Can Asset-Price Bubbles Be Harmless?

Economics / Economic Theory Nov 24, 2009 - 05:36 AM GMTBy: Frank_Shostak

There is an increasing concern among some commentators that the current, extremely loose monetary policy of the US central bank could fuel another round of asset-price bubbles. This in turn, it is held, could pose a serious danger to the US economy.

There is an increasing concern among some commentators that the current, extremely loose monetary policy of the US central bank could fuel another round of asset-price bubbles. This in turn, it is held, could pose a serious danger to the US economy.

Some commentators, such as John Taylor (the inventor of the Taylor rule), are urging the US central-bank policy makers to start considering a tighter stance as soon as possible, in order to prevent a repetition of the Greenspan Fed's interest-rate policy, which kept rates at very low levels for too long. (The Fed lowered its policy rate from 6.5% in December 2000 to 1% by June 2003. The Fed kept the rate at 1% until June 2004).

Taylor and others are of the view that the current financial crisis is the outcome of the Greenspan Fed's very loose monetary stance, which caused gigantic asset-price bubbles.

Taylor and others are of the view that the current financial crisis is the outcome of the Greenspan Fed's very loose monetary stance, which caused gigantic asset-price bubbles.

In contrast to this way of thinking, the former Fed governor and current professor of economics at Columbia University, Frederic Mishkin, holds that the Fed should continue with its loose stance. Mishkin is known as a close confidant of Fed Chairman Ben Bernanke.

In an article in the Financial Times on November 9, 2009,[1] Mishkin argues that not every asset-price bubble is dangerous for the economy. He classifies bubbles into two categories.

The first and dangerous category is one I call "a credit boom bubble," in which exuberant expectations about economic prospects or structural changes in financial markets lead to a credit boom. The resulting increased demand for some assets raises their price and, in turn, encourages further lending against these assets, increasing demand, and hence their prices, even more, creating a positive feedback loop. This feedback loop involves increasing leverage, further easing of credit standards, then even higher leverage, and the cycle continues.

Eventually, argues Mishkin,

The bubble bursts and asset prices collapse, leading to a reversal of the feedback loop. Loans go sour, the deleveraging begins, demand for the assets declines further and prices drop even more. The resulting loan losses and declines in asset prices erode the balance sheets at financial institutions, further diminishing credit and investment across a broad range of assets. The resulting deleveraging depresses business and household spending, which weakens economic activity and increases macroeconomic risk in credit markets. Indeed, this is what the recent crisis has been all about.

For Mishkin it is the first category, the credit-boom bubble, that is dangerous to the economy. The second category of bubbles, which he labels a "pure irrational exuberance bubble" is

far less dangerous because it does not involve the cycle of leveraging against higher asset values. Without a credit boom, the bursting of the bubble does not cause the financial system to seize up and so does much less damage. For example, the bubble in technology stocks in the late 1990s was not fuelled by a feedback loop between bank lending and rising equity values. Indeed, the bursting of the tech-stock bubble was not accompanied by a marked deterioration in bank balance sheets. This is one of the key reasons that the bursting of the bubble was followed by a relatively mild recession. Similarly, the bubble that burst in the stock market in 1987 did not put the financial system under great stress and the economy fared well in its aftermath.

According to Mishkin, since banks are currently curbing their lending, there is no danger of the emergence of a credit-boom bubble in the foreseeable future.

Our problem is not a credit boom, but that the deleveraging process has not fully ended. Credit markets are still tight and are presenting a serious drag on the economy.

Hence, even if the present loose monetary policy were to produce bubbles there is no need to be concerned, since they belong to the harmless bubble category, argues Mishkin.

From this it follows that the Fed should keep its present easy monetary stance as long as it is required. Mishkin is of the view that a policy aimed at preventing the second category of bubbles can only damage the economy.

Credit Expansion and Bubbles — What Is the Link?

According to popular thinking, an asset bubble is a large, above historical average, increase in asset prices. A price of a thing is the amount of dollars paid for it. This means that a bubble is a large, above the historical average, payment of dollars for various assets.

