Fed Fund Interest Rate Futures and Other Financial Market Signals

Stock-Markets / Financial Markets Aug 02, 2007 - 12:23 AM GMTBy: Jim_Willie_CB

A quick review of signals surely can be both encouraging and confusing. They point to higher physical prices, calmer stock prices, and a continued housing crisis & mortgage debacle. The big banks and Wall Street broker dealers are breaking down very badly. The US Dollar bounce is already running out of steam, hampered by a restored expected interest rate cut. Remember: whatever is vigorously and repeatedly denied is almost surely to occur!!! Deception sells products.

The eventual gigantic bailout will render horrendous harm to the US Dollar, from both the broad infusion of phony money in redeemed mortgage bonds, but also lost credibility in the US Federal Reserve and US Dept of Treasury. Bernanke is missing action, but Paulson's words sound downright idiotic. Will Paulson resign early, just like Rubin in 2000, to short the stock market with more liberty? For a while, gold and silver are held hostage to the admission of a required bailout and the final decision to take action. The crude oil price continues to be the path of least resistance, which signals a Petro-Dollar breakdown. These topics are discussed in depth in the upcoming August Hat Trick Letter.

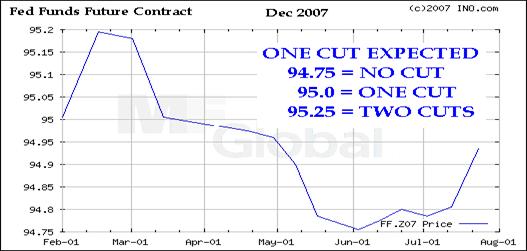

FEDFUNDS FUTURES CONTRACT

The USFed will be forced into under-writing on a massive scale the bond nightmarish losses, especially since the prime mortgage market has been infiltrated. Bernanke regards the prime mortgage market as sacred, to be protected. The official rate cut would jack up the gold price and harm the USDollar. The helpful USTBond yield differential would fade. The December 2007 FedFunds futures contract factored in two 25 bpt rate cuts last February. That belief evaporated with tame doctored consumer prices and a slight rebound in the economic growth. The GDP bounce seen in 2Q2007 might not last long. Now, one 25 bpt cut is expected again with a roughly 80% likelihood. Where is Ben Bernanke in his pep talk to the markets? The hamstrung USFed has been marginalized, perhaps the weakest among all central banks.

US DOLLAR BOUNCE ALREADY TIRED

The USDollar rally as seen in the DX current basket index is one week old and probably half completed. Resistance is likely to be fierce at the 81.5 level. The profit taking for the euro, the swissie, the British sterling, the Canadian loonie, the aussie, and the Kiwi might be close to finished. Enter the bounce in the Japanese yen, with a likely interest rate hike this year. The USDollar will continually scratch at new lows with feeble bounces.

HOUSING CRASHES LOWER

A multi-year breakdown has been registered in the homebuilder stock index. They will lead the carnage. Expect all but one or two major homebuilders to go bankrupt. Their stories are deteriorating, not improving, with much refreshing honesty in their words. They actually together do grand disservice to the housing market by providing new supply in an already overwhelmed inventory situation. The Beazer Home news of losses and corruption sounds dire, with an Securities & Exchange Commission investigation. They might compete with Hovnanian in the race among the builders to be the first to go bankrupt.

MORTGAGE FINANCE CRATERS

This young stock index has already broken down, not even two years old. The mortgage finance defaults will persist for another couple years, resets forcing more delinquencies and defaults. Foreclosures cost lenders an average of $80k per property. The surprise to mortgage finance is the contagion (once denied) to the prime mortgage and junk bond and corporate bond markets. The common them is lax lending and the common route is the Collateralized Debt Obligation package. The hedge fund failures have extended beyond subprime debt.

THE WASTEBASKET J.P.MORGAN CHASE

Some astute observers like Rob Kirby have argued that the credit derivative garbage can, wastebasket, cesspool, has been JPMorgan. It might be permitted to fail, as it serves as the location for hidden monetization of troubled credit default swaps and other credit derivatives.

THE MUSSOLINI EXECUTOR GOLDMAN SUCHS

By that is meant the agent in charge of orchestrated maneuvers for stock, bond, and currency support, together with credit derivative balance of the upside-down pyramid. The merger of state with corporations requires an agent. This compromised agent is in pain. Their asset-backed bonds have suffered the most debt downgrades of all. They can urge a bailout for themselves, with heavy pressure all within the governing bodies in control.

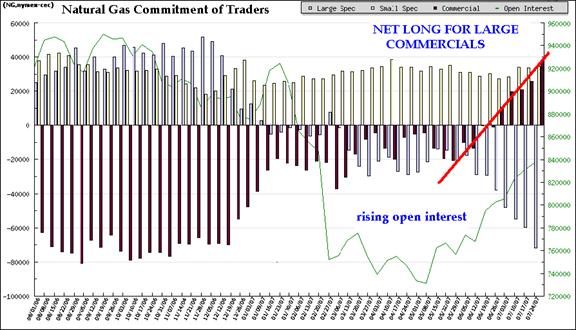

MYSTERIOUS SIGNAL WITH NATURAL GAS

A comment is warranted on how the gold and silver prices have dropped, largely as a result of the increased futures contract pressure. The big players are going farther out on a limb with larger paper short positions in open interest. They will surely never be required by compromised regulators to unwind them. What is surprising is the switch in large commercials in the NATURAL GAS market. Since June, the large comms have turned net bullish. They must know something we don't. It sometimes is not necessary to know the details behind the story. Some traders don't care why. They just want to be in the winning camp. We will hear why the natgas price heads higher at a later date. One could guess about depletion, uncertain supply, or hurricanes. Future supply might be uncertain. Whatever, this is BULLISH.

