Corporate Bond Yields Offer Hint Stock Market Party Is Over

Stock-Markets / Stock Markets 2010 Feb 11, 2010 - 02:40 PM GMTBy: Mike_Shedlock

For months I have been suggesting that as long as bids for corporate bonds remain firm the stock market will not collapse. (Note that "not collapse" is not the same as continue to rise.)

For months I have been suggesting that as long as bids for corporate bonds remain firm the stock market will not collapse. (Note that "not collapse" is not the same as continue to rise.)

We are now starting to see cracks in the corporate bond market. Please consider Bond Sales Tumble 90%, Junk Returns Go Negative: Credit Markets.

Investment-grade debt sales are drying up and returns on high-yield bonds have turned negative for the year as investors wait to see whether European leaders can contain Greece’s budget crisis.

Borrowers in the U.S. and Europe sold $4.71 billion of high-grade securities this week, the least this year and about 90 percent less than the average $52.9 billion, according to data compiled by Bloomberg. Speculative-grade, or junk, bonds in the U.S. have lost 0.09 percent in 2010 after gaining 1.52 percent in January, Bank of America Merrill Lynch index data show.

“Sentiment has turned significantly amid concerns about sovereign deficits and problems surrounding Greece and other peripheral euro-zone economies,” Simon Ballard, a senior credit strategist at RBC Capital Markets in London said yesterday. “For the moment, we’re unlikely to see much in the way of primary market activity as investor sentiment remains fragile and the broad market feeling is one of nervousness.”

Corporate bonds have returned 1.39 percent this year, according to the Merrill index. Junk bonds lost 1.58 percent so far this month, the most in a year, the bank’s U.S. High Yield Master II Index shows.

Prices of high-yield loans fell for the fifth straight day. The S&P/LSTA U.S. Leveraged Loan 100 Index declined to 88.93, the lowest since Jan. 8 and down from 89.07 the day before. Leveraged loans and junk bonds are rated below Baa3 by Moody’s Investors Service and below BBB- by Standard & Poor’s.

ITC Deltacom was the fourth high-yield borrower in almost four weeks to cancel a sale. New World Resources NV, a Czech- owned coal company, called off its 700 million euro ($964 million) bond offering, citing “negative market volatility,” in a statement distributed yesterday.Rot Starts In Subprime

Rot of rising yields is starting to eat away at junk. Canceled sales are another indication of changes in investor sentiment. High grade corporates are still holding up, but for how long?

Corporate bonds are more than fully priced and if they crack, the equity party is over.

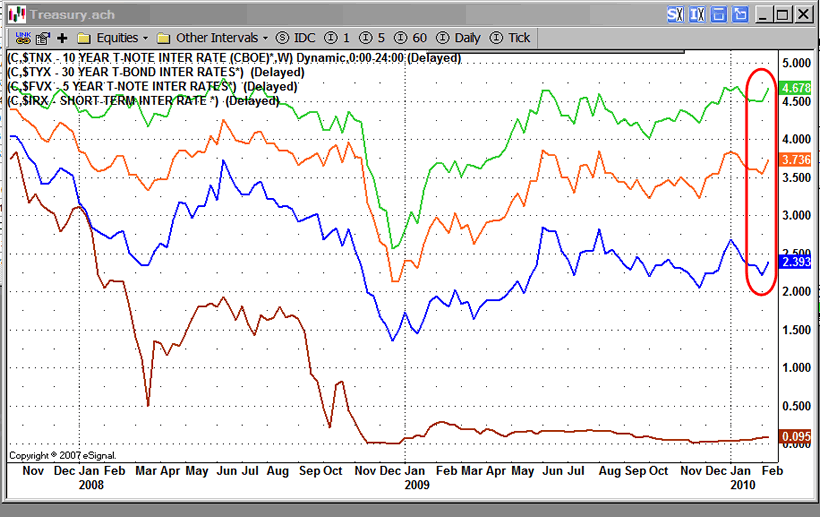

Treasury Yield Curve

In the above chart ...

- $TYX = 30 Yr Yield

- $TNX = 10 Yr Yield

- $FVX = 05 Yr Yield

- $IRX = 03 Mo Yield

I do not think that treasury yields break to the upside. However, they could. And if they do alongside corporate bond yields, there is a distinct possibility, and one that I have pointed out before, that there may be no places to hide in 2010 other than perhaps the much despised US dollar.

Risk is very high, and rising.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.comClick Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2010 Mike Shedlock, All Rights Reserved.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.