Gold Breaks Out in Europe, Complete Global Debt Crisis Coordination

Stock-Markets / Global Debt Crisis Feb 18, 2010 - 12:16 AM GMTBy: Jim_Willie_CB

The subprime debt issue of 2007 blossomed into a global credit crisis. Likewise, the Dubai sovereign debt issue will blossom into a global sovereign debt crisis in similar pathogenesis. The start and end points are located in the Untied States and Untied Kingdom. With the global climax come disruption, restructure, and chaos. The subprime mortgage problem was grossly under-estimated. The Hat Trick Letter called it the beginning of an absolute bond contagion, a global credit market collapse correctly forecasted. Central bankers, led by the clueless USFed Chairman Bernanke, minimized the degree and depth of the credit crisis, and made every conceivable wrong forecast. His reward was reappointment, since his service to the syndicate has been steadfast, loyal, and inventive. Every phase of global finance has entered a crisis mode, as the financial structures are coordinated, linked in complete fashion by the tightening noose using a US$ brand of rope.

The subprime debt issue of 2007 blossomed into a global credit crisis. Likewise, the Dubai sovereign debt issue will blossom into a global sovereign debt crisis in similar pathogenesis. The start and end points are located in the Untied States and Untied Kingdom. With the global climax come disruption, restructure, and chaos. The subprime mortgage problem was grossly under-estimated. The Hat Trick Letter called it the beginning of an absolute bond contagion, a global credit market collapse correctly forecasted. Central bankers, led by the clueless USFed Chairman Bernanke, minimized the degree and depth of the credit crisis, and made every conceivable wrong forecast. His reward was reappointment, since his service to the syndicate has been steadfast, loyal, and inventive. Every phase of global finance has entered a crisis mode, as the financial structures are coordinated, linked in complete fashion by the tightening noose using a US$ brand of rope.

The Dubai debt collapse represents the start of a global rotation of government debt collapse. Dubai has more than $385 billion in additional debt that has not been disclosed yet, so claims an informed source. Furthermore, Kuwait is among other Persian Gulf nations with major debt problems, soon to become clear in a liquidity crunch. The sovereign debt eruption in Greece will be followed by Italy, Spain, Portugal, and even France. The German wellspring will not rescue Greece, despite all spun political niceties. German leaders walk a delicate tightrope, one requiring that they say all the right things politically about support, but where they will at the eleventh hour not provide much debt provision. They must serve up demands that cannot be met, leaving Greece to default. In the process, a European Playbook will be written, a manual to be used immediately with the rest of the F-PIIGS nations.

One must include France in the Club Med losing beachfronts that must be carved off the European core. In the twelfth hour, Paris will be granted a reprieve, and permitted to serve as German squires. They do after all come to the table with a sizeable nuclear arsenal in pocket.

DOLLAR DEATH DANCE, PART II

Recall my great vicious circle of debt shown two months ago, whose crises begin in the US & UK. The debt ripples will end in the AngloSphere also, with a US$-centric global monetary crisis and their own sovereign debt defaults. Monetization of USGovt debt will soon be isolated, in full view, and serve as the focal point of perception in a global monetary crisis. The Direct Bids are already attracting too much attention to the Wall Street Paperhangers who highjacked the USDept Treasury. The Dollar Death Dance began in autumn 2008 with the US$ exchange rate rising. The US$ rallied because its foundation cracked, broke, and died. The liquidation of massive credit derivative contracts signaled the demise of the US domination, but in a queer manner, the settlement in such contracts primarily in US$ terms. So the global reserve currency rallied hard with vigor, Uncle Sam a dancing dead man. Thus the Dollar Death Dance. Fast forward a year and a half. The Greek debt problems sound like a gigantic echo from Dubai. At first, so-called financial experts dismissed the importance of the Dubai problem. They called it managed well. It has only started.

