The Crack-up Boom Series Part V, Introduction - It's Bigger Than Just the dollar!

Economics / Money Supply Jul 11, 2007 - 12:09 AM GMTBy: Ty_Andros

For greater insight into our publication, have a look at the Overview of Tedbits . It helps current and potential subscribers understand our mission in serving you. It also gives a broad description of what's unfolding globally and what you can expect from Tedbits as a regular reader.

Crack-Up Boom Series Intro

The Crack Up Boom series is exploring the unfolding “Indirect Exchange” (as detailed by Ludvig Von Mises), that dollar holders will be using to exit their holdings now and eventually is will be followed by all holders of fiat currency holdings no matter which country is perpetrating the “crime” of confiscation of wealth through the printing and credit creation process that all such monetary schemes evolve into.

The “Crack Up Boom” will drive an inflationary global expansion to inconceivable heights over the coming years. Asset prices will skyrocket as people do what they always do when threatened they will modify their behavior and do the things necessary for “SELF PRESERVATION” of their families, countries, economies and their wealth. Let's take a look at Von Mises's description of the CRACK UP BOOM once again:

This first stage of the inflationary process may last for many years. While it lasts, the prices of many goods and services are not yet adjusted to the altered money relation. There are still people in the country who have not yet become aware of the fact that they are confronted with a price revolution which will finally result in a considerable rise of all prices, although the extent of this rise will not be the same in the various commodities and services. These people still believe that prices one day will drop. Waiting for this day, they restrict their purchases and concomitantly increase their cash holdings. As long as such ideas are still held by public opinion, it is not yet too late for the government to abandon its inflationary policy.

But then finally the masses wake up. They become suddenly aware of the fact that inflation is a deliberate policy and will go on endlessly. A breakdown occurs. The crack-up boom appears. Everybody is anxious to swap his money against "real" goods, no matter whether he needs them or not, no matter how much money he has to pay for them. Within a very short time, within a few weeks or even days, the things which were used as money are no longer used as media of exchange. They become scrap paper. Nobody wants to give away anything against them.

It was this that happened with the Continental currency in America in 1781, with the French mandats territoriaux in 1796, and with the German mark in 1923. It will happen again whenever the same conditions appear. If a thing has to be used as a medium of exchange, public opinion must not believe that the quantity of this thing will increase beyond all bounds. Inflation is a policy that cannot last. Thank you Ludvig.

Unfortunately, for us all this is now NOT an isolated currency policy as detailed in the last paragraph, as globally virtually “ALL” governments are pursuing this policy at this point. So first we will see the biggest offenders suffer from their hubris AKA the “UNITED STATES” then it will rotate to all countries who follow such monetary policies. Public Servants always and every time have become Public Serpents robbing their constituents to further their personal ambitions and collection of power and wealth.

It's Bigger Than Just the Dollar

As regular readers know we have detailed the central bank fiat money phenomenon that has accelerated during the term of Alan Greenspan and now his successor Ben Bernanke. His prescription for every financial and/or economic problem was the US treasuries printing press. He has destroyed the dollars purchasing power enormously since his first episode of irresponsibility, which was the 1987 stock market crash. As central bankers and politicians worldwide observed his actions they too began to emulate his irresponsibility. Inflation, which began its life as government policy in the early 1970's, is doing what it always has done when in the hands of politicians/public servants. DESTROYING THE VALUE OF WHAT YOU HOLD YOU'RE WEALTH IN, THE CURRENCY AS IT SITS IN THE BANK!

As it created the illusion of prosperity and short-lived soft recessions. Essential to reelection hopes of many a politician; therefore they are hearty endorsers of this course of action (rampant money and credit creation). The world's economies have just enjoyed the best four-year stretch of growth since the early 1970's. At the same time it has also seen the greatest explosion in debt issuance in recorded history. A debt bubble extraordinaire. Debt by its very nature is deflationary as it is a call on future income. Oh and what a call it is. The future liabilities of the governments of the industrialized western world (welfare states) are unimaginable, almost uncountable and unpayable in current dollars, Euros, British pounds, etc. So you can expect the to print more of them

