Bond Vigilantes set Sights on Sovereign Debt

Interest-Rates / Global Debt Crisis Feb 25, 2010 - 01:45 AM GMTBy: Gary_Dorsch

The collapse of Lehman Brothers triggered one of the biggest corporate debt defaults in history, and also ignited the biggest stock market meltdown in decades. When the smoke had finally cleared, Lehman’s bonds attracted bids of 8-cents on the dollar, resulting in staggering losses of $365-billion. Worse yet, about 350 banks and investors were thought to have insured $400-billion of Lehman’s bonds through complex derivatives, known as credit default swaps (CDS’s), causing even deeper losses and mayhem in the markets. A fifth was wiped off London Footsie shares, and in Tokyo, the Nikkei-225 index lost 10% of its value in a single week.

The collapse of Lehman Brothers triggered one of the biggest corporate debt defaults in history, and also ignited the biggest stock market meltdown in decades. When the smoke had finally cleared, Lehman’s bonds attracted bids of 8-cents on the dollar, resulting in staggering losses of $365-billion. Worse yet, about 350 banks and investors were thought to have insured $400-billion of Lehman’s bonds through complex derivatives, known as credit default swaps (CDS’s), causing even deeper losses and mayhem in the markets. A fifth was wiped off London Footsie shares, and in Tokyo, the Nikkei-225 index lost 10% of its value in a single week.

The world’s wealthiest nations responded to the crisis, acting in solidarity, with a rescue package of $12-trillion, equal to a fifth of the entire world’s annual economic output. Stabilizing the financial system required capital injections pumped into banks in order to prevent them from collapse, soaking up toxic assets, guarantees over bank debt, and $5-trillion of liquidity support from central banks.

In order to finance the rescue operation, and prevent a second “Great Depression,” the G-20 issued an avalanched of debt, equal to 10% of their combined GDP in 2009, − the biggest since the Second World War. The IMF now calculates the G-20’s debt will reach 118% of GDP in 2014, up from about 80% before the crisis. Essentially, the British and US-governments bankrupted their national treasuries, in a desperate effort to preserve the wealth of the financial elite.

Tremors from the collapse of the House of Lehman are still reverberating today, this time, destabilizing the weakest link in the Euro-zone’s economy. The sharp downturn in global shipping rates, as measured by the Baltic Dry Index, has taken its toll on Greece, which leads the global shipping industry. Today, the world shipping fleet is worth about a $1-trillion and roughly 20% of that, which makes up the backbone, is controlled by the Greeks. Global shipping brings about 17-billion Euros in foreign exchange to Greece’s $357-billion economy.

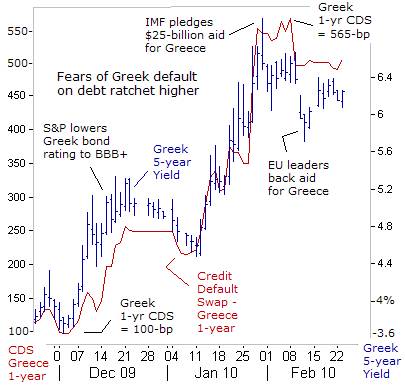

With its top income earners - shipping and tourism, slumping badly, - gunslingers in the world’s money markets have focused their sights on the sovereign bond market of Greece, which trades a paltry $1-billion per day. Speculators have bid-up the cost of insuring Greek debt in the CDS market for one-year, to a record high of 565-basis points this month, up sharply from 100-basis points at the beginning of December.

A frenzy of fear has been whipped-up over Greece’s budgetary woes, and speculators have profited by short selling the Euro, against all other major currencies. Yields on Greece’s 5-year note have been jacked-up 280-basis points higher to 6.35%, over the past few months, and are now sufficiently high enough to choke its economy. Although Greece’s economy only generates 3% of the Euro zone’s output, if it can’t service the €50-billion of debt coming due this year, it could rupture a hole big enough to sink the Euro-zone stock markets.

Greece’s debt totaled €298-billion at the end of last year, equaling 120% of its GDP. The size of its debts is five times that of Moscow’s when it defaulted in 1998. The links go deeper, to German banks holding €500-billion in loans outstanding to Greece, Ireland, Portugal and Spain. But the likelihood of a Greek default seems remote. The IMF has offered a €30-billion loan facility for Athens, in the event of an emergency, and France and Germany would act to protect their biggest banks.

