Financial Market Bubbles in Search of a Pin

Stock-Markets / Financial Markets 2010 Feb 06, 2010 - 01:01 PM GMTBy: John_Mauldin

A Bubble in Search of a Pin

A Bubble in Search of a Pin

Unemployment Numbers: A Mixed Bag

A Bubble in Search of a Pin

And Speaking of Bubbles

Should Greenspan and Bernanke have seen the bubble in housing and other assets and acted, or should we accept their defense that you can't know whether there is a bubble until after the fact? We will look at research that suggests they should have known, and, at the least, policy makers should no longer be allowed to say, "How could I have known?"

Of course, the employment numbers came out this morning, and the results are mixed; but that is better than they have been for the past two years. We dig into the numbers to see what they are really saying. And finally, we examine why the markets are so volatile. Is it just Greece, or is there more? There's a lot of very interesting, and important, material to cover.

But first, and quickly, as I wrote in Outside the Box a few weeks ago, I am starting to very selectively buy biotech stocks, and mostly, though not exclusively, companies associated with the regenerative genetic revolution that is coming our way. I am convinced that this is going to be a decade of the most amazing medical breakthroughs, which will literally change (and in many cases extend) our lives, as therapies to treat all sorts of diseases become available.

This is the last time I am going to mention it, but here is the link to that OTB, which analyzes why we may see a bubble in biotech stocks before the end of the decade. The OTB was written by my friend Pat Cox, who covers these stocks and other technological marvels in his newsletter, Breakthrough Technology Alert. I have been following Pat for some time now, have talked extensively with him, and think he is one of those guys who have a handle on what by all accounts is going to be an amazing decade of breakthroughs.

I have asked his publisher to offer my readers a very discounted subscription price for one more week. (Ignore the deadline of February 5.) And yes, the promotional piece is a little over the top, as it is for most subscription newsletters (I am lucky mine is free - I don't have to do that). But I think his letter has a lot of substance. The link to the site is in the Outside the Box. Don't procrastinate. Join me, because for once in my life, dear God, I want to be in at the beginning of a bubble. And now to our letter.

Unemployment Numbers: A Mixed Bag

January employment numbers are characteristically volatile, as the birth/death ratio numbers are typically the largest of the year. This month the birth/death model subtracted (rather than added) 427,000 jobs (yes, I wrote that correctly). This is a very large "adjustment" month, and the volatility gets smoothed over in the seasonal adjustments. It is part and parcel of the process, as making estimates about how many new businesses are formed or die is extraordinarily difficult at turning points in the economy.

As an acknowledgment of that, the employment level for March 2009 was revised down by 930,000 jobs, and by December it was a total of almost 1.4 million extra jobs lost. That means that the Bureau of Labor Statistics overestimated the number of new jobs significantly. December's job loss was really 150,000, not the 85,000 originally reported. How would the markets have reacted to a number that large?

January saw a slightly larger than estimated loss of 22,000 jobs, which would have been 53,000 without new federal employees, 9,000 of whom were hired to perform the census. (By the way, federal employment is absolutely exploding!)

Now, the somewhat good news. I have been writing about how the household survey has been much weaker for almost two years than the establishment survey. For instance, the total number of unemployed rose by 589,000 in December, while the number of people not classified as looking for work rose by 843,000. No matter how you spin it, those were very ugly numbers.

This month the household survey showed the largest one-month turnaround that I could find. As The Liscio Report noted:

"Adjusting for the changes in the population controls, total household employment rose by 784,000 - and when further adjusted to match the payroll concept, employment was up 841,000. Moves of this magnitude (regardless of sign) are unusual, but not unknown - and frequently undone in subsequent months. The less volatile ratios were also up, with the participation rate up 0.1 point, and the employment/population ratio rose a nice 0.2 point, its first increase since last April. While it's too early to say whether this strength in the household survey is a harbinger of an upturn that will soon show up in payrolls, it's something to be filed under 'tentatively encouraging.'"

