What Institutional Stock Market Investors Did Last Week...

Stock-Markets / Stock Markets 2010 Jan 05, 2010 - 12:32 AM GMTBy: Marty_Chenard

If you recall last Wednesday, we discussed the trending action on the "core holdings" held by Institutional Investors.

If you recall last Wednesday, we discussed the trending action on the "core holdings" held by Institutional Investors.

That was an important discussion for two reasons: 1. Because Institutional Investors represent over 50% of the daily trading volume. 2. Because our 60 minute Institutional Index chart was in a "megaphone pattern".

The bottom line was that Institutional Investors were the "big kahunas", and that one should never trade against what they were doing.

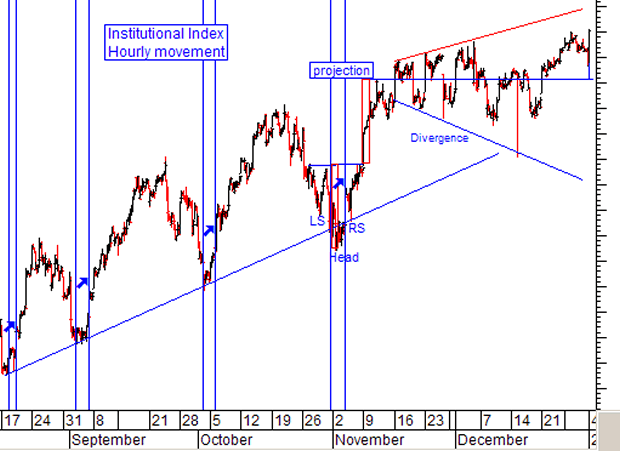

Last week we mentioned that the Institutional chart was showing a megaphone pattern that actually started on November 16th. ... after the index made it up to our projection level on November 11th. (That projection level was the exact fulfillment of the earlier "inverted Head & Shoulder" pattern.)

What was amazing was .... what happened since reaching the projection level. The projection level became the CENTER of the expanding Megaphone pattern. (The Institutional index has been oscillating above and below our projection level in a higher/high and lower/low pattern that has formed the megaphone pattern.

What is this saying?

It is saying that Institutional investors have essentially been in a sideways trading range for the past 6 weeks.

What does this have to do with last Thursday?

Well many investors got spooked in the last half-hour of trading last Thursday. Institutional Investors sold hard into the last 30 minutes. But ... was it about them getting out of the market, or was it about end-of-year tax selling?

Take a look at today's 10:30 AM Institutional Index chart below.

What do you see?

I see that the Institutional Index dropped last week ... and this morning, it opened a tiny bit lower for a fraction of a minute and then charged back up.

What is noteworthy, is that the index fell to its Megaphone's center support line, held at that level, and then continued to move up in the top half of the Megaphone pattern.

For those who may have been spooked last week, what Institutional Investors did put's a different light on things doesn't it?

This is just the first trading day of the year, and the show isn't over ... what the Institutional Investors are going to do is still unfolding. As we mentioned last week ... like all patterns, this one will have its breakout soon, and the breakout and continuation direction will the investable trend that investors will want to follow. For now, the Institutional core holding index is moving up, but it also approaching an upside resistance where an important test will occur.

** Feel free to share this page with others by using the "Send this Page to a Friend" link below.

By Marty Chenard

http://www.stocktiming.com/

Please Note: We do not issue Buy or Sell timing recommendations on these Free daily update pages . I hope you understand, that in fairness, our Buy/Sell recommendations and advanced market Models are only available to our paid subscribers on a password required basis. Membership information

Marty Chenard is the Author and Teacher of two Seminar Courses on "Advanced Technical Analysis Investing", Mr. Chenard has been investing for over 30 years. In 2001 when the NASDAQ dropped 24.5%, his personal investment performance for the year was a gain of 57.428%. He is an Advanced Stock Market Technical Analyst that has developed his own proprietary analytical tools. As a result, he was out of the market two weeks before the 1987 Crash in the most recent Bear Market he faxed his Members in March 2000 telling them all to SELL. He is an advanced technical analyst and not an investment advisor, nor a securities broker.

Marty Chenard Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.