U.S. Weekly Unemployment Claims Jump, Hate Mail From Keynesian

Economics / Recession 2008 - 2010 Feb 04, 2010 - 01:55 PM GMTBy: Mike_Shedlock

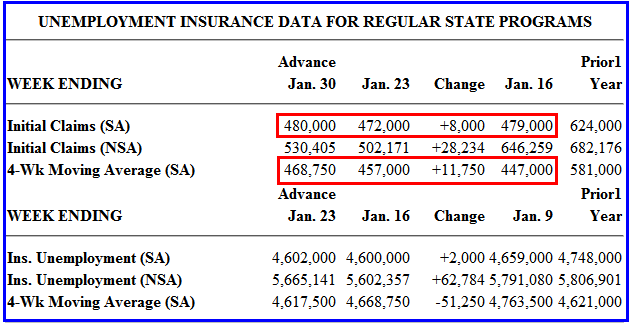

Inquiring minds are investigating the Unemployment Weekly Claims Report from the department of labor. Weekly unemployment claims are up yet again, as is the 4-week moving average of claims.

Inquiring minds are investigating the Unemployment Weekly Claims Report from the department of labor. Weekly unemployment claims are up yet again, as is the 4-week moving average of claims.

The numbers to watch are in the box in red. The 4-week moving average of claims is now clearly headed up. Moreover, if the next two weeks look anything like the past two weeks, that 4-week average will soon be at 480,000. Bear in mind most economists think the average needs to be at or below 400,000 before the economy is growing jobs.

Tomorrow, expect a huge revision in the employment survey numbers and you will not be disappointed. Please see 824,000 Will Disappear On February 5; BLS Admits Flawed Model But Plans No Changes for details.

The question keeps coming up "How will this affect the reported unemployment rate?"

The answer is not at all. The unemployment rates is based off the household survey (a telephone poll), but the revision tomorrow is to the establishment survey, based on a sampling of real live businesses, and "tweaked" (badly) by the fatally flawed Birth-Death Model that has been adding record numbers of jobs to the count all through the recession.

Continuing Claims

The other numbers to watch in the weekly report are the continuing claims counts. To get the count one must add two sets of numbers, continuing claims and emergency continuing claims (the latter as a result of benefits extended as many as 4-5 times for some individuals).

The 4-week average of continuing claims is 4,617,500. Meanwhile the number of emergency claims soared from 5,350,777 to 5,632,219. That is a jump of +281,442. A year ago the number of emergency claims was 1,839,758.

Let's do the math. 5,350,777 - 1,839,758. In one year, over 3.5 million people exhausted all of their benefits and are on federal life support. The total number on federal life support is now over 5.6 million.

Grand Total

To get the grand total of those on continuing claims of some sort, we must add 5,632,219 emergent claims to 4,617,500 regular claims. Drum roll please ....

There are 10,249,719 workers unemployed and receiving benefits. Bear in mind that emergency benefits can run out so the real total is logically higher.

10.25 million workers are collecting unemployment benefits

Meanwhile I have good news on the green jobs front.

70 Green Jobs Created

Inquiring minds are reading a Bloomberg article China’s Labor Edge Overpowers Obama’s ‘Green’ Jobs Initiatives.

President Barack Obama is spending $2.1 million to help Suntech Power Holdings Co. build a solar- panel plant in Arizona. It will hire 70 Americans to assemble components made by Suntech’s 11,000 Chinese workers.

That gap shows the challenge Obama faces as he works to create “green” jobs. Obama is giving billions of dollars in tax breaks to the wind and solar industries to create jobs in the U.S. even as production expands faster overseas.

“The cost of manufacturing here is too expensive compared to Asia,” said Guy Chaffin, chief executive officer of Elite Search International, a Roseville, California-based executive search firm that has found employees for Tempe, Arizona-based First Solar and Solar Millennium AG. “As far as a flood of good jobs coming to the U.S., we’re not seeing it.”Obama’s Pyramid Schemes Addressed

If you want to read a masterpiece on job pyramid schemes and Keynesian folly, then I highly recommend Obama’s Pyramid Schemes Would Make Keynes Happy by Caroline Baum.

That is one of her best columns ever. Yesterday I sent her an email congratulating her for an excellent column. As I was reading it, I thought she was going to get bombarded with mail.

Indeed that is the case. Today she just pinged me with "Thanks, Mish. The Keynesians were all over me. Awful hate mail."

That's OK Caroline. Hate mail from Keynesian clowns is never a bad thing.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.comClick Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2010 Mike Shedlock, All Rights Reserved.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.