Greenspan' and now Bernanke's money printing has now beget fiat money creation worldwide as governments compete to devalue their currencies in competition for trade advantages and to reduce the value of their emerging liabilities. A competitive devaluation raceway, a race to the bottom. Most monetary expansion is done through the issuance of debt, mortgage, consumer, government, etc. We can see this inflation in the in the value of assets of all kinds, financial, real estate, commodities as their prices have skyrocketed in terms of paper “FIAT” money. Let's take a look at Year over year money supply growth courtesy of Financialsence.com:

Historically, in Argentina , Zimbabwe and the Weimar republic this can be seen as every thing went up except the value of the money. This is now unfolding GLOBALLY as the “CRACK UP BOOM” emerges. The purchasing power of the dollar has declined at an 18% compounded annual rate since 2002. This can be seen in the price of gold in foreign currencies as well, as gold is breaking out against all major currencies around the world. Now let's look at the charts and do a little work using the rule of seventy-two. The rule of seventy-two is that you can take the number 72 and divide it by an annual growth rate and determine how long it takes to double the price asset on a compounded basis. For example, if something is growing in price at an 11% annual rate, using the rule of seventy two it is calculated; 72 divided by 11 = 6.54. The time it will take to double the underlying number is 6.54 years. Now let's do this to money and credit supply data from around the world.

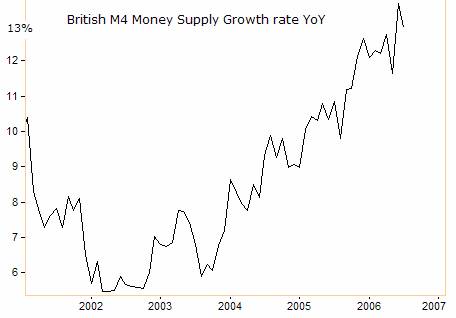

We will start with the United Kingdom :

This chart was compiled in October 2006, but recent money supply reports from the Bank of England confirm its continued expansion at this rate. Using the rule of seventy 72, 72 divided by 14 = 5.14 years to double the money supply. This implies that asset prices will double in terms of British pounds every 5.14 years and that savings will purchase half of what they do now in 5.14 years. Since some of this plain old money printing from which the government pays its bills with and most of this new money is actually debt.

Therefore, reducing the money supply growth rate implies some form of defaults as the debts become unserviceable as the rate of money supply growth does not support the additional new “PONZI” finance necessary to create a new fool to buy the inflated asset value. It is also problematic that an economy growing 4 to 5 percent per year is creating money at a 14% rate indicating 3.5 British pounds of new debt for every dollar of new GDP

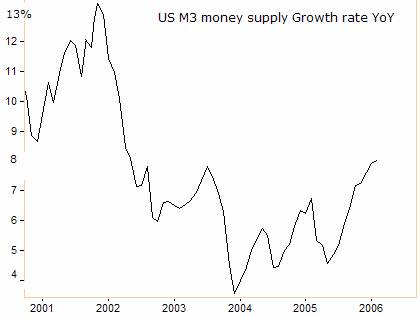

United States :

Of course this is through Marc h 23, 2006 as the Federal Reserve quit printing this at that time. M3 has now been reconstructed by a number of private economists and is now widely reported at 13.7%, and acceleration of over 50% since march 2006. Using the rule of seventy-two; 72 divided by 13.7 the US is doubling the money supply every 5.25 years years. Last October at an International monetary conference Treasury Secretary Hank Paulson “GUARANTEED” that the US sub prime and housing bust would not evolve into a global liquidity crisis, now we know what he meant as this is its definition. Bens helicopters are now patrolling the banking industry dropping money into the holes as they occur. If you add the money that the government borrows from the Social security trust fund the US deficit soars to over 700 + billion on a yearly basis. The US government's unfunded liabilities have grown from 20 trillion in 2000 to over 47 trillion today according to the GAO, the government accounting office.

Real household incomes increased about 100 billion dollars in 2005, while consumer debt was up over 1 trillion. Bush has increased government an astounding 60% since 2000 and with military spending skyrocketing and the US government trying to dominate the world do you think this money and debt creation is going to abate? No way. The recent ascension of the NEW democratic congress presages even more government spending on the near horizon as rewards to campaign contributors past and future. The approaching 2008 elections are ALREADY front and center and the buying of votes is already in their spending plans. All the candidates are running on a platform of “FREE” healthcare. I hope they have sent their orders for additional printing presses to the manufacturers.

