Earthquake in Japanese Commodity Markets

Commodities / Commodities Trading Feb 28, 2010 - 03:53 AM GMTBy: OilPrice_Com

There has been some unusual action on the Japanese commodities markets that demands a comment.

There has been some unusual action on the Japanese commodities markets that demands a comment.

I mentioned earlier this week that over the last two weeks the Japanese have revved up several new structured investment products tracking commodities.

There are now some "seismic signals" registering in those markets, showing these new ETFs and trusts may be having an immediate impact.

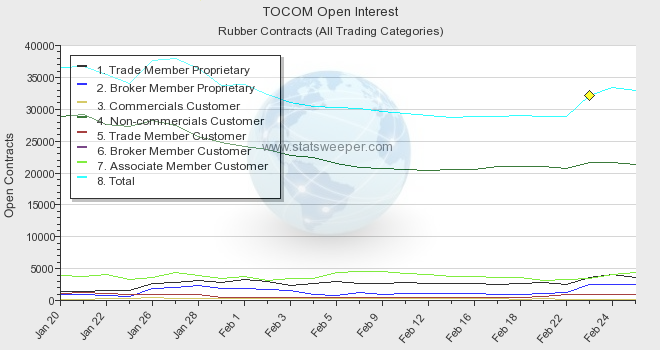

On Tuesday, open interest in rubber futures on the Tokyo Commodity Exchange suddenly jumped 12% (touching off a flurry of prophylactic jokes from some of my coarser Asian colleagues).

This is a large jump. In fact, I can't remember the last time I saw a daily move of this magnitude on a major commodities exchange.

Most interestingly, the majority of the buying came from trade and broker members of the TOCOM. These professional buyers usually account for a very small portion of TOCOM buying. The bulk of purchases almost always comes from non-commercial customers.

Trade and broker members are generally sophisticated buyers. The kind who would be dealing in the structured products TOCOM recently introduced. The big jump in rubber could be a direct result of these new investment options.

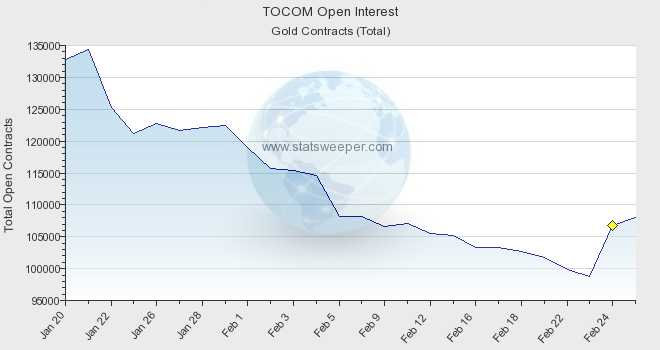

And rubber wasn't a one-off. Yesterday, open interest in TOCOM gold futures jumped 8%. Again, a large portion of the buying came from trade members.

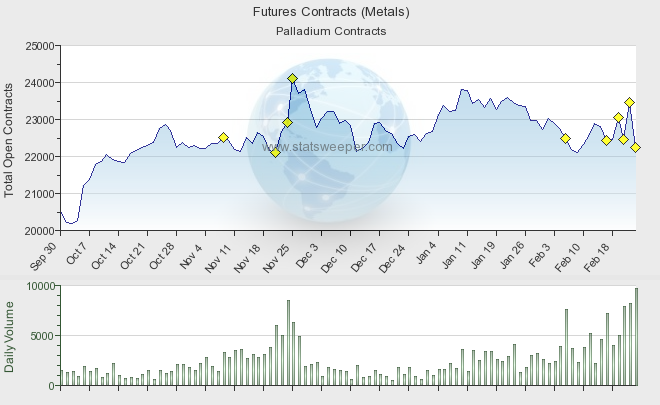

One surprise is that trading in TOCOM platinum and palladium futures has been relatively subdued, despite the launch of new PGM-backed ETFs last week.

But there's been action in other parts of the world. NYMEX palladium futures had a wild week. Last Friday, NYMEX open interest in palladium jumped 2.7%. On Monday, it fell back 2.6%. Only to jump 4.4% on Tuesday and then fall 5.5% yesterday. On near-record volumes.

This is extreme volatility. And it may have to do with speculation that the new Japanese ETFs will increase global demand for platinum group metals.

Something is certainly afoot. Keep an eye on this one.

Here's to rubber, gold and palladium,

Source: http://www.oilprice.com/article-seismic-activity-in-japanese-commodity-markets.html

Dave Forest

By Dave Forest for OilPrice.com who focus on Fossil Fuels, Alternative Energy, Metals, Crude Oil Prices and Geopolitics To find out more visit their website at: http://www.oilprice.com

© 2010 Copyright OilPrice.com- All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.