Sultans Of Swap: Fearing the Gearing!

Stock-Markets / Credit Crisis 2010 Mar 04, 2010 - 02:57 PM GMTBy: Gordon_T_Long

Ever imagine getting your tie caught in a mechanical set of gears (sorry ladies - but I will spare you). The results are nasty! Now you know what the Sultans of Swap in the $695 Trillion global OTC derivatives market feel like. Every day the slow moving gears of the world economies relentlessly grind, making it harder and harder for the Sultans to wiggle loose or breath.

Ever imagine getting your tie caught in a mechanical set of gears (sorry ladies - but I will spare you). The results are nasty! Now you know what the Sultans of Swap in the $695 Trillion global OTC derivatives market feel like. Every day the slow moving gears of the world economies relentlessly grind, making it harder and harder for the Sultans to wiggle loose or breath.

Financial Gearing is what we non-accountants often refer to as simply 'Leverage'. Whichever your preference, it has the Sultans of Swap tightly caught in a manner that has greatly restricted their options and is now slowly squeezing the liquidity life out of them.

Financial Gearing is what we non-accountants often refer to as simply 'Leverage'. Whichever your preference, it has the Sultans of Swap tightly caught in a manner that has greatly restricted their options and is now slowly squeezing the liquidity life out of them.

As the economies of the world adjust to the comatose shock of the Financial Crisis, the general public is only now awakening to the fall-out and structural changes resulting from this historic tremor. Some impacts are obvious; the most important are not - yet!

We hear the word 'de-leveraging' almost daily as a tag line whenever the word 'bank' is used. We often hear it when people discuss the amount of debt the public took on during the housing bubble and are now trying to get out from under. So we think we know what there is to know about leverage. Whoa... are we considering all the users and forms of leverage?

The near collapse of the Shadow Banking mechanism and its exotic gearing instruments such as SIV, VIE, and SPE working in conjunction with operatives such as highly leveraged hedge & private equity funds, has left our highly credit reliant global economies beached. These economies are presently attempting to swim once again but with pre-crisis business models within a greatly diminished credit creation infrastructure. We sense something isn't working like it did before, but it is much too simplistic to say it is because credit is more difficult to secure.

The near collapse of the Shadow Banking mechanism and its exotic gearing instruments such as SIV, VIE, and SPE working in conjunction with operatives such as highly leveraged hedge & private equity funds, has left our highly credit reliant global economies beached. These economies are presently attempting to swim once again but with pre-crisis business models within a greatly diminished credit creation infrastructure. We sense something isn't working like it did before, but it is much too simplistic to say it is because credit is more difficult to secure.

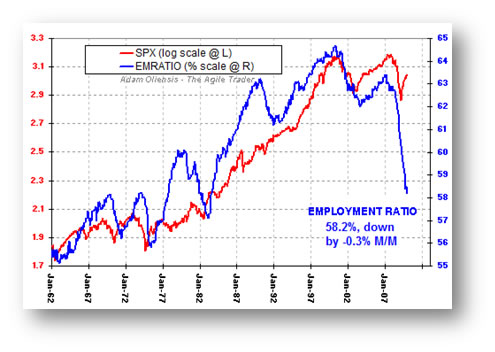

We have staggering numbers of enterprises that have come into existence or grown to unsustainable sizes, solely on the basis of the application of leverage. Like mortgage brokers, appraisers, developers, listing agents, PMI insurers and a raft of other occupations that exploded during the housing bubble, they have collapsed just as quickly with de-leveraging. Economists call it mal-investment. The lay person calls it 'unemployment'.

We need to understand more fully the adjustments associated with de-leveraging or "Reverse Gearing". As I mentioned, some might call it de-leveraging but that distracts from the magnitude and scale of what we are presently experiencing. I like the formal accounting terminology 'reverse gearing'; because it makes it crystal clear the machinery is headed in a different direction.

FINANCIAL GEARING: Systemic Growth of Leverage

Financial Gearing is about any entity increasing debt on its asset liability ledger relative to its earnings, equity or capital base. By increasing debt it potentially allows for greater profits or returns to be made. As in Housing, it is good to have a small down payment and a large mortgage when housing values are increasing. "Leverage" in this case is positive. However, when housing prices fall OR interest rates increase, debt leverage levels can be crippling. A virtuous rising cycle becomes a vicious death spiral.