As a rule, for this to occur, there must be an increase in the pool of dollars, or the pool of money. So if one were to accept the popular definition of what a bubble is, one must also accept that without an expansion in the money pool, bubbles cannot emerge. (Observe that in his article, Mishkin never mentions money supply).

Irrespective of their psychological disposition, if the pool of money is not expanding, people's ability to generate bubbles in various markets is not tenable.

Recall that Mishkin holds that bubbles in the first category — the dangerous bubbles — are set in motion by exuberant expectations about economic prospects or structural changes in financial markets, which trigger a credit boom.

But even if these factors are capable of triggering increases in credit, why must all this produce an expansion in the money supply? The increase in the money supply is the key for the emergence of asset bubbles.

For instance, when Joe lends his $100 to Bob via his bank, this means that Joe via the intermediary lends his money to Bob. On the maturity date, Bob transfers the money to the bank, and the bank in turn (after charging a fee) transfers the $100 plus interest to Joe.

Observe that here we don't have any increase in the money supply — the existing $100 was transferred from Joe to Bob. Also note that the $100 loan by Joe to Bob is fully backed up by $100.

Things are however quite different when Joe keeps the $100 in the bank warehouse or demand deposit. Now, by keeping the money in a demand deposit, Joe is ready to employ the $100 in an exchange at any time he deems it is necessary.

If the bank lends Bob $50 by taking it from Joe's deposit, the bank has now created $50 of unbacked credit, i.e., credit "out of thin air." There is now $150 in demand deposits backed by $100. By lending $50 to Bob, the bank creates $50 of demand deposit.

In this sense, the lending here is without a lender as such. The intermediary, i.e., the bank, has created a mirage transaction without any proper lender. On the maturity date, once the money is repaid to the bank, this type of money disappears. The amount of money will revert back to $100.

Hence an increase in the credit created out of thin air, all other things being equal, gives rise to the expansion in money supply. A fall in the credit created out of thin air, all other things being equal, results in the contraction of the money supply.

What then matters for asset price bubbles is the expansion in credit out of thin air. It is this type of credit that boosts the money-supply rate of growth and hence fuels asset-price bubbles.

Again, an increase in normal credit (i.e., credit that has an original lender) doesn't alter the money supply and hence has nothing to do with asset-price bubbles. (When Bob lends $100 to Joe, what we have here is an increase in lending and a transfer of an existing $100 from lender to borrower — and no change in the money supply).

The Fed's Monetary Policies and Asset-Price Bubbles

It must be realized that without the support from the Fed pumping money, banks will find it difficult to expand the credit out of thin air.

For instance, a farmer Joe sells his saved 1kg of seeds for $100. He then deposits this $100 with Bank A. Observe that Joe is exercising his demand for money by holding his money in the demand deposits of Bank A. (Joe could also have exercised his demand for money by holding the money at home in a jar, or keeping it under the mattress).

Whenever a bank takes a portion of Joe's deposited money and lends it out, it sets in motion serious trouble. Let us say that Bank A lends $50 to Bob by taking $50 out of Joe's deposit. Remember that Joe still exercises his demand for $100. What we have here is $150 that are backed by $100.

"In the extreme case, if there is only one bank it can practice fractional-reserve banking without any fear of being 'caught'."

Now, Joe demands money not to hold it as such but to use it as the medium of exchange. So let us say that Joe decides to use his $100 to buy goods from Sam, who banks with Bank B. On the following day, Bank B will present the check on $100 to Bank A. In short, $100 is shifted from Bank A to Bank B. (No more money is now left at Bank A).

Let us say that Bob, who borrowed $50 from bank A, also buys goods from Sam (remember that Sam keeps his money with Bank B). This, however, will pose a problem to Bank A since it doesn't have the $50 to pay Bank B once the check on $50 written against Bank A is presented by Bank B. This means that Bank A is "caught" here, so to speak.

