Benefit of the Doubt Must Go to the Stock Market Bulls

Stock-Markets / Stock Markets 2010 Mar 02, 2010 - 05:15 AM GMTBy: Steven_Vincent

A quick look at a chart of the SPX shows that price has essentially gone nowhere since October. Essentially there is no trend at this time and there hasn't been since October. Another leg down from a lower high would create a 6.5 month head and shoulders topping pattern.

A quick look at a chart of the SPX shows that price has essentially gone nowhere since October. Essentially there is no trend at this time and there hasn't been since October. Another leg down from a lower high would create a 6.5 month head and shoulders topping pattern.

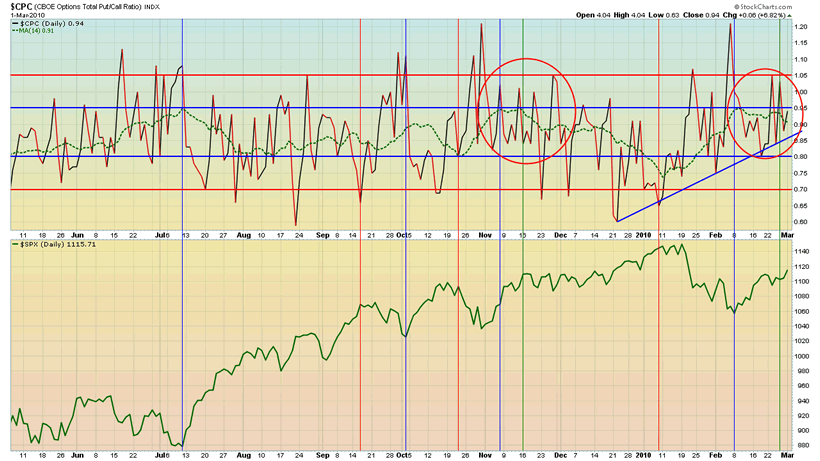

The price close and 14 day MA of the Put/Call ratio is consolidating at its highs and the close is making a series of higher lows even as the market has rallied. The persistence of fear in the market may make a top elusive until the 14 MA comes down to .80 or lower.

Gold is still consolidating but holding up well. Even during a sharp rally in the dollar today, gold did little worse than consolidate. It also appears to be creating a reverse head and shoulders formation. A run to the neckline to complete the head as indicated in the chart would be the next stage. Then a pullback followed by a rally would form the right shoulder. A similar (much larger) pattern launched the most recent bull run from August to December.

The Euro appears to be undergoing a fairly extensive and complicated bottoming process which could produce a more significant rally than otherwise thought. On the other hand, we cannot discount the possibility that this formation is actually a continuation pattern. A

bull move in Euro would likely power equities to complete the reverse head and shoulders pattern as well as a strong move in gold. The fundamental backdrop appears set up for some kind of news event which gives hope to the market that the European debt crisis is blowing over (unlikely). Today's word was that Great Britain is the new Greece.

The setup appears to be for a rally to a double top or new highs in most markets as the dollar sells off and the Euro rallies. Once the reality of the European sovereign debt debacle reasserts itself, selling may be renewed. This is a process that may take several months. There appears to be significant potential for the US Equities, the US Dollar, US Treasuries and Gold to all act as short to intermediate term safe havens during a period of European instability.

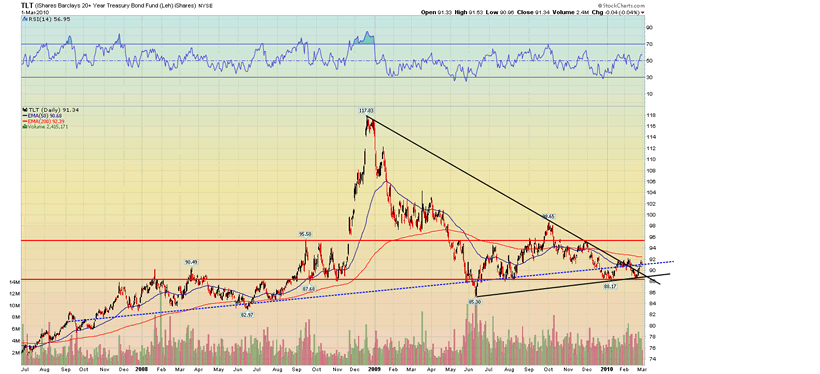

The US long bond looks like it wants to breakout in a setup which evokes the market prior to its 2008 panic run.

It's interesting that the Swiss Market Index has broken strongly to new highs. If a major debt implosion is hitting Europe it would seem unlikely that the stock market of the continent's banking center would be performing so well. Perhaps there is a message here.

For a more detailed analysis of the equities, commodities, precious metals and forex markets watch the BullBear Weekend Update. Here's the first of 10 segments of a 110 minute report:

To watch the full report register to enjoy a one month free trial of BullBear Trading Service:

http://www.thebullbear.com/group/bullbeartradingservice

Good Trading!

Disclosure: No current positions.

By Steve Vincent

The BullBear is the social network for market traders and investors. Here you will find a wide range of tools to discuss, debate, blog, post, chat and otherwise communicate with others who share your interest in the markets.

© 2010 Copyright Steven Vincent - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.