Eurozone:

Since this chart was created last October EUROZONE money supply growth has accelerated to almost 10.9%! A 42% increase in the rate of growth since last OCTOBER. Using the rule of 72; 72 divided by 11= 6.60 years to double the money supply. Growth in the Euro zone is good if it approaches 2% using the rule of 72 its economy doubles every 36 years!!! This will accelerate as the new Euro zone entrants are growing considerably faster. It is a disaster for the old EU. The politicians are in full control of this supposedly INDEPENDANT central bank.

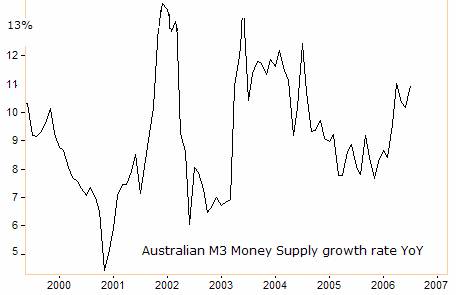

Australia :

Since this chart was created Aussie money supply growth has accelerated to over 14.7% in recent Ce ntral bank reports. An increase in the rate of expansion of OVER 40% Using the rule of 72; 72 divided by 14.7 % the supply of money is doubling every 4.89 years. Australia has gotten its external debts in order and has budget surpluses.

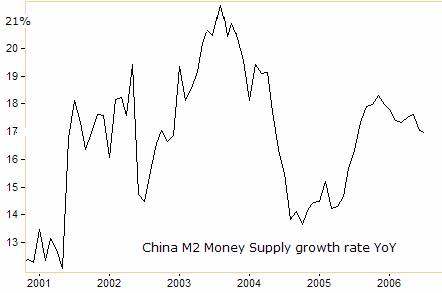

China :

In April 2007 money supply growth was equal to what we see in this chart. Look at this explosive growth, wow. Using the rule of 72; 72 divided by 18.4% they are doubling the size of money and credit every 3.91 years!!! A blistering pace. Remember they sit on over 1.3 trillion dollars of reserves, and are turning away from more dollars. They are on a worldwide spending spree before the dollar really gets clobbered. Bond market debacle anyone? Think of the danger we face from modern day Smoot Hawley's; Senators Chuck Schumer and Lindsey Graham, and their idea for 27% tariffs on Chinese imports. This is their idea of protecting the poor, raising the costs of what they buy at Wal-Mart and other discounter by 27%. New legislation been introduced Presidential candidates Clinton and Obama targets this critical funding source for the US deficit spending. Can you here the trade Unions in the background?

India :

India , just like China , sit on huge reserves of 220 BILLION dollars, using the rule of 72; 72 divided by 19.1% = doubling of the money supply every 3.76 years. Phew. Gold anyone?

Russia 's money supply growth is 45% year over year; 72 divided by 45 = doubling the money supply every 1.6 years. Once again huge reserves of over 400 BILLION dollars on their books.

I could keep on going but you get the idea, anyone holding cash is in danger. On the surface nothing bad can happen at this point, as there is lots of cash in the proverbial cookie jar. Pullbacks in markets will be only temporary as this flood of money has to find a home to try and preserve purchasing power against the powerful central bank money printing machines. Do you really think these governments state inflation accurately?

It is a booming economy courtesy of the illustrations above. It is the theft of savings by government as they destroy the values of those currencies held in bank accounts and fixed income instruments. It is the cheating of retirees “current and future” who get pensions that constantly lose value. The purchasing power of the currencies they are paid in mimicking the action the proverbial ice cube in your hand. It is the destruction of purchasing power of current workers as they only can buy less with each new paycheck.

It is the destruction of lenders “BOND HOLDERS” who lend money based upon government inflation measures. Take a look at this chart courtesy of John Williams' at www.shadowstats.com , this is CPI (Consumer price index) from before Clinton took office.

Let's recall Von Mises's description from above:

But then finally the masses wake up. They become suddenly aware of the fact that inflation is a deliberate policy and will go on endlessly. A breakdown occurs. The crack-up boom appears. Everybody is anxious to swap his money against "real" goods, no matter whether he needs them or not, no matter how much money he has to pay for them.

The first wave of the public the “SMART MONEY” has woken up and is leading the charge to exit through the “indirect exchange” provided by “STUFF” and Units of production called stocks, and of course some the liquidity you see being created is making a direct beeline for stocks as well, a new government created stock market boom to offset Investor balance sheet losses in the unfolding sub prime, CMO (collateralized mortgage obligations), and CDO (collateralized debt obligations) debacles.

