Staggered Return to Global Economic Growth For 2010

Economics / Economic Recovery Dec 22, 2009 - 06:20 PM GMTBy: Victoria_Marklew

We are ushering in 2010 on a note of guarded hope, unlike the dawn of 2009 when great apprehension about the global economy was the predominant theme. Three broad aspects stand out as the curtain closes on 2009. First, recession is now a matter of history. Second, massive financial sector blowups are mostly behind us, but smaller yet significant tempests cannot be ruled out. Third, an arduous economic recovery is nearly certain. Against this backdrop, we think the world economy will move ahead with mixed economic momentum but mostly tilted toward a positive economic growth trajectory. We begin with predictions of economic growth, inflation, and unemployment, then take a look at fiscal challenges, currency issues and potential asset valuation problems in selected countries.

We are ushering in 2010 on a note of guarded hope, unlike the dawn of 2009 when great apprehension about the global economy was the predominant theme. Three broad aspects stand out as the curtain closes on 2009. First, recession is now a matter of history. Second, massive financial sector blowups are mostly behind us, but smaller yet significant tempests cannot be ruled out. Third, an arduous economic recovery is nearly certain. Against this backdrop, we think the world economy will move ahead with mixed economic momentum but mostly tilted toward a positive economic growth trajectory. We begin with predictions of economic growth, inflation, and unemployment, then take a look at fiscal challenges, currency issues and potential asset valuation problems in selected countries.

Economic Outlook

Economic Outlook

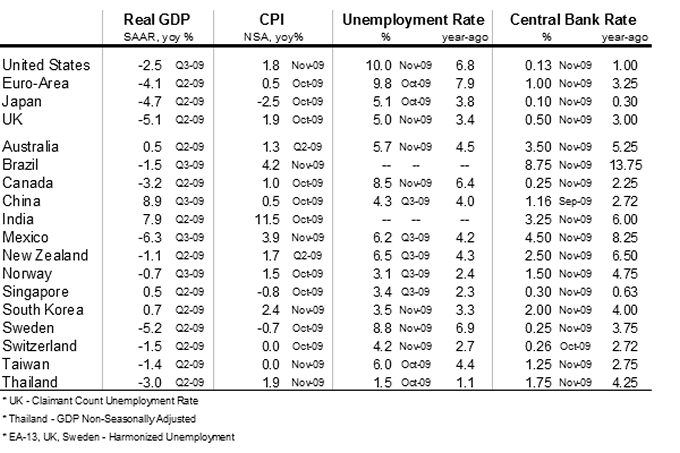

The U.S. economy is predicted to grow around 2.5% in 2010, reversing a decline in real gross domestic product of a similar magnitude in 2009. The pace of economic expansion envisioned for 2010 is roughly one-third of the historical average of economic growth that has occurred in the first year following recessions in the post-war period, excluding the 1990-91 and 2001 downturns. The severe recession of 1981-82 was followed by nearly 6.0% GDP growth in the first year of the recovery. Financial headwinds are the main reason for the projection of tepid growth in the U.S. economy during 2010.

Consumer spending will continue to be constrained by sluggish labor market conditions, reduction in net worth, and tight credit conditions. Discretionary spending will be the missing element in the lukewarm pace of consumer spending. Improved affordability of homes stemming from low mortgage rates, favorable prices and temporary support from the tax credit programs are factors contributing to the housing market recovery. Capital spending will play a small role in the revival of economic activity, with inventory replenishment accounting for most of the activity as firms rebuild their stockpiles following a substantial liquidation in recent quarters. The impetus for export growth is primarily from the worldwide economic recovery and secondarily from a relatively weak dollar. The bulk of the $787 billion fiscal stimulus package will be spent in 2010, augmenting anticipated soft private sector demand. Problem loans in the commercial real estate sector will present a challenge in 2010 as office and industrial vacancy rates have set new record highs and prices of commercial real estate have plunged. In addition, weak employment conditions are affecting the financial viability of commercial real estate investment. Essentially, unfavorable conditions which could set off a cascade of loan defaults in the commercial real estate sector are in place.

