Global Financial Dominance and Control, All Roads Lead to Goldman Sachs

Politics / Market Manipulation Feb 16, 2010 - 12:10 PM GMTBy: Rob_Kirby

Once upon a time, Goldman Sachs shunned publicity. During the period from 1930 to 1969, Sydney Weinberg ran Goldman Sachs where he developed a staunch corporate cultural aversion to publicity. During the 1970s, a tandem of John Weinberg and John Whitehead assumed the reigns of leadership at Goldman Sachs. Whitehead left the company in 1984 to enter public life. John Weinberg carried on in the same vein as his father Sydney – shunning publicity – to the point where he hired a man to keep his name and his firm's out of the press.

Once upon a time, Goldman Sachs shunned publicity. During the period from 1930 to 1969, Sydney Weinberg ran Goldman Sachs where he developed a staunch corporate cultural aversion to publicity. During the 1970s, a tandem of John Weinberg and John Whitehead assumed the reigns of leadership at Goldman Sachs. Whitehead left the company in 1984 to enter public life. John Weinberg carried on in the same vein as his father Sydney – shunning publicity – to the point where he hired a man to keep his name and his firm's out of the press.

He kept him off the full-time payroll (though he sat full-time at a desk in head office) so that if, improbably, a comment did slip out, it could be honestly dismissed as not coming from a Goldman Sachs employee. John Weinberg served as sole senior partner and chairman until 1990. His mantra was to put the client’s interests first and he wouldn’t allow Goldman to be involved hostile takeovers.

He kept him off the full-time payroll (though he sat full-time at a desk in head office) so that if, improbably, a comment did slip out, it could be honestly dismissed as not coming from a Goldman Sachs employee. John Weinberg served as sole senior partner and chairman until 1990. His mantra was to put the client’s interests first and he wouldn’t allow Goldman to be involved hostile takeovers.

The culture at Goldman Sachs dramatically changed in 1990 when operational control of the firm was ceded to Robert Rubin and Stephen Friedman. This tandem became the Co-Senior Partners in 1990 and re focused the firm on globalization and strengthening the Merger & Acquisition and Trading business lines.

Since this cultural shift in 1990, Goldman, its employees and alumni have been attracting HEAPS of public attention – much of it unflattering – owing to allegations and / or public perceptions of frontrunning, government patronage / favoritism and conflict of interests with clients. As the following biographical sketches attest – Goldman Sachs has become not only a world renowned financial juggernaught but also highly influential in areas that transcend finance.

High Profile Goldman Associates – Notable or Notorious?

John Whitehead – Had a 38 year career at Goldman Sachs - he retired in 1984 as Co-Chairman and Co-Senior Partner. He served as United States Deputy Secretary of State in Ronald Reagan's administration from 1985 to 1989 under George Shultz, and was awarded the Presidential Citizens Medal by President Reagan. In 1996, he was the campaign chairman for Michael Benjamin who ran for a seat in New York's 8th congressional district. He is former Chairman of the Board of the Federal Reserve Bank of New York, the United Nations Association, and a former Chairman of The Andrew W. Mellon Foundation and the Harvard Board of Overseers. He is a former director of the New York Stock Exchange and Chairman Emeritus of The Brookings Institution.

Robert Rubin - served as the 70th United States Secretary of the Treasury during both the first and second Clinton administrations. Before his government service, he spent 26 years at Goldman Sachs serving as a member of the Board, and Co-Chairman from 1990-1992.

Henry Paulson - as the 74th United States Treasury Secretary. He previously served as the Chairman and Chief Executive Officer of Goldman Sachs.

John Thain - The last chairman and chief executive officer of Merrill Lynch before its merger with Bank of America. Before he came to Merrill, Thain was the CEO of the New York Stock Exchange from January 2004 to December 2007. He also worked at Goldman Sachs, as head of the mortgage desk from 1985 to 1990, and president and co-chief operating officer from 1999 to 2004.

Robert Steel - Served as Under Secretary for Domestic Finance of the United States Treasury from 2006-08. He has also served as president and CEO of Wachovia Corporation and as vice chair of Goldman Sachs.