You can expect inflation to accelerate as this dawns on people and they seek the safe harbor of the unfolding “CRACK UP BOOM”. The definition of inflation is spending your money now because you believe prices will be higher in the future; this is the definition of inflation!!! Economies will continue to grow on the headline number after stated inflation, not real inflation. There is lots of money around so any market set backs are temporary as money is seeking returns, no matter how much risk. Just look at the spread on treasuries versus junk bonds or emerging debt. This cash hoard is chasing RETURNS. If you buy a US T Bill that yields 5% it takes 14.4 years to double the money while the governments double their money supplies every 2 to 9 years, and of course M3 is a lie!!! What about holders of 10-year notes and longer dated treasuries of any government, these people are big LOSERS, bonds are BOMBS.

There is more paper sitting in bank accounts denominated in currencies of all Stripes (American and Aussie dollars, British pounds, Euros, Rupee, Rubles, Yuan, Yen,etc.) than can be imagined. Paper Fiat currencies are under a full frontal assault to their robustness, store of value, and their ability to retain purchasing power, the thought that these various foreign currencies can rally against the dollar while being created at the rates outlined is simply mind-boggling. It shows you how much of the coming debasement is being priced into the dollars market value!!!

What is supposed to be the safest investments in the world “government bonds” are actually government sponsored theft! These bonds are rated AAA and institutions, pension funds and big money gobble them up, are they smart money? NO, as this monetary debasement can NEVER be withdrawn or the world's financial system will suffer SYSTEMIC failure as the Asset backed economies and financial systems would IMPLODE if is was. The world is booming on the back of a wave of fiat money and debt creation. IT is going to continue to BOOM! Bonds are bombs for anyone holding them, as the unfolding crack up boom caused by the aforementioned CUBIC money creation, but non printables (precious metals, commodities, raw materials, energy, real estate, etc.) or units of production (stocks) are in as they will just “REPRICE” upward in the constantly melting paper in the unfolding “CRACK UP BOOM”.

In conclusion, there's a lot of people that are just waiting for a deflationary collapse, I urge you not to hold your breath for this. This boom has a long way to run, the US may be broke, but the rest of the world is in the pink. US money printing reconstructed at 13.7% growth demonstrates to you the Federal Reserves play book for handling coming banking crisis. Next week the CRACK UP BOOM series will be covering the “SMOKE SIGNALS” in the numbers and markets. It will be an interesting look at what various markets are signaling in chorus to on another. We will also be doing an interesting piece of the stock market and years ending in 7, the back side of those episodes is FASCINATING.

If you are looking to find an investment that is up to meeting the challenges of today's markets contact me through www.TraderView.com , thank you for reading Ted bits, if you enjoyed it send it to a friend, and subscribe its free as www.TraderView.com .

By Ty Andros

TraderView

Copyright © 2007 Ty Andros

Tedbits is authored by Theodore "Ty" Andros , and is registered with TraderView, a registered CTA (Commodity Trading Advisor) and Global Asset Advisors (Introducing Broker). TraderView is a managed futures and alternative investment boutique. Mr. Andros began his commodity career in the early 1980's and became a managed futures specialist beginning in 1985. Mr. Andros duties include marketing, sales, and portfolio selection and monitoring, customer relations and all aspects required in building a successful managed futures and alternative investment brokerage service. Mr. Andros attended the University of San Di ego , and the University of Miami , majoring in Marketing, Economics and Business Administration. He began his career as a broker in 1983, and has worked his way to the creation of TraderView. Mr. Andros is active in Economic analysis and brings this information and analysis to his clients on a regular basis, creating investment portfolios designed to capture these unfolding opportunities as the emerge. Ty prides himself on his personal preparation for the markets as they unfold and his ability to take this information and build professionally managed portfolios. Developing a loyal clientele.

Disclaimer - This report may include information obtained from sources believed to be reliable and accurate as of the date of this publication, but no independent verification has been made to ensure its accuracy or completeness. Opinions expressed are subject to change without notice. This report is not a request to engage in any transaction involving the purchase or sale of futures contracts or options on futures. There is a substantial risk of loss associated with trading futures, foreign exchange, and options on futures. This letter is not intended as investment advice, and its use in any respect is entirely the responsibility of the user. Past performance is never a guarantee of future results.

Ty Andros Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.