The unemployment rate is projected to peak at about 10.5% in the middle of 2010. The soft growth projections for 2010 arising from financial headwinds, the reduced workweek, and the structural change in the economy due to a massive slump in housing and auto demand will result in sluggish hiring in most of next year. Inflation will remain on the backburner in 2010 largely because of weak final demand conditions. These are the broad contours of the nature of economic activity in the U.S. economy during 2010. The most troubling aspect of the recovery is that the economy will continue to be fragile in 2010 and remain susceptible to additional shocks, albeit significantly smaller than those experienced in the recent crisis.

The major challenge for U.S. policymakers at the moment is the lack of credit creation in the economy. Although the Fed has provided an extraordinary amount of monetary accommodation since the financial crisis unfolded in the summer of 2007, this Fed-created credit has not been transformed into credit for the private sector. Thus, a significant credit contraction is underway. Prior to the onset of the current recession, financial institutions were highly leveraged. As the crisis unfolded they experienced severe capital inadequacy. To set their respective financial houses in order, they became engaged in repairing balance sheets, reducing risk, and improving credit quality. Currently, financial institutions appear to be adequately capitalized, but they are reluctant to extend credit. They remain wary because of continued challenges associated with home mortgages, anticipated losses from commercial real estate loans, further defaults of auto loans and credit cards and uncertainty about the new regulatory capital requirements.

The Fed is expected to leave the monetary policy dials untouched until the August 2010 FOMC meeting. The official increase in the federal funds rate is most likely to be preceded by a gradual drift up in the effective federal funds rate to the top of the current target range of 0%-0.25%. The exit strategy of the Fed is anticipated to be made up of two phases. The initial phase of monetary policy tightening is likely to be measured hikes in the second half of 2010 followed by more aggressive policy action in 2011 as the economy gathers momentum (See details).

Euro-zone and UK

In January 2009, Europe was in economic deep-freeze across the board. Today, most of the major economies are showing subdued levels of growth, but this does not indicate a strong recovery.

Where 2009 was the year of coordinated fiscal and monetary stimulus across Europe, stances are already starting to diverge as we head into 2010. The European Central Bank (ECB) is starting to pull back from the "extraordinary" monetary measures put in place last year, even as it emphasizes that policy interest rates will remain on hold for a while. However, in the UK - which continues to suffer from the hangover of the 2008/09 housing bubble collapse and global financial crisis - the focus remains on monetary stimulus and support, with quantitative easing set to continue into the spring and the Bank of England likely to keep interest rates at the current record low into 2011. On the fiscal side, the beginning of 2010 sees stimulative measures firmly in place in the major European markets, but as the year progresses the policy focus will start to shift toward restraint and even outright austerity - with negative implications for demand across the region. There will also be sporadic financial sector concerns throughout the year, as major banks see a large chunk of their lending to countries in central and eastern Europe (CEE) turning sour.

The Euro-zone 16 (and EU-27) emerged from recession in Q3 2009 but so far most indicators for Q4 have been subdued. The 'zone as a whole should see real GDP growth of 1.0% in 2010 but growth in the UK is likely to be lower and could even be slightly negative.

The European Central Bank (ECB) has already begun the process of withdrawing its extraordinary liquidity support measures, but will do so cautiously over the next few months, mindful of the problems that still burden some of the region's larger banks. However, it will be in no hurry to start hiking its refi rate, which has been at 1.0% since May 2009 and looks set to stay there at least through the first half of 2010, and quite possibly until Q4. Once the bank does shift into a hawkish mode, we can expect Governor Trichet to devote a couple of months' worth of press conferences to prepping the markets before any actual rate hike occurs.

Emerging Europe

While emerging markets will be the focus of global growth in 2010, most of the CEE countries will be the exception, with "tail risks" across this region remaining significant. In all but a few cases, the CEEs will continue to under-perform economically and to have higher policy and political risks. Countries such as Hungary, Latvia and Romania will struggle to implement fiscal austerity measures while trying to placate increasingly-restive voters as their economies continue to contract. Poland and the Czech Republic will likely suffer the backwash whenever one of the more troubled markets comes under pressure, even as their economies gain some traction. And at the other end of the spectrum, Ukraine will be lucky to make it through the year without an outright sovereign default.

