Stocks Rally on E.U. Olive Branch For Greece

Stock-Markets / Financial Markets 2010 Feb 10, 2010 - 10:01 AM GMTBy: PaddyPowerTrader

US stocks rallied Tuesday, sending the Dow Jones back above 10,000, as prospects for a bailout of Greece eased concern that deteriorating government finances will derail the global economic recovery. Coca-Cola (+3.6%) reported 4th quarter profit that met expectations. China and India saw better than expected volume growth. Caterpillar (+6.0%) and Monsanto (+3.0%) on broker upgrades. NYSE Euronext (+5.4%) after posting better 4th quarter results due to derivative trading lifting revenues and cutting costs. MetLife (+4.2%) may use more stock to fund more than half of the planned $15bn of an AIG life insurance unit. Airlines advanced after Continental Airlines (+8.6%) and Southwest Airlines (3.9%) led the six biggest US carriers to their first collective increase in monthly traffic since May 2008.

US stocks rallied Tuesday, sending the Dow Jones back above 10,000, as prospects for a bailout of Greece eased concern that deteriorating government finances will derail the global economic recovery. Coca-Cola (+3.6%) reported 4th quarter profit that met expectations. China and India saw better than expected volume growth. Caterpillar (+6.0%) and Monsanto (+3.0%) on broker upgrades. NYSE Euronext (+5.4%) after posting better 4th quarter results due to derivative trading lifting revenues and cutting costs. MetLife (+4.2%) may use more stock to fund more than half of the planned $15bn of an AIG life insurance unit. Airlines advanced after Continental Airlines (+8.6%) and Southwest Airlines (3.9%) led the six biggest US carriers to their first collective increase in monthly traffic since May 2008.

Risk assets have waxed and waned overnight as markets have contemplated the likelihood that the EU will cobble together a support package to assist Greece. Much of the volatility surrounded contrasting reports of the position of Germany, with newswires variously reporting that talk of German support was either wrong or in fact likely (albeit tied to stringent conditions). Olli Rehn (the EU’s new economic affairs commissioner) suggested that “we are talking about support in the broad sense”. Incidentally, it is worth remembering that whilst the Lisbon Treaty was written to ensure that no member country could presume that support would be forthcoming in the event of fiscal troubles, there is nothing to prevent EU members (acting alone or in concert) providing support if that is deemed appropriate. Certainly any support given will be tied closely to Greece following through on its fiscal austerity program.

Today’s Market Moving Stories

- The Bank of Spain has told lenders to write down by 20% the value of their real estate assets this year. The assets consist mainly of apartments and land bought or foreclosed on.

- State-linked indebted conglomerate Dubai World intends to officially ask creditors for a standstill on $22 billion in debt this month, until it completes restructuring. Citing banking sources in creditor banks, UAE’s Al Ittihad said restructuring might require a period of six months. “This important step by Dubai World this month will represent the most significant transitional phase in the group’s negotiations with creditors.”

- Closer to home today we had the BoE Inflation Report and press conference. The report was far more dovish than expected, with CPI projected to be below 2% in 2 years time based on unchanged rates. Under the assumption of market rates inflation is seen at just 1.2% at the end of the forecast horizon. This was a significant undershoot relative to expectations. The primary reason for the dovish outlook is said to be a weaker GDP outlook and “significant slack” in the economy. Such a profile has in the past prompted a QE extension. On this, Governor King said it was ‘far too soon to conclude’ that asset purchases are finished.

- UK industrial production up 0.5% MoM, much higher than the 0.2% expected. Implies a tenth upward revision to Q4 2009 GDP and puts the official series more in line with recent ‘better’ survey data.

- The UK’s Independent writes that new President of the European Council, Herman Van Rompuy, is “using the financial crisis sweeping the Euro-zone to launch an audacious grab for power over national budgets”. The paper cites a secret annexe from Van Rompuy to EU heads of government which states that “members of the European Council are responsible for the economic strategy in their government. They should do the same at EU level. Whether it is called co-ordination of policies or economic government, only the European Council is capable of delivering and sustaining a common European strategy for more growth and more jobs.”

- IMG newswires report that senior Chinese military officials have urged the government to sell US Treasuries to “punish the US for its latest round of arms sales to Taiwan”.

- Data overnight showed that Chinese exports rose 21% YoY in January but fell 16.3% MoM. Imports rose 85.5% YoY but also fell 15.1% MoM. A low base of comparison in January 2009 have made the data difficult to interpret and with the Lunar holiday falling in February this year, China effectively worked one extra week this January than in 2009.

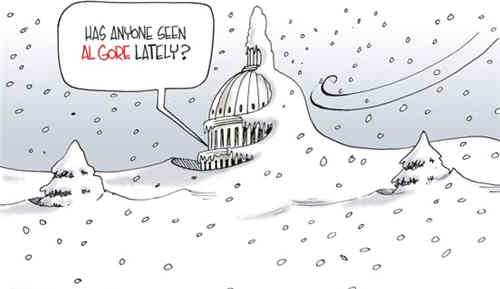

- For once Fed Chairman Ben Bernanke is likely to be overshadowed, not only by the snow which will prevent him from testifying in person to the House Services Committee in Washington but also by the end-game to the Greek crisis. Still, written testimony on the Fed’s exit strategy will be published at 16.00.

- Note to all that the weather has played a bit of havoc on the schedule of data and appearances. Bernanke speech will come out at 16.00 but no Q&A. Geithner has been cancelled, and tentatively retail sales for tomorrow has been pushed to Friday. Crude inventories and Nat Gas also moved to Friday. No change in the bond auctions.

