Gold Price About to Go Parabolic in Euros

Commodities / Gold and Silver 2010 Feb 16, 2010 - 10:17 AM GMTBy: Jordan_Roy_Byrne

How can we tell if a market is about to go parabolic? Trendlines are one way. Another way is to look at the length of corrections. How long is it taking the market to correct? Are the corrections becoming shorter and shorter?

How can we tell if a market is about to go parabolic? Trendlines are one way. Another way is to look at the length of corrections. How long is it taking the market to correct? Are the corrections becoming shorter and shorter?

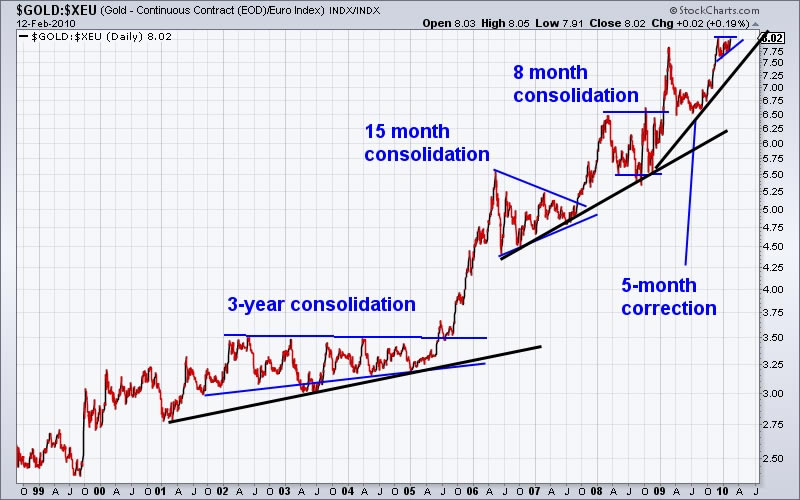

In the case of Gold/Euro, we see a market that is ready to go parabolic. The market has had four major corrections and each one has been shorter then the last. See the chart below.

Gold/Euro went from having a 15-month consolidation to an eight-month consolidation to a recent five-month correction. After emerging from that correction, the market gained 27% in two months. Notice that the market has formed a very bullish flag or pennant, which implies that we’ll see a similar move after breakout. Furthermore, the black trendlines confirm that the trend is set to accelerate even more.

I should mention that I am looking for a bounce in the Euro and some US$ weakness. While we should get a decent rally in the Euro, I doubt it affects the prognosis for Euro/Gold.

Gold/Foreign Currencies compared to Gold in US$

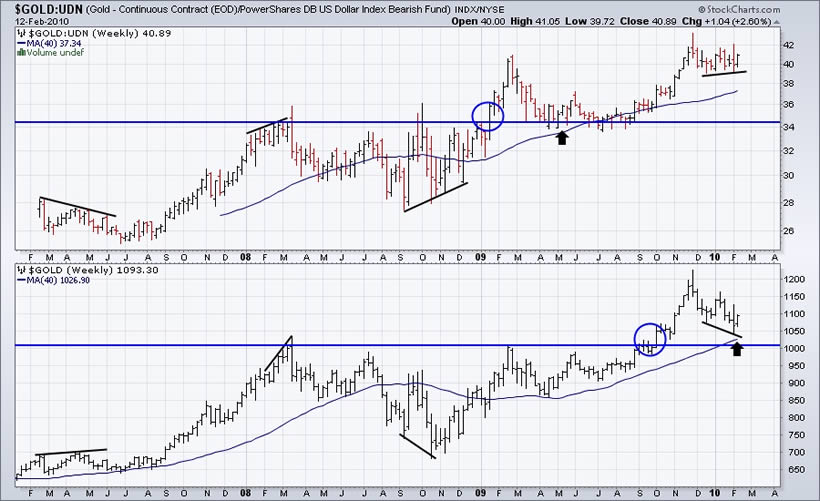

Here we show Gold/UDN on top of Gold. Gold/UDN is Gold against the currencies in the US$ index. As we’ve noted before, at key points in this bull market Gold/foreign currencies has been leading Gold. Here we are just showing the last few years.

Notice how Gold/UDN made its major breakout in January while Gold achieved its breakout in September. If the relationship continues then we’d expect Gold to trade in a tight range for about four months and then begin a new advance to new highs.

Conclusion

The strongest moves in Gold occur when the market is rising against all currencies. While this is a “duh” statement, I bet most analysts neglect to track how Gold is performing against the major currencies. We are tracking it and you can see how bullish Gold/Euro looks and how Gold/UDN is showing a positive divergence compared to Gold in US$. With Gold so strong against all currencies, it will not fall to $950-$1000. In periods of US$ strength, Gold is holding up better and better as its gaining significant strength against the Euro and the other currencies.

Good luck and good investing in 2010!

Jordan Roy-Byrne, CMT

http://www.trendsman.com

http://www.thedailygold.com

trendsmanresearch@gmail.com

Trendsman” is an affiliate member of the Market Technicians Association (MTA) and is enrolled in their CMT Program, which certifies professionals in the field of technical analysis. He will be taking the final exam in Spring 07. Trendsman focuses on technical analysis but analyzes fundamentals and investor psychology in tandem with the charts. He credits his success to an immense love of the markets and an insatiable thirst for knowledge and profits.

Jordan Roy-Byrne Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.