Is The US At An Extreme Risk Of A Double Dip Recession?

Economics / Economic Recovery Jan 09, 2010 - 02:19 PM GMTBy: Submissions

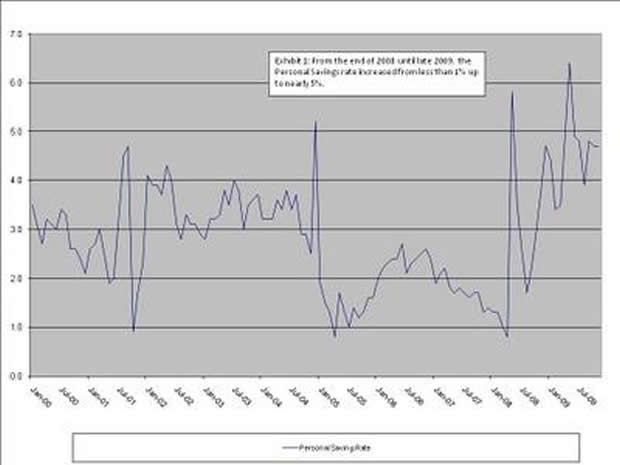

Safari Investment Research write: One of the major concerns at the end of 2008 and beginning of 2009 was how much the average U.S. consumer has to de-lever in order to reach a sustainable debt level that could be supported in a declining asset price environment. As we all know, the environment changed quickly in the 2nd quarter of 2009 when all asset prices began to rise in value and the national savings rate continued to climb (See Exhibit 1).

Safari Investment Research write: One of the major concerns at the end of 2008 and beginning of 2009 was how much the average U.S. consumer has to de-lever in order to reach a sustainable debt level that could be supported in a declining asset price environment. As we all know, the environment changed quickly in the 2nd quarter of 2009 when all asset prices began to rise in value and the national savings rate continued to climb (See Exhibit 1).

Now, in 2010 we face many non traditional economic headwinds such as a historically high unemployment rate, a extremely large government deficit, and a economy that has been on life support for the last several months. In addition, there are many media pundits preaching contrasting views on the health of the economy, many believing we are at an extreme risk of a double dip recession, while others are portraying a more optimistic view in belief that the U.S. economy has had its troubles before and has only proved itself more and more resilient coming out of each recessionary environments.

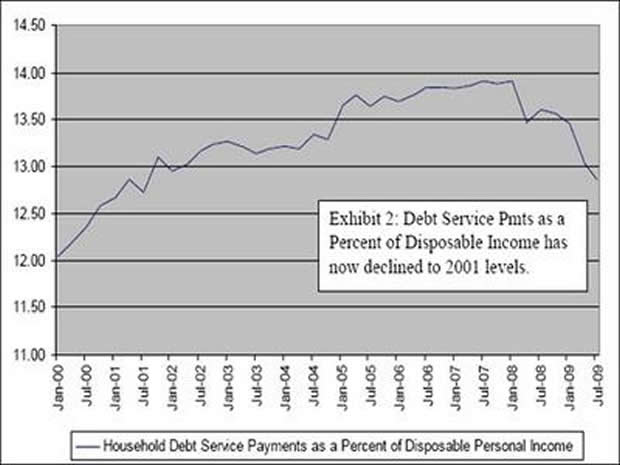

Going into 2010, we believe that the pace at which the U.S. consumer de-levers will slow due to asset prices somewhat stabilizing and fear continuing to leave the marketplace (See Exhibit 2).

We think this will be a positive factor due to the fact that after going through a crisis in 2008, the average U.S. consumer will now learn to live within a lifestyle that will have a certain amount of respect for the use of leverage and what can happen when things turn for the worse. What we are watching in 2010 is the Federal Reserve’s exit strategy it will have to put in place in order to remove its stimulus efforts.

We believe the U.S. is in fairly stable condition going into 2010, but a variable factor that may curtail our thesis is whether the U.S. economy can sustain itself once it is pulled off of life support. This is a process that will take months to play out, but must be watched very closely.

As far as fears of a double dip recession, we feel that this scenario is more of a statistical outlier, as it has only happened 3 times in the last 100 years. A contraction in the market place could be expected and would be considered healthy, as it would create opportunity that would help pave the way for future growth and confidence in financial markets.

Safari Investment Research© 2010 Copyright Safari Investment Research - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.