The Secret Formula for This Stock Market Rally

Stock-Markets / Market Manipulation Jan 19, 2010 - 01:12 PM GMTBy: Graham_Summers

I’m about to share with you the basic outlines for this market rally started March 2009. In no way shape or form am I providing official recommendations or investment advice in this post. I am merely pointing out the obvious trends that this rally has followed.

I’m about to share with you the basic outlines for this market rally started March 2009. In no way shape or form am I providing official recommendations or investment advice in this post. I am merely pointing out the obvious trends that this rally has followed.

The first, most obvious trend is the Manic Mondays trend. I’ve commented on the weekly Monday ramp job that has been occurring in the markets for months now. However, Dr. Robert McHugh as done extensive analysis on this trend, showing that for the 43 weeks ended Friday January 8, 2010, stocks have rallied on 30 out of the 43 Mondays.

Even more significantly, these Monday ramp jobs have contributed the bulk of the market rally’s gains since March 2009. McHugh comments that all told, 80% of the gains stocks have posted since March 2009 have come on Mondays.

The significance of this trend cannot be overstated. Someone (or several someones) has been pushing S&P 500 futures up virtually every weekend since this rally began. Since most Wall Street traders take their cues from the overnight futures market, this has resulted in massive gap ups on most Monday mornings.

By the way, the “Monday effect” works even when the market is closed on Monday as yesterday’s action attested. All you need is a weekend and light futures trading to produce a Manic Monday.

The second trend that has dominated this market since the March 2009 bottom is the Bernanke Options Expiration juicing. In simple terms Ben Bernanke has shown a REAL preference for pumping money into the financial system on the exact week when options are expiring. I’ve bolded the expiration weeks in the table below. You’ll notice the LARGEST Fed moves have ALL occurred on expiration weeks.

You’ll note that on non-expiration weeks, the largest Fed move was a $38 billion capital infusion. However, ON expiration weeks the SMALLEST move is $46 billion. And the largest expiration pump is a whopping $80 billion, which interestingly enough occurred during a time in which stocks were starting to break down. Interestingly enough, the SECOND largest Fed pump occurred in November another time in which stocks were breaking down.

Coincidence?

Options expiration week historically is a time of GREAT market manipulation as Wall Street traders try to push their positions into the black so they can close them out at a profit. For the Fed to be making its biggest infusions of capital on ALL of these dates is “a bit odd” to say the least. The fact it has occurred like clockwork for months makes this trend almost as regular as the Manic Monday Ramp Job.

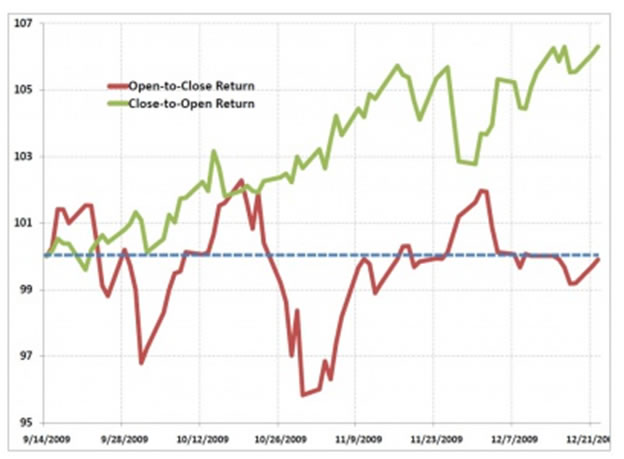

The final trend that has dominated this market is cousin to the Manic Monday Ramp Job. It is the Night Session Ramp Job. I’ve already mentioned this trend in previous essays so I’ll keep today’s comments short. The simple fact is that from September 13, 2009 until year-end, ALL of the stock market’s gains occurred in the over-night futures session from 4:00 ET to 9:30 AM ET.

Tyler of ZeroHedge was the first to identify this trend and created the following graphic. It sums up this trend perfectly.

As you can see, for the last three months of 2009, the market basically traded sideways during the normal day session (9:30ET to 4PM ET). In contrast, the after hours futures market (4PM ET to 9:30AM ET) accounted for ALL stock gains.

So there you have it, the three most dominant trends of this market rally. None of them are pretty. None of them involve fundamentals. And ALL of them are directly related to the Fed’s liquidity pump.

Good Investing!

Graham Summers

PS. I’ve put together a FREE Special Report detailing THREE investments that will explode when stocks start to collapse again. I call it Financial Crisis “Round Two” Survival Kit. These investments will not only help to protect your portfolio from the coming carnage, they’ll can also show you enormous profits.

Swing by www.gainspainscapital.com/roundtwo.html to pick up a FREE copy today!

Graham Summers: Graham is Senior Market Strategist at OmniSans Research. He is co-editor of Gain, Pains, and Capital, OmniSans Research’s FREE daily e-letter covering the equity, commodity, currency, and real estate markets.

Graham also writes Private Wealth Advisory, a monthly investment advisory focusing on the most lucrative investment opportunities the financial markets have to offer. Graham understands the big picture from both a macro-economic and capital in/outflow perspective. He translates his understanding into finding trends and undervalued investment opportunities months before the markets catch on: the Private Wealth Advisory portfolio has outperformed the S&P 500 three of the last five years, including a 7% return in 2008 vs. a 37% loss for the S&P 500.

Previously, Graham worked as a Senior Financial Analyst covering global markets for several investment firms in the Mid-Atlantic region. He’s lived and performed research in Europe, Asia, the Middle East, and the United States.

© 2010 Copyright Graham Summers - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Graham Summers Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.