America. What Went Wrong? (Part 1)

Politics / US Politics Feb 03, 2010 - 05:27 PM GMTBy: Mike_Stathis

As I have detailed with extensive data and accompanying analysis in America's Financial Apocalypse (2006/expanded and 2007/condensed), America’s once great economy has been gradually transformed into a Ponzi scheme through decades of unfair trade policies that destroyed millions of U.S. jobs.

As I have detailed with extensive data and accompanying analysis in America's Financial Apocalypse (2006/expanded and 2007/condensed), America’s once great economy has been gradually transformed into a Ponzi scheme through decades of unfair trade policies that destroyed millions of U.S. jobs.

Unlike many other books which discussed the real estate bubble in isolation, this book went well beyond the real estate bubble by presenting a compelling case for a long period of economic depression.

In my book exclusively dedicated to the real estate bubble, Cashing in on the Real Estate Bubble, I actually recommended that readers short Fannie, Freddie, several other mortgage stocks, banking and homebuilding stocks. Try finding anyone else in the world that had the balls to write that in a book. Let me save you some time. You won’t.

I also discussed many issues that have since become hot beds of discussion, such as chapters on the healthcare crisis, the entitlement tsunami, how Washington manipulates economic data, the commodities bubble, and many other topics.

But of course, due to the media’s widespread ban on me, I have received no credit for exposing these issues. Instead, others who have sold out to the media have stolen my analysis and claimed it as their own. But my written track record demonstrates who the leader is and who the followers are.

I’m telling you this not to boast (one can only be guilty of boasting if everyone knows of their achievements; virtually no one knows about me due to the media) but because you need to understand how you have been fooled.

You need to understand how America’s media monopoly practices censorship daily.

You need to understand who the leaders of critical analysis are and who the followers are.

You need to examine track records and spot agendas.

We are now seeing this depression unfold. Yet, Washington, Wall Street, and the media hacks continue to downplay the severity of the situation, hoping to buy them time as they flood the financial system with a historic amount of dollars.

One could argue that America’s Second Great Depression actually began in 2001. As an attempt to mask the reality of America’s gradual decline, just over a decade ago economists and politicians proclaimed the “Information Age” as the engine of the “New Economy,” promising higher living standards for all.

As I detailed in America's Financial Apocalypse, there have been no real improvements to the economy since 2003 (possibly since 2000). Instead, a new bubble was formed by Alan Greenspan; this time in real estate.

It was the biggest real estate bubble in history, although many industry insiders denied its existence, even as it began to burst.

As I and many others had predicted, the results would create widespread devastation once the bubble popped.

Others served as Wall Street hacks, claiming the economy was great and the stock market was headed to 15,000.

Even as the devastation was sweeping across the nation, America's propaganda machine continued to hide the facts, while interviewing idiots and liars.

But don't blame them. If you listened to these idiots you have no one else but yourself to blame because you didn't bother to check agendas and track records.

If you lost money due to their lies and ignorance, you only have yourself to blame for being gullible.

History only repeats because people don't learn from the past.

Unfortunately, most people will not learn from this, just as they didn't learn from the dotcom collapse.

If one is to accept the traditional dog-and-pony metrics used by Washington economists and related individuals, including groups that adhere to these ideas, the previous “economic expansion” dates back from late 2001 to December 2007.

As the CBPP reports, poverty continued to rise during and after the 2001 recession and failed regress back to prerecession levels, “representing one of the worst periods for poverty reduction of any economic recovery in decades.”

Rather than higher living standards for all, the “New Economy” has brought higher living standards to much of the developing world, corporate executives and wealthy shareholders of U.S. corporations.

Meanwhile, working-class Americans have been left out of the picture.

In fact, because there is a finite amount of wealth to divide, it’s clear that America’s wealthy elite and much of the developing world have seen their living standards increase at the expense of working-class Americans.

As detailed in America's Financial Apocalypse, and has been confirmed by numerous non-partisan, unbiased think tanks before and since, the monetary gains resulting from the previous economic expansion were disproportionately distributed to Americans at the highest income levels.

According to Piketty and Saez, the top 1% of households received two-thirds of the growth in national income during this post-2001 recovery period. This represents the most distorted allocation of incomes seen from every other economic expansion since the “roaring 20s” pre-depressionary period.