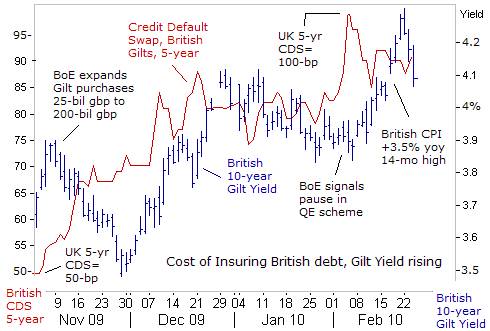

Strategists at Deutsche Bank are stirring up the animal spirits, by warning that the escalating cost of insuring against debt defaults by Greece might be a “dress rehearsal” for a similar attack on the British Gilt market. The UK is running a budget deficit at 13% of GDP this year, exceeding that of Greece. As a proportion of GDP, the budget deficit is the largest ever outside wartime. Britain sold a record 225-billion pounds worth of Gilts last year, but that was almost entirely monetized by the Bank of England via its asset purchase scheme to pump money into the economy.

With the BoE’s “quantitative easing” now on hold and more than 200-billion pounds worth of gilts to be auctioned this year, the British gilt market could be a ticking time bomb, ready to explode at the slightest hint of a serious outbreak of inflation. Nerves were briefly rattled, when official data reported on Feb 16th, showed consumer price inflation rose to 3.5% in January from December's 2.9%, forcing Bank of England chief Mervyn King to write a public letter of apology, for the insidious side-effects of overdosing on the hallucinogenic QE-drug.

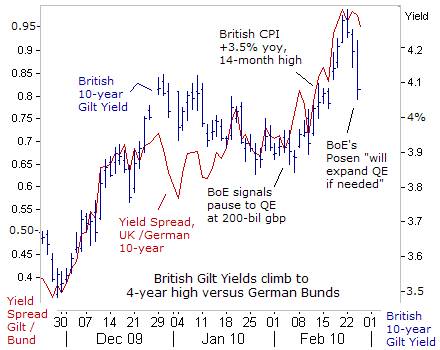

Another sign of underlying weakness in the British gilt market is the widening yield spread between British 10-year gilts and the equivalent German Bunds, climbing to as high as +100-basis points, the highest in 4-years, after the BoE signaled a pause in its gilt-buying spree. Whereas the BoE has openly monetized 90% of the gilts sold last year, the European Central Bank (ECB) has been monetizing debt clandestinely, through a strategy of lending vast quantities of Euros at 1% to European banks, which in turn, buy-up the sovereign debt of Euro-zone nations.

It is estimated that European governments will need to borrow 2.2-Trillion Euros (19% of GDP) from the capital market in 2010, in order to finance large deficits and roll-over existing debt, the largest borrowing binge in decades. Gross borrowing (including maturing and new debt) is projected to be largest in France 454-billion Euros, Italy 393-billion Euros, Germany 386-billion Euros.

One key question is whether the ECB would decide to scale down its lending facilities to Euro-zone banks, which would greatly impact the “liquidity premium” enjoyed by German Bunds. There could be a severe credit crunch before July 1st, when banks are required repay 442-billion Euros in 12-month funds to the ECB -- more than half the liquidity outstanding, and could force the sale of Euro-zone bonds and stocks, if no rollover option becomes available. Shortening the terms of future loans could also trigger sales of longer-term bonds, and worsening the situation for Greece.

In London, on Feb 24th, alarm bells began to ring, after British gilt yields reached 4.25%, putting the UK’s fledgling recovery at risk. The BoE’s Adam Posen quickly rode to the rescue, warning the central bank would rev-up the printing presses, and expand its QE operations if necessary, in order to prevent gilt yields from rising further. “If we have to, we will. Any of you betting on high inflation in major economies, including the UK, will lose money,” Posen warned. In a knee-jerk reaction, speculators rushed to cover short positions in the gilt market, knocking 10-year yields to as low as 4.07-percent.

