The 1% Stock Market Crash, a week in review

News_Letter / Financial Markets 2010 Feb 03, 2010 - 07:10 AM GMTBy: NewsLetter

The Market Oracle Newsletter

January 31st, 2010 Issue #6 Vol. 4

The Market Oracle Newsletter

January 31st, 2010 Issue #6 Vol. 4

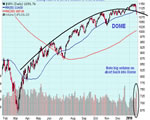

The 1% Stock Market Crash, a week in reviewDear Reader The week saw Tory Bliar appear in front of Britain's amateur Iraq War Inquiry to pound his fist on the table for war without end as he justified lying to the country on the reasons for the Iraq War and subsequent 200k+ deaths, from the 45 minute lie, to the WMD lie, right through to regime change lie on top of the Sept 11th excuse for war, despite the fundamental and absolute fact that it was the Saudi's that flew the planes into the twin towers and not Iraqi's! The reason for the iraq ware were two fold, 1. oil, 2. that Iraq had been systematically disarmed during the preceding 10 years and therefore presented an easy populist election winning victory. The consequences of which was the explosion in the number of terrorist recruits for the formerly dieing Al-Qeeda that has since franchised into a infinite headed hydra. His only regret was that he never got the chance to attack Iran as well. Gordon Brown's great New Afghan idea this week was to put the Taliban fighters onto the payroll along side British solider's. What's next ? Taliban pensions ? Whilst at the same time urging Pakistan to commit suicide by going all out on the Taliban across the border. Can things get any more crazy ? On the plus side both major political parties are starting to publically recognise that tackling Britains ballooning budget deficit is critical for long-term prosperity because the financial markets will not tolerate a deficit anywhere near 14% of GDP and will one day, perhaps much sooner than anyone expects, say NO, NO MORE. Therefore it is infinitely better to tackle the deficit before the market forces action on its terms. Financial Markets Quick Update Dow 10,067 (10,173) -1%. The impression one had going into and during most of the week from the media-sphere was for that of extreme downward price action which even extended to a number of stock market crash calls. As expected the perma analysts (bear) appeared on the financial broadcast channels, with further strong opinions voiced by journalists deluding themselves that they are experienced market traders or economists for what turned out to be a little changed week in an ongoing significant correction after the massive bull run off of the March 2009 low that targeted 10,500 that very few capitalised upon due to the reasons I voiced way back at the start of April 2009. Gold $1,081 ($1,093), - 1%. Gold Continues to meander towards $1050. USD $79.50 (78.3) +1.5%. The dollar bull market swing continues to target USD 84, though actual trend is not particularly strong, i.e. it is taking a LOT of time which is not a sign of strength. The Inflation Mega-trend Ebook The analysis and implications for the inflation mega-trend are complete. The transfer / write up for the pdf ebook is underway. Given the ballooning size of the ebook, the download url will have to be emailed out at a rate that will allow recipients to be able to download it, perhaps in the region of 4,000 per day during the week. In the mean time, one of the key implications of the inflation mega-trend will be emailed out tomorrow on the stock market trend for 2010 and beyond. Subscribers will receive the analysis and the ebook download, if you are not already subscribed then do so now, as it is FREE and the ONLY requirement is a valid email address. Source and comment here - :http://www.marketoracle.co.uk/Article16903.html Your getting distracted by politics analyst. By Nadeem Walayat Copyright © 2005-10 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved. Featured Analysis of the Week

Most Popular Financial Markets Analysis of the Week :

By: Elite_E_Services Modern humans take pride in themselves and their society due to its perceived superiority. It is contrasted most starkly with a period in Europe known as the Dark Ages , a period of little documented innovation, writing, scientific discovery, and general backwardness.

By: Clive_Maund On Friday Goldman Sachs and J P Morgan broke down decisively from their Head-and-Shoulders tops, a development that we predicted before the open based in large part on the huge downside volume in these stocks on Thursday.

By: Mac_Slavo The trend going forward during this economic depression is getting back to basics. We often discuss ‘prepping’ as a way to protect your family in the event of an unforeseen catastrophe (natural or man-made). Recently, we’ve seen more financial analysts and advisers recommend shifting from traditional investments like stocks, bonds, CD’s and money market accounts, to tangible assets that will gain value regardless of what stock and bond markets do.

By: Nadeem_Walayat The big news story of the week was Obama being shocked into action on the Banks AFTER the bruising election result from Massachusetts, which followed a year of dithering on the financial sector reforms issue. Obama has been a huge disappointment during his first year as the U.S. electorate had CHANGE, CHANGE, CHANGE rammed down their throats during the campaign, however we have seen very little actual change where even his flag ship health reforms have now basically been put onto the back burner.

By: Bob_Chapman Few professionals are yet willing to admit we have been in a depression for the last year.

By: John_Mauldin When I was at Rice University, so many decades ago, I played a lot of bridge. I was only mediocre, but enjoyed it. We had a professor, Dr. Culbertson, who was a bridge Life Master at an early age. He was single and lived in our college, playing bridge with us almost every night. He was a master of the "end game." He had an uncanny ability to seemingly force his opponents into no-win situations, understanding where the cards had to lie and taking advantage.

By: David_Galland The first time I spoke with real estate entrepreneur Andy Miller was in late 2007, when I asked him to serve on the faculty of a Casey Research Summit. As John Mauldin, a former faculty member himself, knows, we're very selective with our speakers. And there was no one in the nation I wanted more than Andy to address the critical topic of real estate.

By: Paul_L_Kasriel A lot has been written in recent months about the exploding U.S. Treasury debt and how the U.S. dollar will surely suffer as a result of it. And, there is no doubt that the debt has exploded and is projected to continue rising at a relatively rapid rate for as far as the eye can see. The relatively rapid projected increase in U.S. Treasury debt 10 years out is primarily due to the large number of baby-boomers becoming Medicare recipients and the projections of rising Medicare costs per baby-boomer.

You're receiving this Email because you've registered with our website. How to Subscribe Click here to register and get our FREE Newsletter To access the Newsletter archive this link Forward a Message to Someone [FORWARD] To update your preferences [PREFERENCES] How to Unsubscribe - [UNSUBSCRIBE]

The Market Oracle is a FREE Financial Markets Forecasting & Analysis Newsletter and online publication. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.