As the number of banks rises and the number of clients per bank declines, the chances that clients will spend money on the goods of individuals that are banking with other banks will increase. This in turn increases the risk of a bank not being able to clear its checks once this bank practices fractional-reserve banking — i.e., lends fictitious claims or money out of thin air.

Conversely, as the number of competitive banks diminishes, that is, as the number of clients per bank rises, the likelihood of being "caught" practicing fractional-reserve banking diminishes.

In the extreme case, if there is only one bank it can practice fractional-reserve banking without any fear of being "caught" since it will always clear its own checks. Thus Sam, who sold goods to Bob, will deposit the check with bank A. All that will happen now is that the ownership of the deposit will be transferred from Bob to Sam. If Joe decides to spend his $100 on goods from Tom, then again we will have here a transfer of the ownership of the deposit.

We can thus conclude that in a free banking environment with many competitive banks, if a particular bank tries to expand credit by practicing fractional-reserve banking, it runs the risk of being "caught." So it is quite likely that in a free-market economy the threat of bankruptcy will bring to a minimum the practice of fractional-reserve banking.

From what was said so far, we can suggest that in a free-market economy the practice of fractional-reserve banking would tend to be minimal. This is, however, not so in the case of the existence of a central bank. By means of monetary policy, which is also termed the reserve management of the banking system, the central bank permits the existence of fractional-reserve banking and thus the creation of money out of thin air.

If bank A is short $50, it can sell some of its assets to the central bank for cash, thereby preventing being "caught." Bank A can also secure the $50 by borrowing it from the central bank. Where does the central bank get the money? It actually generates it out of thin air.

The modern banking system can be seen as one huge monopoly bank, which is guided and coordinated by the central bank. Banks in this framework can be regarded as the branches of the central bank. As we have seen, one monopoly bank can practice fractional-reserve banking without running the risk of being "caught."

Through ongoing monetary management, i.e., monetary pumping, the central bank makes sure that all the banks engage jointly in the expansion of credit out of thin air.

The joint expansion in turn guarantees that checks presented for redemption by banks to each other are netted out. By means of monetary injections, the central bank makes sure that the banking system is "liquid enough" so banks will not bankrupt each other.

"So it is quite likely that in a free-market economy the threat of bankruptcy will bring to a minimum the practice of fractional-reserve banking."

Hence without the support from the Fed's pumping, the commercial banks' creation of money out of thin air would be barely noticeable. Pay attention that without the Fed's pumping, the so-called exuberant expectations or mysterious structural changes in financial markets couldn't produce an expansion of the money supply and thus set in motion asset bubbles as Mishkin suggests.

Once it is realized that the key source for asset bubbles is the monetary pumping of the Fed (i.e., central bank) it becomes clear that there is no need to categorize various bubbles.

What matters is the fact that the Fed's loose monetary policy gives rise to various nonproductive (bubble) activities that undermine the process of real-wealth formation, thereby impoverishing the economy.

The reversal of the Fed's pace of money pumping sets in motion the bursting of bubble activities.

Bubbles and the Fed's Policies — Historical Evidence

Both the plunge in technology stocks from February 2000 to September 2002 and the October 1987 stock market crash were set in motion by the boom–bust policies of the Fed.

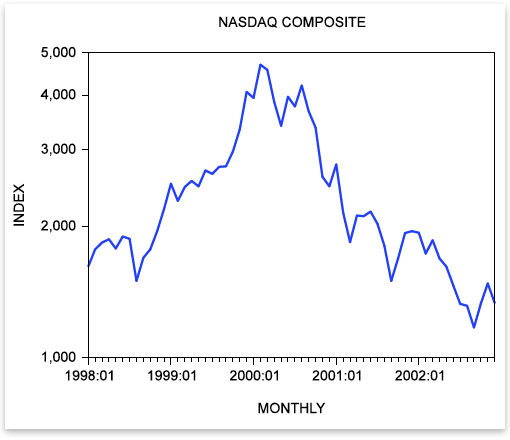

By the end of September 2002, the NASDAQ composite stock-price index closed at 1,172.06 — a fall of 75% from the high of 4,696.69 reached at the end of February 2000.

