Where Is the U.S. Economy Heading?

Economics / Economic Recovery Dec 07, 2009 - 06:34 AM GMTBy: Frank_Shostak

Economists are currently divided on the issue of how strong the US economic recovery is going to be. Some are of the view that as a result of the stimulus policies of the Fed and the Federal government, the recovery is going to be quite strong. Some others are more pessimistic given still-rising unemployment, which they believe will keep consumer spending subdued. In October the unemployment rate jumped to 10.2% from 9.8% in the previous month and 6.6% in October last year.

Economists are currently divided on the issue of how strong the US economic recovery is going to be. Some are of the view that as a result of the stimulus policies of the Fed and the Federal government, the recovery is going to be quite strong. Some others are more pessimistic given still-rising unemployment, which they believe will keep consumer spending subdued. In October the unemployment rate jumped to 10.2% from 9.8% in the previous month and 6.6% in October last year.

Most economists assess the so-called economy in terms of gross domestic product, or GDP. This indicator reflects the amount of money that was spent during a period of time on final goods and services.

Most economists assess the so-called economy in terms of gross domestic product, or GDP. This indicator reflects the amount of money that was spent during a period of time on final goods and services.

The major component of this indicator is personal outlays, which comprise almost 70% of GDP. Obviously, the more money people have, the greater the spendable income is going to be, hence the greater the GDP is going to be. Consequently, fluctuations in money supply lead to fluctuations in spendable income and thus to fluctuations in GDP. To establish the rate of growth of "real GDP," changes in GDP are adjusted for changes in the prices of goods and services.

Boom-Bust Cycles and the Fed

In our writings we have argued that the key factor for swings in the money-supply rate of growth is central-bank monetary policies. Whenever the central bank, i.e., the Fed, embarks on a loose monetary policy and lifts the money-supply rate of growth, this increases the monetary expenditure on goods and services, i.e., we have an increase in the rate of growth of GDP.

Whenever the central bank reverses its stance, this slows down the expansion in money supply. As a result, the monetary expenditure on goods and services follows suit, i.e., we have here a decline in the rate of growth of GDP.

Again, for boom-bust cycles — i.e., fluctuations in the GDP rate of growth and hence so-called economic recoveries and recessions — the key is fluctuations in the rate of growth of money supply.

When the Fed embarks on loose monetary policy and raises the pace of monetary pumping, this pumping is taken further by commercial banks. The initial Fed pumping gets amplified by banks lending out of thin air through fractional-reserve banking.

Now, the key reason for the Fed's boom-bust monetary policy is the view that economic fluctuations are caused by various shocks. The role of the central bank is supposed to be to counter the effect on the economy from these shocks.

It is held that if, in response to psychological factors, consumers and businesses are not spending enough money, the central bank must step in and lift the pace of money pumping to prevent the economy from falling into a recession. Conversely, if, on account of positive psychological factors, people are overspending, the central bank must step in and cool off the excessive spending by curtailing the pace of monetary pumping.

In this way of thinking, the economy is a ship, and the Fed is the captain who must navigate it onto the growth path of economic stability.

Money Supply and the Pool of Real Savings

Changes in money supply not only set in motion fluctuations in monetary expenditure, but also affect the underlying real economy.

For instance, whenever the central bank loosens its monetary stance, the injection of new money into the economy benefits individuals who receive the newly created money first at the expense of those individuals who receive the new money later or not at all. The early recipients can then purchase a greater amount of goods while the prices of these goods are still unaffected.

Furthermore, because the early recipients of money are much wealthier now compared to before the monetary injections took place, they are likely to alter their patterns of consumption. With greater wealth at their disposal, their demand for less-essential goods and services expands. The increase in the real wealth of the first recipients of money gives rise to the demand for goods which, prior to monetary expansion, would not have been considered.

A change in the pattern of consumption draws the attention of entrepreneurs who, in order to secure profits, start to adjust their structure of production in accordance with this new development. Now, on account of loose money policy, entrepreneurs find it easy to secure new loans from the banking system — an economic boom ensues.

What all this means is that increases in money supply divert real savings from wealth-generating activities to various activities that emerged on the back of increases in money supply. Note that without the support from the increase in the money supply these activities wouldn't emerge, since they wouldn't be able to fund themselves.

This means that, by diverting real savings, increases in money supply in fact strengthen nonproductive activities and weaken wealth-generating activities.

As the pace of monetary pumping strengthens, the pace of the diversion of real savings also strengthens, thereby weakening the process of real-wealth generation. As time goes by, the pace of production of goods and services slows down.

Note that increases in money supply mean that more money is paid for each unit of real goods, i.e., the prices of goods have gone up.

With a faster money-supply rate of growth and a decline in the rate of growth of production of goods, the rate of increase in prices of goods strengthens further. At that stage, the Fed tightens its monetary stance to cool off the economy.

In the final stages of the boom, a tighter stance by the Fed coupled with the pressure on the pool of real savings also causes banks to slow down their expansion of credit out of thin air. So all this leads to a decline in the money supply rate of growth and to a consequent reduction of the pressure on the pool of real savings.

