Quality Individual U.S. Companies

Companies / Investing 2009 Nov 09, 2009 - 12:35 AM GMTBy: Richard_Shaw

We generally prefer investment funds over individual stocks to minimize investment selection risk (focusing more on asset allocation as the greater issue). However, when we do look at individual stocks, we focus on quality companies with financial strength, limited leverage, solid cash flow, and growing sales and dividends.

This short list consists of companies that are candidates for consideration. If you are a do-it-yourself investor who prefers individual stocks; and you have a non-speculative, conservative approach, this list may be worth researching further.

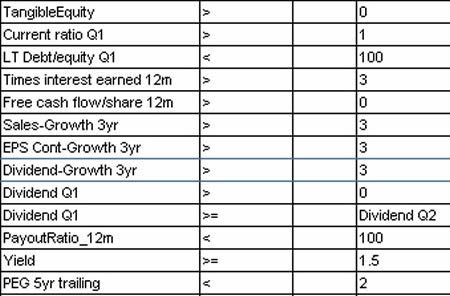

We identified those companies that S&P rated B+ or better for earnings and dividend strength, and which paid dividends continuously for at least 10 years. Subsequently, we ran that list through a fundamental filter (described below) to arrive at this list of six prospects.

These are not recommendations for purchase, but they are a list that has been “worked over” a bit from the data angle. We have not made a thematic evaluation and make no representation about the “story” for each company. That’s up to you to do that. You need to look into them more fully before deciding to own any of them. At a minimum, this list may save do-it-yourself investors some work.

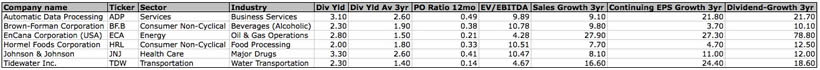

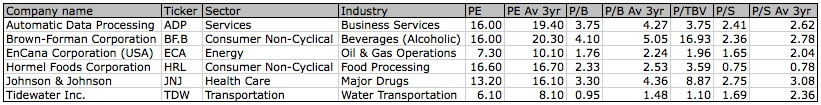

The two tables that follow each contain the same list, but with different quantitative attributes.

Filter Results 11/06/2009

Companies in the tables: ADP, BF.B, ECA, HRL, JNJ, TDW.

Here are the screening criteria we used on the companies we first identified through S&P as strong and with 10 years or more of dividends payments:

By Richard Shaw

http://www.qvmgroup.com

Richard Shaw leads the QVM team as President of QVM Group. Richard has extensive investment industry experience including serving on the board of directors of two large investment management companies, including Aberdeen Asset Management (listed London Stock Exchange) and as a charter investor and director of Lending Tree ( download short professional profile ). He provides portfolio design and management services to individual and corporate clients. He also edits the QVM investment blog. His writings are generally republished by SeekingAlpha and Reuters and are linked to sites such as Kiplinger and Yahoo Finance and other sites. He is a 1970 graduate of Dartmouth College.

Copyright 2006-2009 by QVM Group LLC All rights reserved.

Disclaimer: The above is a matter of opinion and is not intended as investment advice. Information and analysis above are derived from sources and utilizing methods believed reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Do your own due diligence.

Richard Shaw Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.