The Cult of Stock Market Investor Non-participation

Stock-Markets / Investing 2010 Dec 14, 2009 - 03:25 PM GMTBy: Clif_Droke

Over the last few years we’ve made reference to the “cult” of non-participation. By this I mean the relative lack of retail investor interest in the stock market compared to the former decade. In tonight’s report we’ll look at why this trend of non-participation may be soon coming to an end.

Over the last few years we’ve made reference to the “cult” of non-participation. By this I mean the relative lack of retail investor interest in the stock market compared to the former decade. In tonight’s report we’ll look at why this trend of non-participation may be soon coming to an end.

The so-called “buyer’s strike” that was the topic of discussion last year during the credit crisis actually began in 2004 when the 10-year cycle last bottomed. It was then that a definite trend came into being whereby small retail investors became bearish on the market outlook and were convinced that a repeat of the 2001-2002 market debacle was imminent. When the 10-year cycle bottomed in October 2004, however, the market disappointed this expectation and began a long upward path to new all-time highs in the major indices. Yet the small retail investor remained largely unconvinced of the bull’s durability and remained on the sidelines, effectively launching what became a 5-year-long buyers strike.

The year 2005 was an unusual one in that the stock market should have been much stronger than it was but was held back by the policies of the Greenspan Fed. Stocks were kept on a tight leash that year and because the much touted “Year Five Phenomenon” didn’t produce a stellar gain for stocks in 2005, the small retail investor became even more entrenched in his conviction that the market was ripe for another crash.

That crash never came, even with the peak of the Kress 6-year cycle that year. Following the 6-year peak, the market topped out on an interim basis in early 2006 and stumbled into the summer of that year. For the non-participating retail investor, here at last was the moment he had been waiting for. Stock prices were tumbling and for all the world it looked like the bottom might actually fall out of the global markets. But before the hopes of the small investor could be realized the market bottomed out in June that year and turned around in dramatic fashion, leaving the small investor once again standing on the sidelines aghast at the site of the market train leaving the station without him.

The market outperformance of the second half of 2006 was one of the most amazing rallies of this decade and another of the many missed opportunities of the small retail investment crowd, which was by now fully cognizant of the missed opportunities of the preceding three years. Indeed, the frustration of the non-participating investor had by this point reached the boiling point and there began a fulmination against what these non-participating observers felt was a “rigged” stock market that was tilted in favor of the “big boys” and against the interest of the small investor. It was at this point that the collective buyer’s strike of the small investor achieved a critical mass. Non-participants were even more determined to justify their refusal to buy stocks by actively rooting for the stock market’s downfall. They formed Internet support groups to cheer each other along in their bearish cult of non-participation. The perma-bear gurus of yesteryear came back into vogue and being bearish became fashionable and marked its adherents with an air of sophistication.

To the delight of the bears, along came 2007 and with it the beginning of the credit storm. The year 2007 was the year that the collective frustrations of the non-participants reached its apogee. It was a year characterized by extreme market volatility, negative news and a fierce struggle between the bulls and the bears. By the end of ’07, the bears had finally gained a victory as they took control of the market and, with the 6-year cycle tilted in their favor entering 2008, the bears took full advantage of the situation.

In many ways 2008 was a catharsis for the members of the non-participation cult. They had the satisfaction of seeing the stock market crumble, the same market that had consistently left them standing in the lurch watching its meteoric ascent from the sidelines. They were afforded the long awaited opportunity of being able to say with smug satisfaction, “See, I told you so!” The market crash of 2008, to the non-participants, was for all intents and purposes the release of four years’ worth of pent up tension.

Aside from the myriad factors that led to the credit crisis, there is another factor behind the 2008 crash that is seldom discussed. Call it the cost factor. When stock prices began to rally in late 2004 after the 10-year cycle bottom, then continued rallying into 2007, a point was reached along the way whereby the cost of participation became largely prohibitive. Stocks became progressively more expensive relative to household incomes to the point where even those non-participants who were willing to step off the sidelines and into the market were quite unable to. The tight money policy of the Fed during the 2005-2007 period didn’t help matters and the implosion of the housing bubble in 2006 effectively took away a major support from the small investor, which only made matters worse. That the credit crash last year did more to rectify this problem is something most pundits aren’t prepared to acknowledge.