China

This year began with China pressing extreme fiscal stimulus to counter the rising headwind of a global slowdown that was crushing exports and stirring rumors of recession. Since then, growth has rebounded while fears have subsided, and focus is now turning toward normalizing the policy environment, adjusting the stimulus-induced imbalances in the economy, and assessing the condition of the banking sector.

According to official Chinese statistics, the economy reached its low point during Q1 2009 when growth slowed to 6.1% on the year. After that point, the effects of Beijing's 4 trillion yuan ($586 billion, or about 16% of GDP) fiscal stimulus package began to take hold, bringing growth to 8.9% by Q3 and raising expectations that the economy would reach or exceed the government's goal of 8.0% growth for all of 2009. The trade surplus has stabilized, although at a lower level than pre-crisis, leaving some concerns about how much of a contribution net exports will make to GDP and the overall recovery.

Looking forward, the official figures will suggest the economy is rebalancing itself in 2010 while inflation returns at a manageable level. However, there will be questions about the sustainability of growth when the fiscal stimulus package runs its course and the economy again has to rely on external demand from a weakened global economy. Also of concern will be how damaging the recent slowdown was to the Chinese financial system and whether accumulated losses will need to be addressed going forward.

Japan

When the global financial market crisis hit in September 2008, Japan was already on its way into recession. The collapse of global demand aggravated the economic slowdown significantly, and only after four quarters of GDP contraction did the economy post positive figures. The rebound, however, has been weak despite fiscal boosts and a return to quantitative easing, and growth could easily turn negative in early 2010.

Japan's struggles over the past year stem from three sources - a large export sector that leaves the economy exposed to fluctuations in global demand, heavily-burdened public finances that handcuff policymakers' ability to generate fiscal stimulus, and precious little room for monetary easing to spur credit growth. These constraints ensured that the recession was deeper and more prolonged than anything witnessed since the Nikkei bubble burst in 1990, and that the recovery would be fragile and heavily dependent on a strong recovery in the rest of the industrialized world. Further to this, significant deflation has raised real interest rates, which has in turn strengthened the yen and placed exporters at a competitive disadvantage.

The coming year will provide the Bank of Japan and fiscal policymakers plenty of challenges, and there are not many tools handy to turn around the country's fortunes. The most likely scenario suggests weak and occasionally negative growth during 2010, with the only positive developments coming from a modest recovery in exports. This has been the standard route out of recession for Japan, but it will be particularly difficult to handle this year and is fraught with substantial downside risks.

Developing Asia

Most of the export-driven Asian countries entered the global slowdown with low growth rates and weak external balances, and in turn went through sharp contractions in growth from the drop in net exports. However, many of these countries - in particular Singapore, Hong Kong, Taiwan and South Korea - spent the last decade reforming their regulatory and policy structures in the wake of the Asian financial crisis. With substantial cushions of reserves, low levels of foreign-currency denominated or short-term debt and fair-valued currencies, these economies were able to withstand the global economic upheaval and quickly return to positive, albeit modest, rates of growth.

Americas

The countries in the Americas that are deeply tied to the US economy had a tough year and, as we expect for the US, will see a slow recovery in 2010. The first in this category is Canada. While the coupling of the Canadian economy with that of its southern neighbor weighs heavily on its outlook, the avoidance of a full-scale housing crash and subsequent financial fallout places Canada in a relatively stable position going into the New Year and beyond. The contraction seen in 2009, expected to amount to 2.6% of GDP, was driven primarily by weak American demand for its exports, as well as lower commodity prices and declining investment early in the year. Though the export sector appears to have stabilized and job losses have stopped, the growth prospects for 2010 remain constrained by demand prospects in the US. The growth story for next year is similar in Mexico, which is expected to post a 3.0% expansion, after suffering through a 2009 real GDP contraction of over 7.0%. In addition to being subject to fluctuations in the US, the Mexican economy faces the harms of continuing fiscal decline, looming inflation (driven in part by recent tax changes) and declining oil output next year. The myriad countries that rely on the US for their service income, namely in the English-speaking Caribbean, will face continued hardship in 2010 with little prospect of meaningful recovery. Tourism receipts are not likely to recover to pre-crisis levels for many years and an inability to take on much public debt has lessened the capacity for stimulative government spending.

