Obama And Earnings Reports Soothe Stock Market Investors Nerves

Stock-Markets / Financial Markets 2010 Jan 28, 2010 - 09:45 AM GMTBy: PaddyPowerTrader

A more hawkish than expected FOMC statement yesterday saw equities ending higher and debt lower. There was also relief that Obama’s State of Union speech contained no negative surprises. He announced an extension of tax incentives which was warmly received and announced the elimination of capital gains tax on small businesses. Not sure whether this squeeze has legs but with one hurdle out of the way some of the bears are covering – it’s just a question of whether the long-only sellers we have seen all week decide to come in of the side lines. We are knee deep in earnings and global proxies. CAT, Hitachi Construction etc are guiding lower which doesn’t exactly fill me with a great deal of confidence.

A more hawkish than expected FOMC statement yesterday saw equities ending higher and debt lower. There was also relief that Obama’s State of Union speech contained no negative surprises. He announced an extension of tax incentives which was warmly received and announced the elimination of capital gains tax on small businesses. Not sure whether this squeeze has legs but with one hurdle out of the way some of the bears are covering – it’s just a question of whether the long-only sellers we have seen all week decide to come in of the side lines. We are knee deep in earnings and global proxies. CAT, Hitachi Construction etc are guiding lower which doesn’t exactly fill me with a great deal of confidence.

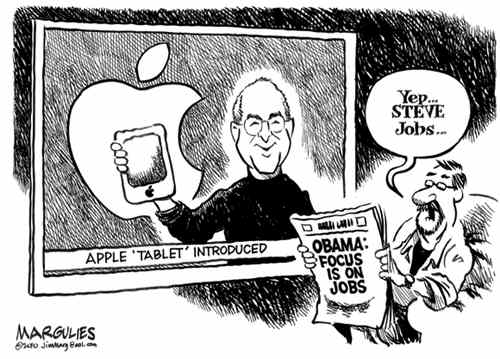

Despite oil falling to a 5 week low, airlines were the big losers yesterday after International Air Transport Association said traffic fell the most ever last year and a recovery in demand in recent months has yet to translate into higher fares. Berkshire Hathaway (+4.9%) after the company has been picked to join the S&P 500. Boeing (+7.3%) reported 4th quarter numbers that beat the street. CAT (-4.3%) reported 4th qtr earnings that missed. US Steel (-6.7%) on brokers downgrades following forecasting more losses in the next qtr. Apple (+0.94%) is seeking to revolutionise the publishing business in the same way the iPod transformed the music industry, unveiling their tablet computer starting at $499, a price that was 50% lower than some analysts predicted.

European stocks in vogue to include Barclays and RBS (after Obama said that he wasn’t interested in “punishing banks). Nokia (up nearly 10%) and clothes retailer H&M (up 8%) both comfortable exceeded analysts EPS estimates. Talk that French train operator SNCF is in merger negotiations with Arriva, which boosted the latter by 4%. Drug maker AstraZeneca was the notable loser today, off 3% after missing Q4 earnings expectations.

US futures are pointing up after Ford posted a profit of $2.9bn (with a little help from the government and zero cost financing), Proctor & Gamble upped guidance for 2010, Eastman Kodak beat profit forecasts and adhesives giant 3M also beat EPS estimates and more interestingly also revised their 2010 outlook higher. Citibank and Bank of America are also looking perky pre market on Obama’s (u-turn?) more soft spoken attitude to the big bad banks. But another nasty jump in the US weekly jobless claims numbers at 13.30 (to 470k) has knocked a bit of puff out of the bulls with the futures halving their earlier gains.

While we may be done for the week in terms of major central bank policy meetings, there still awaits another marquee event of the week – vote to limit debate on FRB Chairman Bernanke’s re-appointment – in the US session today. While independent surveys and bookies suggest risk of reappointment to be very low, it’s still not a done deal and the market will be keen to learn the outcome. Today’s vote requires full attention as any surprise delivered may lead to volatile moves especially in the current headline sensitive market.

Today’s Market Moving Stories

- We’re not in Kansas anymore as KC President Tom Hoenig dissented in the FOMC statement believing “that economic and financial conditions had changed sufficiently that the expectation of exceptionally low levels of the federal funds rate for an extended period was no longer warranted”. I suspect that when the meeting’s minutes are published in three weeks time they will reveal a reasonably robust discussion and variety of views about the appropriate ‘exit strategy’.

- Delivered in the middle of the Asian time zone, US President Obama’s State of the Union address resounded with elements that should continue to support the positive turn for risk sentiment in the US. The President announced that job creation would be his “number one focus in 2010″, along with measures to improve investment incentives and the flow of credit to small businesses. As a result Asian stocks rose for the first time in nine days, led by companies reliant on American demand. Canon, which generates 28% of its revenue in the Americas, advanced 2.2% after forecasting its biggest profit increase in a decade. Sony and Honda jumped more than 5% after the Nikkei newspaper flagged improved profitability at the two companies.

- Japan’s retail sales unexpectedly fell for a 16th month in December. Sales slid 0.3% from a year earlier against an expected gain of 0.3%. The benefits of the nation’s export-led recovery haven’t spurred hiring or pay checks for the nation’s households.

- China’s banking regulator told lenders to step up scrutiny of property loans while pledging to satisfy “reasonable” financing needs as it seeks to control credit growth and prevent asset bubbles. Banks should “strictly” follow real estate lending policies, the China Banking Regulatory Commission said yesterday in a statement on its Web site after a quarterly assessment of the nation’s economic and financial situation. It repeated a call for banks to “reasonably control” lending growth.

