Global Megatrends and Among all the successes we've enjoyed together ...

Stock-Markets / Financial Markets Jul 23, 2007 - 11:55 AM GMTMartin Weiss writes: Among all the successes we've enjoyed together in recent years, one of the most gratifying to me has been the outpouring of positive feedback regarding my online video briefing.

Now, I'm doing two things:

First, I'm getting ready to take advantage of the minor pullback we saw last week in China and other foreign markets — to take action!

And second, I'm providing the transcript of the video for your review …

Two Global Megatrends

A Transcript

by Martin D. Weiss, Ph.D.

You've probably read my words — in my emails and my newsletters. And you've perhaps heard my voice — in my audio alerts. But we may have not had the chance to meet in person.

So I decided to greet you with this video — to tell you about two new global megatrends that are changing my life … and could change yours as well.

I'm Martin Weiss, editor of Money and Markets and the Safe Money Report .

Ever since I was six years old, I've lived overseas, studied overseas, traveled overseas and learned to adapt to cultures overseas — in most of Latin America … and much of Asia.

I've been to every continent except Antarctica. I've studied every major world language except Arabic. But until this century, there's one thing I did not do very often — or very much — in those foreign countries: Invest my money.

Sometimes, it was because I didn't trust their governments. Sometimes, it was because I didn't trust their data. But usually it was because I simply had no confidence in their currency.

And it's that last critical factor — the strength of their money compared to the U.S. dollar — that's the first critical change of this era: Today virtually all of those currencies are going up. And today, unfortunately, our dollar is going down.

It's going down in a way that it has never gone down before. And I'll explain why in a moment.

But first let me explain why this is so important to me personally … and why I think it's so important for you financially.

Many years ago, my father, Irving Weiss, tried to prevent this dollar decline from ever beginning.

He founded the Sound Dollar Committee.

He enlisted the support of men like Bernard Baruch who was the former adviser to many presidents …

Herbert Hoover, the former president who presided over the worst of our times.

And McChesney Martin who was Chairman of the Federal Reserve.

He organized a massive grass-roots campaign to balance the budget, fight inflation, and protect the American dollar.

He helped Eisenhower achieve one of the few solid, balanced budgets of the 20th century. And he won several landmark battles for the dollar.

But he lost the war.

Today, I am the chairman of the Sound Dollar Committee, and I wish I could accomplish as much as Dad did to stop the dollar's decline. But right now, the forces driving it down are far too powerful; and among our leaders who might be able to influence its direction, too many are far too complacent.

Today, you need to vote with your money. You need to put that money to work where it's protected from a dollar decline, where it can profit from rising currencies, where it can benefit from rising asset values.

And therein lies the most critical change that's sweeping the globe today.

You see, in the past, when the dollar went down, it went down strictly against the major currencies of the world — the currencies of the strongest nations in Western Europe or the strongest nations in East Asia — the euro, the British pound, the Swiss franc, the Japanese yen.

That was then.

Now, the dollar is not only going down against those major currencies, it's also going down against dozens of minor , formerly downtrodden currencies in formerly shaky countries.

The dollar is going down against the Brazilian real, the Polish zloty, and the South African rand.

It's going down against currencies in Eastern Europe, Southeast Asia and even Africa.

In fact, last I checked the dollar was falling against fifty foreign currencies.

This, my friend, is what is signaling big changes in the making. Even if you see temporary rallies in the dollar. Even if you hear talk that the dollar decline is ending. It cannot change the gravity and long-term danger this new megatrend implies.

This leaves you — and me — two choices: We can either sit here mulling over the negative consequences it's bound to have on our money, our family, our country … or we can stand up, look at the positive side, and take action to grow our wealth.

That's the primary course I have chosen — for myself and for all those who follow my writings: I am investing globally, and I think you should do the same.

No, I'm not in the camp that recommends actually taking your money out of the country. With the wide variety of instruments you now have available, there's no need to do that. You can invest right here in U.S. markets, from the comfort of your home, just by buying exchange-traded funds (ETFs) or just by buying global companies listed on the New York Stock Exchange.