Meanwhile, the outlook in economies that are less US-dependent looks unsurprisingly better. Stronger than expected commodity demand in China helped insulate Brazil, Chile and Peru from the crisis and has the countries poised to realize sizeable real GDP gains in 2010: 4.8%, 4.2% and 4.1%, respectively. While it was commodities that helped to insulate, faster-than-expected domestic demand growth, combined with steady payroll increases, suggest that economic expansion will be driven from within in coming years.

Africa

The emerging market-led growth story of 2010 will extend to sub-Saharan Africa in rare instances. The majority of the continent remains moored to the whims of commodity markets and the vagaries of agricultural production. While we expect the next year to bring continued commodity strength, it is far from a reliable proposition. The two largest economies, South Africa and Nigeria, will both see meaningful expansion in 2010, 2.8% and 5.5% respectively, though it will be driven by continued counter-cyclical spending and not a household recovery. Infrastructure spending ahead of the 2010 World Cup in South Africa will tail off in the second quarter, though the services boost should continue throughout the summer. The government in South Africa has allowed the public finances to run amok ahead of the tournament in an effort to stem job losses while banking on the impending recovery to stabilize the fiscal account in coming years. While not as serious as in many parts of the developed world, fiscal deterioration across the continent will present a significant liability should the global recovery be much slower than forecast.

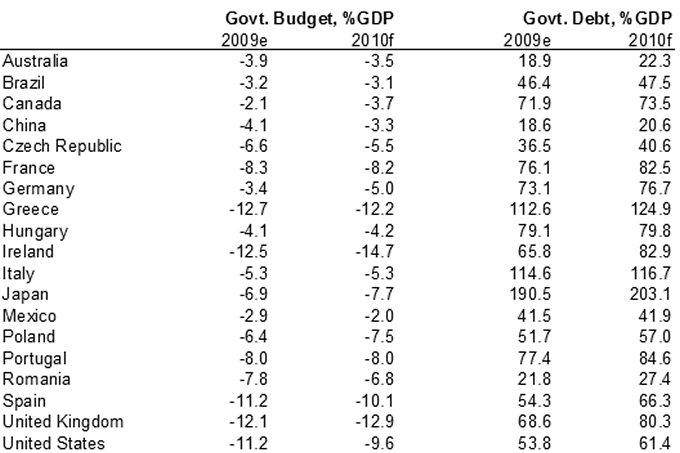

Fiscal Challenges

The financial crisis spawned massive fiscal policy support across the globe to stabilize the world economy. The size of the public sector spending to offset insufficient private sector demand varied across the global economy and it has been largely justified given the nature of the crisis. The synchronized increase of budget deficits across major economies of the world will leave most governments with the highest debt levels as a percentage of GDP in the post-war period. Stability of the global economy has been the raison d'être for the extraordinary policy actions following the financial crisis. Therefore, cautious unwinding of policy actions is expected but questions about the sustainability of large and growing public debt will remain prominently on the radar screen.

Most of the fiscal deficit story is focused on the major markets of Europe and North America (and perennially Japan). However, unlike most of emerging Asia or Latin America, which learned their lessons in past crises, the CEE countries are facing fiscal deficit problems as a result of the excesses of the past decade.

Starting with the U.S., the main criticism about policy management during the Great Depression is the premature withdrawal of fiscal and monetary policy support which led to the second leg of the crisis during 1937-38. Therefore, policymakers are likely to err on the side of being cautious before reducing fiscal accommodation. The fiscal stimulus package enacted in February 2009 will work its way through 2010 with discussions about reining in future budget deficits gaining importance after signs of self-sustaining economic growth have emerged.