With the decline in the money-supply rate of growth, the support for various goods and services that emerged on the back of the previous, loose monetary policy weakens, and consequently various structures that were created to support these goods and services become too expensive to run.

As a result, various activities that prospered on the back of increases in money supply now find it difficult to stay alive. In short, a tighter stance weakens the diversion of real savings to these activities.

In this sense a tighter monetary stance is good news for wealth generators, since less real savings is now being taken away from them.

As the tighter monetary stance intensifies and the recession deepens on account of the liquidation of various nonproductive activities, wealth generators can move ahead and strengthen the pool of real savings.

At some point, however, the Fed aborts its tight stance and thus renews the support for nonproductive activities by again diverting real savings.

Commercial-Bank Lending and the State of the Pool of Real Savings

As long as the pool of real savings holds up, commercial banks are likely to cooperate with the Fed's monetary pumping and convert it into a stronger money-supply rate of growth.

However, if the pool of real savings is in trouble, banks are likely to ignore the pumping by the Fed. Why is that so?

A fall in the pool of real savings means that less real wealth can be generated. This in turn means that the quality of banks' assets is likely to come under pressure. Obviously, this leads to the curtailment of credit and the curtailment of the expansion of credit out of thin air.

All this puts pressure on the rate of growth of the money supply. When the damage to the pool of real savings is severe, this is likely to be mirrored by a much more severe curtailment in credit expansion by banks.

As a rule, an important factor that inflicts damage on the pool of real savings is loose monetary policies of the Fed. By means of strong monetary pumping and a drastic lowering of interest rates, the Fed can seriously damage the process of real-savings formation, thereby setting in motion a severe economic crisis.

Another factor that inflicts damage on the pool of real savings is the government's loose fiscal policies. Loose fiscal policy also diverts real savings from wealth generators to nonproductive activities.

From what was said so far we can infer that as long as the pool of real savings is growing, the Fed is likely to find it relatively easy to revive commercial banks' expansion of credit out of thin air and boost the money-supply rate of growth via loose monetary policy.

In the framework of a shrinking pool of real savings with the consequent decline in credit expansion out of thin air, the Fed's loose monetary policy is likely to encounter difficulties in setting in motion a sustainable increase in the money-supply rate of growth.

Consequently, the Fed's loose monetary stance is likely to encounter difficulties in generating a sustained economic recovery in terms of real GDP.

Does Real GDP Reflect Reality?

In our writings, we have shown that monetary pumping cannot be a catalyst for economic growth. If it could, then world poverty would have been eradicated a long time ago.

The so-called real economic growth as depicted by real GDP has nothing to do with the real world. It is only on account of misleading price deflators that the increase in money supply leads to the increase in so-called real GDP.

In reality, however, an increase in money supply by a given percentage in a particular market simply raises the price of a given good in this market by the percentage increase in money supply. This in turn means that the change in spending in real terms will be nil.

Thus, if monetary expenditure on tomatoes goes up by 10%, all other things being equal, the price of tomatoes will also go up by 10%. (Remember, the price of a good is just the amount of money paid for it). In real terms, however, the rate of increase is nil, since the 10% increase in monetary expenditure is offset by the 10% increase in the price of tomatoes.

If instead we were to employ an average-price increase (the GDP framework deals with average prices) and use it in the calculation of spending in real terms, we could get misleading results. For instance imagine that money moved only to tomatoes and didn't as yet move to the market for potatoes. The average increase in the prices of these two goods will be (10% + 0%) / 2 = 5%. If we now adjust the increase in monetary expenditure of 10% by 5% we will get an increase in real spending of 5%.

Note again that if monetary pumping could be an agent of economic growth, then all our economic difficulties would have been fixed a long time ago.

What Does It All Mean for the Economy in Terms of GDP Ahead?

As long as the pool of real savings is growing, loose monetary and fiscal policies can appear to be effective in driving the real economic growth in terms of so-called real GDP.

However, once the pool of real savings is in trouble, the illusion that monetary and fiscal policies can grow the economy in terms of real GDP is shattered.

We suggest that the loose monetary policy of the Fed from 2001 to 2004 was instrumental in a severe depletion of the pool of real savings. The manifestation of this damage is the gigantic bubbles that sprang up in various parts of the economy, in particular the housing market. Also, the fact that banks are now curtailing credit raises the likelihood that the pool of real savings is severely depleted. This could be indicative of a sharp fall in the percentage of wealth-generating activities versus nonproductive, wealth-consuming activities.

