Greece Turns the Euro Into a “Carry Trade” Currency

Commodities / Gold and Silver 2010 Feb 18, 2010 - 09:58 AM GMTBy: Gary_Dorsch

Last year’s parabolic rallies in copper, gold, Brazilian and Russian stocks, and the Australian dollar, are running out of steam. Suddenly, there are eerie reminiscences of scarier days gone-by. Volatility has returned to the money markets, amid worries about a possible “double-dip” recession for the world economy, capital flight from European sovereign debt markets, monetary tightening in Australia, China, and India, and the President Obama’s backing for the “Volcker rule,” – which calls for a clamp-down on the speculative trading binges of the Wall Street Oligarchs.

Last year’s parabolic rallies in copper, gold, Brazilian and Russian stocks, and the Australian dollar, are running out of steam. Suddenly, there are eerie reminiscences of scarier days gone-by. Volatility has returned to the money markets, amid worries about a possible “double-dip” recession for the world economy, capital flight from European sovereign debt markets, monetary tightening in Australia, China, and India, and the President Obama’s backing for the “Volcker rule,” – which calls for a clamp-down on the speculative trading binges of the Wall Street Oligarchs.

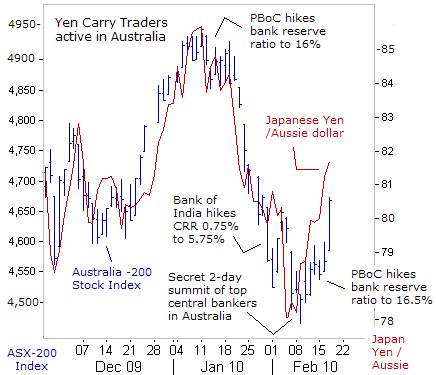

As fate would have it, on February 6th, many of the world’s top central bankers were huddling in Sydney, Australia, for two-days of secret talks. European Central Bank chief Jean-Claude Trichet, New York Fed chief William Dudley, the governor of the People’s Bank of China, Zhou Xiaochuan, and the Bank of New Zealand’s Alan Bollard were all in attendance, while global commodity and stock markets were skidding lower, in their first significant correction since last June.

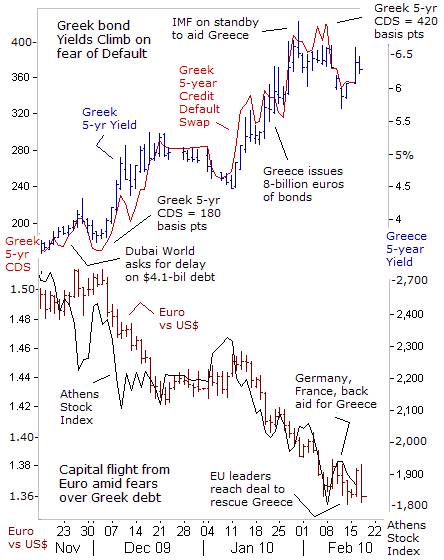

Spooked by fears that Greece or Dubai World would default on their debt repayments, Australia’s ASX-200 Index fell below the 4,500-level, losing 10%, of its value in three-weeks, due to rapid unwinding of Aussie /yen carry trades. There were equally sharp downdrafts on Wall Street, the Nikkei-225 Index in Tokyo, and the Hang Seng index crashed below the psychological 20,000-mark. Sovereign debt fears hammered the Australian dollar to 78-yen from above 85-yen a few weeks earlier. It began to feel like 2007-08 all over again.

ECB chief “Tricky” Trichet didn’t have a chance to sip champagne or dine with his G-20 cohorts. Instead, he was flying back to Brussels to attend an emergency meeting. The worst of the global carnage hit the stock markets of Greece, Portugal, and Spain, three heavily indebted Euro-zone countries whose ability to re-pay lenders, including $331-billion owed to German banks, $307-billion owed to French banks, and $156-billion owed to British banks was in doubt. Swiss banks hold 47-billion Euros of Greek debt, equal to 12% of Swiss GDP. Furthermore, there’s an outer ring of fire surrounding Club-Med that could spread to Eastern Europe.