Rather than higher living standards for all, this proclamation of a “New Economy” has been nothing short of a smoke screen for trade policies that continue to destroy working-class America, while enriching corporations, their owners and executives, and workers from developing nations.

It’s been socialism for corporations and developing nations at the expense of working-class Americans.

Not by coincidence, the current bailouts advocated by Washington bear a striking resemblance to their own policies of economic extortion through the mechanisms of free trade.

Not by coincidence, the most recent asset bubble imploded in a manner similar to the previous dotcom bubble.

Not by coincidence, the media, Wall Street and Washington denied the problems all the way down.

It was a domino effect, starting with the implosion of hundreds of dotcoms that had cooked the books.

Next, 911 came.

Shortly thereafter, giant blue chips held by nearly every investor collapsed.

First there was Enron, then WorldCom, then Tyco. This caused a dismissal of confidence in the capital markets.

By the time the media admitted problems, everything had bottomed out.

By the time Wall Street issued sell signals, stocks were at multi-decade lows.

Investors panicked, causing the markets to plummet further. And Wall Street quietly began buying at the bottom, as they always do.

The strong economic partnership between Wall Street and the financial media made both sides very wealthy at the expense of Main Street, just as it always has.

Just as in the dotcom collapse, the current real estate collapse has seen virtually no criminal indictments for securities fraud directly responsible for the collapse.

Instead, a few scapegoats were chosen to distract attention from the true criminals who intentionally extorted shareholder equity.

After the dotcom bubble popped, the media focused on Enron, WorldCom and Tyco – none of which had anything to do with the dotcom fraud.

This allowed thousands of corporate executives, Wall Street bankers and analysts to escape from the heist scott free, wealthier than they could ever have imagined.

Today, the media focuses on Bernie Madoff, and Stanford.

While each Ponzi scheme was a victim not cause of the collapse, the media has fooled Main Street by focusing on them so as to protect the real criminals running the commercial banks, mortgage companies and Wall Street firms.

As a replacement for jobs that produce real goods; goods in demand across the globe, America’s “New Economy” is now characterized by a service economy based on scavenging wealth from the huge Ponzi scheme designed by Washington.

To promote this scheme, the claim America has a free market economy. But the facts tell a different story, as I have alluded to on many occasions.

America’s “Old Economy” created good jobs during a period when U.S. imports were in high demand.

As a result, America became the world's largest creditor because it served as the global leader of manufactured goods; real products needed and demanded by the world – the best automobiles, consumer appliances, textiles, and basic materials.

Foreigners sent money into America in exchange for the best consumer goods in the world.

This helped create a strong middle class that fueled economic growth.

Pension plans grew over the years, providing retirement income, disability, and healthcare even during retirement.

During the "Old Economy" Americans had a healthy savings rate. One-income households were the norm, so children were raised with more responsibility and attention.

During the “Old Economy,” healthcare and higher education were affordable, there were no credit cards, there was no need for cheap labor from illegal aliens, and America was a net exporter of crude oil.

Employer-sponsored healthcare became the nations’ most predominant mechanism of providing healthcare, reaching 180 million Americans just a few years ago.

Towards the final stages of America’s “Old Economy” Asia began modernizing its own manufacturing industries.

Rather than automotive plants and consumer electronics, much of Asia’s manufacturing efforts were focused on providing goods for its own consumers so as to decrease dependence on imports. At first, they weren’t so good at it.

But once free trade became the status quo, it enabled Asia to enter the market place with unfair advantages while using illegal trade practices.

As discussed in America's Financial Apocalypse, as more American firms sent manufacturing plants overseas, Asia became the recipient of the unintended but inevitable transfer of intellectual property from the United States. This helped speed the pace of Asian manufacturing and know-how.

It enabled Asian companies to gain access to critical manufacturing and design secrets. Even Japan has benefited from U.S. intellectual property as the result of free trade.

In many cases, huge companies have been sold off to foreign competitors because they simply cannot compete on U.S. soil due to unfair trade.

In return, U.S. corporations have increased their profits while providing cheap goods to U.S. consumers who buy more than they can afford using credit. This has created a perpetual loop of no escape.

As we know, all Ponzi schemes eventually come to a harsh end. At some point you need a real job to buy goods.

