Gold and Silver Set For Parabolic Move Like 1970s?

Commodities / Gold & Silver 2009 Nov 20, 2009 - 05:20 AM GMTBy: GoldCore

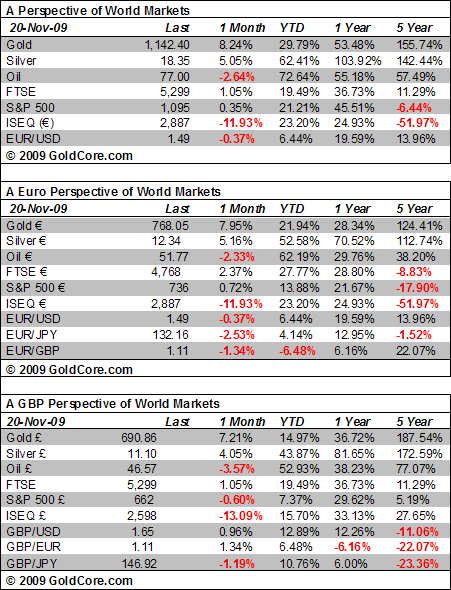

Gold was unchanged yesterday and remained near record nominal highs as equities fell and the dollar staged a moderate rally. Gold appears to be attempting to consolidate at these higher levels and the unchanged close will encourage the bulls and support is now at $1,130/oz. Gold has moved back up to $1,144.70/oz and remains near record nominal highs in euro and sterling - €770/oz and £690/oz.

Gold was unchanged yesterday and remained near record nominal highs as equities fell and the dollar staged a moderate rally. Gold appears to be attempting to consolidate at these higher levels and the unchanged close will encourage the bulls and support is now at $1,130/oz. Gold has moved back up to $1,144.70/oz and remains near record nominal highs in euro and sterling - €770/oz and £690/oz.

It is interesting to note that while government mints are working flat out to provide investors with gold and silver bullion coins, the shortages and surging premiums seen in the small coin and bar market of last year are no longer to be seen. Many retail investors are under financial pressure and many have had to sell their liquid precious metal investments (including coins and bars) and some have sold as they are wary that gold is a bubble. What is interesting is that the tightness in the small bar market seen last year appears to be more evident in the large bar market with the futures market close to backwardation (spot price or price of gold and silver for immediate delivery becomes less than price of front futures contracts - for delivery at a later date).

This indicates that demand for larger bars remains immediate and substantial. This makes sense when one considers the increasing high net worth, pension fund, hedge fund, institutional and central bank demand for gold. Paul Walker, CEO of GFMS, said in September that gold was going up because of some "large lumpy transactions in a market with a degree of illiquidity." There have been many cries of wolf in recent years but this does bear monitoring and could lead to a short squeeze that could propel the precious metals into a parabolic move upwards as happened in the 1970s.

Silver

Silver has also rebounded after a bout of profit taking moving back from below $18/oz to $18.50/oz, €12,43/oz and £11.15/oz.

Platinum Group Metals

Platinum is $1,437/oz, palladium is $366/oz and rhodium is $2450/oz.

This update can be found on the GoldCore blog here.

The Bullion Services Team

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.