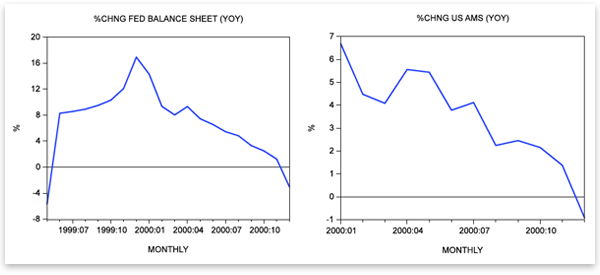

What set this collapse in motion was a sharp fall in the growth momentum of the Fed's monetary pumping. Year-on-year, the rate of growth of the Fed's balance sheet fell from 16.9% in December 1999 (Y2K pumping) to −3% by December 2000.

In response to this, the yearly rate of growth of our monetary measure AMS[2] fell from 6.7% in January 2000 to −1% by December 2000.

Also note that the yearly rate of growth of commercial-bank lending fell from 13.1% in September 2000 to 1.5% by December 2001. (Given the sharp decline in the growth momentum of commercial-bank lending, it is quite likely that the growth momentum of commercial-bank lending out of thin air had also fallen).

The yearly rate of growth of our measure of monetary liquidity fell from −1.1% in January 2000 to −5.3% by December 2000.

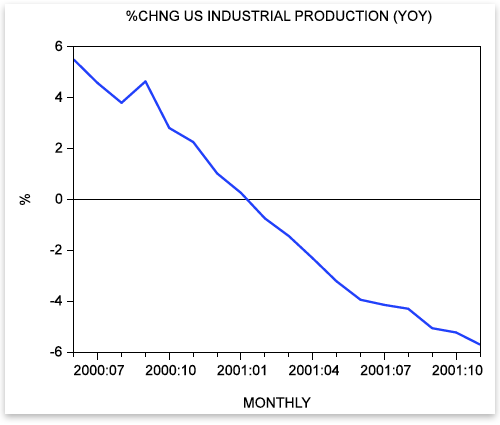

As a result of the plunge in the pace of monetary pumping, the yearly rate of growth of industrial production fell from 5.5% in June 2000 to −5.7% by November 2001.

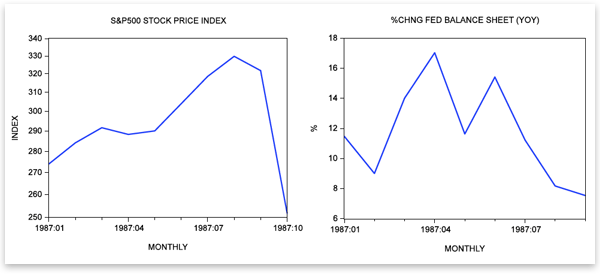

Also, in the October 1987 stock-market crash, the Fed's monetary policy played a key role. By the end of October 1987 the S&P500 closed at 251.79 — a fall of 23.7% from the end of August 1987.

What set in motion this plunge was the sharp fall in the yearly rate of growth of Fed's balance sheet from 17% in April 1987 to 7.5% by September of that year.

In response to this, the yearly rate of growth of our monetary measure AMS fell from 17.2% in January 1987 to 10.5% by September. (Our measure of liquidity plunged from 15.1% in January to −0.3% in September).

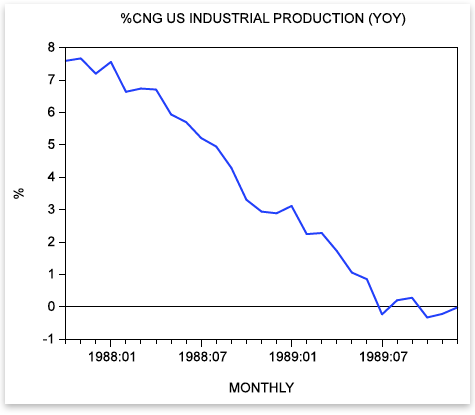

As a result of the decline in the Fed's monetary pumping, the yearly rate of growth of industrial production fell from 7.7% in November 1987 to −0.3% by October 1989.