ECB chief “Tricky” Trichet didn’t have a chance to sip champagne or dine with his G-20 cohorts. Instead, he was flying back to Brussels to attend an emergency meeting. The worst of the global carnage hit the stock markets of Greece, Portugal, and Spain, three heavily indebted Euro-zone countries whose ability to re-pay lenders, including $331-billion owed to German banks, $307-billion owed to French banks, and $156-billion owed to British banks was in doubt. Swiss banks hold 47-billion Euros of Greek debt, equal to 12% of Swiss GDP. Furthermore, there’s an outer ring of fire surrounding Club-Med that could spread to Eastern Europe.

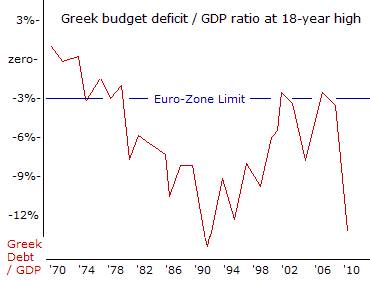

Greece is the weakest link in the Euro-regime, and it’s in the eye of the storm, owing 300-billion Euros of outstanding debt. Athens doesn’t have an independent central bank that can simply print drachmas to pay-off its debts, so without a bailout from its wealthier neighbors, it could default on €50-billion ($72-billion) of debt coming due this year. But given the enormous amount of loans extended to Club Med from German and French banks in particular, Athens is betting that German Chancellor Angela Merkel and French President Nicolas Sarkozy have little choice, but to pay the tab for Greece’s flamboyant spending.

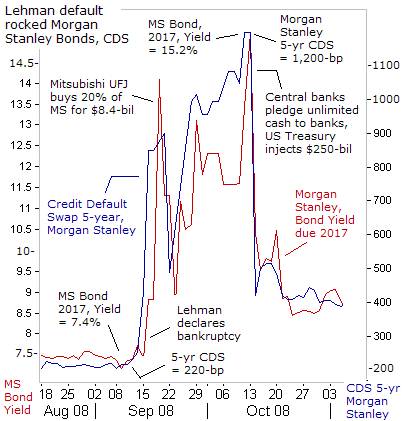

The size of Greece’s debt is roughly equal to that of fallen Lehman Brothers, whose bankruptcy in Sept 2008, ignited the explosion of $400-billion of credit default swaps (CDS), linked to its debt, and nearly led to the collapse of Wall Street titan Morgan Stanley. At the height of the panic, CDS rates on Morgan Stanley’s debt soared to 1,200-basis points, and MS’s bonds fell to 50-cents on the dollar. Thus, European leaders are keen to prevent a replay, this time with Greece’s budget woes spreading to Portugal or Spain, which in turn, could reverberate around the globe.

“Euro-area member states will take determined and coordinated action, if needed, to safeguard financial stability in the Euro area as a whole,” warned EU President Herman Van Rompuy on Feb 11th. “Greece won’t be left alone, but there are rules that must be adhered to. On this basis we will agree on a statement,” Germany’s Merkel added. “The International Monetary Fund stands ready to help Greece with its debt crisis,” said IMF chief John Lipsky on Jan 30th.

“Euro-area member states will take determined and coordinated action, if needed, to safeguard financial stability in the Euro area as a whole,” warned EU President Herman Van Rompuy on Feb 11th. “Greece won’t be left alone, but there are rules that must be adhered to. On this basis we will agree on a statement,” Germany’s Merkel added. “The International Monetary Fund stands ready to help Greece with its debt crisis,” said IMF chief John Lipsky on Jan 30th.

The CDS market is a hotbed of speculation, where bankers and hedge funds, can bet on the price of contracts, without transparency, and without actually holding the underlying bonds. By whipping-up hysteria of a looming sovereign default in the media, and driving-up the cost of insuring debt in the CDS market, speculators can weaken confidence in a government bond market, and drive-up interest rates.

“This is an attack on the Euro-zone by certain interests, - political or financial, - and often countries are being used as the weak link of the Euro zone,” said Greek Prime Minister George Papandreou at the World Economic Forum in Davos on Jan 28th. “We are being targeted, particularly with an ulterior motive or agenda, and of course, there is speculation in the world markets,” he said.