When we use the terms interest and asset prices as we just did, you can be assured that the next sentence will have something to do with the Wall Street magicians plying their crafty trade. They are insidious in unlocking the strategies that live in the world of price, rate and time differentials. None are more shrewd nor pervasive than the Sultans of Swap.

Let's have a quick 'look see' at how the post financial crisis looks to some key sectors and where the Sultans of Swap with their portly derrieres have their ties caught.

Let's have a quick 'look see' at how the post financial crisis looks to some key sectors and where the Sultans of Swap with their portly derrieres have their ties caught.

A) NON FINANCIAL CORPORATIONS

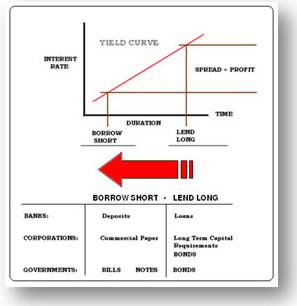

The US is no longer primarily a manufacturing economy nor a service economy. The US has been operating as a Financial Economy since the Dot Com bubble. To survive and indeed prosper in this Financial Economy, corporate America was forced to use its balance sheet both as an engine of growth and as a corporate defense. Multi-national conglomerates have aggressively practiced this for the last decade. Exactly the same way the financial & banking industry is structured to "borrowing short and lend long", American industry has steadily shortened its lending duration to shorter and shorter, less costly, short-term financing. The use of Commercial Paper, easily rolled over on monthly and quarterly periods, was substantially cheaper than issuing longer term corporate notes and bonds. Corporations like GM (GMAC), Ford (Ford Credit), GE (GE Capital) had long ago stopped being industrial corporations. They were financial corporation's leveraging their highly competitive credit ratings to borrow extensively while 'leveraging-up' their balance sheets. Corporations were quick to realize it gave them an unfair competitive advantage in the new emerging world of financial engineering. The less sophisticated were forced to follow or be 'gobbled up" by competitors with elevated stock valuations.

Recent earnings results have showed us clearly that earnings are now being achieved by brutal cost cutting efforts to offset revenue shrinkage. Existing "Lines of Credit" have become more expensive and harder to obtain, especially with satisfactory terms. "Covenant Lite" loans are now due. Roll-Over of funding needs are more onerous.

Funding sources, terms and availability have changed adversely and for the foreseeable future. Corporate America is now strategizing, planning and reacting to this new reality. Pimco call it the 'new normal' of smaller growth rates. It is called 'accelerated unwinding' in corporate board rooms. Increasing corporate cash hoards are your first signs. (1)

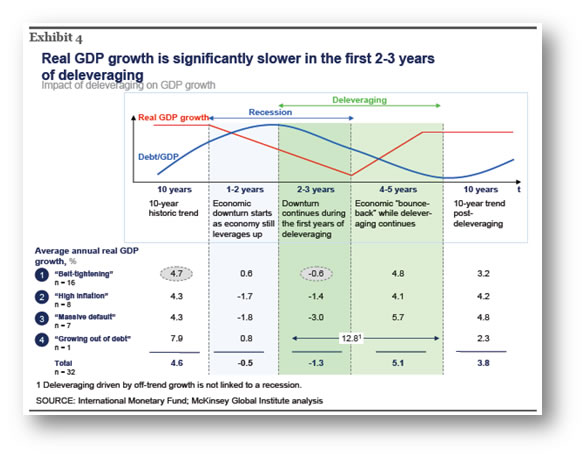

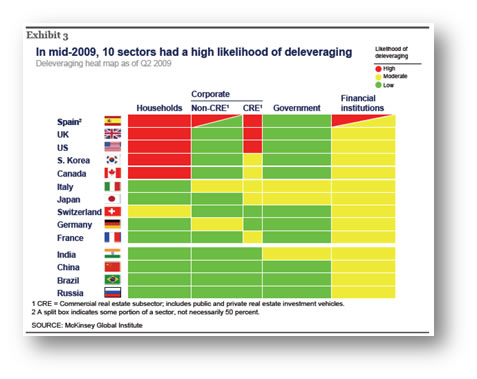

The reason this recession is different is that it is a deleveraging recession. We borrowed too much (all over the developed world) and now are forced to repair our balance sheets as the assets we bought have fallen in value (housing, bonds, securities, etc.). A new and very interesting (if somewhat long) study by the McKinsey Global Institute found that periods of overleveraging are often followed by 6-7 years of slow growth as the deleveraging process plays out. No quick fixes.