Nor am I recommending that you put all your money in these investments. Quite to the contrary, there is still an important role in your portfolio for the very safest U.S. investment you can buy, like Treasury bills and other conservative instruments.

But if you don't allocate at least some of your money to foreign investments, I think you could be making a grave error.

Look where we are and whence we've come:

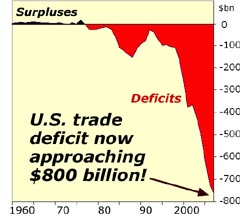

I remember very well. Years ago, when Dad and I gave our last seminars together, we told the audience big trade deficits would harm the U.S. economy.

We warned that America was losing its ability to compete internationally, while economies overseas were gaining. We said the dollar would slide, while major foreign currencies rise.

Now, those forecasts have not only come true … they're accelerating.

Ten years ago, the U.S. trade deficit was $104 billion. Now it's approaching $800 billion.

But the flip side of big trade deficits in the U.S. is equally big surpluses overseas. So for investors who protect themselves by investing globally — and safely — this is not a threat. Quite to the contrary, I see it as the genesis of two global money-making trends.

The first global money-making trend is the rise of foreign currencies against the dollar, as I've told you.

The second global money-making trend is the scores of foreign stock markets that are creating armies of new millionaires.

In China, India, Brazil and throughout what used to be called the "Third World," three billion new wage earners are now entering the middle class.

And for the first time ever, half the world's families in these emerging nations are now beginning to use their new middle class incomes to eagerly buy the trappings of success.

This, in turn, is triggering one of the most explosive global economic growths in modern history.

While the U.S. economy is crawling at a slow, lumbered pace, Brazil, Singapore, India and China are growing two times, five times, even eight times faster.

This is why foreign stock markets have greatly outperformed the U.S. This is why 55 foreign stock markets beat the S&P 500 in 2006. And this is why I think you're likely to see many foreign stock markets outperform the U.S. in bad times as well.

So let's sum up:

- We have 50 foreign currencies rising against the U.S. dollar.

- We have 55 stock foreign stock markets outperforming the U.S. market.

- And we have no one lifting a finger to narrow the trade deficit … help make America more competitive … help turn this situation around. No one in Washington or on Wall Street. No one acting for the short term or the long term.

The two global megatrends I wanted to tell you about today are the rising foreign currencies and the rising foreign stock markets. And the reason you must do something to protect yourself and build your wealth is the complacency among our leaders everywhere.

You know, I have very mixed emotions about this.

As an American who loves his country, I have dreaded this day since the first time Dad and I began working together to prevent it.

But as an investor, I have dreamed of a moment like this since the first day I opened a savings account as a child.

Investors fantasize about the day when they can see great megatrends like these … make the right moves with the right investments … and come away with a king's ransom in profits.

Enough money to guarantee a secure and comfortable retirement.

Enough to give your kids and grandkids a helping hand.

More than enough to never have to worry about money again.

And now, thanks to the confluence of these two unprecedented megatrends, that opportunity is within your grasp.

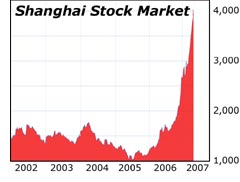

It didn't start yesterday. And it won't end tomorrow. Indeed, the first of these two megatrends began in China after the end of the Cold War — when Beijing's leaders abandoned their communist economic system in favor of a capitalist economic system.

Free enterprise spread like wildfire in the world's most populous nation. Entrepreneurs founded companies and built them into behemoths. Millions of former peasants left their farms for jobs in China's burgeoning cities — and became wage earners, savers and consumers. For the first time in history, many became investors in China's fledgling stock market.

Suddenly, China's economy was expanding by 10% per year, and sustaining that pace.

Then, around the middle of 2005, China's stock market reached critical mass. Since then, it has doubled in value … then nearly doubled again!