Next came the connection with the Greek debt problem. The link is a global intolerance for excessive debt that has no future prospect of eventual payment. Talk is steady of default for both UKGilt debt and USTreasury debt, denied vigorously, too vigorously. All of Europe will be reconstructed soon enough. After the Greek resolution occurs, Italy will next be expelled from the European Union. By resolution is meant expulsion, debt default, sale of discounted sovereign debt, return to former currency, rewritten commercial contracts, decisions for which banks to fail or preserve, and a massive devaluation of the reinstated currency. We are witnessing not just the consolidation of Europe, but the second phase of the Dollar Death Dance. Anyone who believes the USGovt finances are better than those of Greece, or Italy, or Spain, or Portugal is as bad a student of economics and finance as Benny Bernanke and Timmy Geithner. They remain in office only to serve the syndicate.

The Dollar Death Dance part II began in December 2009 with the loud Dubai gong. The US$ rallies again because fiat currencies are all dying. The Competing Currency War is brisk, more like a Reverse Beauty Pageant. As monetary crisis comes full circle, pushed by gargantuan government deficits on a global basis, the US$ will again resume its powerful decline. The Enronization of US financial structures is gradually being exposed, replete with false accounting, diverse hidden tentacles, and prolific slush funds. The credit climax will be a global shock wave, a grand restructure of financial structures, tremendous disorder & chaos, dislocations of important supply chains, and enormous challenge. Prepare! Gold, silver, and platinum will be survivors left standing!! They have been offered in recent weeks at heavy discount in U$ terms, but quite the opposite in Europe. Only the dimwits are discouraged by the phony posted paper gold & silver prices.

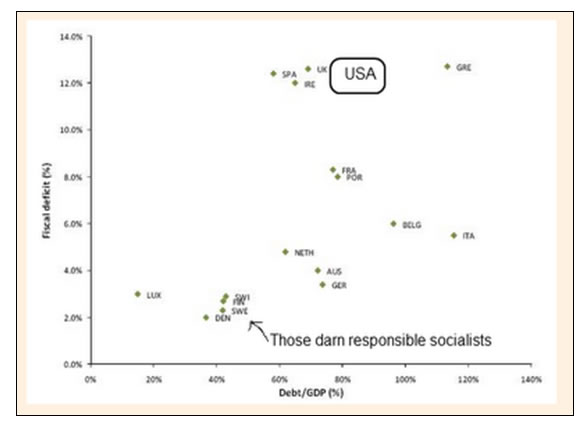

The US is an oversized Third World nation. It ranks poorly relative to other nations in its debt structure and exposure. The United States is in worse condition than almost all nations in the Western world, equally bad as those in Europe currently denigrated in crisis mode. Left to finance its own debt, the USGovt would suffer an immediate cave-in. It has the Printing Pre$$ at its disposal, and a USMilitary to expose to creditors, thus creating an unstable system. The US has an 80% debt/GDP ratio, easily to hit 100% next year. The US wanders and wallows with puffed chest of arrogance, yet besides Greece, the US is worse off than all the PIIGS nations criticized as basket cases so readily.

The PIIGS nations are Portugal, Ireland, Italy, Greece, and Spain. The chart shows the latest annual fiscal deficit as a percentage of GDP on the vertical scale, and the total debt as a percentage of GDP on the horizontal scale. The PIIGS nations are all in the risk-filled upper right quadrant. Notice the often criticized socialist nations of Scandinavia in the lower left strong quadrant, nowhere near as innovative as Wall Street and London. The healthiest nation on display is tiny Luxembourg, alone to the lower left. The United States is Greece, but with monuments of betrayed forefathers like Washington, Jefferson, Madison, Adams, and Lincoln, buttressed by vast money trees and shrill press trumpets.