Let's look at some of their main conclusions (and they have a solid ten-page executive summary, worth reading.) This analysis adds new details to the picture of how leverage grew around the world before the crisis and how the process of reducing it could unfold. Here is what McKinsey has to say and is listened to by global board rooms:

- Leverage levels are still very high in some sectors of several countries - and this is a global problem, not just a US one.

- To assess the sustainability of leverage, one must take a granular view using multiple sector-specific metrics. The analysis has identified ten sectors within five economies that have a high likelihood of deleveraging.

- Empirically, a long period of deleveraging nearly always follows a major financial crisis.

- Deleveraging episodes are painful, lasting six to seven years on average and reducing the ratio of debt to GDP by 25 percent. GDP typically contracts during the first several years and then recovers.

- If history is a guide, many years of debt reduction are expected in specific sectors of some of the world's largest economies, and this process will exert a significant drag on GDP growth.

- Coping with pockets of deleveraging is also a challenge for business executives. The process portends a prolonged period in which credit is less available and more costly, altering the viability of some business models and changing the attractiveness of different types of investments. In historic episodes, private investment was often quite low for the duration of deleveraging. Today, the household sectors of several countries have a high likelihood of deleveraging. If this happens, consumption growth will likely be slower than the pre-crisis trend, and spending patterns will shift. Consumer-facing businesses have already seen a shift in spending toward value-oriented goods and away from luxury goods, and this new pattern may persist while households repair their balance sheets. Business leaders will need flexibility to respond to such shifts.

You can read the entire report at their web site, including the ten-page summary. http://www.mckinsey.com/mgi/publications/debt_and_deleveraging/index.asp

B) PRIVATE EQUITY

July 2007

July 2007Presently garnering little media coverage is the historic levels of leveraged buyouts that have taken place over the last decade using short term money, pre-financial crisis 'covenant lite' terms & extraordinarily geared balance sheets.

Private Equity firms "bought more than 3000 American corporations from 2000 to 2008, employing close to 10 million people - nearly 1 of every 10 workers in the private sector.

The formula was simple: buy a target company with a small down payment and lots of other people's money. Leverage it with huge loans using the acquired company - not the Private Equity firm - as collateral. Cut short-term costs through radical layoffs. Resell at a profit within 5 years, before the cuts & debt have totally crippled the business.

In ten years Private Equity deals have generated more than $1 Trillion in new debt - which will come due just when these businesses are least likely to be able to pay it off. As a result it is forecasted that about half of all Private Equity owned companies will likely collapse between now and 2015, throwing 2 million people out of work" (2)

