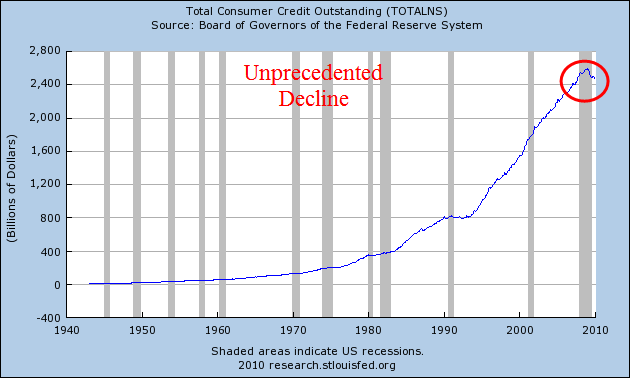

Consumer Credit Drops Record $17.5 Billion; Steepest Declines Since WWII

Economics / Deflation Jan 10, 2010 - 05:05 AM GMTBy: Mike_Shedlock

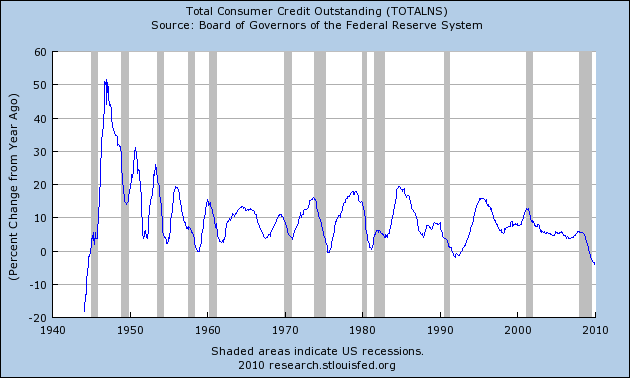

While monetarist clowns focus on so-called excess reserves and the huge surge in inflation that is supposed to bring (See Fictional Reserve Lending And The Myth Of Excess Reserves) I am watching the biggest plunge in consumer credit since WWII.

While monetarist clowns focus on so-called excess reserves and the huge surge in inflation that is supposed to bring (See Fictional Reserve Lending And The Myth Of Excess Reserves) I am watching the biggest plunge in consumer credit since WWII.

Please consider Consumer Credit in U.S. Drops Record $17.5 Billion.

Consumer credit in the U.S. dropped a record $17.5 billion in November as unemployment close to a 26- year high discouraged borrowing and banks limited access to loans.

The slump in credit to $2.46 trillion was more than anticipated and followed a revised $4.2 billion drop in October, Federal Reserve figures showed today in Washington. The median estimate of economists surveyed by Bloomberg News projected a decrease of $5 billion. The series of 10 straight declines was the longest since record-keeping began in 1943.

“Double-digit unemployment is eroding consumer confidence and the uncertainty is prompting consumers to pay down their credit card debts,” said Chris Rupkey, chief financial economist at Bank of Tokyo-Mitsubishi UFJ Ltd. in New York. “We have not seen such a wholesale reduction in consumer credit since the last time we had double-digit unemployment rate following the early ‘80s recessions.”

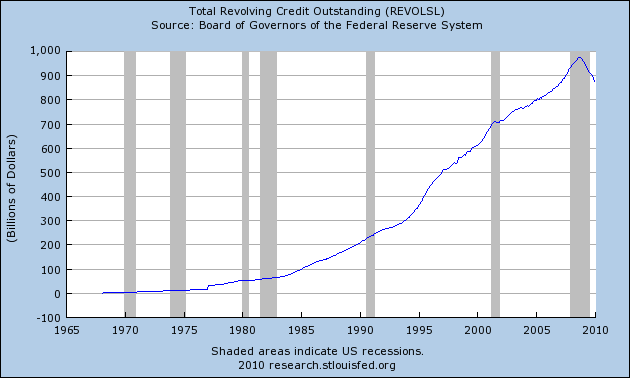

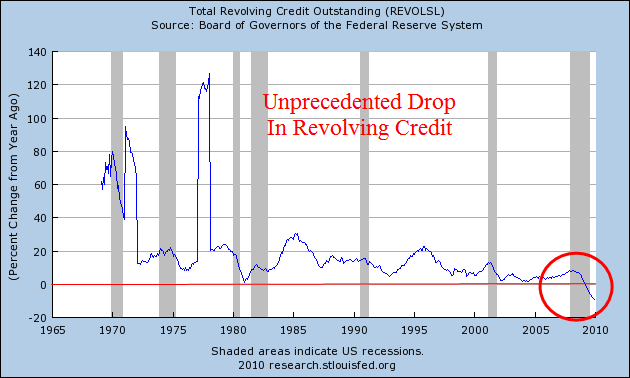

Revolving debt, such as credit cards, plunged by a record $13.7 billion in November, the Fed’s statistics showed. Non-revolving debt, including loans for autos and mobile homes, declined by $3.8 billion. The Fed’s report doesn’t cover borrowing secured by real estate.

Bank of America Corp. Chief Executive Officer Brian T. Moynihan has said the largest U.S. lender needs to reduce the loss rate on credit cards, which ranked highest among the nation’s six biggest card companies in November. Bank of America’s card defaults are “still very high,” Moynihan, 50, said.

‘Significant Bubble’

“As an industry, we over-lent and customers over-borrowed, and that led to a fairly significant bubble,” Moynihan said Jan. 4 in an interview on Bloomberg Television in Raleigh, North Carolina. “We have to help lead the economic recovery. At the same time, we have to be responsible lenders.”

Total Consumer Credit

Total Consumer Credit Percent Change From Year Ago

Total Revolving Credit Outstanding

Consumers Attitudes Are Key To Deflation

The Fed has pumped (attempted to is a more apt description) $trillions into the economy.

Consumers (and lenders) responded by cutting credit. Here is the telling comment of the week from the CEO of Bank of America: "We have to help lead the economic recovery. At the same time, we have to be responsible lenders.”

New Religion

- Banks have a new religion on lending.

- Consumers have a new religion on borrowing.

If you think that is inflationary, you have no idea what inflation is. In case you need a refresher course please consider Fiat World Mathematical Model.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2010 Mike Shedlock, All Rights Reserved

Mike Shedlock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.