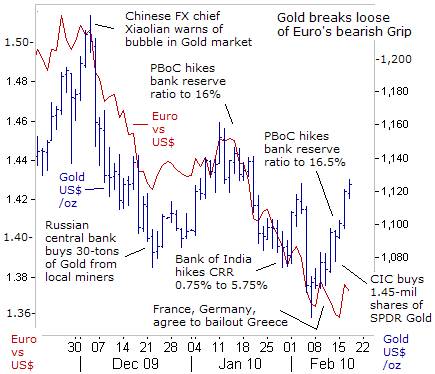

Through the rigging of the opaque CDS market, speculators were able to conjure-up fears of a Greek default on its debt, while aiming to profit from short sale positions in Greek bonds or equities. Traders also profited by short selling the Euro against the Australian dollar and the Brazilian real. Since Dubai World requested a moratorium on $4.1-billion of debt payments on Nov 28th, the Euro has also fallen 10% against the pitiful US-dollar, sinking to a low of $1.3580 on Feb 17th.

Under the weight of rising interest rates, the Athens stock exchange index lost a quarter of its value over the past three-months. Hard times lie ahead for Greece, with EU heads of state and parliaments calling for harsh austerity measures in return for bailout money. Greek President George Papandreou has been forced to call for across-the-board freeze on Greece’s public sector wages along with a cut in allowances, which amounts to a wage cut of 4-percent. He’s also called for pension reform, which entails raising the retirement age, as well as higher fuel taxes.

But Greece’s largest labor unions, which equal half of the country’s 5-million-strong workforce, are joining forces for a strike to protest cuts to their wages. Although Germany’s deputy finance minister says Greece should mimic Ireland and Latvia, and slash spending and wages savagely, at the end-of-the-day, Bonn and Paris must deliver the bailout money to protect the interests of their largest banks, and avoid the systemic risk posed to the entire European monetary union.

But Greece’s largest labor unions, which equal half of the country’s 5-million-strong workforce, are joining forces for a strike to protest cuts to their wages. Although Germany’s deputy finance minister says Greece should mimic Ireland and Latvia, and slash spending and wages savagely, at the end-of-the-day, Bonn and Paris must deliver the bailout money to protect the interests of their largest banks, and avoid the systemic risk posed to the entire European monetary union.

While, Greece, Portugal, Ireland, and Spain are the most vulnerable, even Germany, the Euro-zone’s locomotive, has a public debt expected to reach 90% of GDP this year, and a budget deficit expected to reach 6% of GDP in 2010 -- figures that put Berlin in non-compliance with the stability pact. All that’s left to be worked out are some cosmetic concessions to be offered by Greece, to make the cost of financing its bailout more palatable to its resentful Euro-zone neighbors.

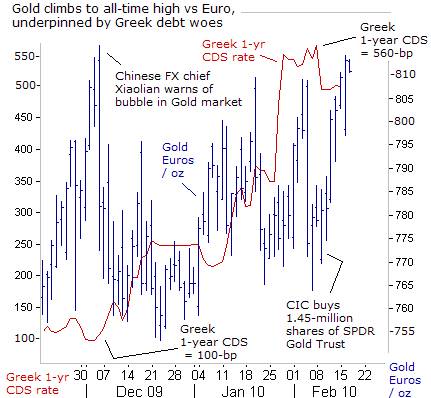

With the Euro sliding against all currencies, amid capital flight from Euro-zone bonds, traders turned to gold as a safe haven from a potential banking or currency crisis. There are also signals that an outbreak of inflation in the Euro-zone is looming on the horizon. For gold bugs, the most electrifying bolts of energy were reports that the China Investment Corp (CIC), the trading arm of Beijing’s $300-billion sovereign wealth fund, recently bought 1.45-million SPDR Gold Trust shares (NYSE: GLD), or 0.4% of the total shares outstanding, for a cash outlay of $155-million.

Traders also learned that Beijing dumped $34-billion of US-Treasuries in December, trimming its total holdings down to $755-billion. China is now the second-biggest holder of US Treasuries, after Japan, a sign the Chinese Politburo is alarmed by America’s out-of-control fiscal policy. Looming over the debt crisis in Europe is the far greater crisis of the world’s biggest debtor, - the United States.

