Is all this Fed Central Bank Exit Strategy Talk Warranted?

Interest-Rates / US Interest Rates Feb 19, 2010 - 12:33 AM GMTBy: Tim_Iacono

Boy, for a group of policymakers at the nation's central bank who, in a best case scenario, are going to just sit on their hands for at least the rest of the year, there sure has been a lot of talk about an "exit strategy".

Boy, for a group of policymakers at the nation's central bank who, in a best case scenario, are going to just sit on their hands for at least the rest of the year, there sure has been a lot of talk about an "exit strategy".

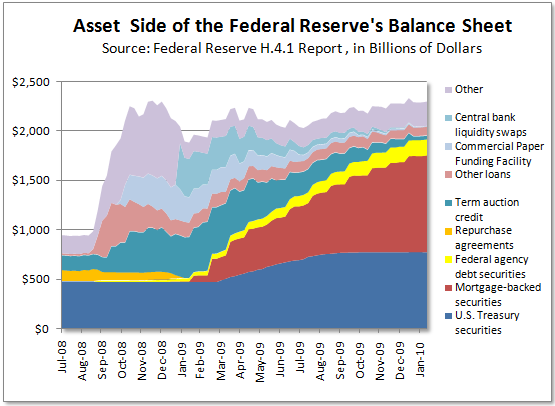

That is, how the Federal Reserve plans to withdrawal the trillions of dollars in asset purchases, emergency lending facilities, and liquidity measures that have been undertaken over the last year that purportedly saved us from another Great Depression.

While it's probably a good idea to begin thinking about this sort of thing, the way Fed chief Ben Bernanke and others at the central bank have been talking lately, you'd think that the economy is about ready to fire on all cylinders again and that there's a pressing need to begin dialing back on some of the aid they've been providing.

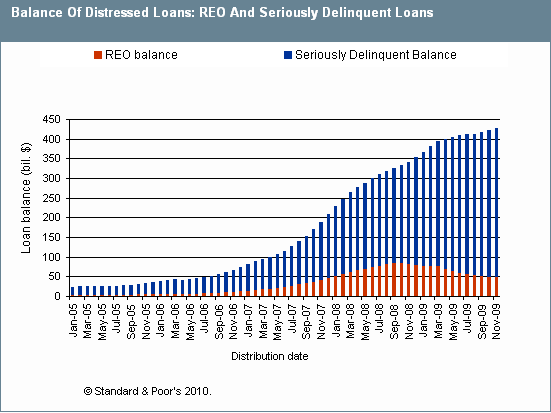

What they should probably be worried about instead is the massive wave of foreclosures now washing up onto shore and the waning inventory rebuilding cycle that, when combined, will require more assistance in the form of money printing in the year ahead, not less.

Just this morning, Philadelphia Federal Reserve Bank President Charles Plosser said that he would favor selling some of the $1.25 trillion in mortgage-backed securities that have been piling up on the Fed's balance sheet "sooner rather than later", as if, he really thinks that the economic recovery we've been experiencing over the last six months - built mostly on government bailouts and handouts - is going to last.

Last week, it was Chairman Ben Bernanke who detailed a plan to Congress that would have the central bank adjusting the interest paid on "excess reserves" - money held by member banks at the Fed - in order to keep credit from expanding too rapidly and realizing the worst of the inflation hawks' fears - runaway inflation.

Shouldn't the question of what will happen to the market for home loans when the Fed stops their monthly purchases of between $60 to $100 billion worth of mortgage-backed securities next month be a more pressing concern?

Sure, they now own a considerable amount of the souring mortgage debt in the U.S., but they'll probably have to buy at least another trillion dollars or so to keep the housing market propped up, that is, unless there is some other plan in the works where, with their loss limits recently removed, wards of the state Fannie Mae and Freddie Mac can take on the job.

[The graphic above is from Standard and Poor's report on troubled mortgages]

Goldman Sachs weighed in last week with something about the Fed not raising interest rates until 2012 and there are more than a few who think that we'll be turning Japanese this decade in a very big way, as in, ZIRP (Zero Interest Rate Policy) for as far as the eye can see.

Maybe all this talk about "exit strategies" is simply a way for policymakers to generate confidence that might not otherwise be there.

For example, anyone looking at consumer spending, consumer confidence, or the unemployment rate could easily come to the conclusion that we've got a long way to go before the economy begins to grow again in any substantive sort of way.

But, if they were to listen to the Federal Reserve talking about how they're going to get out of the business of printing money on a scale never before seen by Mankind, then maybe they'll think that, just maybe, the Fed knows something that they don't know.

Then again, the more likely explanation is that economists at the central bank are just as clueless about where the economy is headed today as they were a few years ago before we all experienced the worst financial market crisis and the sharpest economic contraction since the end of World War II.

In case anyone needs to be reminded, here's what Fed chief Ben Bernanke thought about the economy and financial markets back in the middle of the last decade.

Why are we still listening to this guy?

Is there any reason to think that he'll do any better in this decade than he did in the last one?

Isn't this talk of the Fed's "exit strategy" way too premature?

By Tim Iacono

Email : mailto:tim@iaconoresearch.com

http://www.iaconoresearch.com

http://themessthatgreenspanmade.blogspot.com/

Tim Iacano is an engineer by profession, with a keen understanding of human nature, his study of economics and financial markets began in earnest in the late 1990s - this is where it has led. he is self taught and self sufficient - analyst, writer, webmaster, marketer, bill-collector, and bill-payer. This is intended to be a long-term operation where the only items that will ever be offered for sale to the public are subscriptions to his service and books that he plans to write in the years ahead.

Copyright © 2010 Iacono Research, LLC - All Rights Reserved

Tim Iacono Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.