Why is the US Government Trying to Sell US Sub-prime Mortgages to China?

Stock-Markets / US Stock Markets Jul 18, 2007 - 07:39 PM GMTBy: Marty_Chenard

A few months ago, the sub-prime problem seemed to be a mammoth problem to many investors.

But ... nothing bad happened, so investors thought that this was another over-hyped problem that really amounted to nothing. Besides, the Fed was being proactive as our big market-protectors, so there was nothing to worry about ... Mighty Mouse was here to save the day.

A week ago, Bloomberg had a little news items that was hardly noticed. In the article, they described how our US Dept. of Housing and Urban Development Secretary (Alphonso Jackson) was in Beijing. His US Government mission was to meet with Chinese banking authorities and ask them to BUY U.S. Mortgage backed securities.

That should have been a "red flag" to American investors. For our government to try and sell our sub-prime mortgages to China suggested that "they are scared as hell" and that they know the sub-prime problems are finally starting to filter down at a visible level.

The first sub-prime bomb went off last night. Bear Sterns announced that their was "little value left in its two failed hedge funds" ... zero value in one, and about 9% left in the other.

Think about it ... Bear Sterns is the second largest underwriter of mortgage backed securities and a very sharp investment house, and they still couldn't control the risk or unwinding of these assets until they went to zero?

Like it or not, Bear Sterns is the tip of the iceberg. Secretary Jackson didn't go to China and beg them to buy our sub-prime problems because he thought it was a good deal for them. He did it because our government knows that we are sitting on a mountain of trouble related to mortgage problems.

It bugs me, that I had to go to the India Daily this morning to find out how much was lost. They reported that 20 billion dollars went to almost zero in value. You would have expected that our media would be screaming about the amount and we should be asking why it wasn't headline news when the two hedge funds had dropped 50% and lost 10 billion.

The incubation time is about done on the sub-primes, and in the next 30, 60, to 90 days ... these problems will begin to unfold and become visible to the public.

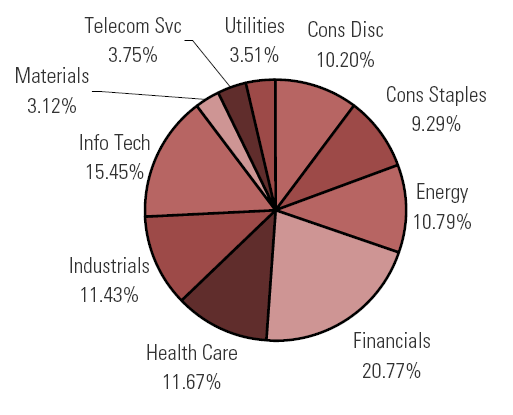

For a couple of weeks, I have been mentioning that the Financial sector is in trouble and that this was a problem because the Financial sector represents 20.77% of the S&P 500.

If you recall, last Wednesday we said, "One of the things worrying large investors is fallout from sub-prime loan problems. This concern is reducing investor interest in banking stocks."

Obviously, our stock market won't be happy about it today. As I have mentioned before, the thing to keep an eye on is the Banking Index. Its chart is below ...

Note that the Banking Index is coming to the end of a triangular pattern. If it loses support on the triangle's bottom line, then there is another 4 1/2 year support line just below it.

If that support is broken, then the Banking Index will see a nasty correction , and that will spill over to the S&P 500 and other indexes. Take the time to keep an eye on this index ... its symbol is BKX.

Repeated from last week's posting for your reference:

This chart shows the makeup of the S&P 500 Index by sector. Note that the Financials Sector makes up 20.77% of the S&P 500.

If the Banking index loses support, the heavy weighting it has in the S&P will have a very negative affect on the markets.

Thinking about becoming a paid subscriber? Just go to this link for details on subscription options: Memberships

By Marty Chenard

http://www.stocktiming.com/

Please Note: We do not issue Buy or Sell timing recommendations on these Free daily update pages . I hope you understand, that in fairness, our Buy/Sell recommendations and advanced market Models are only available to our paid subscribers on a password required basis. Membership information

Marty Chenard is the Author and Teacher of two Seminar Courses on "Advanced Technical Analysis Investing", Mr. Chenard has been investing for over 30 years. In 2001 when the NASDAQ dropped 24.5%, his personal investment performance for the year was a gain of 57.428%. He is an Advanced Stock Market Technical Analyst that has developed his own proprietary analytical tools. As a result, he was out of the market two weeks before the 1987 Crash in the most recent Bear Market he faxed his Members in March 2000 telling them all to SELL. He is an advanced technical analyst and not an investment advisor, nor a securities broker.

Marty Chenard Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.