The work-week hours rose slightly. Income growth was better than it has been. Temporary workers rose, which is typically a harbinger of an increase in full-time employment. The number of people working part-time for economic reasons plummeted by 849,000.

And finally, the unemployment rate fell 0.3% to 9.7%. This of course means that more people are dropping out of the labor pool, and it also means they will at some point come back.

On the negative side, a loss of 22,000 jobs is nowhere close to the 100,000 new jobs that are needed just to hold unemployment steady. 41% of those unemployed have been so for over 6 months.

And quoting David Rosenberg:

"While there will be many economists touting today's report as some inflection point, and it could well be argued that we are entering some sort of healing phase in the jobs market just by mere virtue of inertia, the reality is that the level of employment today, at 129.5 million, is the exact same level it was in 1999. And, during this 11-year span of Japanese-like labour market stagnation, the working-age population has risen 29 million. Contemplate that for a moment; fully 29 million people competing for the same number of jobs that existed more than a decade ago. That sounds like pretty deflationary stuff from our standpoint.

"Not only that, but consideration must be taken that in 2009, we had a zero policy rate, a $2.2 trillion Fed balance sheet and an epic 10% deficit-to-GDP ratio. You could not have asked for more government stimulus. Yet employment tumbled nearly 5 million in 2009."

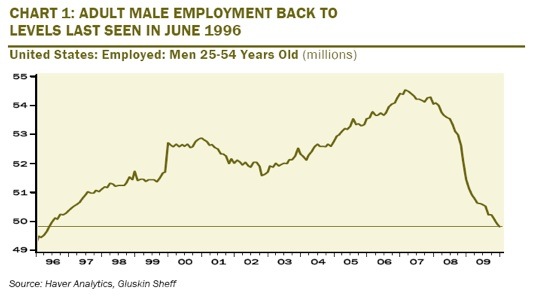

Finally, a very sad chart, courtesy of David. Those in the 25-54 year-old male category have seen their total number of jobs fall back to the level it was in 1996. Fourteen years later, and the "breadwinners" who are supposedly in their prime have seen an almost 10% drop in employment.

As noted above, January employment numbers are very volatile, and are likely to be adjusted either up or down by a lot in coming months. But this report was not the disaster of December. It still shows a very weak economy that certainly does not need a large tax hike next year. I hope we start seeing some positive numbers soon, but I am not optimistic that we are going to see the 200,000-plus new jobs per month we need to really start denting the unemployment numbers, for some time. Not when the National Federation of Independent Business says 71% of small businesses do not plan to hire this year.

The Fed is taking away quantitative easing. Stimulus spending is exiting in the last half of the year. States and communities are having to either raise taxes or cut spending by $350 billion! I heard on the radio coming back from the gym (I think it was my friend Steve Liesman on CNBC) that there are now 55,000 fewer teachers than a few years ago.

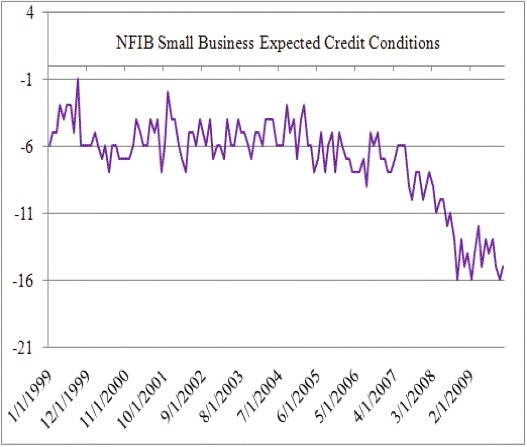

And again from the NFIB, small businesses see very tight credit conditions, which makes it hard for them to expand (see chart below). The headlines this week from the Fed banking survey said that banks were prone to be less tight, but the NFIB writers went deep into the report. What they found is that very large banks are willing to be less tight in their lending standards. Smaller banks were in fact not as easy. Loan demand is falling. Consumer credit actually declined slightly in December, after plunging in November. If you can't count on Americans to buy during Christmas, the world is in fact moving to the New Frugal.