And as China's economy continued its unprecedented expansion, it began making other emerging nations rich.

First, its trading partners in Asia caught fire, growing wealthy as their ports shuttled trillions of dollars of goods to and from China.

Then, the former Soviet states across Eastern Europe got their share, reaping the benefits of their own post-Cold War boom, while also exporting to Asia.

And finally, Chinese billions began flowing to the great resource countries on the planet — Australia, Canada and Brazil — the source of many of the natural resources China must have to fuel its economic expansion.

I personally saw this unfold from both sides of the planet. I've visited China, the world's biggest consumer of resources. And I've spent many months and years at our home in Brazil, one of the world's largest providers of those resources.

I hope someday you can come down there with me. If you do, I will show you our farm where we produce one of the most promising renewable fuel sources in the world, and where we drive some of the most innovative automobiles on the planet.

Overall, from East Asia to South America, we are now witnessing the single greatest industrial revolution in history.

Every day, armies of new wage earners and entrepreneurs become new consumers — purchasing automobiles, televisions, computers, refrigerators and microwaves.

And every day, they're marching forward, consuming nearly everything in their paths … making manufacturers, wholesalers and retailers in scores of emerging nations richer … and driving their stocks and stock markets higher.

That's why I say, if most of your money is in the U.S. stock market, you're missing out on the greatest profit bonanza of our generation, and leaving up to 90% of your profit potential on the table!

Look, in a recent quarter, Japan's stock market did two times better than ours. Russia's did four times better. South Korea's did seven times better.

France's stock market did more than nine times better than ours. Switzerland's did twelve times better. And Brazil's market spun off an amazing $16 gain for every $1 gain on the S&P 500.

And those numbers don't account for the rising value of their currencies. Just recently, as the dollar has gone down …

The Canadian dollar has hit a 15-year high …

The British pound has also reached a 15-year high …

The New Zealand dollar has hit a 22-year high …

And the euro, which is a newer currency of course, has reached an all-time record high.

Help me in my lifelong fight for a stronger dollar.

And let me help you to build your wealth.

Questions from Viewers

Now, I want to go to questions from our viewers. So I've invited my good friend, financial journalist Bob Nichols, to gather your questions and ask them on your behalf. Bob …

Bob Nichols: Thank you, Martin. We've received a tremendous number of insightful questions and our only dilemma is how to fit so many into the short time we have. But the ones we can't get to today, we'll answer by email. Here's the first one:

"Martin, I've got huge profits in my China investments. But now some people are saying that the China boom is a bubble? What is your opinion? Should I take my profits now?"

Martin: When I look at bubbles — like the tech bubble here in the U.S. in the late 1990s or the housing bubble of recent years — I see a huge difference: The boom in China is driven by a massive and fundamental transformation on the ground. And this transformation is driven by the basic needs of 1.3 billion people. It's not about the latest tech gadget. It's about food, clothing, homes, transportation.

Bob: The viewer is also asking if he should take his profit now?

Martin: Nothing wrong with taking profits, especially when they're so large. That's what we did too when the market reached a peak.

Bob: Here's the next question. "Martin, you and Mike were the first to warn about the housing crisis and you've continued to do so. But how does that affect your investing strategy?"

Martin: Safety is always our first priority — with or without the housing crisis. That's why we continue to recommend Treasury bills for your cash. That's why we recommend hedges to protect yourself. And that's also why we feel you need to diversify internationally, and to buy investments that are far away from the housing crisis in the U.S.

One more point: The housing and mortgage crisis is bad for the U.S. dollar — and that's good for investments denominated in foreign currencies.

Bob: Here's a question in a similar vein. "What if the stock market takes a big beating? Then what do you do?" Martin, I think he's come to the right place to ask that question. Weiss Research is famous for its skill at handling down markets.

