Why You Should Care About DJIA Priced in Gold

Commodities / Stock Markets 2010 Jan 09, 2010 - 08:34 AM GMTBy: EWI

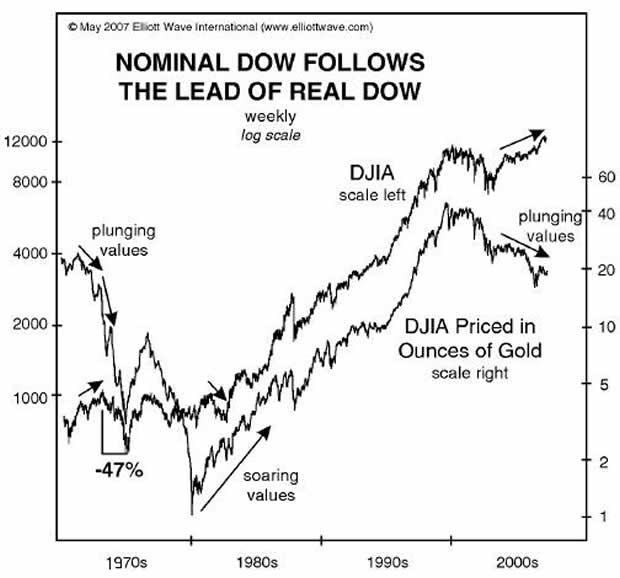

"The Real Dow" has proven to be a good leading indicator for nominal DJIA.

"The Real Dow" has proven to be a good leading indicator for nominal DJIA.

Vaid Pokhlebkin writes: The following article is provided courtesy of Elliott Wave International (EWI). For more insights that challenge conventional financial wisdom, download EWI’s free 118-page Independent Investor eBook.

Of the many forward looking market indicators we at EWI employ, one of the most interesting tools (and least discussed in the financial media) is the DJIA priced in gold -- "the real money," as EWI's president Robert Prechter calls it.

We've been tracking the Dow/Gold ratio for many years and it has serves our subscribers well. It's not a short-term timing tool, yet in the longer term, as our January 6 Short Term Update put it, "the nominal Dow eventually plays catch up to what is transpiring in the Dow/Gold ratio."

Here's a good example. Remember when the nominal DJIA hit its all-time high? October 2007, just above 14,000. At that time, most investors expected new highs still to come. But our Elliott Wave Financial Forecast warned five months prior, in May 2007:

One key reason [for a coming top in the DJIA] is the undeniable bear market status of the Dow Jones Industrial Average in terms of gold, the Real Dow...

Notice, by contrast, the relative strength of the Real Dow versus the nominal Dow, the index in terms of dollars, from 1980 to 1982. By August 1982 when the Dow denominated in dollars bottomed, the Real Dow was rising strongly from its 1980 low... The nominal Dow soon played catch-up, and they both rallied more or less in sync until 1999.

Now, instead of soaring the Real Dow is crashing relative to the nominal Dow. In fact, it’s barely off its low of May 2006. This dichotomy reveals the weakness that underlies the financial markets’ push higher. When mood turns and credit inflation reverses, the ensuing drop in the nominal value of the market should be dramatic.

"Dramatic drop" did indeed follow: Between October 2007 and March 2009, the DJIA lost 53%, high to low.

For more information, download Robert Prechter’s free Independent Investor eBook. The 118-page resource teaches investors to think independently by challenging conventional financial market assumptions.

About the Publisher, Elliott Wave International

Robert Prechter, Jr., is a social theorist and market analyst. He is president of Elliott Wave International, a forecasting firm servicing institutional and private investors around the world. Since 1978, Prechter has published the monthly Elliott Wave Theorist and has authored 14 books. His Elliott Wave Principle with A.J. Frost in 1978 predicted the great bull market. His New York Times bestseller, Conquer the Crash (2002), forecast a collapse of the global credit mania and the ensuing period of deflation. His two-book set, Socionomics, presents his seminal hypothesis that endogenously regulated waves of social mood determine the character of social actions.

Prechter attended Yale University on a full scholarship and graduated in 1971 with a degree in psychology. He began his career as a Technical Market Specialist with the Merrill Lynch Market Analysis Department in New York City.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.