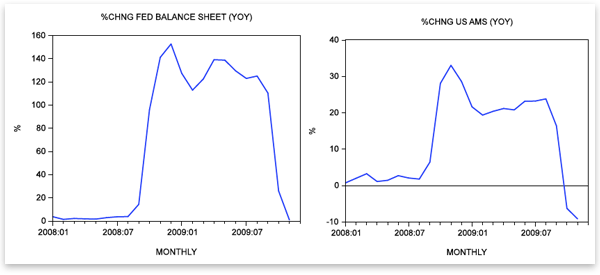

At present we are observing a repetition of the past boom–bust policies of the Fed. Thus the yearly rate of growth of the Fed's balance sheet jumped from 1.5% in February 2008 to almost 153% by December of last year.

Afterwards, the yearly rate of growth has been in steep decline, closing at 0.3% by mid-November this year. It seems that notwithstanding pronouncements by various Fed officials that the US central bank will keep its easy stance intact, the Fed in fact has already drastically reduced the pace of monetary pumping.

As a result of the wild fluctuations in the pace of money pumping by the Fed, the yearly rate of growth of AMS jumped from 0.8% in January last year to 33.1% by November of 2008. In early November 2009 the yearly rate of growth of AMS stood at −9.1% against −6.2% in October. In short, the Fed has already set in motion another economic bust.

Now after settling at 2.5% in January 2006 the yearly rate of growth of industrial production fell to −13.3% in June 2009. We have seen that in the 2000–2001 recession the yearly rate of growth of production fell from 5.5% in June 2000 to −5.7% in November 2001. Furthermore, from November 1987 to October 1989, the slump in industrial production was even less severe. Recall that Mishkin is of the view that the much more severe, current economic slump is a result of the collapse in bank lending.

We suggest that the main reason for the present, more-severe slump is not a fall in lending but the damage inflicted to the pool of real savings by past and current monetary and fiscal policies. A fall in bank lending only reflects the precarious state of the pool of real savings. This fall, however, is not responsible for the economic slump. As a result of the past and present loose monetary and fiscal policies, the process of real-wealth formation has likely been severely damaged. (Note that loose monetary and fiscal policies provide support for nonproductive activities by diverting real savings from wealth-generating activities).

Conclusion

In his Financial Times article, the former Fed governor Mishkin argues that the possible emergence of asset-price bubbles on account of loose Fed policies shouldn't be feared. He argues that only bubbles that originate from credit expansion pose a danger to the economy. Since banks are currently curbing the expansion of credit, bubbles that emanate from loose monetary policy by itself are not harmful, argues Mishkin.

On the contrary, maintains Mishkin, in the present, still-subdued economic climate, the Fed must keep its loose-money stance in place for a prolonged time. According to Mishkin, a policy that will try to counter the emergence of bubbles whilst banks are cutting their lending can only damage the economy.

We suggest that what matters here are the Fed's boom–bust policies and not bubbles that emanate from credit expansion. It is the Fed's loose monetary policy that gives rise to various nonproductive bubble activities, while the reversal of the Fed's policy undermines these activities and sets in motion an economic bust. This means that it is not bubbles as such that pose a threat to the economy but the boom–bust monetary policies of the central bank. Note that bubbles are just the manifestation of loose monetary policies.

So we are in perfect agreement with Mishkin, although for radically different reasons, when he says, rather unwittingly in our view,

Monetary policymakers, just like doctors, need to take a Hippocratic Oath to "do no harm."

Frank Shostak is an adjunct scholar of the Mises Institute and a frequent contributor to Mises.org. He is chief economist of M.F. Global. Send him mail. See his article archives. Comment on the blog.![]()

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.