According to estimates of the Congressional Budget Office, if fiscal stimulus will be withdrawn between 2010 and 2012, the budget deficit will decline from 10% of GDP in 2010 to 4.0% of GDP in 2012. By implication, private sector demand will have to grow by this measure, all other things constant, to prevent a reduction in output and employment. It is widely expected that a virtuous cycle of economic expansion will emerge such that a real and financial recovery will reinforce each other by the final three months of 2010.

The longer term fiscal challenge for the U.S. economy is seen in the Congressional Budget Office projections of the budget deficit several years down the road. The most recent forecasts show that after 2012, budget deficits would remain above 3% of GDP under current law and would be close to 6% of GDP if the 2001 and 2003 tax cuts were to be extended and the Alternative Minimum Tax were indexed to inflation. This is a serious setback for the long-term growth path of the U.S. economy as an upward trend of budget deficits would translate into rising interest rates and the textbook case of crowding-out of private sector investment and a shrinking of potential GDP of the economy. Moreover, in the eventuality of an extension of the 2001 and 2003 tax cuts coupled with growing entitlement expenditures, the public debt of the nation would be more problematic. In a nutshell, the fiscal challenges facing the U.S. economy in the near term are less threatening than those in the medium/long term.

Europe

In the major economies of the European Union, ballooning fiscal deficits and rapidly-rising levels of public sector debt will be a major headache in 2010. The worst problem is looming in Greece, which had been able to take advantage of its membership in the Euro-zone over the past decade to issue hefty amounts of debt at low interest rates, so cushioning successive governments from the effects of their profligacy. It has now become glaringly obvious to investors that not all Euro-zone debt issuers are created equal, and pricing has shifted accordingly. It has also become clear that Germany is neither willing - nor, under the terms of the European Monetary Union, able - to bail out the likes of Athens. The dismal state of the Greek public accounts will dominate the headlines in 2010, weighing on investor perceptions of the Euro-zone as a whole, particularly if public spending cuts trigger widespread protests across the country.

Global Fiscal Picture -- selected markets

In addition to Greece, the headlines will also focus on the woes of Portugal, Italy, Ireland, and Spain (together with Greece, now dubbed the PIIGS). Spain and Ireland suffered very sharp recessions in 2009 and their recovery in 2010 will be hampered by the lingering effects of bursting housing market bubbles. However, both are working hard to get their public finances into shape, and both have much better overall macro-economic prospects over the medium term. Italy and Portugal will likely continue to under-perform and the size of their public sector debts does not give either one much room for fiscal maneuver, but of the five PIIGS the one at greatest risk of further sovereign rating downgrades is Greece.

The rest of the 16-member Euro-zone is not immune to fiscal woes. Member governments have agreed to bring their budget deficits back below 3.0% of GDP by 2012, which implies that some hard decisions about fiscal austerity will have to be made starting in 2010. This will have negative implications for domestic demand across Europe heading into 2011, even for those EU countries that entered the recession in better fiscal shape than their neighbors.

Outside the Euro-zone, fiscal problems are particularly stark in the UK, where the extent of austerity that will be needed to get the public accounts back on a sustainable footing is likely to become apparent after the general election due in the first half of the year. The UK will struggle with budget problems for the next few years, but its structural fundamentals are in much better shape than was the case in the mid-1970s (the UK asked the IMF for aid in 1976 after unemployment and inflation both soared). Today, it still has some room to maneuver before being seriously at risk of losing its coveted AAA status.

The outlook for emerging Europe is similarly divergent. Some countries launched fiscal consolidation efforts in 2009 - e.g., Hungary and Romania - and they are starting to suffer the political fall-out, which will worsen through 2010. However, even the likes of Poland and the Czech Republic, which went into 2009 in better fiscal shape than many others and also weathered the recession somewhat better, will have to start reining in public spending at the same time as facing higher long-term global interest rates and still-subdued export demand from their neighbors.

