Are Commodities and the Stock Market Dow Index Dead?

Stock-Markets / Financial Crash Jan 24, 2010 - 03:39 PM GMTBy: Chris_Vermeulen

It was a heart pounding week on Wall Street as traders and investors locked in profits during 2010’s first round of earnings season. While it is normal to see selling of shares after good news hits the market, last weeks melt down was over exaggerated and for good reasons.

It was a heart pounding week on Wall Street as traders and investors locked in profits during 2010’s first round of earnings season. While it is normal to see selling of shares after good news hits the market, last weeks melt down was over exaggerated and for good reasons.

In short, we expected good earnings and that is why the markets have been crawling higher the past couple months (buy on rumor, sell on news). But what made last weeks sell off so strong was the fact the market was way overbought on the short term time frame and looking ready for a correction already. So we saw twice the selling pressure crammed into one week.

Looking back at a 12 year chart of the Dow Jones Industrial Average we can see the market is now trading at a major resistance level. There are two scenarios the market will likely follow in the coming 12 months. And it could take a year for each of these scenarios to unfold.

Scenario #1 – The market could top then start heading lower to test the 2009 March low. I don’t want this but it could still happen. Topping is a process. Unlike most bottoms which happen very quickly, tops tend to drag out much longer. In this case I figure we are looking at 4-12 month time frame for the market to truly roll over and confirm that we are in a major bear market again.

Scenario #2 – If the market holds up relatively well and forms a bull flag then we can expect to see higher prices in the future. If this happens it will take 4-12 months to unfold also.

Both scenarios have characteristics associated with them, so as the market progresses I will update on the market internals which will help tell us if the underlying market is holding up well or deteriorating. Only time will tell and we will play it one candle at a time.

Dow Jones Industrial Average – What Is Next?

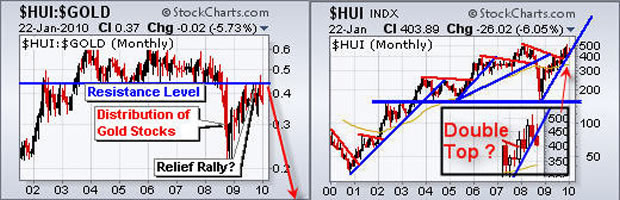

Gold Stocks – Rockets or Rocks?

The gold stock index closed below its support trend line which held up for over a year. This is not a good sign for gold or gold stocks but there is light at the end of the tunnel.

Simple technical analysis is telling us to be cautious at these price levels. If we zoom way out on the charts the current price level and chart patterns on these charts scare me. The gold stock/Gold ratio chart is trading under resistance and the HUI (gold stock index) is trading near the 2008 high. What I do not like is the technical breakdown on the HUI monthly chart. You can see the trend line break on the chart with my small zoomed in picture.

The good news is that everything looks to be extremely over sold on the 60 minute charts so I am expecting a bounce across the entire market for a 1-5 day dead cat bounce. Friday we did see gold stocks move up strong off their lows out performing the price of gold. This is positive for gold and stocks. Depending on how that unfolds we could take a short term momentum play to profit from a possible leg lower.

Precious Metals ETF Daily Charts – Gold & Silver

Gold and silver lost some shine last week as they plunged towards their next support level. A bounce is expected but then I feel we are heading lower and this will likely shake out the majority of traders before starting another rally higher.

On Jan 13th I posted a report indicating gold and silver were headed lower because of the recent price action as silver and gold both had a Pop & Drop chart pattern with heavy selling volume on the 60 minute chart:

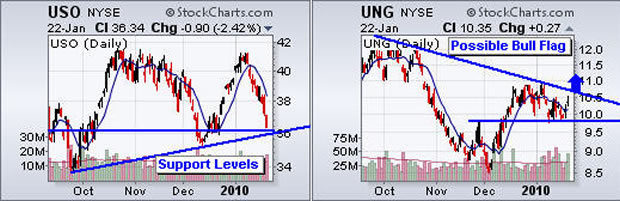

Energy Fund Trading – USO & UNG

I am really starting to like USO for an oversold bounce off support. I would like to see the market reaction on Monday before we do anything. With everything closing near their lows on Friday, panic selling from fear may creep into the minds of traders and investors.

Natural Gas fund looks to be setting up a bull flag. It will be interesting to watch this progress.

Commodity and Stock Market Index Trading Conclusion:

This month looks and feels like last Jan – March, but reversed. The market is now getting choppy as the bulls and bears fight for direction making is difficult to swing trade. Times like these are best for intraday traders, not swing traders. Trading tops is actually much more difficult than trading a bottoming market in my opinion so I will be picky with trade setups. My number one goal is to preserve capital and avoid choppy market conditions as part of managing risk.

Final trading thoughts, I look for the broad market to get a possible bounce this week, but I feel lower prices are still to come. The USO oil fund looks prime for the picking and that could be our next trade.

Hello, I'm Chris Vermeulen founder of TheGoldAndOilGuy and NOW is YOUR Opportunity to start trading GOLD, SILVER & OIL for BIG PROFITS. Let me help you get started.

To Your Financial Success,

By Chris Vermeulen

Chris@TheGoldAndOilGuy.com

Please visit my website for more information. http://www.TheGoldAndOilGuy.com

Chris Vermeulen is Founder of the popular trading site TheGoldAndOilGuy.com. There he shares his highly successful, low-risk trading method. For 6 years Chris has been a leader in teaching others to skillfully trade in gold, oil, and silver in both bull and bear markets. Subscribers to his service depend on Chris' uniquely consistent investment opportunities that carry exceptionally low risk and high return.

This article is intended solely for information purposes. The opinions are those of the author only. Please conduct further research and consult your financial advisor before making any investment/trading decision. No responsibility can be accepted for losses that may result as a consequence of trading on the basis of this analysis.

Chris Vermeulen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.