CRISIS AS THE NEW NORM

What makes the current sovereign debt crisis more acute, and more a lock to come full circle across the globe and settle with an even grander shock to the Untied States is the collection of arenas in full crisis. In fact, one can safely claim that all financial arenas are in crisis, and therefore crisis is the new norm. The swine flu virus seems to have become an aborted mission, with current investigations of the World Heath Organization and national centers for disease control, after a massive profiteering by big pharmaceutical firms. The SWIFT bank has refused to cooperate with the US bankers on shared information, as the war on terror seems to be losing its flare based in creative writing. The Swiss banking system is in the midst of an unprecedented hemorrhage of funds, a shocking amount exiting each week. Goldman Sachs is on the hot seat not only for its AIG pressured fraudulent tactics, but now again for its concealed misrepresentation of European sovereign bonds. My sources tell me that Goldman Sachs has yet more even larger embarrassment lying ahead with criminal implications.

Central bankers have cajoled a mountain of funds from banks, called euphemistically excess reserves, when they are actually Loan Loss Reserves parked inside the USFed chambers. The big banks have almost zero reserves to handle their impaired loans and credit assets. So the USFed essentially covers up its own insolvency by attracting big bank reserves that will soon be urgently needed. The USFed is next considering a hike in such reserves, thus strangling the USEconomy further. The USFed data shows a Monetary Multiplier that fell to a record low of 0.809 in mid-December, a virtual collapse. The multiplier calculates the amount of money that an initial deposit can be expanded with a given reserve ratio, the multiple of held reserves disseminated as loans. Money is being tightly held, not even lent as fast as produced. Commercial paper has shrunk by $280 billion since October 2009. Bank credit has dropped from $10.844 trillion to $9.013 trillion since November 25th, a stunning 16.9% drop. It has been on a decline since June. The broad M3 money supply is contracting at over 5% pace.

The inflation adjusted annual M3 money supply rate of change signals a strong downturn in USEconomic activity. A double-dip recession would worsen the USGovt deficits, a concept not fathomable. The leading indicator is well established in modern economic history, and a reliable signal for a double-dip recession. The above graph of year-to-year change in real M3 versus annual change in payroll employment displays a forward shift in M3 by six months. Doing so highlights the embedded correlation between money supply contractions and delayed employment pullbacks. The January 2010 real M3 declined an estimated 5.2% versus January 2009, following an annual contraction of 3.3% in December 2009 and 0.3% in November. This is a harbinger for economic recovery? Hardly, except to those commited to propaganda artistry and federal funds diversion. Conclude that another recession lies ahead.

Freddie Mac will begin takeovers of a raft of delinquent mortgages. The move appears to be a follow-up to the Christmas decision to enable unlimited Fannie & Freddie credit lines. The USTreasury will be buying failed mortgages, after the USFed basically ruined its own balance sheet with toxic bonds. What has occurred over two decades is abuse of Fannie & Freddie as the central clearinghouse for numerous gargantuan federal fraud programs spanning three decades, valued in theft well over $3 trillion. The Powerz had to nationalize Fannie & Freddie. They are not just mortgage programs. Their supply cannot be shut off without disturbing the largest syndicate fraud channels in the history of mankind, well placed under USGovt finance operations, no exaggeration. Answering questions where the money went would bring about an extreme shift in US perceptions, probably full global recognition of the syndicates in charge, resulting in calls for a new system to administer to the US population.

The USEconomy slides further into a masked depression, still not recognized, as morale is on the decline. Moves toward cost savings and improved productivity are backfiring. Worker morale is a sneaky undermine to productivity. The January official Jobs Report hid some deep wounds. Meanwhile, home foreclosures and home loan delinquencies continue unabated with new records, and bank credit remains on a strong decline. No recovery in sight. The tragedy of home foreclosures continues unabated except by moratoriums imposed. The national tragedy continues. Federal home loan modification programs continue to be intentionally inadequate. The key is mortgage bond fraud coverup. Forecasts call for much worse foreclosures in the current 2010 year. David Rosenberg expects a further decline in home prices, and a second stage of economic recession. He forecasts 50% of US households will be insolvent on home loans by end 2011. Rosenberg is chief economist and strategist at Gluskin Sheff & Assoc in Toronto. He is one of my very few respected economists. Small businesses are not in recovery. They are cutting capital spending. National economic statistics do not capture small business activity properly. Their optimism is at the historical low of the past four recessions.

