Gold Price Bubble, Is George Soros Right or Wrong?

Commodities / Gold and Silver 2010 Feb 03, 2010 - 06:54 AM GMTBy: Dudley_Baker

George Soros has been quoted recently as saying gold is in a bubble. Now that's an interesting comment but based upon what?

George Soros has been quoted recently as saying gold is in a bubble. Now that's an interesting comment but based upon what?

Who are we to question the comments of one of the wealthiest men on the planet?

And don't you love it when the 'big name players', like Soros, Jim Rogers, Roubini, Marc Faber, Bob Hoye, Pamela & Mary Anne Aden and David Nichols have differing opinions?

How can the average investor make an intelligent decision when even these 'big boys' can't agree? Well, for me, I love it and say, let's ask a few more questions and then look at some charts.

What do 'they' mean by a bubble?

When I hear the word bubble I immediately think of a parabolic move. A market that has gone straight up and this could be for a period of weeks, months or years.

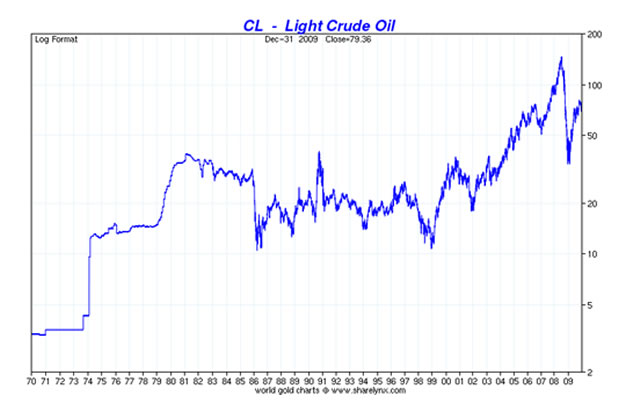

Parabolic moves and thus bubbles in my opinion were seen in the NASDAQ market into 2000, the oil futures spiking to $147, the parabolic rise in the housing stocks and the Japanese Nikkei, etc.

This next chart on Light Crude Oil shows the big bubble-parabolic move from approximately $10 to $147, (almost 15 times) from 2000 to the top in June 2008. Chart courtesy of www.sharelynx.com

Now let's look at gold:

Gold: where is the parabolic move? There is none. Look at this beautiful monthly chart below on gold from the low in 2001. This is a chart of beauty and it is not a chart of a bubble.

Could we be in the early stages of a bubble, yes, but we are no where near to a peak and/or a parabolic move. Look for yourself.

When we start to see gold go parabolic, rising day after day and everyone in the world getting excited and joining the party, then we will know gold is in a bubble. We believe that gold's big move up with be a moon shot like this chart of Homestake Mining from 1932 to 1934. Our challenge then will be to exit before the masses and we see the strong possibility of this event happening within the next 18 months.

We would therefore be in the camp with Jim Rogers, Bob Hoye, David Nichols, Marc Faber and Pamela & Mary Anne Aden. Up is the direction and the remaining question is how high?

We believe investors are being given the rare possibility of a once-in-a-lifetime-opportunity, yes, and a parabolic move in gold. The question is what will you do with it and do you need some assistance?

For those readers unfamiliar with our services:

- PreciousMetalsWarrants.com provides an online database for all warrants trading on the natural resource companies in the United States and Canada.

- InsidersInsights.com tracks the buying and selling of corporate insiders with a focus on the junior mining and natural resource sectors. Buy and Sell Alerts are issued as deemed relevant based upon our analysis.

We encourage all readers to sign up for our free weekly email.

Dudley Pierce Baker

Guadalajara/Ajijic, Mexico

Email: support@preciousmetalswarrants.com

Website: PreciousMetalsWarrants

Website: InsidersInsights

Dudley Pierce Baker is the owner and editor of Precious Metals Warrants and Insiders Insights. Articles are written by Dudley Baker along with contributing editors, Arnold Bock of Mendoza, Argentina and Lorimer Wilson of Toronto, Canada. PreciousMetalsWarrants provides an online subscription database for all warrants trading on junior mining and natural resource companies in the United States and Canada and a free weekly newsletter. InsidersInsights alerts subscribers when corporate insiders of a limited number of junior mining and natural resource companies are buying and selling.

Disclaimer/Disclosure Statement:PreciousMetalsWarrants.com is not an investment advisor and any reference to specific securities does not constitute a recommendation thereof. The opinions expressed herein are the express personal opinions of Dudley Baker. Neither the information, nor the opinions expressed should be construed as a solicitation to buy any securities mentioned in this Service. Examples given are only intended to make investors aware of the potential rewards of investing in Warrants. Investors are recommended to obtain the advice of a qualified investment advisor before entering into any transactions involving stocks or Warrants.

Dudley Pierce Baker Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.