All this is not the stuff that robust recoveries are made of. We drift back into Muddle Through the last half of the year, I think. And if Congress does not act to postpone or mitigate the enormous tax increases due in 2011, we slip back into recession. It will be a policy error of major magnitude to raise taxes with 10% unemployment and a weak economy.

A Bubble in Search of a Pin

We are going to once again return to the book highlighted the last few weeks, This Time Is Different, by Carmen M. Reinhart and Kenneth Rogoff. This is a book you should buy and read, especially the last 4-5 chapters, and try to get your Congressman to read it as well, so he or she can see what happens to countries that run up their debt. It makes no difference if it is small or large, the end result is the same.

Last week we looked at the role of confidence in allowing governments to borrow money. This week we ask whether Greenspan and Bernanke, along with the entire Fed, should have been able to determine whether a bubble was building in the US economy and lean against it, preventing the debacle we are now in. Reinhart and Rogoff gently come down on the side of those who think they should have, and that we need to implement changes in our institutions. Others, as we will see, are not so gentle. Let's look at a few selected paragraphs I pulled off my Kindle (all emphasis mine).

"As we will show, the outsized U.S. borrowing from abroad that occurred prior to the crisis (manifested in a sequence of gaping current account and trade balance deficits) was hardly the only warning signal. In fact, the U.S. economy, at the epicenter of the crisis, showed many other signs of being on the brink of a deep financial crisis. Other measures such as asset price inflation, most notably in the real estate sector, rising household leverage, and the slowing output - standard leading indicators of financial crises - all revealed worrisome symptoms. Indeed, from a purely quantitative perspective, the run-up to the U.S. financial crisis showed all the signs of an accident waiting to happen. Of course, the United States was hardly alone in showing classic warning signs of a financial crisis, with Great Britain, Spain, and Ireland, among other countries, experiencing many of the same symptoms.

"... On the one hand, the Federal Reserve's logic for ignoring housing prices was grounded in the perfectly sensible proposition that the private sector can judge equilibrium housing prices (or equity prices) at least as well as any government bureaucrat. On the other hand, it might have paid more attention to the fact that the rise in asset prices was being fueled by a relentless increase in the ratio of household debt to GDP, against a backdrop of record lows in the personal saving rate. This ratio, which had been roughly stable at close to 80 percent of personal income until 1993, had risen to 120 percent in 2003 and to nearly 130 percent by mid-2006. Empirical work by Bordo and Jeanne and the Bank for International Settlements suggested that when housing booms are accompanied by sharp rises in debt, the risk of a crisis is significantly elevated. Although this work was not necessarily definitive, it certainly raised questions about the Federal Reserve's policy of benign neglect.

"The U.S. conceit that its financial and regulatory system could withstand massive capital inflows on a sustained basis without any problems arguably laid the foundations for the global financial crisis of the late 2000s. The thinking that "this time is different" - because this time the U.S. had a superior system - once again proved false. Outsized financial market returns were in fact greatly exaggerated by capital inflows, just as would be the case in emerging markets. What could in retrospect be recognized as huge regulatory mistakes, including the deregulation of the subprime mortgage market and the 2004 decision of the Securities and Exchange Commission to allow investment banks to triple their leverage ratios (that is, the ratio measuring the amount of risk to capital), appeared benign at the time. Capital inflows pushed up borrowing and asset prices while reducing spreads on all sorts of risky assets, leading the International Monetary Fund to conclude in April 2007, in its twice-annual World Economic Outlook, that risks to the global economy had become extremely low and that, for the moment, there were no great worries. When the international agency charged with being the global watchdog declares that there are no risks, there is no surer sign that this time is different. [By that they mean that the attitude of the market in general and central bankers in particular was that "this time is different" and so we did not need to worry about the warning signs. The entire point of the book is that it is never different. We just somehow believe we are in a special situation.]