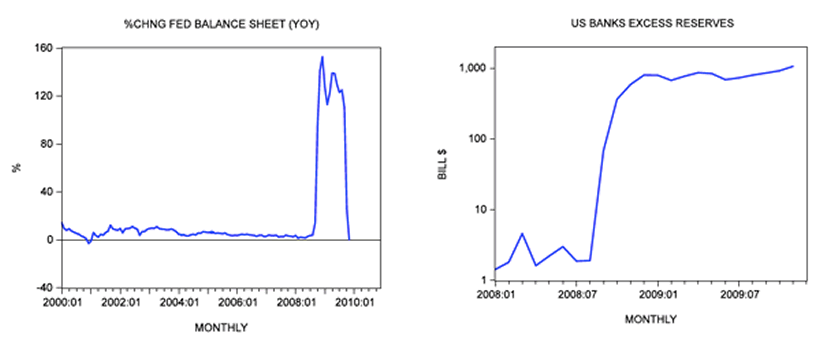

Despite massive pumping by the Fed, banks have so far chosen to curb lending and sit on a massive amount of cash. (The yearly rate of growth of the Fed's balance sheet jumped to 153% in December last year). So far in November, banks' excess cash reserves stand at $1,046 billion against $1.9 billion in August last year.

Year on year, the rate of growth of bank loans fell in November so far to −7.5% from −7.4% in October — this is the seventh consecutive monthly decline.

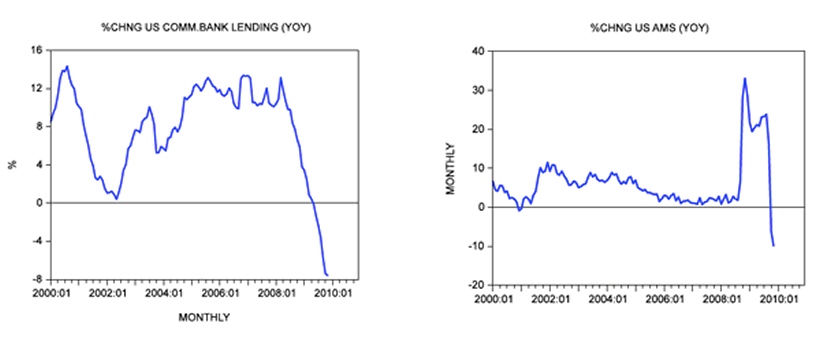

Our monetary measure AMS[1] has fallen 9.9% so far in November this year from November last year. This is the second consecutive monthly decline.

The various rescue packages and further monetary pumping by the Fed are bad news for the process of wealth formation. Consequently, all the positives for wealth generation on account of a tighter monetary stance from June 2004 to September 2007 have likely been erased by the stimulus policies since. Hence, the fall in bank credit raises the likelihood that the pool of real savings is actually declining.

Based on this, we suggest that until the pool of real savings starts to expand again, banks will have difficulty engaging in an expansion of credit. As a result, the money-supply rate of growth, all other things being equal, will stay under pressure. Obviously, this cannot be good news for economic growth in terms of real GDP.

There is always the possibility that the Fed could embark on the so-called helicopter-money scheme and try to bypass the banking sector. This, however, would only damage the true economy further and thus force the Fed to abort such a scheme.

Quantifying the Future Course of Real GDP

After closing at 1.8% in August last year, the yearly rate of growth of our monetary measure AMS jumped to 33% by November. Since then, the rate of growth has been on a declining path: it stood at 23.8% in August this year before falling to −6.3% in October and −9.9% so far in November.

The strong money pumping from August last year until August this year is likely to manifest itself in the strengthening in the growth momentum of GDP. Given the still-subdued price indexes, this is likely to result in a visible strengthening in the real-GDP rate of growth. (Remember, this is on account of misleading deflators).

As a result of a recent, steep fall in the growth momentum of AMS, we forecast that the growth momentum of real GDP will come under pressure in Q2 next year. (Year on year, the rate of growth is forecast to rise to 1.7% in Q1 next year before falling to −0.2% in Q4). Again, please note that real GDP has nothing to do with the true state of the economy.

Conclusions

In the so-called "normal" business cycles since the post World War II period, the Fed seemed to be able to revive the US economy with relative ease whenever it fell into recession. All that the US central bank had to do was raise the pace of monetary pumping and the rest would appear to follow suit. It seems that the Fed is now encountering massive difficulties in reviving economic activity in terms of real GDP.

Despite massive pumping — in December last year the yearly rate of growth of the Fed's balance sheet jumped to 153% — economic activity remains depressed. We suggest that the key here is commercial-bank lending. Without support from commercial banks, the Fed will find it difficult to revive economic activity. As a result of past and present loose monetary and fiscal policies, the process of real-wealth generation has been severely damaged. This, we suggest, has increased the risks that banks would incur in lifting the supply of credit.

As long as the pool of real savings — the key for the process of real-wealth formation — is under pressure, bank lending is also likely to remain paralyzed. On account of a strong rebound in the money-supply rate of growth between August last year and August this year, the economy in terms of GDP is likely to strengthen in the months ahead. However, a collapse in the money supply since October raises the likelihood of a fall in the GDP rate of growth from the second half of next year. Various measures to revive the economy are likely to make things much worse because they only weaken the pool of real savings.

Notes

[1] AMS is defined as currency plus demand deposits with commercial banks and thrift institutions plus saving deposits plus government deposits with banks and the central bank. See Shostak, Making Sense of Money Supply Data.

Frank Shostak is an adjunct scholar of the Mises Institute and a frequent contributor to Mises.org. He is chief economist of M.F. Global. Send him mail. See Frank Shostak's article archives. Comment on the blog.![]()

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.