Baum Makes Mincemeat of Bernanke's Twisted Zero Interest Rate Logic

Interest-Rates / US Interest Rates Jan 06, 2010 - 01:44 AM GMTBy: Mike_Shedlock

In Ivory Tower Doesn’t Have a Mortgage, Bloomberg columnist Caroline Baum makes mincemeat out of Bernanke's twisted defense of Fed policy.

In Ivory Tower Doesn’t Have a Mortgage, Bloomberg columnist Caroline Baum makes mincemeat out of Bernanke's twisted defense of Fed policy.

Bernanke takes great pains to rebut criticism that the funds rate was well below where the Taylor Rule, developed by Stanford economist John Taylor, suggested it should be following the 2001 recession.

Substitute forecast inflation for actual inflation, and the personal consumption expenditures price index for the consumer price index, and -- voila! -- monetary policy looks far less accommodating, Bernanke said.

It’s always easier to start with a desired conclusion and retrofit a model or equation to prove it.

What if easy money is a necessary but not sufficient condition to explain the magnitude of housing bubbles across countries?

The real fed funds rate was negative from 2002 to 2005, the longest stretch since the 1970s, a decade notable for high inflation and unemployment. The teaser rates lenders offered on ARMs were pretty close to zero when adjusted for inflation.

When you can borrow for free and invest in an asset whose price can only go up (at least that was the perception about home prices), guess what happens? Credit is misallocated. Lending standards decline. Everyone wants in.

Yes, monetary policy is a blunt instrument, as Bernanke pointed out. Keep rates too low -- create too much money -- and sometimes that money chases goods and services prices, which we designate as inflation. Other times it piles into certain assets, which we call a bubble.

“The best response to the housing bubble would have been regulatory, not monetary,” Bernanke said, avoiding any reference to prevention.

The two aren’t substitutes. Relying on regulation to counteract the impetus of easy money is like using a split-rail fence to stop an auto with the accelerator pressed to the floor. They are different species, operating in different spheres.

All the regulation in the world can’t counteract the power of near-zero interest rates. At the same time, high interest rates won’t prevent financial institutions from engaging in shady practices. To think regulation can prevent the next asset bubble is naive.

Why is the Fed so fixated on inflation expectations and so blase about asset-price expectations? Aren’t they of a piece?

Taylor Rule Nonsense

The highly respected Taylor Rule is fatally flawed because it only looks at the CPI, while ignoring asset bubbles in virtually anything else, including housing.

I have pointed this out many times, most recently in Ben Bernanke Looks In Mirror, Sees Barney Frank.

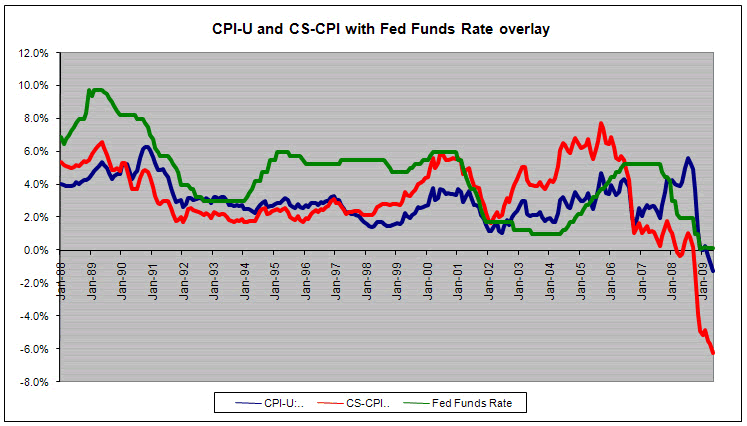

Substituting home prices for OER the CPI was running a hot 6%+ in mid 2004 with the Fed Funds Rate near .25%.Bernanke blames inadequate subprime regulation for the housing bubble.

Bernanke also takes refuge in the Taylor Rule although there is considerable disagreement over what it says. My take is the Taylor Rule is fatally flawed because it fails to take into consideration housing prices (asset prices in general).

Watch what happens when the Case-Shiller Housing Index is substituted for Owners' Equivalent Rent (OER) in the CPI.

Case Shiller CPI vs. CPI-U

The above is from What's the Real CPI?

The Fed could have and should have acted to rein in property bubbles, but Bernanke is so dense he could not even see there was a property bubble.

Who's The Bigger Fool?

1) Taylor in all his hubris for believing his fatally flawed rule is the only policy tool the Fed needs

2) Bernanke for relying on it to the point of insanity

Academic Wonks vs. Practicality

Bernanke is an academic wonk, totally incapable of looking at policy in terms of anything other than formulas and his twisted ideas about the great depression.

Baum on the other hand shows impeccable logic with...

Relying on regulation to counteract the impetus of easy money is like using a split-rail fence to stop an auto with the accelerator pressed to the floor. All the regulation in the world can’t counteract the power of near-zero interest rates.

Indeed.

When the price of money is too low, it is virtually guaranteed to cause speculation in something. In 2000 it was Nasdaq and technology speculation. This go around it was housing, followed by commercial real estate, followed by immense commodity speculation driving the price of oil to $140.

The moral of this story is loose money always finds a home.

It is beyond absurd we have a Fed chairman that does not understand that simple construct or for that matter basic economics in general.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2009 Mike Shedlock, All Rights Reserved

Mike Shedlock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.