We're Going to Need a Good Recession to Avoid Much Higher Energy Prices!

Commodities / Crude Oil Jul 11, 2007 - 03:38 PM GMTBy: Tim_Iacono

The International Energy Agency released their " Medium-Term Oil Market Report " a short time ago - it looks like we're going to need a good recession to avoid much higher energy prices over the next few years.

Thought you might like to hear that first thing on a Monday morning - here's why:

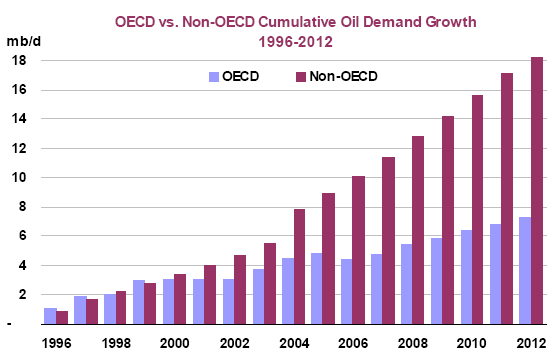

Apparently, demand is expected to win out over supply in the years ahead, largely a result of increasing consumption by Non-OECD Countries.

All the OECD countries are shown in blue below, non-OECD countries would probably be everything else.

They must hate being referred to in this way - being called a non-anything sounds condescending and with an acronym like OECD, you never know whether the first "n" should be capitalized.

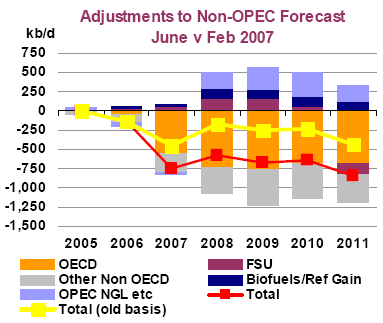

Here's a chart for the supply side - forecasts for non-OPEC oil production are being revised downward:

Now "non-OPEC" doesn't sound nearly as bad as "non-OECD" - why is that?

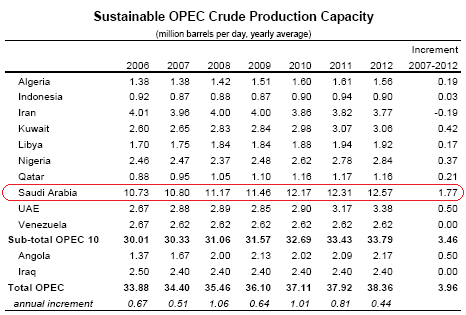

Here's the scariest part - the world is counting on increasing output from Saudi Arabia over the next few years to help keep demand from getting too far ahead of supply:

Oh Dear! Does the world have enough drill rigs to make this happen?

The entire report(.pdf) is free at the Wall Street Journal, maybe it would be a good idea to read the thing instead of just picking out charts.

The first paragraph of the WSJ story($) must have created a sense of urgency to share this news with readers.

" In a dire forecast, the Paris-based International Energy Agency is warning of an impending crunch in the supply of oil and natural gas needed to power world economic growth in coming years."

It looks like we're going to need a good recession.

By Tim Iacono

Email : mailto:tim@iaconoresearch.com

http://www.iaconoresearch.com

http://themessthatgreenspanmade.blogspot.com/

Tim Iacano is an engineer by profession, with a keen understanding of human nature, his study of economics and financial markets began in earnest in the late 1990s - this is where it has led. he is self taught and self sufficient - analyst, writer, webmaster, marketer, bill-collector, and bill-payer. This is intended to be a long-term operation where the only items that will ever be offered for sale to the public are subscriptions to his service and books that he plans to write in the years ahead.

Tim Iacono Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.