Gold Long-term Performance Analysis

Commodities / Gold & Silver 2009 Dec 13, 2009 - 12:07 PM GMTBy: Richard_Shaw

How has gold performed in the 42 years since 1967 when it last traded at a fixed price of $35 in the US?

How has gold performed in the 42 years since 1967 when it last traded at a fixed price of $35 in the US?

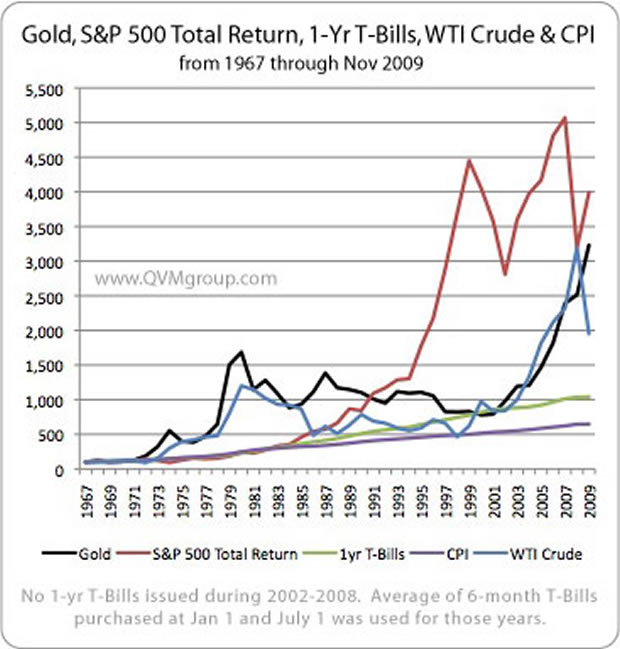

Let’s look at it versus the total return of the S&P 500, the total return of 1-yr T-Bills, West Texas Intermediate Crude and the Urban Consumers All Items Consumer Price Index?

The chart shows the performance of each item indexed to 100 as of 1967.

Gold has had its ups and downs, as have oil and stocks. How well you would have done holding it, of course, depends on when you would have acquired and sold it.

Gold generally rose from 1967 to the late 1970’s, then generally declined until about the time of the Dot.com bust and the 9/11 terrorist attacks on New York City, and has subsequently been rising aggressively. Oil began rising aggressivly at about the same time, but lost its momentum and declined with the 2008 economic crash. US stocks are still ahead of gold over the entire 4+ decade period.

Clearly, there were times when gold was a better holding than stocks, and there were times when stocks were better holdings than gold. That’s where asset allocation practices come into play to enhance total portfolio return.

SPY and IVV are proxies for the S&P 500. GLD and IAU are proxies for gold.

Compliance Disclosure:

We own GLD and SPY in some managed accounts. We do not own other mentioned securities. We are a fee-only investment advisor, and are compensated only by our clients. We do not sell securities, and do not receive any form of revenue or incentive from any source other than directly from clients. We are not affiliated with any securities dealer, any fund, any fund sponsor or any company issuer of any security.

By Richard Shaw

http://www.qvmgroup.com

Richard Shaw leads the QVM team as President of QVM Group. Richard has extensive investment industry experience including serving on the board of directors of two large investment management companies, including Aberdeen Asset Management (listed London Stock Exchange) and as a charter investor and director of Lending Tree ( download short professional profile ). He provides portfolio design and management services to individual and corporate clients. He also edits the QVM investment blog. His writings are generally republished by SeekingAlpha and Reuters and are linked to sites such as Kiplinger and Yahoo Finance and other sites. He is a 1970 graduate of Dartmouth College.

Copyright 2006-2009 by QVM Group LLC All rights reserved.

Disclaimer: The above is a matter of opinion and is not intended as investment advice. Information and analysis above are derived from sources and utilizing methods believed reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Do your own due diligence.

Richard Shaw Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.