Beware Of Germans Bearing Gifts

As the Greek situation remains in the centre stage of the market, any relevant headlines and its impact on risk markets would continue to drive general FX trends. Today, Greek public sector workers will strike. It may be seen as a first major test of the government’s commitment to push through fiscal austerity and tackle a debt crisis which has shaken the euro zone. Also, Greek PM Papandreou will meet French president Sarkozy and PM Fillion today. However, a more important event for Greece may be the EU leaders’ meeting on Thursday (press conference is expected to be held at 15:45), where I would expect details on their decision. An EU official has said that despite the agenda being about Haiti and climate change if there was also a statement on Greece.

If European governments deliver bilateral assistance to Greece, and if Europe imposes conditionality akin to an IMF program (targets/timetable for the primary deficit), then EUR/USD will have seen a near-term bottom. I have argued recently that Europe would require a couple of months to agree on assistance for Greece since officials would first want to see implementation of fiscal tightening and evidence that Greece could not finance itself through public bond markets. But a series of headlines since yesterday suggest that Europe may act much more pre-emptively, probably fearing widespread contagion.

If European governments deliver bilateral assistance to Greece, and if Europe imposes conditionality akin to an IMF program (targets/timetable for the primary deficit), then EUR/USD will have seen a near-term bottom. I have argued recently that Europe would require a couple of months to agree on assistance for Greece since officials would first want to see implementation of fiscal tightening and evidence that Greece could not finance itself through public bond markets. But a series of headlines since yesterday suggest that Europe may act much more pre-emptively, probably fearing widespread contagion.

German finance minister Schaeuble briefed lawmakers on the situation today saying that he was considering aid beyond loan guarantees. That said a German finance official has just said that there is “no decision” on Greece. So a lot of arm twisting beckons to sort out these thorny Hellenc-ish issues.

More newswire headlines… now even I’m confused:

- GERMAN GOVT OFFICIAL SAYS BILATERAL AID FOR GREECE IS NOT PLANNED TO OUR KNOWLEDGE

- GERMAN GOVT OFFICIAL SAYS BAIL-OUT BAN APPLIES TO BOTH JOINT AND BILATERAL AID

- GERMAN GOVT OFFICIAL SAYS GREECE MUST PURSUE SUSTAINED PATH TO CONSOLIDATION

- GERMAN GOVT OFFICIAL SAYS THERE IS NO DECISION ON AID FOR GREECE, AND IT’S NOT PENDING EITHER

- GERMAN GOVT OFFICIAL SAYS IT’S NOT GERMANY’S JOB TO TELL GREECE WHAT IT NEEDS TO DO

- GREECE TO GIVE GERMANS PRIORITY SUNLOUNGERS IN ALL GREEK RESORTS

Back to square one? mmm… and just imagine if this has to go thru Bundesrat. There may be trouble ahead!

Company News

- Micron Technology agreed to buy flash-chip maker Numonyx Holdings for about $1.27 billion to help it compete better with Samsung. Micron will issue 140 million shares to Numonyx’s investors.

- Smurfit Kappa has reported strong Q4 results with EBITDA of €186m coming in 5.7% better than market expectations at €176m. The company reported a return to positive volume growth in the final two months of 2009 with management stating that this trend has continued into 2010. They commented that the market is supportive of the recent containerboard price increases which is translating into higher box prices.

- Élan today reported full year results for 2009 which “met or exceeded all of its financial guidance for 2009” according to the company. Revenues for the full year grew by 11% to $1.1bn, largely due to a 30% increase in Tysabri sales to $724.3 million. The increase along with a 9% fall in operating expenses saw EBITDA of $96.3m well ahead of previous guidance of $75m. For 2010 revenues are forecast to continue to grow, driven by Tysabri and the launch of products in EDT’s portfolio.

- Honda will recall 437,763 vehicles globally to repair air bags that can deploy with too much pressure, adding to previous US recalls for the same defect. The expansion covers 378,758 vehicles in the US. Honda’s biggest competitor, Toyota, is working to reassure customers after recalling more than 8 million vehicles worldwide to fix problems linked to unintended acceleration and brake failures.

- HeidelbergCement was the first of the European building materials sector to provide colour on 2009 performance when it released headline numbers this morning that came in light of expectations, albeit with management claiming that bad weather and adverse currency movements hampered performance in 2009 Q4. Full year sales declined by 19.4%. The Group also indicated that it expects to record a €404m goodwill writedown in relation to its US and Spanish operations which have been particularly hard hit by the downturn in residential construction.

- ArcelorMittal has reported Q4 EBITDA of $2.13bn, at the lower end of its $2-2.4bn guidance range and a touch below consensus of $2.16bn. These results and the restrained outlook may disappoint the equity markets.

- What’s not to love about the world’s most diversified miner, BHP Billiton, which continues to beat consensus estimates by 10%? Despite sales revenue falling 18% to $24.6bn (largely commodity price volatility), BHP Billiton has recorded a half year NPAT of $6.1bn (consensus estimates $5.5bn). Sales into China represented 25% of group revenue.

- Walt Disney, the world’s biggest media company, reported fiscal first quarter profit that beat analysts’ estimates as TV revenue rose and theme-park results stabilised. Net income totalled $844 million, compared with $845 million a year earlier, when a gain on the sale of TV stations boosted results.

And Finally… Recession Song

Disclosures = None

By The Mole

PaddyPowerTrader.com

The Mole is a man in the know. I don’t trade for a living, but instead work for a well-known Irish institution, heading a desk that regularly trades over €100 million a day. I aim to provide top quality, up-to-date and relevant market news and data, so that traders can make more informed decisions”.© 2010 Copyright PaddyPowerTrader - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

PaddyPowerTrader Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.