What Bernanke's Economic Recovery Means for U.S. Jobs

Economics / Employment Nov 16, 2009 - 03:39 PM GMTBy: Mike_Shedlock

Earlier today, At the Economic Club of New York, Fed Chairman Ben Bernanke gave his Outlook for the Economy and Policy.

Earlier today, At the Economic Club of New York, Fed Chairman Ben Bernanke gave his Outlook for the Economy and Policy.

His speech contains much self-serving claptrap about how Federal Reserve policy save the day. Nowhere has the Fed admitted its role in creating the mess.

Bernanke thinks printing money and borrowing from the future via cash-for-clunkers can have lasting benefits. I think that if anything lasting comes from cash-for-clunkers, it will be net-negative.

Bernanke is still extremely concerned about commercial real estate, bank lending, and jobs. On those issues he is certainly right to be concerned. Here are a few snips from the speech.

Bank Lending Practices

Access to credit remains strained for borrowers who are particularly dependent on banks, such as households and small businesses. Bank lending has contracted sharply this year, and the Federal Reserve's Senior Loan Officer Opinion Survey on Bank Lending Practices shows that banks continue to tighten the terms on which they extend credit for most kinds of loans--although recently the pace of tightening has slowed somewhat. Partly as a result of these pressures, household debt has declined in recent quarters for the first time since 1951. For their part, many small businesses have seen their bank credit lines reduced or eliminated, or they have been able to obtain credit only on significantly more restrictive terms. The fraction of small businesses reporting difficulty in obtaining credit is near a record high, and many of these businesses expect credit conditions to tighten further.

While I am on the topic of bank lending, I would like to add a few words about commercial real estate (CRE). Demand for commercial property has dropped as the economy has weakened, leading to significant declines in property values, increased vacancy rates, and falling rents. These poor fundamentals have caused a sharp deterioration in the credit quality of CRE loans on banks' books and of the loans that back commercial mortgage-backed securities (CMBS). Pressures may be particularly acute at smaller regional and community banks that entered the crisis with high concentrations of CRE loans. In response, banks have been reducing their exposure to these loans quite rapidly in recent months. Meanwhile, the market for securitizations backed by these loans remains all but closed. With nearly $500 billion of CRE loans scheduled to mature annually over the next few years, the performance of this sector depends critically on the ability of borrowers to refinance many of those loans. Especially if CMBS financing remains unavailable, banks will face the tough decision of whether to roll over maturing debt or to foreclose.

The Job Market

In addition to constrained bank lending, a second area of great concern is the job market. Since December 2007, the U.S. economy has lost, on net, about 8 million private-sector jobs, and the unemployment rate has risen from less than 5 percent to more than 10 percent.6 Both the decline in jobs and the increase in the unemployment rate have been more severe than in any other recession since World War II.

Besides cutting jobs, many employers have reduced hours for the workers they have retained. For example, the number of part-time workers who report that they want a full-time job but cannot find one has more than doubled since the recession began, a much larger increase than in previous deep recessions. In addition, the average workweek for production and nonsupervisory workers has fallen to 33 hours, the lowest level in the postwar period. These data suggest that the excess supply of labor is even greater than indicated by the unemployment rate alone.

With the job market so weak, businesses have been able to find or retain all the workers they need with minimal wage increases, or even with wage cuts. Indeed, standard measures of wages show significant slowing in wage gains over the past year. Together with the reduction in hours worked, slower wage growth has led to stagnation in labor income. Weak income growth, should it persist, will restrain household spending.

The best thing we can say about the labor market right now is that it may be getting worse more slowly. Declines in payroll employment over the past four months have averaged about 220,000 per month, compared with 560,000 per month over the first half of this year. The number of initial claims for unemployment insurance is well off its high of last spring, but claims still have not fallen to ranges consistent with rising employment.

Although economic pain is widespread across industries and regions, different groups of workers have been affected differently. For example, the unemployment rate for men between the ages of 25 and 54 has risen from less than 4 percent in late 2007 to 10.3 percent in October--nearly double the rise in unemployment among adult women. This discrepancy likely reflects the high concentration of job losses in manufacturing, construction, and financial services, industries in which men make up the majority of workers. From the perspective of America's economic future, the effect of the recession on young workers is particularly worrisome: The unemployment rate among people between the ages of 16 and 24 has risen to 19 percent--and among African American youths, it is now about 30 percent. When young people are shut out of the job market, they lose valuable opportunities to gain work experience and on-the-job training, potentially reducing their future wages and employment opportunities.