Asia

With the exception of Japan, Asia's public debt situation is far more manageable than other regions. Debt reduction is a key policy measure for most of the exporting economies, and as external demand rose during the 2006-08 period and revenues grew beyond expectations, governments placed a priority on reducing their debt obligations. Even Japan's immense public debt stock fell beneath $8 trillion (just over 160% of GDP) just before global credit markets locked up and brought on the global financial crisis. However, most countries in the region had debt ratios closer to 35% of GDP in late 2008, providing ample room for fiscal stimulus.

With Japan's public spending binge likely to place government debt at over $10 trillion in early-2010 and on a steep upward trajectory, markets are beginning to ponder the possibility of Tokyo falling into a spiraling debt trap. Japan has been able to issue the bulk of its debt during an extended period of ultra-low interest rates that have held down servicing costs and kept compounding low when rolling over these obligations. However, such low yields make yen-backed securities less desirable, so without a better return the market is likely to get saturated at some point, forcing treasury rates higher and placing the government in a pinch to service its debt. Nobody is talking of a Japanese debt default in 2010, but unless the new government takes some measures to address the escalating debt situation, it is possible that it could receive agency downgrades, which would also force up rates and push matters ever-closer to the edge.

Two of the standout economies in the Asia-Pacific region have been Australia and New Zealand, which have handled the recent crisis well despite being strong net importers. The two developed economies both ran strong current account deficits, with New Zealand holding the larger as a percentage of GDP. Their relative stability was maintained in large part due to high interest rates that brought in high levels of foreign investment to satisfy high financing demands, and budget surpluses that left public debt contained and offered a second source of domestic savings. New Zealand did experience a sharp correction in its inflated real estate market and therefore experienced a significant recession, but its structural integrity and underlying monetary and fiscal flexibility allowed policymakers to weather out the global crisis without any lasting damage. Australia avoided recession altogether, and is one of the few countries raising interest rates toward a more normalized level.

Americas

While the Latin American economies have largely avoided the fiscal trappings to the levels that are seen in much of the developed world, concerns remain for 2010 and beyond. Across the board, government deficits have increased, though not to a level that presents immediate vulnerability. It should be noted that Latin American governments have been notoriously bad at reining in spending once it has been inflated (see Argentina). This factor is of concern in Brazil, where a looming election will make it even harder to contract expenditures. Similarly, in Mexico, the bleak outlook for fiscal reform and the deteriorating sustainability of public finances have resulted in rating downgrades, and the picture is unlikely to change in the coming year unless a massive run-up in oil prices were to insulate the account. Conversely, many Latin American nations have taken advantage of low interest rates and improved outlooks to reduce their debt-service burdens through restructuring. Maturities have been extended, most notably in Peru and Brazil, with Argentina even clamoring to get in on the action. The interest payment burden, which is of perennial concern to Latin American fiscal sustainability, will be further eased in 2010 as global interest rates remain low.

Currency Issues

By default, we need to start with the U.S. dollar. The U.S. dollar trade-weighted index moved from a low of 69.6 in March 2008 to 86.1 by March 2009 reflecting a flight to safety after the collapse of Lehman Brothers. It is now trading in the low 70s as the global economy stabilized, risk appetites returned and non-dollar assets were considered as relatively safer bets. These wide swings of the trade-weighted dollar reflect the turbulence in financial markets. The world economy is now operating on firmer ground and exchange rates appear to be stabilizing. The probability of the dollar declining significantly in the near term is small because the risks associated with the euro are growing and will be tested further. The budgetary issues that Portugal, Italy, Ireland, Greece, and Spain are facing will need a resolution in the near term. A clear communication to markets of how the authorities would address the problem such that these governments will not default will be necessary in the short-term to alleviate concerns about the euro. The U.S. dollar also is gaining stability as expectations of second-half 2010 Fed tightening increase. At the same time, the probability of a sharp appreciation of the dollar is tied to the status of financial markets in 2010. In the event of a major global crisis, a flight to safety and a rally of the dollar is conceivable. Based on these considerations, it appears the dollar is most likely to trade in a narrow range in 2010.