By March 2009 when the bear market ended, stock prices had plunged to the very levels that were seen when non-participants turned bearish all those years ago. Here was a prime opportunity for the non-participating small retail investor to finally re-enter the market and ride the recovery rally that was sure to follow on the heels of the 6-year cycle bottom. Yet once again the small investor refused to participate. He found himself again in the unenviable position of watching as stocks took off and rallied 60 percent over the next nine months.

At this point the refusal to participate can no longer be blamed on a buyer’s strike. Instead it can be attributed to a visceral fear that a recurrence of last year’s crisis is just around the corner. But as the much hoped for economic recovery becomes more of a reality and banks and the housing market stabilize, the non-participants are slowly starting to change their attitude toward equities. They’ve grown tired of receiving a pittance for their reluctance to enter the stock market. They’re low-yielding safe haven investments are no longer seen as attractive as they were last year when virtually every asset price was plunging and now that prices have largely recovered. They’re casting a furtive glance at the stock market they’ve so despised over the last five years.

Another factor that isn’t much discussed is that a market recovery can only proceed so far without widespread participation from the retail investment crowd. There is a limit to the extent to which institutional and hedge fund investors can push the market before hitting the wall. In order for this recovery to continue, the public must emerge from its collective shell and start showing some interest in stocks, otherwise the market recovery will prove to be nothing more than an elongated decompression rally. Market makers are well aware of this and will do everything they can to lure the non-participating public out of the bomb shelter.

As the economic recovery gains traction in 2010, these non-participants will gradually retreat from the safe havens and renounce their membership in the cult of non-participation. Until stock prices once again become too expensive relative to the incomes of the small retail investor, the market will prove to be an enticement too great to ignore for the small investor. The days of the cult of non-participation may yet be numbered.

On a related note, we continue to look to the stocks of the leading U.S. retailers for signs as to what the critical holiday sales season will hold. The retail shopping season is already well underway and this is where many retailers make their biggest profits of the year. This year’s retail season will be a litmus test as to whether consumers are coming out of their shells after taking a hiatus in the previous two retail seasons.

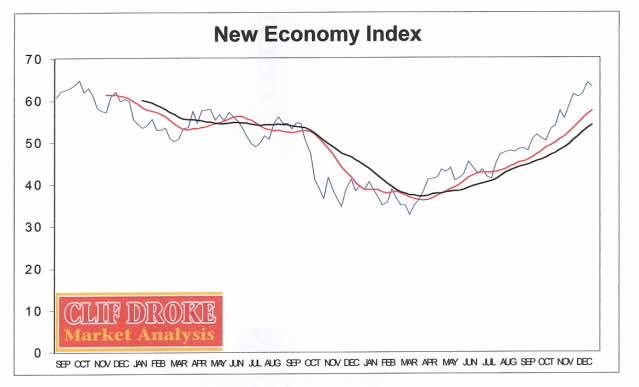

Our New Economy Index (NEI) attempts to measure future anticipated strength or weakness in the U.S. retail economy through the action of the five leading retail and domestic business outlook stocks: Amazon.com (AMZN), Ebay (EBAY), Wal-Mart (WMT), FedEx (FDX) and Monster Worldwide (MWW). Collectively these five stocks reflect the outlook for online as well as “bricks and mortar” retail sales (AMZN and WMT), retail employment (WMT), domestic employment (MWW) and domestic sales and shipping (FDX) as well as consumer and home-based business sales demand (EBAY).

The New Economy Index chart shows that the combined action of the aforementioned stocks has outperformed the broad market S&P 500 (SPX) quite significantly and the NEI is closing in on a 2-year high. The implication is that the U.S. retail sales outlook is more promising in the intermediate-term outlook than many of the pundits are willing to concede.

By Clif Droke

www.clifdroke.com

Clif Droke is the editor of the daily Gold & Silver Stock Report. Published daily since 2002, the report provides forecasts and analysis of the leading gold, silver, uranium and energy stocks from a short-term technical standpoint. He is also the author of numerous books, including 'How to Read Chart Patterns for Greater Profits.' For more information visit www.clifdroke.com

Clif Droke Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.