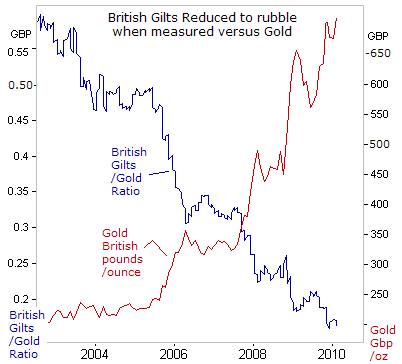

However, looking beyond Posen’s propaganda, traders betting on the demise of the British gilts market have profited handsomely, by utilizing gold as a hedge, against the BoE’s money printing operations. Over the past 6-years, British gilts have lost more than two-third’s of their purchasing power, when stacked-up against the yellow metal, and until the BoE begins to drain the liquidity swamp in London, gilts are in danger of going below zero in value, when measured in gold.

Central banks of emerging nations, which control more than $5.2-trillion of foreign currency reserves, need to seriously consider whether to recycle their stash in government bonds, or switch into gold. Owning Euros is an increasingly risky venture with European banks holding $2.1-trillion in sovereign debt of the weakest Euro-zone countries. Instead, China is bolstering its gold reserves by purchasing gold mines abroad, and buying bullion from local miners, rather than tipping off its hand in the spot market. China dumped $34.2-billion of US Treasury notes in December, and must think twice before investing in the Euro or British pound.

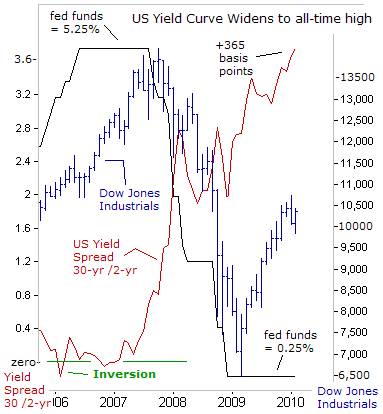

With the spread between the US Treasury’s 30-year bond and 2-year note widening to a record high of +364-basis points this week, Fed chief Bernanke tried to reassure nervous bondholders that the central bank won’t hike the fed funds rate for an “extended period” of time. “Notwithstanding the positive signs, the job market remains quite weak. The Fed continues to anticipate low rates of resource utilization, subdued inflation trends, and stable inflation expectations, to warrant exceptionally low levels of the federal funds rate for an extended period,” he said.

The parabolic steepening of the US Treasury’s yield curve is one of the biggest anomalies in the marketplace today. Typically, the yield curve steepens when long-term yields are rising faster than shorter-term rates, and traders are anticipating an economic recovery, to be followed by a tightening of monetary policy. Moreover, the extreme widening of today’s yield curve would normally be associated with signs of a V-shaped recovery for the US-economy, and the Fed telegraphing its intention to drain excess liquidity, in order to keep inflationary pressures in check.

But today, the message that’s coming across from the Fed is the opposite, - warning of a comatose labor market, and record foreclosures in the real estate market. Treasury chief Timothy Geithner is forced to reassure foreign investors that the United States will “absolutely not lose its AAA debt rating,” even after the Obama administration predicted a $1.6-trillion budget deficit in 2010. Thus, the extreme widening of the yield curve is partly linked to America’s massive debt.

The Fed’s policy of flooding financial markets with cheap credit at near-zero interest rates and the electronic equivalent of printing $1.75-trillion, was designed to prop-up the Oligarchic banks, and enable them to reap bumper profits and bonuses, despite double-digit unemployment. The Fed’s shift to nuclear QE has fueled a huge wave of speculation on risky assets, such as stocks, bonds, commodities, and currencies. However, Chinese central banker Zhu Mi has warned, “When the US has to fund its deficit through issuing more Treasuries and printing more dollars, it is inevitable that the US-dollar will continue to weaken. The US can’t expect other nations to increase purchases of Treasuries to fund its entire fiscal shortfall,” he said.