Edward Liddy - Was on the board of Goldman Sachs from 2003 to 2008, when he resigned to become CEO of AIG. He was selected by Henry Paulson for both roles.

Stephen Friedman – Former Chairman of the Federal Reserve Bank of New York, resigned on May 7, 2009. Worked for much of his career with investment bank Goldman Sachs, holding numerous executive roles. He served as the company's co-chief operating officer from 1987 to 1990, was the company's co-chairman from 1990 to 1992, and the sole chairman from 1992 to 1994; he still serves on the company board.

William Dudley – Worked 21 years at Goldman Sachs, succeeded Tim Geithner as President of the New York Federal Reserve in 2009.

Josh Bolten – Worked 5 years at Goldman Sachs, became White House Chief of Staff for George W. Bush.

Reuben Jeffrey – Had an 18 year career at Goldman, left in 2001 when President Bush appointed him as his Special Advisor on Lower Manhattan Development, and in 2002, Jeffery left Goldman Sachs to take on this responsibility. In 2003, Jeffery became a Special Advisor to L. Paul Bremer, head of the Coalition Provisional Authority in Iraq and then became the Representative and Executive Director of the Coalition Provisional Authority Office in The Pentagon. He served as a member of the United States National Security Council until 2005, as a Senior Director responsible for International Economic Affairs. Jeffery was named the chairman of the Commodity Futures Trading Commission. On April 16, 2007 President Bush nominated Jeffery as Under Secretary of State for Economic, Business, and Agricultural Affairs.

Arthur Levitt Jr. – Former Securities and Exchange Commission [S.E.C.] Chairman and senior advisor to the Carlyle Group began advisory role with Goldman Sachs in June 2009.

Rahm Emanuel – Current White House Chief of Staff [Obama], was originally hired by Bill Clinton as his chief fundraiser. At that time [1992] Emanuel was on the payroll of Goldman Sachs, receiving $3,000 per month from the firm to ‘”ntroduce us to people” according to a Goldman partner.

Gavyn Davies – Former Chief Economist at Goldman Sachs and current President of the British Boadcasting Corp. [BBC] is married to British Prime Minister Gordon Brown's special adviser Sue Nye.

Gerald Corrigan - Was a special Assistant to Federal Reserve Board Chairman, Paul Volcker in Washington, D.C. He went on to serve as president of the Federal Reserve Bank of Minneapolis from 1980 to 1984 and President of the Federal Reserve Bank of New York from 1985 until 1993. From 1991 to 1993 he was Chairman of the Basel Committee on Banking Supervision. From 1993 to 1995 he was director of the Council on Foreign Relations. Dr. Corrigan is currently a partner and managing director in the Office of the Chairman at Goldman Sachs and was appointed chairman of GS Bank USA, the bank holding company of Goldman Sachs, in September 2008. He is also a member of the Group of Thirty, an influential international body of leading financiers and academics.

Duncan Niederauer - Was appointed chief executive officer and director of NYSE Euronext, effective December 1, 2007, after joining NYSE Euronext in April 2007 as a member of the Management Committee. Mr. Niederauer also serves on the boards of NYSE Group and Euronext N.V. Mr. Niederauer was previously a partner at The Goldman Sachs Group, Inc. (United States) (GS) where he held many positions, among them, co-head of the Equities Division execution services franchise and the managing director responsible for Goldman Sachs Execution & Clearing, L.P. (formerly known as Spear, Leeds & Kellogg L.P.). Mr. Niederauer joined GS in 1985. From March 2002 until his resignation in February 2004, Mr. Niederauer also served on the board of managers of Archipelago Holdings, LLC (United States).

Lawrence Summers - Director of the White House's National Economic Council for President Barack Obama and former Secretary of the U.S. Treasury [Clinton].. In 2008, Summers was paid 135,000 for giving a speech to Goldman executives.

Jon Corzine - Served five years of a six-year Senate term before being elected Governor in 2005. He was defeated for re-election in 2009 by Republican Chris Christie. Former Chairman and co-CEO of Goldman Sachs. Left firm in 1998 and entered politics.

