Return Of The Gold Standard

Economics / Money Supply Jul 21, 2007 - 01:00 AM GMTBy: James_West_2

We humans are remarkably committed to self delusion.

From the personal level to the most powerful government on earth, we contrive realities with distorted perspectives so we can execute ideas that would otherwise cause us to hesitate if we were to objectively and honestly consider their moral implications. The moral code is constantly being revised to accommodate current events.

World War I is a perfect example.

Archduke Franz Ferdinand, heir apparent to the then powerful Austro-Hungarian empire, was assassinated on the 28 th of June, 1914 , by a Serbian nationalist group known as the “Black Hand”.

The Austrian-Hungarian government effectively declared that Serbia 's sovereignty would be revoked unless the perpetrators were brought to justice forthwith. What they were really after was the Balkan lands comprising Serbia and Bosnia .

Austria-Hungary's expectation was that Serbia would reject the remarkably severe terms of the ultimatum, thereby giving her a pretext for launching a limited war against Serbia .

Serbia 's strong ties to Russia at the time caused the Hapsburgs to solicit the tacit support of Germany , if required, to dissuade Russia from rescuing Serbia . The Austro-Hungarians declared war on Serbia on July 28, 1914 , one month after the Archduke's death.

Russia promptly mobilized her vast army in compliance with its treaty terms with Serbia . Germany , in observation of its treaty with Austria-Hungary , declared war on Russia three days later.

France , and then Britain joined the fray after Germany 's invasion of Belgium .

With Britain 's throw-down, Canada , Australia , India , New Zealand and South Africa were obliged to take up arms.

Eventually, Italy , Japan , and finally the United States were drawn in.

Superficially, the motivating factors for aggression were various treaty agreements and allegiances that facilitated the subsequently obscured ambitious intent behind each nation's declaration.

In fact, each country's decision to enter the war was really based on either limiting the empirical ambitions of a neighbour, and/or furthering their own expansionist designs.

Like most wars, it became a war fought on fabricated principles to obfuscate the covetous designs of the participant's leadership.

It was known that the very wealthy were interested in involving the American government in that war, and Secretary of State Will iam Jennings Bryan was one who made note of this. "As Secretary [Bryan] had anticipated, the large banking interests were deeply interested in the World War because of wide opportunities for large profits.

On August 3, 1914 , even before the actual clash of arms, the French firm of Rothschild Freres cabled to Morgan and Company in New York suggesting the flotation of a loan of $100,000,000, a substantial part of which was to be left in the United States , to pay for French purchases of American goods."

The average citizen, as both foil and cannon fodder for armed forces, had to be coerced into consent through the elaborate machination of public opinion by the elite forces that controlled the media.

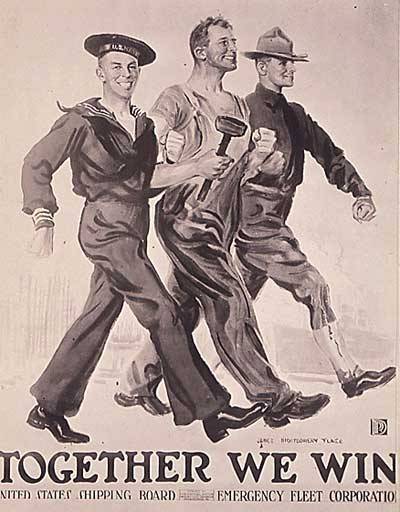

Though the US didn't joined the war until 1917, the government deployed more propaganda posters in support of its decision than any other nation involved.

Robert Lansing, the Assistant Secretary of State, is on record as stating: "We must educate the public gradually — draw it along to the point where it will be willing to go into the war."

Gold's role in modern global economics is as much a result of perception manipulation as was the ultimate perception of the moral imperatives behind the First World War.

The financial elite understand that you can't make as much money off of something with a finite existence (gold) as you can with an infinite existence (currency).

Thus the propaganda machine of the US Government – the media – has been hard at work, facilitating the popular perception that inflationary economics are sound economic theory and gold has limited use outside of jewelry.

I'm not even going to go into any detail on the incredible manipulation that has gone on by the gold cartel since 1990.

The gold standard, popularly perceived to have been abandoned in 1971 with the suspension of the Bretton Woods Agreement, is alive and well. All it takes is a modification of one's own perception to understand that fact.

I suggest here that a centurial analysis of the history of gold will reveal that, in fact, even in times of dissolution, the gold standard ultimately exists, albeit tacitly.

Because gold's value is intrinsic, and its price governed absolutely (in the absence of market manipulation) by the economic forces of supply and demand, it is not subject, in an absolute sense, to participation, or abandonment, by any government or financial institution.

And when I say “intrinsic”, I mean, intrinsic. (Defined: “belonging to a thing by its very nature.”)

No matter where you are in the history of civilized (using the term loosely) humanity, the value of gold is recognized instinctively.

Even if you were from another planet, and you were to pick up a gold coin lying at your feet and put it into your pocket, everybody from your own planet that you showed it to would agree that it was valuable by its very appearance and heft, and would want to acquire it from you in exchange for something of value that they possessed and could convince you of its worth.

There is not a currency in existence today that wouldn't be merely wadded up and disposed by our visiting aliens, because they wouldn't be privy to the collective human mindset that values a paper promise over the tangible real McCoy.

Evidence in support of this premise abounds in the wild fluctuations of the world's floating fiat currency markets, which is essentially a marketing driven popularity contest underlain by the threat and ability to dispatch superior armed forces to support one's inflationary policies.

In a broader sense of time, the de-coupling of a nation's worth from its reserves of gold will be viewed in retrospect as a comical experiment by corrupt and duplicitous governments to achieve self-enrichment at the expense of their own citizenry.

Ultimately, all currencies are measured in a historical sense against the value of gold. Civilizations come and go, along with their fiat currencies, while gold's value endures, and gold itself endures, ad infinitum, across all the manifestations of human delusion.

And what, may I inquire, is the difference between a currency tied to gold and a gold ETF?

A return to “The Gold Standard” is closer than you think.

By James West

James West is an independent writer who has been active in the management, finance and public relations of public companies in both the resource and technology sectors for over twenty years.

Disclaimer: The opinions expressed above are not intended to be taken as investment advice. It is to be taken as opinion only and I encourage you to complete your own due diligence when making an investment decision.

James West Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.