C) BANKS & FINANCIAL INSTITUTIONS

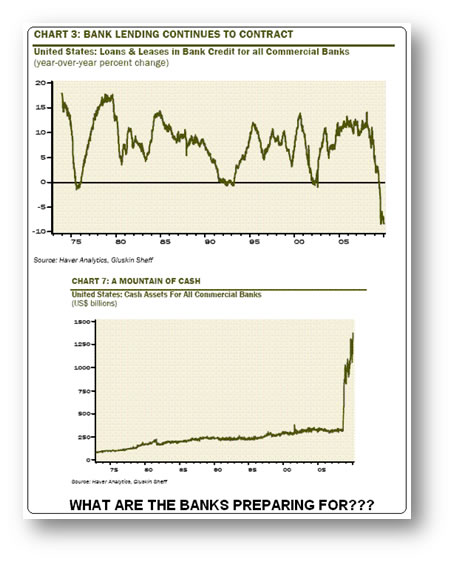

The raison d'être of banks is the gearing or leverage of their balance sheets. The fractional reserve banking system allows the expansion of bank balance sheets but limits it with reserve requirements. However loans can be increased with more Capital infusions. The banks have over time, creatively found ways to utilize debt instruments as capital thereby fulfilling bank regulatory requirements. These debt instruments, which have been classified as Tier 1 Capital, are custom agreements typically not tradable that can only be valued by the use of extremely complex proprietary non-auditable bank models. The assumptions and variables used in these models make their 'mark to market' valuations much closer to 'market to myth'. They are blatantly obscure and totally non transparent to investors. The problem is these 'mystical assets' have become such a large part of bank capital assets. This has fostered the recent explosion in bank lending, that current reclassification attempts by bank regulators and the implementation of the new International Basel Banking definitions of Tier 1 Assets have led to significant conflicts and crippling potential problems for the banks. The solution to date has been to simply defer any changes until the credit crisis subsides. Since the investment community is now aware of the problem but still cannot get enough information, investment professionals are skeptical of investing in banks, thereby allowing them to raise capital to allow for future 'adjustments'.

The raison d'être of banks is the gearing or leverage of their balance sheets. The fractional reserve banking system allows the expansion of bank balance sheets but limits it with reserve requirements. However loans can be increased with more Capital infusions. The banks have over time, creatively found ways to utilize debt instruments as capital thereby fulfilling bank regulatory requirements. These debt instruments, which have been classified as Tier 1 Capital, are custom agreements typically not tradable that can only be valued by the use of extremely complex proprietary non-auditable bank models. The assumptions and variables used in these models make their 'mark to market' valuations much closer to 'market to myth'. They are blatantly obscure and totally non transparent to investors. The problem is these 'mystical assets' have become such a large part of bank capital assets. This has fostered the recent explosion in bank lending, that current reclassification attempts by bank regulators and the implementation of the new International Basel Banking definitions of Tier 1 Assets have led to significant conflicts and crippling potential problems for the banks. The solution to date has been to simply defer any changes until the credit crisis subsides. Since the investment community is now aware of the problem but still cannot get enough information, investment professionals are skeptical of investing in banks, thereby allowing them to raise capital to allow for future 'adjustments'.

If Tier 1 Capital problem is not enough, the banks have also been employing practices that simply kept alarming amounts of loans off their balance sheets completely. There are a broad range of practices used but the largest was the use of SIV's or Structured Investment Vehicles. Over the last decade SIV's have been a major wheel in using low yielding public money market funds to foster the procurement of the toxic assets that have become so well covered by the media. Slowly the banks have had to pull these structures back on their balance sheets but at a very 'measured' and glacially slow rate.

If Tier 1 Capital problem is not enough, the banks have also been employing practices that simply kept alarming amounts of loans off their balance sheets completely. There are a broad range of practices used but the largest was the use of SIV's or Structured Investment Vehicles. Over the last decade SIV's have been a major wheel in using low yielding public money market funds to foster the procurement of the toxic assets that have become so well covered by the media. Slowly the banks have had to pull these structures back on their balance sheets but at a very 'measured' and glacially slow rate.

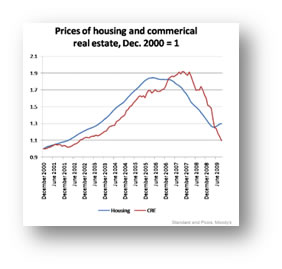

The government is presently keeping the yield curve at a historically steep rate, for a protracted period of time, to allow the banks time to attempt some sort of work-out. Unfortunately delinquencies and foreclosures on existing loans have reached such a level that the net result is barely any real resolution. Now collapsing Commercial Real Estate values are adding another truly massive problem to the mix. (3)

It is not only the major banks, or the regional banks (which are being taken over by the FDIC at approaching 3-5 per week - 140 since the crisis began) that have problems because of excessive gearing. Throughout the financial services industry the collapsing commercial real estate market is putting pressures on Insurance companies, Real Estate Developers, REITs, Property Management Corporations and a whole mix of financial services who are major holders of commercial real estate assets. Their balance sheet assets are collapsing, placing their solvency into question and minimally forcing a major contraction in any new activities.

| 2010 | 2011 | 2012 | 2013 | 2014 | TOTAL | |

| COMMERCIAL REAL ESTATE | 552 | 560 | 537 | 480 | 459 | 2.7T |

| LEVERAGED BUY-OUT DEBT | 71 | 113 | 203 | 294 | 406 | |

| HIGH YIELD DEBT | 35 | 64 | 75 | 82 | 126 | |

| TOTAL | 657 | 737 | 815 | 856 | 992 | 4.2T |

The above chart from Morgan Stanley, Fixed Income Research & Economics (4) indicates we will require $4.2 TRILLION in new financing to accommodate loans of questionable viability, existing lending terms or Loan to collateral value coming due.