We are now seeing this Ponzi scheme unravel. Unfortunately, it still has a long way to go.

As a direct beneficiary of intellectual property from the U.S., Asia has evolved from making cheap trinkets to quality automobiles, consumer electronics, prescription drugs, and so on.

For many years now, Asia has dominated the consumer electronics industry. Now, China and Japan dominate the automotive industry.

But as thrifty Americans eager to snatch up the lowest-priced goods have seen, there is a hidden price that comes with Chinese imports; namely safety issues. As America becomes more reliant on China for more goods, without adequate safety standards, Washington has effectively threatened the safety of U.S. consumers because it was Washington that has created this import-driven economy. They have mortgaged off America’s ability to be self-sufficient.

China has already destroyed the U.S. textile, chemical, steel and other industries, using unfair trade and pricing practices. Meanwhile, Washington has sat idle, as has the World Trade Organization.

You ask why? How can this be?

Washington doesn’t have much bargaining power since China is the principal player in America’s Ponzi scheme, providing financing to keep interest rates low, which keeps U.S. consumers shopping “till they drop.”

Of more detriment, U.S. consumers are buying a huge amount of imports from Asia, Europe and Latin America. This has indirectly led to even more job losses in America. But is some respects, they haven’t had a choice, as the buying power of the dollar has been in decline for a decade, while real media wages have not moved.

As you can imagine, this Ponzi scheme economy is nothing other than a perpetual loop that is virtually impossible to escape from without a major collapse; a collapse much larger than we see today.

Due to the toxic effects of free trade, China will soon dominate the automotive and drug manufacturing industries. Already China leads the world in IT exports, boasts the second largest market for luxury goods, and leads the world in many other areas. By 2020, China will have the largest economy in the world.

Today, as healthcare costs mount, more companies are outsourcing in order to eliminate their fastest growing cost – healthcare.

You can imagine how job losses have affected families who relied on employer-based healthcare.

Obtaining health insurance in the private market is extremely costly. And if you have a pre-existing medical condition, it might be impossible. At the very least, in many cases, it will be cost-prohibitive.

Today, 160 million Americans rely on employer-based healthcare. Millions have been stripped of affordable healthcare coverage along with their jobs, in the name of free trade. And with the unfair rules of free trade in play, you can bet that millions more will lose affordable access to medical care one way or another.

Many companies have responded to rapidly rising healthcare costs by shifting premium hikes to employees. Other employers have changed their health plan to one that doesn’t cover as much or has higher deductibles. And of course other employers are sending jobs overseas where they don’t have to pay the costly expenses for health insurance and retirement benefits.

America is the only nation in the world with employer-based healthcare. It is a relationship that served the nation well decades ago, before unfair rules of trade pressured U.S. corporations to export jobs overseas. Without radical changes to free trade and a radical reform to its healthcare system, America will continue its competitive decline in global trade.

If you want to devise a system of free trade, all participants must play by the same rules. Otherwise, competitive advantages will be established favoring one or more nations over those operating under less favorable rules.

As it stands today, America has no chance to mount a permanent economic recovery without radical realignment of economic and trade policies.

Until free trade has been restructured into fair trade, millions of additional jobs will be sent permanently overseas. And the only replacement of these jobs will be service-oriented professions catering to the wealthy, similar to what you see in third world nations.

These will be jobs with no employee benefits; no healthcare, no disability, no retirement plans, no nothing. This shift has been in effect for two decades, but has accelerated with each of the most recent bubble implosions. Yet, many Americans only learn the hard way once they have lost their employee benefits, as this compensation amounts to over 40% of the media worker’s total compensation package.

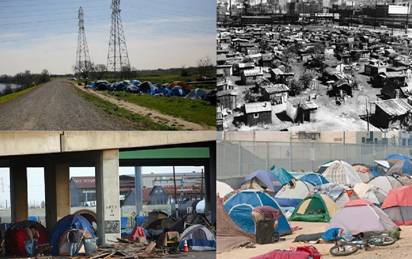

During America’s “Old Economy” Detroit was at its peak, along with Cleveland, Philadelphia and St. Louis. Today, these cities consist largely of ghettos.

Where blue-collar workers once lived, gangs have taken over. Instead of learning skills or obtaining an education, teens look to their parents and see no future, so they learn the drug trade as the only way out of the ghetto.