Gary Gensler - Chairman of the U.S. Commodity Futures Trading Commission [CFTC] under President Barack Obama. Gary Gensler spent 18 years at Goldman Sachs, making partner when he was 30, becoming head of the company’s fixed income and currency trading operations in Tokyo by the mid-’90s.

Robert Zoellick - Is the eleventh president of the World Bank, a position he has held since July 1, 2007. He was previously a managing director of Goldman Sachs, United States Deputy Secretary of State (resigning on July 7, 2006) and U.S. Trade Representative, from February 7, 2001 until February 22, 2005.

Neel Kashkari - In July 2006, Kashkari was appointed as a special assistant to Treasury Secretary Henry Paulson. In the summer of 2008, he was appointed assistant secretary for international economics and was confirmed in that post by the U.S. Senate. On October 6, 2008, Paulson named Kashkari interim head of the new Office of Financial Stability. Overseen by the treasury secretary, he is in charge of creating and implementing the United States government's $700 billion financial stabilization program. Prior to joining the Treasury Department, Kashkari was a Vice President at Goldman, Sachs & Co. in San Francisco.

Mario Draghi – Head of the Bank of Italy and former mentor to current U.S. Treasury Secretary, Tim Geithner. Draghi was vice chairman and managing director of Goldman Sachs International and a member of the firm-wide management committee (2002-2005).

Mark Carney – Governor of the Bank of Canada. Before joining the public service, Carney had a thirteen-year career with Goldman Sachs in its London, Tokyo, New York and Toronto offices.

Grecian Formula – Gray Area Operations

This past weekend revelations surfaced in New York Times reporting that Goldman Sachs has been involved in “masking” the true state of Greece’s sovereign financial situation for close to a decade.

Wall St. Helped to Mask Debt Fueling Europe’s Crisis

Wall Street tactics akin to the ones that fostered sub-prime mortgages in America have worsened the financial crisis shaking Greece and undermining the euro by enabling European governments to hide their mounting debts.

As worries over Greece rattle world markets, records and interviews show that with Wall Street’s help, the nation engaged in a decade-long effort to skirt European debt limits. One deal created by Goldman Sachs helped obscure billions in debt from the budget overseers in Brussels…….

According the New York Times report, even as Greece’s sovereign finances were approaching a “flashpoint” last fall, Goldman dispatched a team of high level operatives to Greece in an attempt to forestall their financial day of reckoning;

Even as the crisis was nearing the flashpoint, banks were searching for ways to help Greece forestall the day of reckoning. In early November — three months before Athens became the epicenter of global financial anxiety — a team from Goldman Sachs arrived in the ancient city with a very modern proposition for a government struggling to pay its bills, according to two people who were briefed on the meeting.

The bankers, led by Goldman’s president, Gary D. Cohn, held out a financing instrument that would have pushed debt from Greece’s health care system far into the future, much as when strapped homeowners take out second mortgages to pay off their credit cards…

The rationale for such actions – as put forward by the New York Times columnist – is that this “financial delaying tactic” had worked before;

“It had worked before. In 2001, just after Greece was admitted to Europe’s monetary union, Goldman helped the government quietly borrow billions, people familiar with the transaction said. That deal, hidden from public view because it was treated as a currency trade rather than a loan, helped Athens to meet Europe’s deficit rules while continuing to spend beyond its means.”

The Times article goes on to point out that,

Athens did not pursue the latest Goldman proposal, but with Greece groaning under the weight of its debts and with its richer neighbors vowing to come to its aid, the deals over the last decade are raising questions about Wall Street’s role in the world’s latest financial drama.

While Goldman did not create Greece’s debt problem – it did allow them to borrow beyond their means – and as the Times pointed out, it was all perfectly legal.

While not debating the legality of such activity on the part of Goldman – one might question the appropriateness of attaching superlatives like “perfect” to such activity owing to the eerie similarity it exhibits to the enabling of highly questionable [but legal?] over-leveraging of U.S. homeowners in the mortgage market.

It is one thing to seduce consumers with the elixir of historic low [arbitrarily rigged, perhaps?] interest rates but quite another to do the same while systematically, simultaneously outsourcing their jobs or their ability to service that same debt.