The fiscal and political plight of California worsens. Look for their state bond yields to reach at least 2009 high levels. USGovt assistance seems at best too little too late. The biggest state in the nation offers major clues to the plight of the states. The seven most crippled US states compare worse to some European nations, but with 35% of its national population involved. Given the PIIGS nations are small, the Untied States is hampered by a much larger looming state problem than what unfolds in Europe. The states in the crisis list are California, Florida, Illinois, Ohio, Michigan, North Carolina, and New Jersey. Each basket case state has a population above 8 million people. Each state has been forced to borrow more than $1 billion dollars, to pay for unemployment benefits. Each state currently registers broad unemployment over 15%. Each state is a large net importer of energy sources.

No Macro Economic Report is provided this month in the Hat Trick Letter for paid subscribers, since the entire global financial system is stuck in crisis mode. Details for the crisis situation can be found in the Crisis Coverage Report in the February Hat Trick Letter. The system is not so much hurtling over a cliff, like my previous metaphor of a locomotive train long past crossing the cliff's edge. The system is more like busy creating numerous huge airpockets of insolvency, so many that eventually the entire nation suffers an historically unprecedented descent into a MASSIVE SINKHOLE of its own making. It will then find itself squarely in the Third World. The main questions are A) whether the foreign creditors pull the rug out, or B) whether the US Supreme Court renders a great decision regarding requisite disclosure of the US Federal Reserve to unmask its corrupt core, or C) whether the deteriorated state indeed permits the descent into a sinkhole constructed by Economic Mother Nature.

NON-EXISTENT EXIT STRATEGY

Heat rises from the debate of a USFed Exit Strategy from 0% interest rates to mask a broken banking system, and from massive money growth to enable monetized ustreasury bond purchases. Once more is seen the return of the 'Second Half Myth' as talk has begun of the USFed hiking interest rates in the second half of 2010. Far enough away to forget, close enough to be imminent, always forgiven when wrong, with new wrong revisions given. Chairman Bernanke is stuck in a policy corner. He must be aware. There is a great difference between being a bad economist and a stupid humanoid. A formal interest rate hike would torpedo the already weak vulnerable housing market, when mortgage rates have been creeping upward. A reduction in the USFed balance sheet would drain the system of funds, when lending is sparse, unresolved loan losses litter the balance sheets, and banks still hold massive toxic bonds and actual home inventory. The entire banking system depends heavily upon a cornucopeia of liquidity facilities, without which the system would have ground to a halt many months ago.

Soon money market funds will augment the demand for USTreasurys for bubble maintenance, as redemptions become difficult to receive for trapped investors. Worse, a rate hike would pop the USTreasury Bond bubble the USFed has manufactured and add greatly to absurdly cheap borrowing costs on the USGovt debt. The good Chairman, Secretary of Inflation, would never agree that in September 2008 the US financial sector died. What he accomplished since then is vast pumping of blood through a dead corpse, with plenty of lateral drains directed to Wall Street firms. To expect an Exit Strategy to succeed is to demand a dead man to walk without the gigantic crutches and vast intravenous lines attached.