EQUITIES (STOCKS) VERSUS METAL (BULLION)

The positive promising development that favored equity shares in mining companies over the precious metal bullion price has quickly vanished in the midst of the brutal selloff. During a market heavy distress period, all assets fall in price. A reversal seems to be in progress. Watch for the 20-week moving average, to see if it rises above the slower 50-week moving average, which would be an important positive signal. A titanic battle might soon ensue, between leveraged stocks of mining companies, versus the physical metal. Poor liquidity harms stocks more than metals. Rising metal prices can lead to zooming stock prices.

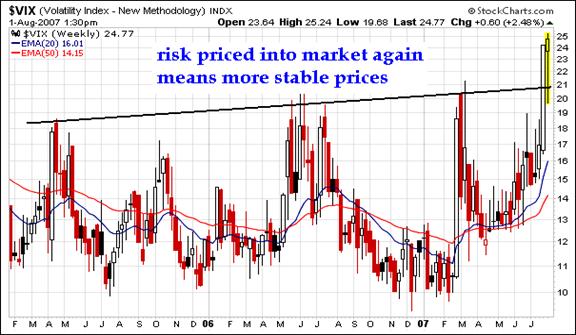

RISK PREMIUM RESTORED

As long as risk is improperly priced in the stock market, shock waves are likely to occur, as we have recently seen. With risk more properly perceived, shock waves are less likely. However, a long slide in mainstream (not commodity) stock prices is possible from gradual revelation of detrimental economic effects. The energy sector had been a prime powerhouse for the S&P500 stock index, and still is. Market rebounds are more likely with higher VIX readings, like now. The VIX is set from option premiums integrated within S&P index options.

BIG CAP SELF-DEALING

The stock market has been fueled by a number of factors. Talk is incessant about private equity buyouts, their leverage, their heavy debt. They should be regarded as aristocratic grabs laced with self-payment largesse, balance sheet destruction, favorable tax pursuits, and regulatory avoidance. The other more important factor behind the 14,000 Dow high for stocks and the accompanying S&P movement is the stock repurchase by major corporations. Some abuse their debt situation in order to enrich themselves indirectly through executive stock options, funded by corporate debt issuance. They are generally spending more on stock buybacks than on capital expenditures. This is natural in a finance driven US Economy, with the tail wagging the dog. A few such companies have suffered immediate debt downgrades, since the ratings agencies respond quickly.

THE HAT TRICK LETTER PROFITS IN THE CURRENT CRISIS.

From subscribers and readers:

“My subscription is worth double what I pay. Once for the economic analysis, and once for the education in wordsmithing! I am coming to value the second one the most, as your alliteration and parable-esque style keeps me smiling even as you write about the walls crashing down!” (MichaelH in Georgia )

“I want to congratulate you and thank you for your quick and frankly stated revision on bonds [the 4.0% forecast]. That was my thinking all along, but I must say that your writing was and continues to be a most valuable input to my thinking in the first place. That type of integrity makes me value your opinion all the more and is likely to keep me as a loyal subscriber for years to come.” (ScottD in Pennsylvania )

“I am staggered by the depth and breadth of the information I now have access to in your newsletter. Just one problem, I cannot put my computer down. Reading your current reports and catching up on earlier editions you make available in your ‘library' is dominating my mornings, afternoons and evenings!” (DavidR in England )

“I believe your wit and disgust at the state of affairs stand untouched.” - (Charlie P in Virginia )

“I am currently subscribed to over 60 paid newsletters. Your analysis is by far the most accurate every time. The most impressive characteristic of your thought processes is your ability to think in multi-factorial terms. You are one of the few remaining intellectuals with such capacity intact.” -(Gabriel R in Mexico )

By Jim Willie CB

Editor of the “HAT TRICK LETTER”

www.GoldenJackass.com

www.GoldenJackass.com/subscribe.html

Use the above link to subscribe to the paid research reports, which include coverage of several smallcap companies positioned to rise like a cantilever during the ongoing panicky attempt to sustain an unsustainable system burdened by numerous imbalances aggravated by global village forces. An historically unprecedented mess has been created by heretical central bankers and charlatan economic advisors, whose interference has irreversibly altered and damaged the world financial system. Analysis features Gold, Crude Oil, USDollar, Treasury bonds, and inter-market dynamics with the US Economy and US Federal Reserve monetary policy. A tad of relevant geopolitics is covered as well. Articles in this series are promotional, an unabashed gesture to induce readers to subscribe.

Jim Willie CB is a statistical analyst in marketing research and retail forecasting. He holds a PhD in Statistics. His career has stretched over 24 years. He aspires to thrive in the financial editor world, unencumbered by the limitations of economic credentials. Visit his free website to find articles from topflight authors at www.GoldenJackass.com . For personal questions about subscriptions, contact him at JimWillieCB@aol.com

Jim Willie CB Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.