- Portuguese Prime Minister Jose Socrates defended his 2010 budget, saying that Portugal was not different from the EU average and that public accounts are in order. On Tuesday the Portuguese government had to report a higher-than-expected deficit of 9.3% for 2009 but pledged to lower it to 8.3% in 2010. Socrates insisted that public debt was with 77.4% well below EU average of 78% but markets reacted with disappointment.

Greek Bond Premiums Hitting Record Highs

Chinese central bank advisor Yu Yongding said that China shouldn’t buy a large amount of Greek debt since its securities are more unsafe than US Treasuries. He added: “Let European governments and the ECB rescue Greece.” As a result investors freaked out yesterday demanding highest premiums for Greek bonds and also turned against Spain and Portugal. The Greek 10 year bonds reached a record high of 6.92%.

John Authers concluded that Greece is now considered as a riskier credit than the average emerging market. The trading spread of 3.6pp over US treasuries is higher than the average emerging market sovereign bond spread of 2.97pp over treasuries. Is it justified? While Greece economic problems are less severe than those of Spain, the markets mistrust Greek data. The deficit is deep seated and pre-dates the crisis. Only true austerity measures can counter it, which may curtail economic growth or stir up social discontent.

An Economist article is getting some attention suggesting that top EU officials are already past the moral hazard debate and onto how a bailout would work in practice. No reaction in Greek spreads whilst we understand that there is no actual trading in the street in the new 5-year deal, “indicated” at +450 bps over bunds on the bid side.

iPad Stories

Apple will “likely” use LG Display and Innolux Display to supply liquid-crystal displays for its new iPad device. But Apple’s plan to call its new tablet computer the iPad may run into trademark problems because of an older application for the name by Japanese computer maker Fujitsu. Fujitsu has sought a trademark on the name since 2003 for a hand-held computing device.

Apple has also dealt Verizon Wireless investors and customers a blow by naming AT&T as the provider of wireless service for its tablet computer. Verizon Communications stock fell as much as 2.2% yesterday. The iPad may generate $100 million in earnings a year for AT&T.

Company News

- BSkyB H1 figures came broadly in line with expectations, with operating profit rising 3% to £401m on sales up 10%. BSkyB stated they absorbed around £70m of upfront costs related to installing High Definition services to subscribers, which suppressed near term profitability. In terms of Q2, net DTH (satellite) additions rose by 172,000 to 9.7 million, whilst Sky+HD net additions rose by an impressive 482,000 to 2.1 million.

- Tate & Lyle indicated that Q3 performance was “marginally below our expectations” due to lower industrial sales in their Food & Industrial Ingredients, Americas division. They did however say that profit before tax for the nine months was in line with their expectations, and that full year operating profit would be “marginally below” the previous year (£298m). Looking forward, despite lower input costs, margins will be lower in calendar 2010. More positively, debt was down a further £123m to £864m due primarily to further improvements in working capital. All in all, slightly negative news.

- Morrison’s announced the appointment of the relatively unknown Dalton Philips as its new CEO. Philips is currently COO of Loblaw, and formerly worked at Wal-Mart’s International business. It appears there was strong support among the Board to appoint CFO Richard Pennycook as CEO, although Sir Ken Morrison was keen to appoint a retailer rather than a converted accountant. The obvious concern is that Pennycook now leaves.

- Ford and Zhejiang Geely aim to sign a deal on the sale of the U.S. automaker’s Volvo unit by the Chinese New Year on February 14. Geely is expected to pay almost $2 billion for Volvo, which Ford acquired in 1999 for $6.5 billion. Ford is likely to contribute to Volvo’s pension fund, which could reduce its proceeds from the sale by $200 million to $300 million.

- Qualcomm, the world’s biggest maker of mobile-phone chips, lowered its 2010 sales outlook and forecast second-quarter profit that missed analysts’ estimates, a sign demand isn’t rebounding as fast as anticipated. Sales this year will be $10.4 billion to $11 billion. It previously forecast revenue of as much as $11.3 billion.

- Vodafone CEO Vittorio Colao may face pressure from investors to break up the company as it tries to turn around its underperforming European operations and faces an impasse in the US, where it owns a 45% stake in Verizon Wireless. Investors are calling for Colao to close the gap between Vodafone’s market capitalisation and analysts’ sum-of-the-parts valuations.

- Microsoft may beat analysts’ estimates for Q4 earnings and still see its shares decline after reporting results later today, ISI Group’s Heather Bellini said. Traders’ so-called whisper number is about 66 cents a share, said Bellini. That tops the 60 cent average estimate of analysts. “For the stock to go up, it’s got to be 67 cents or higher, and even at 67 the stock may do nothing,” said Bellini, who recommends buying the shares.

- Symantec forecast fourth-quarter profit and sales that may miss some analysts’ estimates, pushing down the shares as much as 5%. Excluding some costs, profit will be 36 cents to 37 cents a share in the current quarter. Sales will be $1.51 billion to $1.525 billion. Analysts estimated profit of 37 cents a share and sales of $1.52 billion.

- Tullow Oil prefers to team up with China National Offshore Oil Corp and Total in developing Uganda’s energy industry. Tullow Oil will start oil production in Uganda this year with initial output of 500 to 1,000 barrels per day, which will ultimately increase to 150,000 barrels of oil per day in 2015.

And Finally… Hayek And Keynes Go Head To Head

Disclosures = None

By The Mole

PaddyPowerTrader.com

The Mole is a man in the know. I don’t trade for a living, but instead work for a well-known Irish institution, heading a desk that regularly trades over €100 million a day. I aim to provide top quality, up-to-date and relevant market news and data, so that traders can make more informed decisions”.© 2010 Copyright PaddyPowerTrader - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

PaddyPowerTrader Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.