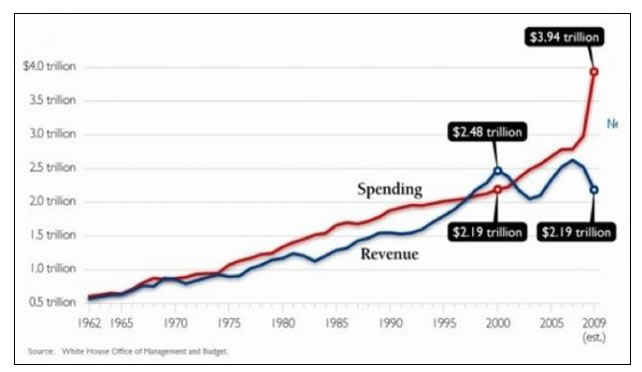

USGovt spending and tax revenue are diverging. The path is actually a pathogenesis, not sustainable. A monetary crisis comes, accompanied by a sovereign debt crisis. The Untied States will not be spared. Focus on war is the ruin on the exterior, while destructive focus on inflation is the ruin from within. Witness the climax of the Fascist Business Model, a final chapter. The status of USGovt finances reads like a Banana Republic. Often a picture is 1000 times more clear than any concisely written paragraph. The red line is spending. The blue line is tax revenue. Bubbles approach their climax before the bust by demanding an exponentially increasing amount of money. The USTreasury Bond is no different, whose securities finance the yawning USGovt debt. Both are manifested bubbles. The difference between spending and revenue is deficit, and the USGovt will rack up well over $1.5 trillion in fresh 2010 deficits despite claims last year to the contrary, all false.

ENDORSEMENT OF ENGRAINED FAILURE

When a system reaffirms itself with an endorsement of grand errors and corruption, it guarantees its failure. Identify the endorsements of failure. The signature of the Obama Admin is no change. Nations often are given opportunities to change course. The Untied States with these important decisions, has chosen to maintain the path of ruin, to seal it with approval, institutionalizing further its banker devotion, even after fraud has been exposed, failed policy recognized, and participants identified. At the end of the road lies a USMilitary dictatorship and USTreasury default, my ongoing unswerving forecasts. Both might be disguised. The complete lack of moves toward reform or true remedy, in my view, serves as an EPITAPH on the imperial tombstone. We just see bigger funding lifelines to the same big financial locations that caused the problems. The USEconomy is dying and is simply not going to recover, stuck in deterioration mode, lifted only by USFed steriods and Congressional adrenalin. Next comes shock. The important decisions of endorsed failure:

- Approval in October 2008 of the TARP funds totaling $700 billion to be distributed like a vast slush fund to Wall Street banks, with Goldman Sachs in charge of dispensation and first in line for reception. It was extortion by any other name.

- Selection and confirmed appointment of Tim Geithner as Treasury Secy in January 2009. The syndicate continues its stranglehold, enabling easier continued coverup of grand frauds.

- Decision made at several points in time to continue the wars in the Middle East by the West Axis. The USCongress approved the sacred status of war, instead of rebuilding the US economic structures. Still nobody searches for the missing $50 billion from the Iraq Reconstruction Fund.

- Empty Economic Stimulus Bill signed into law in February 2009, when it was only a set of important plugs to the massive state budget shortfalls. In this sense, the bill was merely a grand band-aid patch applied to a hemorrhage wound, not even a tourniquet.

- Blessing given to the relaxed accounting rules offered by the Financial Accounting Standards Board, approved by the USCongress, effective in April 2009. The rule change enabled big banks to declare any value for assets they wished, according to any model they chose, without scrutiny, without any connection to reality of markets.

- Confirmed reapointment of Bernanke as Chairman of US Federal Reserve in late January. Bernanke was confirmed by the weakest vote (70 - 30) in the history of the USFed. Threats of calamity accompany calls for full disclosure of the USFed itself. A NO vote would have signaled an unseating of the USFed as center for the financial syndicate. The US Supreme Court is next in line for a crucial vote.

GOLD BREAKS OUT IN EUROPE

Nobody can dispute that Europe has captured global attention with the threat of sovereign debt defaults, a string of them potentially. While the asylum directs attention of the paper gold price in US$ terms, pushed down by incredible naked shorting of futures contracts at a time when never the COMEX nor LBMA metals exchanges have been in possession of less gold & silver metal in inventory, the real story is the Gold price in Euro terms. It has broken out past €800. A runup should continue for around an 18% move, like to the €940 to €945 range. What a strong uptrend in Euro terms, a strong moving average uptrend, and strong stochastix index! The strength of the Gold price in Euro terms should continue until the Germans establish clarity with the New Core Euro. They will order the financial butchers to carve off the PIIGS fat, leaving the Central Europe core without the basket case nations that boast busted housing bubbles, busted banking systems, outsized federal deficits, heavy import needs, and capital requirements impossible to meet. When the New Core Euro is clear, then the surviving form of the Euro currency will rise and rise and rise, certainly challenging the USDollar. Only then will the Euro push toward 200/US$ in its exchange rate.