Benchmark interest rates like the risk-free 10 year bond rate are historically set at the REAL INTEREST RATE [nominal rate minus inflation] plus 200 – 250 basis points. If you believe the much followed work of Shadow Stats’ John Williams – you already know that the official inflation data reports are falsified – and that real inflation is running in the 6 % neighborhood:

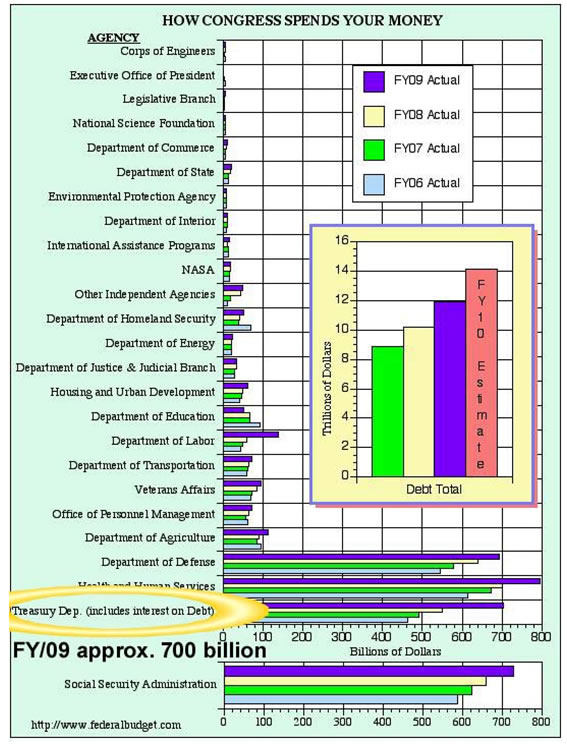

Acknowledgement of such real inflation would dramatically “boost” the cost [more than doubling it] of the U.S. Government to service its debt – a cost which stood at 700 billion dollars in fiscal year 2009:

Put simply, the U.S. Government CAN NO LONGER AFFORD to pay market rates of interest. This is why interest rates HAD TO BE ARBITRARILY RIGGED AT LOW RATES.

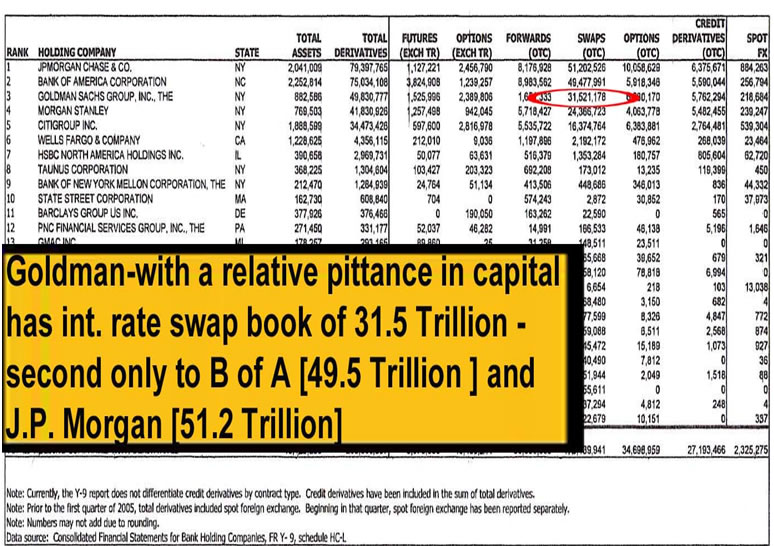

Obscene amounts of interest rate swaps with embedded bond trades have been utilized by the likes of Goldman Sachs and other Fed / U.S. Treasury proxy institutions to give U.S. monetary elites complete mastery over the entire interest rate curve. Goldman Sachs has had a huge hand in this:

The unsavory exploits of Goldman Sachs [and J.P. Morgan-Chase] have been a recurring topic in this space for a number of years now. Goldman’s high-jinx [or plunder, perhaps?] in our global capital markets has been well documented over the years,

In more recent times, the altering of component weightings in benchmarks like the Goldman Sachs Commodities Index [GSCI] have led to massive liquidations and subsequent [temporary] price collapses of leveraged commodities positions held by pension and hedge funds. Goldman Sachs is an institution that has long been regarded as a proxy institution for the U.S. Treasury.