D) SOVEREIGN COUNTRIES

D) SOVEREIGN COUNTRIES

I have been very concerned about all of the items mentioned above, but my biggest concern is the staggering amounts of debt being increased almost daily - Sovereign Country Debt. This is not just a USA problem but global, as countries have taken on debt loads to be used for stimulus fiscal spending. This debt must be paid!

My recent article: "Eight Financial Fault Lines Appear In The Euro Experiment!" lays out the undeniable fractures that are occurring. The balance sheet gearing problem or rather "game" in this instance is how this debt is presently being funded. In the PIIGS there is large concern with how debt has been accounted for going back to the inception of the EU and what sovereign governments did to qualify and gain entry under the Maastricht Treaty.

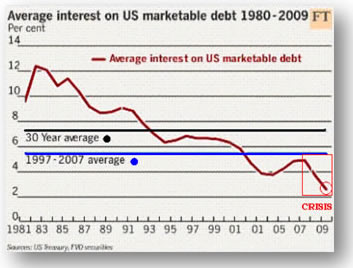

Additionally, Governments are using the "Duration" game to hide the loads. Specifically they are lending on short term duration where interest expenses are extremely low versus locking in the loan on longer term bonds. The latter is the traditional manner governments employ to protect taxpayers from increases in interest rates. New debt and roll-over debt is being funded on less than 12-18 months terms. This is leaving accelerating balances of debt which will need re-funding in a year's time. What happens if interest rates move up from unprecedented historically low rates to even moderately higher rates? Why would governments even consider such a strategy?

Additionally, Governments are using the "Duration" game to hide the loads. Specifically they are lending on short term duration where interest expenses are extremely low versus locking in the loan on longer term bonds. The latter is the traditional manner governments employ to protect taxpayers from increases in interest rates. New debt and roll-over debt is being funded on less than 12-18 months terms. This is leaving accelerating balances of debt which will need re-funding in a year's time. What happens if interest rates move up from unprecedented historically low rates to even moderately higher rates? Why would governments even consider such a strategy?

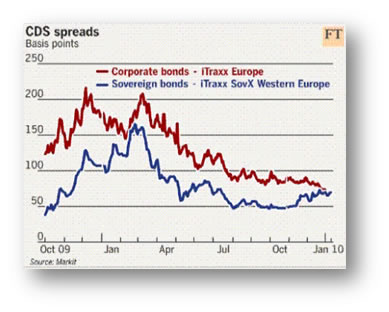

Credit Rating agencies are so concerned about the current situation that they have already started warning about sovereign credit rating downgrades and in some instances have downgraded countries such Greece.

Downgrades immediately make new debt issuances for a sovereign country more expensive. Poor credit ratings and rising rates will quickly bankrupt any sovereign nation.

E) REVERSE GEARING (DELEVERAGING) & ITS GLOBAL RAMIFICATIONS

The LEX column in the Financial Times this week observes, concerning the report:

"It may be economically and politically sensible for governments to spend money on making life more palatable at the height of the crisis. But the longer countries go on before paying down their debt, the more painful and drawn-out the process is likely to be. Unless, of course, government bond investors revolt and expedite the whole shebang."

And that is the crux of the matter. We have to raise $1 trillion-plus in the US from domestic sources. Great Britain has the GDP-equivalent task. So does much of Europe. Japan is simply off the radar. Japan, as I have noted, is a bug in search of a windshield.

Sometime in the coming few years the bond markets of the world will be tested. Normally a deleveraging cycle would be deflationary and lower interest rates would be the outcome. But in the face of such large deficits, with no home-grown source to meet them? That worked for Japan for 20 years, as their domestic markets bought their debt. But that process is coming to an end.

James Carville once famously remarked that when he died he wanted to come back as the bond market, because that is where the real power is. And I think we will find out all too soon what the bond vigilantes have to say.