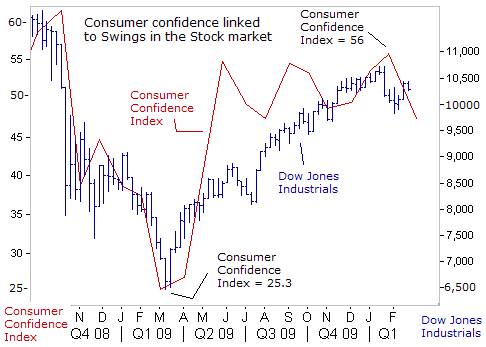

The Fed chief knows the stock market is climbing a “wall of worry,” and without the support of Beijing in funding the Treasury’s massive debt, US Treasury bond yields could continue to edge higher, and stymie any chance of a sustained economic recovery. Much of the recovery in S&P-500 profits is linked to massive reductions in labor expense, but now, the opposite side of the coin, slumping consumer confidence and spending, are expected to weaken top-line revenues in the months ahead.

The Conference Board’s confidence index indicated that the number of respondents who said jobs were plentiful fell to just 3.6%, while the proportion who said jobs are hard-to-get increased to 47.7-percent. Thus, Wall Street will continue to be plagued by gut-wrenching fears of a “double-dip” recession on the one-hand, but witnessing miraculous rallies on other days, thanks to an ocean of excess liquidity that buoys stocks, even without any fundamental justification.

However, the Fed’s super-easy money policy can also generate inflationary pressures in the commodity markets, which are exacerbated by strong demand from fast growing economies in the emerging world. How all these moving parts, combined with an avalanche of $1.6-trillion of new debt, all play out in 2010, is the central focus for Treasury traders. And if bond yields continue to rise further, regardless of the Fed’s stance, a stock market crash would happen eventually.

This article is just the Tip of the Iceberg of what’s available in the Global Money Trends newsletter. Subscribe to the Global Money Trends newsletter, for insightful analysis and predictions of (1) top stock markets around the world, (2) Commodities such as crude oil, copper, gold, silver, and grains, (3) Foreign currencies (4) Libor interest rates and global bond markets (5) Central banker "Jawboning" and Intervention techniques that move markets.

By Gary Dorsch,

Editor, Global Money Trends newsletter

http://www.sirchartsalot.com

GMT filters important news and information into (1) bullet-point, easy to understand analysis, (2) featuring "Inter-Market Technical Analysis" that visually displays the dynamic inter-relationships between foreign currencies, commodities, interest rates and the stock markets from a dozen key countries around the world. Also included are (3) charts of key economic statistics of foreign countries that move markets.

Subscribers can also listen to bi-weekly Audio Broadcasts, with the latest news on global markets, and view our updated model portfolio 2008. To order a subscription to Global Money Trends, click on the hyperlink below, http://www.sirchartsalot.com/newsletters.php or call toll free to order, Sunday thru Thursday, 8 am to 9 pm EST, and on Friday 8 am to 5 pm, at 866-553-1007. Outside the call 561-367-1007.

Mr Dorsch worked on the trading floor of the Chicago Mercantile Exchange for nine years as the chief Financial Futures Analyst for three clearing firms, Oppenheimer Rouse Futures Inc, GH Miller and Company, and a commodity fund at the LNS Financial Group.

As a transactional broker for Charles Schwab's Global Investment Services department, Mr Dorsch handled thousands of customer trades in 45 stock exchanges around the world, including Australia, Canada, Japan, Hong Kong, the Euro zone, London, Toronto, South Africa, Mexico, and New Zealand, and Canadian oil trusts, ADR's and Exchange Traded Funds.

He wrote a weekly newsletter from 2000 thru September 2005 called, "Foreign Currency Trends" for Charles Schwab's Global Investment department, featuring inter-market technical analysis, to understand the dynamic inter-relationships between the foreign exchange, global bond and stock markets, and key industrial commodities.

Copyright © 2005-2010 SirChartsAlot, Inc. All rights reserved.

Disclaimer: SirChartsAlot.com's analysis and insights are based upon data gathered by it from various sources believed to be reliable, complete and accurate. However, no guarantee is made by SirChartsAlot.com as to the reliability, completeness and accuracy of the data so analyzed. SirChartsAlot.com is in the business of gathering information, analyzing it and disseminating the analysis for informational and educational purposes only. SirChartsAlot.com attempts to analyze trends, not make recommendations. All statements and expressions are the opinion of SirChartsAlot.com and are not meant to be investment advice or solicitation or recommendation to establish market positions. Our opinions are subject to change without notice. SirChartsAlot.com strongly advises readers to conduct thorough research relevant to decisions and verify facts from various independent sources.

Gary Dorsch Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.