President Obama’s latest budget projects a shortfall of $1.6-trillion, equivalent to 11.4% of GDP, the highest since the end of World War II. This approaches Greece’s deficit ratio of 12.7% of GDP, and the UK’s 13.3% deficit, while the US budget, moreover, projects trillion-dollar deficits for years to come. Washington responded to the financial crash of 2008, by essentially bankrupting the Treasury, and the country, in order to preserve the wealth of Wall Street’s financial elite.

President Obama’s latest budget projects a shortfall of $1.6-trillion, equivalent to 11.4% of GDP, the highest since the end of World War II. This approaches Greece’s deficit ratio of 12.7% of GDP, and the UK’s 13.3% deficit, while the US budget, moreover, projects trillion-dollar deficits for years to come. Washington responded to the financial crash of 2008, by essentially bankrupting the Treasury, and the country, in order to preserve the wealth of Wall Street’s financial elite.

China’s investment in the Spider Gold Trust (GLD), was timed after a 15% correction in the spot gold price, to below $1,100 /oz. Interestingly enough, on Dec 2nd, Hu Xiaolian, the PBoC’s currency chief, warned speculators that Gold prices were too high at $1,225 /oz and said traders should be careful of a bubble bursting. “We must keep in mind the long-term effects when considering how to use as our reserves. We must watch out for bubbles forming, and be careful in those areas.”

Xiaolian’s comments coincided with a peak in gold prices at $1,225 /oz, before panic selling set-in the following day, when the US Labor department reported much better than expected employment figures, sending US Treasury yields 50-basis points higher. The PBoC itself triggered a second wave of selling in gold, when it hiked its bank reserve ratio for its largest banks to 16%, aiming to slow its M2 money supply growth rate from 29.5% last October, to 18% in the year ahead.

After shaking the speculative froth off the gold market, Beijing began buying GLD for its strategic reserves. Beijing is also buying gold quietly from its local miners. But a second hike in the PBoC’s reserve ratio to 16.5% on Feb 12th, failed to put a lasting dent in the gold market, as traders reckoned that the Greek tragedy would further delay the ECB’s plans to exit from its ultra-easy money policies. As a result, gold was able to break the bearish grip of a declining Euro and stronger US-dollar.

After shaking the speculative froth off the gold market, Beijing began buying GLD for its strategic reserves. Beijing is also buying gold quietly from its local miners. But a second hike in the PBoC’s reserve ratio to 16.5% on Feb 12th, failed to put a lasting dent in the gold market, as traders reckoned that the Greek tragedy would further delay the ECB’s plans to exit from its ultra-easy money policies. As a result, gold was able to break the bearish grip of a declining Euro and stronger US-dollar.

CIC, whose chairman is the former Communist Party of China insider Lou Jiwei, has been quietly accumulating stakes in natural resource companies, including Canada’s Kinross Gold, Teck Resources, Potash of Saskatchewan, Brazilian iron ore and nickel giant Vale, Euro-zone steel producer ArcelorMittal, and other mining and energy related companies, such as US-natural gas producer Chesapeake Energy, the US Securities and Exchange Commission has revealed.

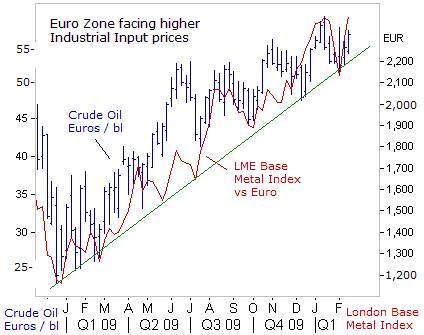

A surprise move by Beijing to revalue the yuan by 5% or more this year would provide Chinese importers with greater purchasing power of industrial commodities, helping to keep raw material prices high. This is creating a headache for the ECB, since a weaker Euro is pushing-up the cost of imported crude oil, and key metals, such as copper, nickel, platinum, and zinc, used in manufacturing. And historical price charts show a close correlation between the year-over-year change in commodity markets, and the Euro-zone’s Producer Price Index.

