shown all stocks tend to under perform during the summer. If we are following this pattern, then the market is entering the weakest months of July and August.

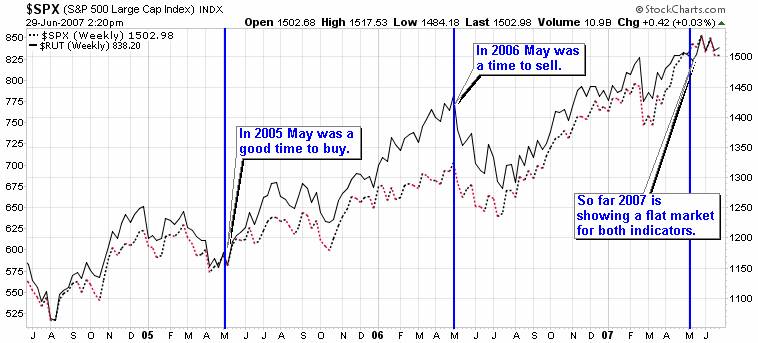

The chart below shows the S&P 500 (dotted line) and the Russell 2000 (solid line). What is interesting about these two charts is in May of 2005, it was a time to buy, not sell. However, in May of 2006 the rule was correct with July being the bottom. So far in 2007 we have experienced a flat summer market that began in May. In addition both indexes are performing almost the same during May and June 2007.

So the first question is will history repeat itself or will the market surprise us again? The major influences in the summer are corporate earnings that begin in July and last until the middle of August, weather and global events. For the S&P 500 analysts are expecting earnings to be in the 5.0 to 5.3% area for this quarter.

Remember that last quarter companies surprised dramatically to the upside as executives learned to under promise and over deliver. I doubt we will see as big a difference as last quarter, but I believe actual earnings will be above current expectations. Earnings growth of 6% will not be enough to cause the market to overcome the summer blahs. It will take more like 8 to 10%, I believe, which is not likely. So I do not expect earnings to cause the market to change its normal summer pull back.

What about the weather, actually hurricanes. Well, the forecast is for several severe hurricanes this summer, but they said that last year. In any case it is definitely a possibility and something to be monitored.

Then there are any serious global events that would impact the current situation. Again, these are hard to predict. The best strategy is to be ready when they happen to take action. However, the markets tend to be quite resilient in these cases, so investors should not be too concerned. After all, the markets barely blinked with the most recent car bomb threats in London and Glasgow.

So what should investors do now? The most likely case is we will see a slight pull back (probably in the 5% area) during July and into August. Actually this would be good for investors, especially those with cash on hand to invest once prices pull back further to new support levels. Use the time wisely to find quality companies with good earnings growth and are at strong support levels.

By Hans Wagner

tradingonlinemarkets.com

My Name is Hans Wagner and as a long time investor, I was fortunate to retire at 55. I believe you can employ simple investment principles to find and evaluate companies before committing one's hard earned money. Recently, after my children and their friends graduated from college, I found my self helping them to learn about the stock market and investing in stocks. As a result I created a website that provides a growing set of information on many investing topics along with sample portfolios that consistently beat the market at http://www.tradingonlinemarkets.com/

Hans Wagner Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.