And so we have uncertainty all around us. What will our taxes look like in the US in just 12 months? Health care? Who will finance the bonds, without a credible plan to reduce the deficit? And any plan that has Nancy Pelosi as its guarantor is by definition not credible.

SULTANS OF SWAP

I know many of you are worried about our Sultans of Swap with their ties caught in the gears. What does this mean to them? More importantly you ask, what does it mean to us all?

Through the magic mix of Credit Default Swaps, Dynamic Hedging and Interest Rate Swaps the Sultans of Swaps have effectively been controlling interest rate spreads. Through Regulatory Arbitrage they extorted tremendous political sway globally. They have existed in the world of risk free spreads. To them low interest rates simply attract more volume for their concoctions. But this has changed. Individuals, Corporations, Financial Institutions and Sovereigns all have more debt than they can handle. Is the global savings growth rate sufficient to handle further debt growth plus debt associated with possible compounding interest payments with unpaid balances and roll-overs? We are very likely nearing a global supply & demand cusp with China's reserve growth rate slowing, but without question we are seeing and will see accelerated defaults from Commercial Real Estate (2) to Sovereign Debt. We don't need to see defaults. How many Greek Sovereign credit downgrades would it take to begin cascading collateral calls?

Through the magic mix of Credit Default Swaps, Dynamic Hedging and Interest Rate Swaps the Sultans of Swaps have effectively been controlling interest rate spreads. Through Regulatory Arbitrage they extorted tremendous political sway globally. They have existed in the world of risk free spreads. To them low interest rates simply attract more volume for their concoctions. But this has changed. Individuals, Corporations, Financial Institutions and Sovereigns all have more debt than they can handle. Is the global savings growth rate sufficient to handle further debt growth plus debt associated with possible compounding interest payments with unpaid balances and roll-overs? We are very likely nearing a global supply & demand cusp with China's reserve growth rate slowing, but without question we are seeing and will see accelerated defaults from Commercial Real Estate (2) to Sovereign Debt. We don't need to see defaults. How many Greek Sovereign credit downgrades would it take to begin cascading collateral calls?

"If the US administration's budgetary projections are correct, the national debt to GDP ratio will climb from 40% in 2008 to 77.3% in 2020. Even if we are able to curb future deficits, it is likely that this ratio will grow over the next decade. As a result, rates on treasuries and other debt obligations are likely to climb over the coming decade with profound implications for the debt and stock markets." (5). It is not a matter of 'if' - it is a matter of 'when'. With $3.7T in Gross Derivative Credit Exposure outstanding we are talking some potentially very serious problems.

As I outlined in "Sultans of Swap - Explaining $605 Trillion in Derivatives" significant amounts of debt today is hidden in the murky depths of "special" purpose instruments - like SPE, SPV & SPC or "Structured" entities- like SIV. This is done to keep debt off the balance sheet. Why would you not want something on the balance sheet where investors and interested parties could see what is happening? Obviously so you can camouflage them from what is happening. The reason is fundamentally Credit Ratings. Keep your debts low, your credit ratings high and the cost of money is cheap. The cheaper money is, the more borrowing will occur. Everyone is happy except the unwitting lender.

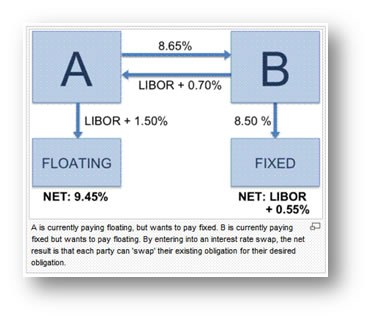

To the right I illustrate the simplest of interest rate swaps. What you need to appreciate is that everything is normally tied to LIBOR on the floating leg. LIBOR goes up, one party gets hurt. If rates go up either party could suffer credit rating downgrades. A credit rating downgrade can and often does trigger collateral calls. One of the parties then gets hurt. So any significant moves in interest rates and credit ratings and we have problems. With $3.7T in Gross Derivative Credit Exposure outstanding we are talking some potentially serious 'hurting'.

To the right I illustrate the simplest of interest rate swaps. What you need to appreciate is that everything is normally tied to LIBOR on the floating leg. LIBOR goes up, one party gets hurt. If rates go up either party could suffer credit rating downgrades. A credit rating downgrade can and often does trigger collateral calls. One of the parties then gets hurt. So any significant moves in interest rates and credit ratings and we have problems. With $3.7T in Gross Derivative Credit Exposure outstanding we are talking some potentially serious 'hurting'.