The long-term prospects of the dollar are tied to a sustained reduction of the budget deficit. The nation has to be weaned away from foreign savings that finance the shortfall. The latest upward trend of domestic private sector saving is a big positive for the U.S. economy and supportive of the dollar. The dollar will remain as the preferred reserve currency, albeit a gradual reduction of its role is likely as the power structure is changing with new players in the global economy. There are no alternatives for the dollar waiting in the wings to assume the role of a full-fledged international reserve currency in the near future.

Europe

The fiscal woes of many of the Euro-16 economies will weigh on the common currency in 2010, not to mention periodic concerns about some national banking sectors. These are not new developments - Greece has had public finance problems for years and the exposure of some Austrian banks to bad debts in the Balkans has been an issue for months. However, with the worst of the global financial crisis and recession now behind us, markets are more focused on such problems, all of which will be negative for the euro over the coming months.

China

The rate of the Chinese yuan, currently held around RMB6.83/US$, is pivotal to the country's recovery but also to maintaining a healthy relationship with trade partners. As the global economy began to slow in 2008, the Chinese government halted the yuan's managed appreciation at close to its current rate as a means of supporting the export industry. As the global crisis emerged and snowballed into 2009, the yuan and its de facto peg gained competitiveness through dollar weakness but drew the ire of regional economies with free-floating currencies that were appreciating dramatically. China's export industry is in fact coming back from its end-2008 depths, but there is no clear consensus on when the government will allow the yuan to resume its gradual appreciation.

As of now, the People's Bank of China believes that the economy is in full recovery mode, but that the rebound is uneven and has points of weakness. There are also unspoken concerns about the relative stability of the financial sector, which took a significant hit from the dramatic economic slowdown (although figures are difficult to find). These factors both suggest that the government is unwilling to allow for any near-term yuan appreciation that could threaten stability, and is unlikely to make any adjustments to exchange rate policy until at least July 2010. Any revaluations would likely be preceded by a bullish change in outlook by the PBoC, with a month or so of preparatory statements that would normally precede any policy tightening. Until such a move is made, Beijing will have to convince the outside world that a stronger yuan could be of detriment to its economy and to global recovery and fend off increasingly-strong demands for some forex adjustment.

Japan

Conversely, the free-floating yen remains an enigma. Despite a weak economy and ultra-low interest rates, high real interest rates thanks to a renewed bout of deflation have supported the yen's rise to ¥86.1 by end-November. Exports, which fell by half over the course of last year, have in turn struggled to recover in light of a particularly strong currency and weakness in the US$. The government has run out of effective tools with which to somehow inflate the economy, weaken the yen and restore export activity other than printing more yen. With concerns about a pending debt trap on the rise, Tokyo has resisted using inflation as its way out of trouble, which leaves the painful alternative of hoping for a brisk recovery in the US and its other main trading partners and letting their demand for Japanese exports drag the country out of its recession. Until that happens, the yen will remain as Japan's worst enemy.

Developing Asia

Other regional economies without such dramatic imbalances will experience some appreciation in trade-weighted terms, which will be matched to an extent by nominal gains as policymakers initiate rate hikes. Most countries will be hesitant to raise rates before China tightens policy (monetary or forex), but by end-2010 the major export economies will have hiked rates at least once. As long as the tightening is not at a faster rate than moves by the US Fed, currencies will be little-affected by widening interest rate differentials.

Americas

Latin American currencies have seen rapid run-ups in both their nominal and real values during the past year, with the conspicuous exception of the Argentine peso. The Chilean peso will end the year up 22% against the dollar and the Brazilian real has seen a 25% appreciation this year. Even the Mexican peso is up 7%, despite a brutal year for the economy. These appreciations, and more amongst the minor currencies, have been a result of both dollar weakness and strong capital inflows. We expect the currencies to maintain strength relative to their long-term trade-weighted values; though slight depreciation will likely be the trend for 2010. In the past, when Latin American economies have witnessed overvalued real exchange rates and huge capital surpluses, as many are today, the economic growth to support the trend has not followed. Once inflows dried up, massive depreciations followed. That should not be the case this time around, as many central banks have used their currencies' strength to amass huge dollar reserves which will help to provide relative currency stability throughout 2010. To put this in some perspective, Brazil started the decade with roughly $30 billion in foreign-exchange reserves and will end it with about $210 billion. While this certainly insulates against a sharp, sudden depreciation, reserves will not protect Latin American currencies from depreciation that may be viewed as beneficial to exporters by governments - a factor that is likely to be of increased importance in 2010 as the effects of deteriorating terms-of-trade gain weight politically.