"... We have focused on macroeconomic issues, but many problems were hidden in the 'plumbing' of the financial markets, as has become painfully evident since the beginning of the crisis. Some of these problems might have taken years to address. Above all, the huge run-up in housing prices - over 100 percent nationally over five years - should have been an alarm, especially fueled as it was by rising leverage. At the beginning of 2008, the total value of mortgages in the United States was approximately 90 percent of GDP. Policy makers should have decided several years prior to the crisis to deliberately take some steam out of the system. Unfortunately, efforts to maintain growth and prevent significant sharp stock market declines had the effect of taking the safety valve off the pressure cooker.

"... The signals approach (or most alternative methods) will not pinpoint the exact date on which a bubble will burst or provide an obvious indication of the severity of the looming crisis. What this systematic exercise can deliver is valuable information as to whether an economy is showing one or more of the classic symptoms that emerge before a severe financial illness develops. The most significant hurdle in establishing an effective and credible early warning system, however, is not the design of a systematic framework that is capable of producing relatively reliable signals of distress from the various indicators in a timely manner. The greatest barrier to success is the well-entrenched tendency of policy makers and market participants to treat the signals as irrelevant archaic residuals of an outdated framework, assuming that old rules of valuation no longer apply. If the past we have studied in this book is any guide, these signals will be dismissed more often that not. That is why we also need to think about improving institutions.

"... Second, policy makers must recognize that banking crises tend to be protracted affairs. Some crisis episodes (such as those of Japan in 1992 and Spain in 1977) were stretched out even longer by the authorities by a lengthy period of denial."

The evidence is there. So why did the Fed miss it?

A more pointed critique is leveled at the Fed and Greenspan, and at Bernanke in particular, by Andrew Smithers in his powerful book (now updated) Wall Street Revalued: Imperfect Markets and Inept Central Bankers. The foreword is by one of my favorite analysts, Jeremy Grantham. This is on the top of my reading list for the coming week. I am loving the first part, which ties nicely into the themes explored by Reinhart and Rogoff.

The book is a withering critique of the Efficient Market Hypothesis (EMH), among other economic theories. Smithers argues that because the tenets of EMH are so ingrained, Greenspan and Bernanke could not recognize the bubble, because they believed in the efficiency of markets. "Dismissing financial crisis on the grounds that bubbles and busts cannot take place because that would imply irrationality is to ignore a condition for the sake of theory." Which they did.

As Grantham wrote in the foreword: "My own favorite illustration of their views was Bernanke's comment in late 2006 at the height of a 3-sigma (100-year) event in a US housing market that had no prior housing bubbles: 'The US housing market merely reflects a strong US economy." He was surrounded by statisticians and yet could not see the data... His profound faith in market efficiency, and therefore a world where bubbles could not exist, made it impossible for him to see what was in front of his own eyes."

Reinhart and Rogoff show time and time again that bubbles always end in tears. Markets and investors are in fact irrational. What kind of Fed governor would it have taken to suggest that housing was in a bubble and we were going to have to take steps to slow it down - raising rates, analyzing securitization and ratings? It would have taken one tough hombre. In fact, we had Greenspan, who encouraged the unchecked expansion of the securitized derivatives market. And a Congress that would not allow proper supervision of Fannie and Freddie (which is going to cost US taxpayers on the order of $400 billion). The list is long.

And Speaking of Bubbles

This week the turmoil that is Greece continues. One of my favorite quotes comes from Donald Morris, writing in June of 1993 (hat tip to Dennis Gartman):

"If all of the Greek islands were merged with the mainland, it would be about the size of Alabama; there are 10 million Greeks - and perhaps another 4 million living throughout the world, who still think of themselves as Greek. They are, thanks to their history, magnificent patriots and nationalists - and abominable citizens, who deeply mistrust every government they've ever had. Essentially they are fierce individualists, who mistrust not so much whatever government happens to be in power as the very idea of government. The have almost no sense of civic responsibility - Pericles complained about this at length - and History has never given them much of a chance to work out a stable system of government. Democracy, yes (the Greeks invented it!!), but stability, no."