Dead-Ends, Calamari and Other Musings

Last week, additional revelations surfaced showing how Goldman had “pitched” State Governments on the privatization of infrastructure assets to raise ‘quick cash’;

Goldman Sachs Wants You to Pay-by-the-Mile to Drive on U.S. Roadways

On January 12, AFP interviewed Mike Robinson, the editor of the UK Column, a liberty-minded newspaper not unlike AMERICAN FREE PRESS.

“Road charging,” as it is called in England, is widespread, he told AFP, as fiber optic cable has been laid along most English roads to help track vehicle travel by the mile so drivers can be charged.

“It has been on the European Union agenda for quite a long time,” he added.

His comments came amid recent news of a radical plan to raise $200 billion by privatizing “the motorway network,” as Brits call it. The plan was presented to the three main political parties by NM Rothschild, the influential investment bank, British news sources say.

The Rothschild bank, called “an architect of several privatizations,” reportedly made its pitch in the weeks running up to the summer recess back on July 21, 2009. Bankers told leading politicians that the sale of the roads overseen by the [public] Highways Agency—all motorways and most “big trunk roads”—could help revive battered public finances. This is the same story Americans have been told…….

And how did U.S. politicians get the idea that privatizing roads was an acceptable future? Two words: Goldman Sachs, according to noted Texas columnist Ed Wallace.

“Yes, large Wall Street investment banks, led by Goldman, started advising states across the nation on how to raise fast money by diverting the most necessary publicly owned assets—roads—into private ownership,” wrote Wallace. “You have to admit, it’s brilliant, because it’s a forced and guaranteed market: Americans can’t get out of driving.”

And as Daniel Schulman and James Ridgeway wrote in a scathing article, “The Highwaymen,” in January 2007, “Many similar deals are now on the horizon, and MIG and Cintra are often part of them. So is Goldman Sachs, the huge Wall Street firm that has played a remarkable role advising states on how to structure privatization deals—even while positioning itself to invest in the toll road market.”

This quick cash will not and is not designed to solve States’ structural financial problems. It enriches Goldman Sachs while forestalling States’ financial day of reckoning.

So, what Goldman Sachs really brings to the table – as evidenced in the example above - is sophisticated financial products for HUGE fees or profits to Goldman Sachs, which cause their clients to undertake big financial risk which likely weaken [think tapeworm] their clients’ financial position over time.

This is a familiar modus operandi of established Wall Street investment banks – where Goldman sits at the head-of-the-class. They intertwine themselves with their clients’ [prey] activities through sophisticated toxic financial tentacles [sold as solutions] known as derivatives. Once the host is sufficiently weakened and “captive” – new solutions are then fashioned which offer little more than “false hope” to the host – while the parasitic investment bank harvests what’s left of value for pennies on the dollar.

Goldman Sachs is a ship that has lost its moral compass. This is why they have been dubbed, the Vampire Squid.

At this point, it seems like the world might be better off with LESS Wall Street and Goldman Sachs inspired and directed crisis management.

Subscribers to Kirbyanalytics.com are educating themselves; not only about the merits of ownership of gold and precious metals – but valuable macro-economic insight into today’s most vexing economic issues.

Subscribers to Kirbyanalytics.com are educating themselves; not only about the merits of ownership of gold and precious metals – but valuable macro-economic insight into today’s most vexing economic issues.

By Rob Kirby

http://www.kirbyanalytics.com/

Rob Kirby is proprietor of Kirbyanalytics.com and sales agent for Bullion Custodial Services. Subscribers to the Kirbyanalytics newsletter can look forward to a weekend publication analyzing many recent global geo-political events and more. Subscribe to Kirbyanalytics news letter here. Buy physical gold, silver or platinum bullion here.

Copyright © 2010 Rob Kirby - All rights reserved.

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Rob Kirby Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.