The Outlook for the Economy and Policy

I return now to the outlook for the economy and policy. As I noted, I expect moderate economic growth to continue next year. Final demand shows signs of strengthening, supported by the broad improvement in financial conditions. Additionally, the beneficial influence of the inventory cycle on production should continue for somewhat longer. Housing faces important problems, including continuing high foreclosure rates, but residential investment should become a small positive for growth next year rather than a significant drag, as has been the case for the past several years. Prospects for nonresidential construction are poor, however, given weak fundamentals and tight financing conditions.

In the business sector, manufacturing activity has been expanding and should be helped by the continuing strength of the recovery in the emerging market economies, especially in Asia. As the recovery takes hold, enhanced business confidence, together with the low cost of capital for firms with access to public capital markets, should lead to a pickup in business spending on equipment and software, which has already shown signs of stabilizing.

I have discussed two of the principal factors that may constrain the pace of the recovery, namely, restrictive bank lending and the weak job market. Banks' reluctance to lend will limit the ability of some businesses to expand and hire. I expect this situation to normalize gradually, as improving economic conditions strengthen bank balance sheets and reduce uncertainty; the fallout for banks from commercial real estate could slow that progress, however.

Jobs are likely to remain scarce for some time, keeping households cautious about spending. As the recovery becomes established, however, payrolls should begin to grow again, at a pace that increases over time. Nevertheless, as net gains of roughly 100,000 jobs per month are needed just to absorb new entrants to the labor force, the unemployment rate likely will decline only slowly if economic growth remains moderate, as I expect.Mapping The Bernanke Recovery

Inquiring mind just might be interested in mapping those statements. Let's assume it takes 100,000 jobs per month to absorb new entrants, decreasing to 70,000 a month by 2020.

Bernanke says jobs will be scarce for some time. He did not define "scarce" or give a timeline. However, let's assume jobs will be scarce only for 1 year. Also let's assume unemployment will rise for about a year (while jobs are scarce), level off, then start dropping in accordance with the paragraphs in red above.

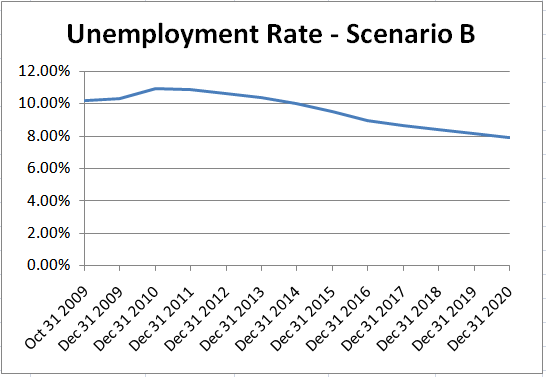

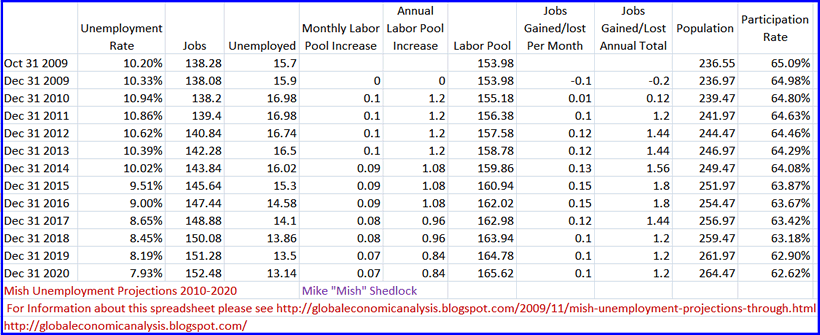

Scenario "B"

Scenario "B" Data

Scenario "B" Suggests 100,000 jobs per month from 2010 through 2013 will be needed to keep up with birthrate and immigration. I took the liberty of helping out Bernanke by assuming demographics would start lowing the number of jobs requited.

I also assumed no bump in the participation rate as discouraged workers currently out of work start looking. Then again, perhaps Bernanke factored that in to his 100,000 estimate. However, judging from other things he has said in the past, I do not believe that to be the case.

Scenario "B" also assumes no double dip recession or any kind of recession for that matter all the way through the end of 2020 even though the Fed must at some point tighten to reduce its balance sheet.

Moreover, in spite of what Bernanke said in his speech about housing and commercial real estate, I have the Bernanke forecast as assuming +100,000 jobs a month starting in 2011, and adding a minimum of 120,000 jobs a month for 6 consecutive years while simultaneously subtracting jobs needed to keep up with the birth rate and demographics all the way through 2020.

Yet even under this optimistic scenario, unemployment will still be above 10% at the end of 2014 and will not dip below 8% until the end of 2020.

To play around with these parameters in a downloadable spreadsheet, please see the addendum to Mish Unemployment Projections Through 2020.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2009 Mike Shedlock, All Rights Reserved

Mike Shedlock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.