Martin: Yes, but the answer is not complicated: First, we are continually taking profits off the table before a major decline. Second, we use investments that make money from the decline. And third, this is the most important: During declines, investors typically throw out the baby with the bath water. They sell the best investments and temporarily drive their prices down. That opens up some of the best opportunities.

Bob: Another question we're getting frequently: "A while back, you introduced Tony's Sagami's Asia stock service about China. How is that doing so far?"

Martin: You're talking about Tony Sagami's Asia Stock Alert . But it's more than just China. Tony personally goes to every major nation in East Asia to hunt down new opportunities, including not only China, but Taiwan, Japan, Singapore, even India.

And he's been hitting one winner after another. Just in the last several months …

He recommended a Chinese company specialized in teaching English to millions of Chinese and it has surged 43.2%.

He recommended one of China's leading construction companies, and it has surged 65.5%.

He recommended one of China's leading cell phone providers, and it has surged 93.6%.

Plus, he's taken some substantial profits off the table with other Asian stocks.

He recommended D-Link Corp., it rose 27.4% and that's when he told his subscribers to take profits.

He recommended MEMC Electronic Materials, it surged 74.1% and that's when he told his subscribers to take profits.

He recommended Siliconware Precision Industries, it surged 107.9% … and that's when he told his subscribers to take profits.

This one is one of the best track records I've seen in all my years in the business.

Bob: Kudos to your team, Martin.

Martin: Don't forget though, past performance is no guarantee of future results. Any more questions on the big picture?

Bob: Yes, here's one: "If the U.S. economy weakens, the dollar should weaken even further. How does that impact my profits?"

Martin: Simple. If you've got all your money in investments tied to the dollar, you're likely to lose. If you've got investments tied to foreign economies and foreign currencies, you're likely to win. The dollar decline gives you an extra boost to your foreign stocks. It gives an extra boost to your international ETFs, or to your options on international ETFs. The more the dollar falls, whether it's because of the housing bust or the big trade deficits, the more money you can make on them.

Bob: I have one last question from a member, which goes back to China. This woman asks: "China has been going gangbusters for years. And I'm afraid I missed it. Is it too late for me to invest in Chinese companies?"

Martin: No. China isn't going for overnight miracles — here today and gone tomorrow. In the U.S., our politicians think in terms of one to four-year time windows. In China, they think in terms of 10 and even 100-year time windows. China is looking to sustain its growth for decades.

And China's Vice-Premier just confirmed that Beijing is beginning to use part of its $1.2 trillion foreign reserve war chest to invest its money in its stock market.

There will be setbacks in China and other fast-growing countries. But that's an opportunity for investors like you that are starting now.

And please don't forget: Profiting from the dollar decline is great self defense. But don't put all your money in one basket. Despite its problems, ours is still a great country. ◊

Time for Action

Now …

You have the big picture — these two great megatrends I told you about in my video briefing.

You have the modest pullback in China and other foreign markets we told you about last week.

You have what looks like a new surge in those markets. (Even while the U.S. market fell on Friday, China's was up nearly 4%!)

So stand by. As early as tomorrow, we'll be alerting you to action we are taking — aiming to make some real money.

Good luck and God bless!

Martin

P.S. Be sure to read "About This Transcript," below.

About This Transcript

This transcript is designed to reflect precisely the editorial information provided in the recent online video briefing by Martin D. Weiss entitled "Two Global Megatrends."

Therefore, it has not been updated to reflect the most recent changes in the markets, including …

- A further rise in most foreign currencies.

- A further rise in foreign stock markets.

- Additional gains in most of our services.

For disclaimers and cautions, be sure to see the material provided with the information on our services.

By Martin Weiss

This investment news is brought to you by Money and Markets . Money and Markets is a free daily investment newsletter from Martin D. Weiss and Weiss Research analysts offering the latest investing news and financial insights for the stock market, including tips and advice on investing in gold, energy and oil. Dr. Weiss is a leader in the fields of investing, interest rates, financial safety and economic forecasting. To view archives or subscribe, visit http://www.moneyandmarkets.com .

Money and Markets Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.