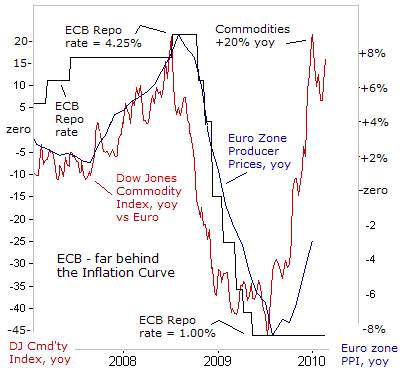

A serious outbreak of inflation lies ahead for the Euro zone, especially for imported goods, due to the devaluation of the Euro, and the upward surge in the Dow Jones Commodity Index, now running +16% higher than a year ago. After a series of rapid-fire rate cuts to a record low of 1%, the ECB now finds itself far behind the “Inflation Curve,” but can’t tighten its monetary policy, in reaction to the upward surge in commodities markets, as it did in the past.

serious outbreak of inflation lies ahead for the Euro zone, especially for imported goods, due to the devaluation of the Euro, and the upward surge in the Dow Jones Commodity Index, now running +16% higher than a year ago. After a series of rapid-fire rate cuts to a record low of 1%, the ECB now finds itself far behind the “Inflation Curve,” but can’t tighten its monetary policy, in reaction to the upward surge in commodities markets, as it did in the past.

Instead, the ECB’s hands are tied by the Greek tragedy, and instead, must rely on government apparatchiks at EuroStat, to fudge (mute) the official inflation numbers, in order to buy precious time, for its ultra-easy money policy. However, the surge in global commodity inflation has already swept across the English Channel. British consumer price inflation surged to +3.5% in January, far above the Bank of England’s 2% target in January, forcing BoE chief Mervyn King to write a public letter of apology, for the insidious side-effects of QE.

Soon, even the apparatchiks at EuroStat would be forced to admit that the PPI is turning sharply higher. In turn, sentiment towards Euro-zone bonds could sour further, amid a steady erosion of the Euro on global currency markets. ECB officials would argue that a 10% jobless rate, and vast amounts of unused capacity in the economy, will contain inflationary pressures, but such arguments are starting to fall on deaf ears, as Asian demand buoys global commodity markets.

Former Bundesbank hawk Otmar Issing has warned on Feb 15th, that bailing out Greece would deal a “major blow” to the Euro’s credibility. “The viability of the whole framework -- nothing less -- is at stake. Financial assistance for countries that violated the terms of their participation in EMU would be a major blow for the credibility of the whole framework. Such principles do not allow for compromise. Once Greece is helped, the dam would be broken. The question is whether monetary union can survive,” said Issing.

Former Bundesbank hawk Otmar Issing has warned on Feb 15th, that bailing out Greece would deal a “major blow” to the Euro’s credibility. “The viability of the whole framework -- nothing less -- is at stake. Financial assistance for countries that violated the terms of their participation in EMU would be a major blow for the credibility of the whole framework. Such principles do not allow for compromise. Once Greece is helped, the dam would be broken. The question is whether monetary union can survive,” said Issing.

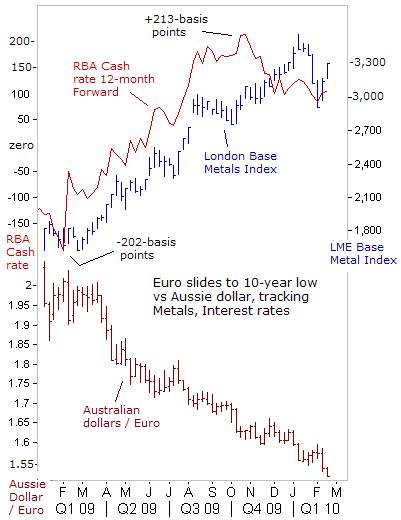

Nerve wracked Euro investors are scanning their radar screens, and have found a safe haven from the Greek debt bomb. The Euro has slipped to a new 10-year low against the Aussie dollar, after losing a quarter of its market value from a year ago. Carry traders are having a field day, borrowing vast quantities of Euros at 1%, and lending in Aussie dollars at 3.75%, or Brazilian reals at a higher interest rate of 8.75%, while pocketing huge profits from the “commodity currency” gains.