Asset Markets Outside the United States

Europe

There is no real risk of new asset bubbles arising anywhere in Europe over the coming year. The region is still suffering the effects of a massive destruction of capital in 2008/2009, and European banks will remain cautious about credit provision well into 2010. The one notable exception is Russia, which has seen a surge in speculative inflows in recent weeks, boosting its stock market to unsustainable levels. The government will likely try to curb such inflows with Brazilian-style reverse capital controls, but is unlikely to have much success. In the longer term, however, fundamental risks remain: the Russian economy is unbalanced, the financial system is fragile, and the political outlook is highly uncertain.

Asia

Most of Asia experienced a fair deal of wealth destruction over the past fifteen months as minor asset bubbles burst and stock markets priced in a weaker future. The initial impact throughout the Pacific Rim in Q4 2008 was a decline in equity markets of about 30%, but by Q2 2009 most value misalignments corrected and began pricing in a recovery that would be ahead of the rest of the world. The exceptions to this are the Shanghai/Shenzhen exchanges, which began posting positive monthly returns as of November 2008. This striking rebound was in no small part due to the belief that the government's immense fiscal stimulus package would provide strong and lasting results, but in turn it also drew considerable amounts of speculative inflows, both into the stock market and into real estate, which did not correct as much as what was witnessed on the Shenzhen. The stock market ended November 2009 up an improbable 120% with significant momentum, all while the economy's recovery is defined by public officials as uneven and incomplete. Even considering the Shenzhen's peak-to-trough decline of 69% over the 12 months to October 2008, such a rapid and vigorous recovery suggests there could be a little frothiness in the markets, and that any corrections made last year are being undone quickly by speculative inflows and short-term hot money.

Americas

The spectacular performance of the Brazilian bourse this year has highlighted the global fears over a nascent emerging market asset bubble. The Bovespa index, up 78% on the year, has posted gains that make any sane person ponder the existence of a bubble. Currently below 2008 highs, the index has been buttressed this year by its heavy commodity composition and a prevailing positive view of the structure and future of the Brazilian economy. The expeditious increase in Brazilian equity prices this year has been largely because of the short-term undervaluation in late 2008 - the economy was only tangentially affected by the financial crisis, yet the market fell over 50% between June and November 2008. Barring a collapse of commodity prices, the index should avoid a large correction in 2010 as strength is based on healthy diversification and related future earning potential. Similarly, the Chilean IGPA is up 45% on the year, reaching a record high. With tamer growth prospects than Brazil and heavy reliance on one single commodity, copper (+145% in 2009), the Chilean market might be a riskier proposition. A bigger concern comes from a domestic economic stability standpoint. Massive inflows into the healthy Latin American economies are giving way to record growth in private credit and money supply, already pushing up real asset prices in Brazil and other places on the continent. The excess liquidity seen in 2009 will likely continue in 2010 as monetary tightening is on the table, further driving the yield prospects on Latin American assets.

Global Economic Data

By Victoria Marklew

Asha G. Bangalore

James A. Pressler

Richard Thies

By Victoria Marklew

The Northern Trust Company

Economic Research Department - Daily Global Commentary

Victoria Marklew is Vice President and International Economist at The Northern Trust Company, Chicago. She joined the Bank in 1991, and works in the Economic Research Department, where she assesses country lending and investment risk, focusing in particular on Asia. Ms. Marklew has a B.A. degree from the University of London, an M.Sc. from the London School of Economics, and a Ph.D. in Political Economy from the University of Pennsylvania. She is the author of Cash, Crisis, and Corporate Governance: The Role of National Financial Systems in Industrial Restructuring (University of Michigan Press, 1995).

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

Victoria Marklew Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.