Have things changed? From here it does not seem so. Greece apparently hid about 40 billion euros of debt from the public and EU governing bodies. (If the government can hide that much, is it any wonder that individual Greeks themselves can hide their income and pay so little in actual taxes? They have made it an art form!) In response to just the initial phase of belt tightening, unions are launching strikes and protests. What will happen when it gets serious? Stratfor estimates that Greek deficits may actually run as high as 15% of GDP rather than "just" the 10% or so publicly revealed. That will require far more than a little belt tightening.

Let's look at the record. Greece has been in default for 105 years out of the last 200. They have never had a balanced budget, at least not willingly.

The EU is backed into a corner. They have this treaty that says governments will act in certain ways. Greece is flaunting that treaty. Everyone acts as if Greece defaulting on its debt would be the end of the EU. Will the EU force Greece to withdraw if they do not control their budget? Upon reflection, I am not so sure.

Let's take that proposition to the US. What if Illinois defaulted on its debt? Would we kick them out of the Union? Hardly. A default would mean a severe loss of credit, a forced retrenching, and a severe economic crisis in Illinois. The losses would be serious for banks and investors. There would be negotiations on how to deal with the debt, who gets a haircut on their bonds, what pension assets and expenses would be cut, and so on. A crisis? Yes. End of the world? No.

So what if Greece does default? The banks and those who lent them the money would take a loss of some amount. The cost of borrowing for Greece would rise dramatically, if they could even get into the debt market. If they actually cut their budgets enough to deal with the deficit in a responsible way, it would mean, at best, a severe and prolonged recession. If Stratfor is right about deficits reaching 15% of GDP, it could mean a depression. They have no good choices.

It is doubtful that German and French voters will be happy with any bailout using their tax money that does not impose serious cuts in Greek budgets, with realistic controls as a condition for the bailout. Can Greece live with that? We'll see.

(I am sure I have hundreds of Greek readers. I would love to hear from you as to your views, from the inside.)

But is it so unthinkable that Greece could simply default and then be forced by the market to get realistic about its deficits? The same market forces that work in Illinois can work in Greece.

But if the EU does bail out Greece, what then of Ireland, which is making the tough choices? Will Portugal be next? If Greece is allowed to fail, or better, actually shows some fiscal discipline, that bodes well for the EU in the long run. It will be a lesson that each nation is responsible to maintain its own house.

The data presented by Reinhart and Rogoff show clearly that adding yet more suffocating debt to a bloated debt crisis is not the solution. It simply puts off the inevitable. Greece is an intractable problem. From here it looks like default or a very serious recession, with large unemployment numbers.

But in the meantime the Greek situation is adding volatility to risk markets of all types. I have written before of the connection between what is called the euro-yen cross and risk markets all over the world. Right now, you can borrow money very cheaply in dollars and yen (the so-called carry trade). When investors want to reduce risk, they pay back those loans, which has the result of increasing the value of the dollar and the yen.

That is what is happening with the euro-yen cross as of this morning. It is in the process of falling out of bed. And so are risk markets. Markets do not like uncertainty. And Greece and Portugal and Spain are uncertainty in spades. If Greece defaults, who owns the debt? Which banks? My bank? Will they call my loan? This happened in 2008 a lot! Can it happen again? We still have banks all over the world that are too big too fail. Credit default swaps are not on an exchange (because to do that would make them less profitable for the investment banks that sell them, and thus the lobbyists have convinced Congress to ignore them).

Are we at the place where we can think the unthinkable? That sovereign nations can in fact default? I think we see a de facto default by Japan this decade.