The Gold price in US$ terms, despite the hue & cry, is hanging on well. It maintains support above the $1050 price. It has succumbed to two powerful downdrafts, aided to be sure by selling golden paper. In fact, the suppression of the paper gold price has resulted in production ironically of physical metal placed by honest brokers as margin collateral. See margin calls and forfeited collateral. Its long-term 50-week moving average remains in uptrend. In the last week, gold investors have been treated to a bullish stochastix crossover in the making. When the New Core Euro is clear, watch the US$ DX long-term decline resume, and do so powerfully. The globe will face the worst monetary crisis in history, with epicenter the USDollar. The sovereign debt defaults will come full circle, the start being September 2008, the conclusion an attack on the USTreasury Bond. The USGovt debt is unsustainable, growing worse, and will eventually break. Pure financial physics. Gravity will sink the US Ship of State and its imprisoned economic flotilla. The global reserve currency in the USDollar stands as the biggest travesty in the history of global finance.

THE HAT TRICK LETTER PROFITS IN THE CURRENT CRISIS.

From subscribers and readers:

At least 30 recently on correct forecasts such as the Lehman Brothers failure, numerous nationalization deals such as for Fannie Mae, grand Mortgage Rescue, and General Motors.

“You freakin rock! I just wanted to say how much I love your newsletter. I have subscribed to Russell, Faber, Minyanville, Richebacher, Mauldin, and a few others, and yours is by far my all time favorite! You should have taken over for the Richebacher Letter as you take his analysis just a bit further and with more of an edge.” - (DavidL in Michigan)

“I used to read your public articles, and listen to you, but never realized until I joined what extra and detailed analysis you give to subscription clients. You always seem to be far ahead of everyone else. It is useful to ‘see’ what is happening, and you do this far better than the economists! I can think of many areas in life now where the best exponent is somebody not trained academically in that area.” - (JamesA in England)

“A few years ago, I was amazed at some of the stuff you were writing. Over time your calls have proved to be correct, on the money and frighteningly true. The information you report is provocative and prime time that we are not getting in the news. I was shocked when I read that the banks were going to fail in one of your prescient newsletters.” - (DorisR in Pennsylvania)

“You seem to have it nailed. I used to think you were paranoid. Now I think you are psychic!” - (ShawnU in Ontario)

“Your unmatched ability to find and unmask a string of significant nuggets, and to wrap them into a meaningful mosaic of the treachery-*****-stupidity which comprise our current financial system, make yours the most informative and valuable of investment letters. You have refined the ‘bits-and-pieces’ approach into an awesome intellectual tool.” - (RobertN in Texas)

by Jim Willie CB

Editor of the “HAT TRICK LETTER”

Home: Golden Jackass website

Subscribe: Hat Trick Letter

Use the above link to subscribe to the paid research reports, which include coverage of several smallcap companies positioned to rise during the ongoing panicky attempt to sustain an unsustainable system burdened by numerous imbalances aggravated by global village forces. An historically unprecedented mess has been created by compromised central bankers and inept economic advisors, whose interference has irreversibly altered and damaged the world financial system, urgently pushed after the removed anchor of money to gold. Analysis features Gold, Crude Oil, USDollar, Treasury bonds, and inter-market dynamics with the US Economy and US Federal Reserve monetary policy.

Jim Willie CB is a statistical analyst in marketing research and retail forecasting. He holds a PhD in Statistics. His career has stretched over 25 years. He aspires to thrive in the financial editor world, unencumbered by the limitations of economic credentials. Visit his free website to find articles from topflight authors at www.GoldenJackass.com . For personal questions about subscriptions, contact him at JimWillieCB@aol.com

Jim Willie CB Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.