The Fed FOMC Tango with Gold and U.S. Dollar

Stock-Markets / Financial Markets 2010 Jan 28, 2010 - 03:10 AM GMTBy: Vishal_Damor

Right. The much awaited FED FOMC statement is behind us. Where does that leave the two most important classes of assets vis vis other assets and with respect to each other.

Right. The much awaited FED FOMC statement is behind us. Where does that leave the two most important classes of assets vis vis other assets and with respect to each other.

GOLD

We have a very contrarian view on Gold. Most analysts and Gold sentiment indicator like Hulbert are all very bearish. But it confounds most that Gold has paid no heed to sentiment as it sits atop its all time high or rather a healthy 10% below the all time highs. In fact Gold is the only asset among all the assets including Agri, Equitites, Bonds and other Instruments that sit at its all time highs. Gold is a clean winner no matter what people and analysts say about it. They have all got it wrong when it rose to 1225. They got its fall to $1100 wrong. They will again get its rise wrong. That is why making money is so difficult.

I am not a Gold bug and I must confess that I hate the metal. But I also understand that Gold will punish the monetary fraud and will fail the fiat currency if there is an extended period of devaluation. It is inevitable. GOLD rise petrifies no one more than the central banks as it effectively proclaims failure of their currency. That is why Hitler said “Banish those who hold Gold”. Gold has been state enemy from the time monetary fiat currency was established. 70 years hence, nothing has changed.

But having said that, where is Gold headed? I am attaching my thoughts in the chart below.

Gold clearly is forming a triangle formation and will break out or break down. If it breaks out, the target is 1450-1500 at the minimum. It could well reach 1650 Jim Sinclair target. If it breaks down, I do not have a target.

Just for the record: we reinforce our GOLD target for 2010 peak of $1500.

Dollar

If there is another asset which is as important as Gold it is the world’s leading nation’s currency: The Dollar. There is no doubt in my mind that dollar days are counted. The hole that FED has dug for US treasury is a bottomless one. There will be intermediate mini bounces in dollar but dollar has an impossible chance of being a reserve currency a few years or even months down. Am expecting a massive currency crisis this year.

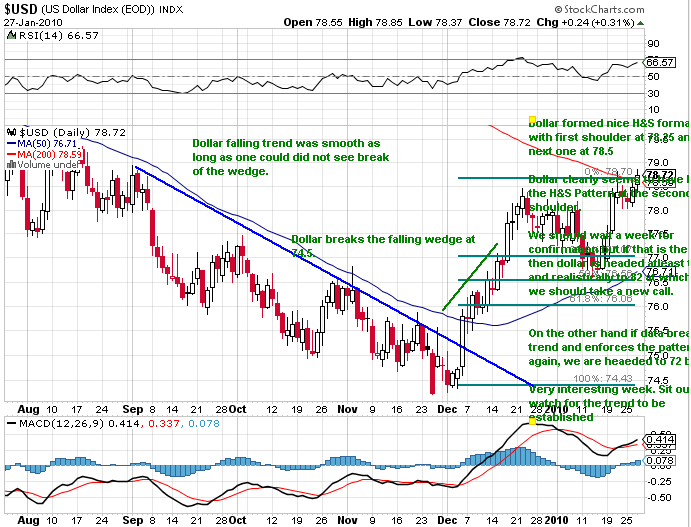

But that does not take away the fact that dollar has broken a falling wedge as shown in the graph and will head up. We did forecast this in our previous post Why is dollar rising

Very interesting week. Stay clued. This week will set the trend.

The question is whether dollar can rise while Gold breaks out the triangle towards the upside? I do not think so. I believe Gold will hold inside the Triangle while Dollar rallies this week before topping.

Vishal Damor

http://investingcontrarian.com/

Vishal Damor, works for an emerging market financial consulting firm and is the editor at INVESTING CONTRARIAN, a financial analysis and reporting site covering commodities, emerging markets and currencies.

© 2010 Copyright Vishal Damor - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.