Do not assume that we have weathered the storm. We may just be getting ready for the next one.

Help in Europe, California, and Tampa, and Becoming our Parents

Tiffani wanted me to ask some of you for help with our vacation. I am taking all seven kids, four spouses, and three grandkids to France and then to Italy in June. We could use some suggestions, especially for how to accommodate 14 people. We will spend most of the time in Italy, after stopping at Bill Bonner's French chateau for a few days. I am checking out the International Living website for ideas. I really enjoy each issue, as I dream about having a retreat in some less hectic locale. You should check it out if you have that dream as well. It is inexpensive inspiration.

Tomorrow Tiffani, Ryan, and I head for a last-minute important meeting in LA. This will be interesting, as we are taking 2-month-old granddaughter Lively and the nanny as well. "Dad, I am just not prepared to leave my baby yet. I have to have more notice to get used to the idea." The bonus is that I get to have dinner with Rob and Marina Arnott on Sunday before we head back Monday morning.

And then next week is the NBA All-Star Game, which most of my kids will be attending with me. What a fun day!

And the following weekend I am off to meet with Jeff Saut, the chief investment officer of Raymond James. But we may slip in a little fun on his boat in the bay in Tampa. It's going to be a good, good month.

It seems that more than a few times lately that Tiffani has turned to me and said, "Dad, don't you remember telling me that just a few days ago?" It is almost a running joke. Then as I was drifting off the other night, I remembered telling my Dad the same thing - only when he was a lot older than I am now! I am becoming my Dad. Sigh. And I would give a great deal to still be able to chide him on his failing memory.

Have a great week!

Your going to eat Greek food this weekend (but no ouzo) analyst,

By John Mauldin

John Mauldin, Best-Selling author and recognized financial expert, is also editor of the free Thoughts From the Frontline that goes to over 1 million readers each week. For more information on John or his FREE weekly economic letter go to: http://www.frontlinethoughts.com/learnmore

To subscribe to John Mauldin's E-Letter please click here:http://www.frontlinethoughts.com/subscribe.asp

Copyright 2010 John Mauldin. All Rights Reserved

John Mauldin is president of Millennium Wave Advisors, LLC, a registered investment advisor. All material presented herein is believed to be reliable but we cannot attest to its accuracy. Investment recommendations may change and readers are urged to check with their investment counselors before making any investment decisions. Opinions expressed in these reports may change without prior notice. John Mauldin and/or the staff at Millennium Wave Advisors, LLC may or may not have investments in any funds cited above. Mauldin can be reached at 800-829-7273.

Disclaimer PAST RESULTS ARE NOT INDICATIVE OF FUTURE RESULTS. THERE IS RISK OF LOSS AS WELL AS THE OPPORTUNITY FOR GAIN WHEN INVESTING IN MANAGED FUNDS. WHEN CONSIDERING ALTERNATIVE INVESTMENTS, INCLUDING HEDGE FUNDS, YOU SHOULD CONSIDER VARIOUS RISKS INCLUDING THE FACT THAT SOME PRODUCTS: OFTEN ENGAGE IN LEVERAGING AND OTHER SPECULATIVE INVESTMENT PRACTICES THAT MAY INCREASE THE RISK OF INVESTMENT LOSS, CAN BE ILLIQUID, ARE NOT REQUIRED TO PROVIDE PERIODIC PRICING OR VALUATION INFORMATION TO INVESTORS, MAY INVOLVE COMPLEX TAX STRUCTURES AND DELAYS IN DISTRIBUTING IMPORTANT TAX INFORMATION, ARE NOT SUBJECT TO THE SAME REGULATORY REQUIREMENTS AS MUTUAL FUNDS, OFTEN CHARGE HIGH FEES, AND IN MANY CASES THE UNDERLYING INVESTMENTS ARE NOT TRANSPARENT AND ARE KNOWN ONLY TO THE INVESTMENT MANAGER.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.