But there’s a silver lining for some. Each of these “ghetto cities” has one or two small areas representing “old money” from the “Old Economy.” These estates rest on gorgeous lots, with fancy landscaping.

Chances are, the owners of these residences accumulated their wealth as a result of, or in spite of the decaying industries that once made these cities economic giants.

Chances are, they were the beneficiaries of free trade, corporate fraud and crony capitalism; some of the more prominent symbols of modern America.

They may have transitioned from politics into the corporate world where they were paid millions of dollars for having lunches with their friends in Washington in order to secure big government contracts.

They may have transitioned from the corporate world into politics, where they used their power to reward their corporate friends.

They may have worked as bankers, attorneys or consultants on leveraged buyouts and other deals that destroyed jobs and eliminated pensions.

Some of them are actually spies for foreign governments.

The “New Economy” is characterized by huge financial institutions which scavenge off of consumers and corporations.

This does nothing to create net productivity.

In fact, America's financial giants actually cause more harm than good.

As you might imagine, most of America’s largest financial services firms also make extensive use of outsourcing, just as most other U.S. corporations; anything for profits, even if it threatens the economic and thus national security of America.

Those who read America's Financial Apocalypse (2006) and Cashing in on the Real Estate Bubble (2007) were not only alerted to the catastrophe we see today, but were provided with SPECIFIC ways to profit that have yielded over 100% gains since then.

I can guarantee you the chapter on the real estate bubble alone (chapter 10) serves as the most detailed and comprehensive analysis presented from any book solely dedicated to this bubble.

These books are arguably more valuable today because the catastrophes over the past two years have confirmed that my understanding of what will happen is unmatched anywhere in the world.

If you want access to institutional-level research, analysis and investment guidance, subscribe to the AVA Investment Analytics newsletter today. www.avaresearch.com

If you want a chance to make $100,000, check this offer

By Mike Stathis

www.avaresearch.com

Copyright © 2009. All Rights Reserved. Mike Stathis.

Mike Stathis is the Managing Principal of Apex Venture Advisors , a business and investment intelligence firm serving the needs of venture firms, corporations and hedge funds on a variety of projects. Mike's work in the private markets includes valuation analysis, deal structuring, and business strategy. In the public markets he has assisted hedge funds with investment strategy, valuation analysis, market forecasting, risk management, and distressed securities analysis. Prior to Apex Advisors, Mike worked at UBS and Bear Stearns, focusing on asset management and merchant banking.

The accuracy of his predictions and insights detailed in the 2006 release of America's Financial Apocalypse and Cashing in on the Real Estate Bubble have positioned him as one of America's most insightful and creative financial minds. These books serve as proof that he remains well ahead of the curve, as he continues to position his clients with a unique competitive advantage. His first book, The Startup Company Bible for Entrepreneurs has become required reading for high-tech entrepreneurs, and is used in several business schools as a required text for completion of the MBA program.

Restrictions Against Reproduction: No part of this publication may be reproduced, stored in a retrieval system, or transmitted in any form or by any means, electronic, mechanical, photocopying, recording, scanning, or otherwise, except as permitted under Section 107 or 108 of the 1976 United States Copyright Act, without the prior written permission of the copyright owner and the Publisher. These articles and commentaries cannot be reposted or used in any publications for which there is any revenue generated directly or indirectly. These articles cannot be used to enhance the viewer appeal of any website, including any ad revenue on the website, other than those sites for which specific written permission has been granted. Any such violations are unlawful and violators will be prosecuted in accordance with these laws.

Requests to the Publisher for permission or further information should be sent to info@apexva.com

Books Published

"America's Financial Apocalypse" (Condensed Version) http://www.amazon.com/...

"Cashing in on the Real Estate Bubble" http://www.amazon.com/...

"The Startup Company Bible for Entrepreneurs" http://www.amazon.com...

Disclaimer: All investment commentaries and recommendations herein have been presented for educational purposes, are generic and not meant to serve as individual investment advice, and should not be taken as such. Readers should consult their registered financial representative to determine the suitability of all investment strategies discussed. Without a consideration of each investor's financial profile. The investment strategies herein do not apply to 401(k), IRA or any other tax-deferred retirement accounts due to the limitations of these investment vehicles.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.