What we need to differentiate is who exactly the Sultans of Swap are: Are they the Counterparties A & B who hold the OTC contract? Are they the third party that administers the ongoing payment exchanges? Are they the issuers or holders of CDS's to protect against counterparty failure? Are they the magicians that put this OTC contract together, took a quick fee and rapidly left the scene? Are they the banks making almost obscene trading charges ($35B in 2009 trading fees alone (6)) on brokering these swaps from parties desperate to re-align contract bets since the financial tsunami arrived? Or is it all of them as cumulative 'cohorts in crime'?

There is an old saying in poker parlance: "when you look around the table and you can't tell who the patsy is - it is you!" I will leave it to you, shrewd reader, to determine who the patsy is and who the card shark is at this table! There is only one person holding a risk free winning hand. They may all be Sultans of Swap but there is only one Emir or Merlin here!

What is especially evident to many of these Sultans is that they have their ties clearly caught. They now foresee a rising LIBOR, likely Credit Rating downgrades, and probable collateral calls as inevitable in the ongoing process of reverse gearing. The gears just keep on turning.

Let me close with a point of clarification. For those of you having troubles understanding any of the above, let me relate a story. I was explaining swaps to a New Yorker who appeared to have no financial background. When I finished my 'swaps in 100 words or less' dissertation he simply nodded his head without any questions. He then looked me straight in the eye with a knowing expression and explained. "In New York if I owe the Mob $100 dollars and I can't pay, but my best friend Bob owes me $100 and hasn't paid me yet, then Bob owes the mob $100. A swap, right? Well, when the mob collects the $100 from Bob, and Bob now has a broken leg and refuses to ever talk to me again, I still owe the mob $50 for collection fees plus the 'vig' on the original $100. The mob is now up $150 and I desperately need more friends. A swap, right - yeh I understand!"

SOURCES:

(1) 03-04-10 With Fistfuls of Cash, Firms on Hunt Wall Street Journal

(2) “The Buyout of America” Josh Kosman, Penguin Group, 2009. Quotation from front jacket flap.

(3) 03-02-10 Realpoint Research Monthly Delinquency Report .pdf Realpoint

(4) Wall of debt a barrier to US recovery – 12-16-09 – The Sydney Morning Herald, Malcolm Maiden

(5) 03-02-10 Obama's Wake Up Call and What It Suggests for Future Interest Rates Stephen Shefler

(6) 03-01-10 Frank, Peterson Vow to Eliminate Provision Keeping Swaps Opaque Bloomberg

McKinsey Global Institute http://www.mckinsey.com/mgi/publications/debt_and_deleveraging/index.asp

FREE Additional Research Reports at Web Site: Tipping Points

Gordon T Long gtlong@comcast.net Web: Tipping Points

Mr. Long is a former executive with IBM & Motorola, a principle in a high tech start-up and founder of a private Venture Capital fund. He is presently involved in Private Equity Placements Internationally in addition to proprietary trading that involves the development & application of Chaos Theory and Mandelbrot Generator algorithms.

Gordon T Long is not a registered advisor and does not give investment advice. His comments are an expression of opinion only and should not be construed in any manner whatsoever as recommendations to buy or sell a stock, option, future, bond, commodity or any other financial instrument at any time. While he believes his statements to be true, they always depend on the reliability of his own credible sources. Of course, he recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction, before making any investment decisions, and barring that, we encourage you confirm the facts on your own before making important investment commitments.

© Copyright 2010 Gordon T Long. The information herein was obtained from sources which Mr. Long believes reliable, but he does not guarantee its accuracy. None of the information, advertisements, website links, or any opinions expressed constitutes a solicitation of the purchase or sale of any securities or commodities. Please note that Mr. Long may already have invested or may from time to time invest in securities that are recommended or otherwise covered on this website. Mr. Long does not intend to disclose the extent of any current holdings or future transactions with respect to any particular security. You should consider this possibility before investing in any security based upon statements and information contained in any report, post, comment or recommendation you receive from him.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.