There’s a good chance the interest rate spread between the commodity currencies and the Euro will widen further, after the Australian jobless rate fell to an 11-month low of 5.3%, and Australian employers added 194,600 jobs over the past five-months. In recent days, the central banks of Australia and Brazil have stated that the task of moderating inflation would require gradual rates hikes. In Sydney, the 12-month forward market is pricing in 100-basis points of RBA’s rate hikes to 4.75%, and in Sao Paulo, Brazil, traders are predicting 150-basis points of tightening in the overnight Selic rate to 10.25-percent.

In the case of Australia and Brazil, their economies are linked to surging Chinese demand for commodities, especially coking coal, crude oil, and iron-ore. If the ECB doesn’t act to defend its currency soon, by draining liquidity, the Euro could become the top “carry trade” currency, usurping the US-dollar for short selling strategies. Minutes of the Fed’s meeting in January indicated that several Fed officials want to start draining the US$ liquidity swamp, by selling mortgage backed bonds, sooner rather than later. If correct, the US-dollar could move higher, and Euro would fall further (below US$1.35). In a deleterious cycle, the Euro-zone economy would stumble into the dreaded trap of “Stagflation.”

This article is just the Tip of the Iceberg of what’s available in the Global Money Trends newsletter. Subscribe to the Global Money Trends newsletter, for insightful analysis and predictions of (1) top stock markets around the world, (2) Commodities such as crude oil, copper, gold, silver, and grains, (3) Foreign currencies (4) Libor interest rates and global bond markets (5) Central banker "Jawboning" and Intervention techniques that move markets.

By Gary Dorsch,

Editor, Global Money Trends newsletter

http://www.sirchartsalot.com

GMT filters important news and information into (1) bullet-point, easy to understand analysis, (2) featuring "Inter-Market Technical Analysis" that visually displays the dynamic inter-relationships between foreign currencies, commodities, interest rates and the stock markets from a dozen key countries around the world. Also included are (3) charts of key economic statistics of foreign countries that move markets.

Subscribers can also listen to bi-weekly Audio Broadcasts, with the latest news on global markets, and view our updated model portfolio 2008. To order a subscription to Global Money Trends, click on the hyperlink below, http://www.sirchartsalot.com/newsletters.php or call toll free to order, Sunday thru Thursday, 8 am to 9 pm EST, and on Friday 8 am to 5 pm, at 866-553-1007. Outside the call 561-367-1007.

Mr Dorsch worked on the trading floor of the Chicago Mercantile Exchange for nine years as the chief Financial Futures Analyst for three clearing firms, Oppenheimer Rouse Futures Inc, GH Miller and Company, and a commodity fund at the LNS Financial Group.

As a transactional broker for Charles Schwab's Global Investment Services department, Mr Dorsch handled thousands of customer trades in 45 stock exchanges around the world, including Australia, Canada, Japan, Hong Kong, the Euro zone, London, Toronto, South Africa, Mexico, and New Zealand, and Canadian oil trusts, ADR's and Exchange Traded Funds.

He wrote a weekly newsletter from 2000 thru September 2005 called, "Foreign Currency Trends" for Charles Schwab's Global Investment department, featuring inter-market technical analysis, to understand the dynamic inter-relationships between the foreign exchange, global bond and stock markets, and key industrial commodities.

Copyright © 2005-2010 SirChartsAlot, Inc. All rights reserved.

Disclaimer: SirChartsAlot.com's analysis and insights are based upon data gathered by it from various sources believed to be reliable, complete and accurate. However, no guarantee is made by SirChartsAlot.com as to the reliability, completeness and accuracy of the data so analyzed. SirChartsAlot.com is in the business of gathering information, analyzing it and disseminating the analysis for informational and educational purposes only. SirChartsAlot.com attempts to analyze trends, not make recommendations. All statements and expressions are the opinion of SirChartsAlot.com and are not meant to be investment advice or solicitation or recommendation to establish market positions. Our opinions are subject to change without notice. SirChartsAlot.com strongly advises readers to conduct thorough research relevant to decisions and verify facts from various independent sources.

Gary Dorsch Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.