U.S. Negative Real Interest Rates, Case-Shiller CPI Now Tracking CPI-U

Interest-Rates / US Interest Rates Mar 05, 2010 - 04:55 AM GMTBy: Mike_Shedlock

It's been about 4-5 months since I last talked about Case-Shiller CPI (CS-CPI). Case-Shiller CPI is formulated by substituting the Case-Shiller housing index for Owner's Equivalent Rent (OER) in the CPI for all urban consumers (CPI-U) index, commonly shortened to CPI.

It's been about 4-5 months since I last talked about Case-Shiller CPI (CS-CPI). Case-Shiller CPI is formulated by substituting the Case-Shiller housing index for Owner's Equivalent Rent (OER) in the CPI for all urban consumers (CPI-U) index, commonly shortened to CPI.

For a complete description of the reasons and methodology for making this substitution, please see What's the Real CPI?

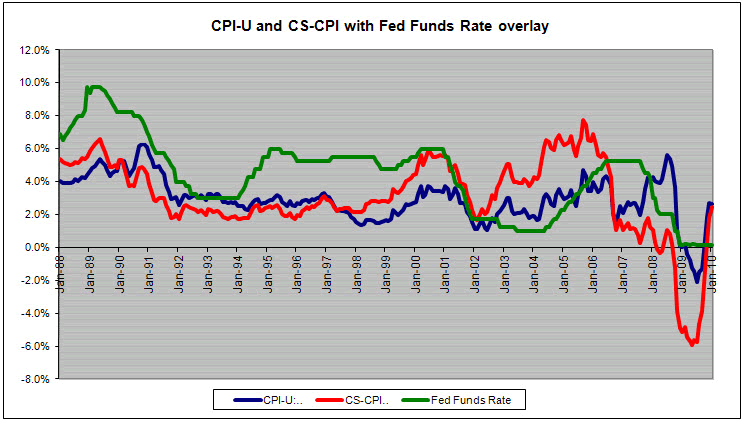

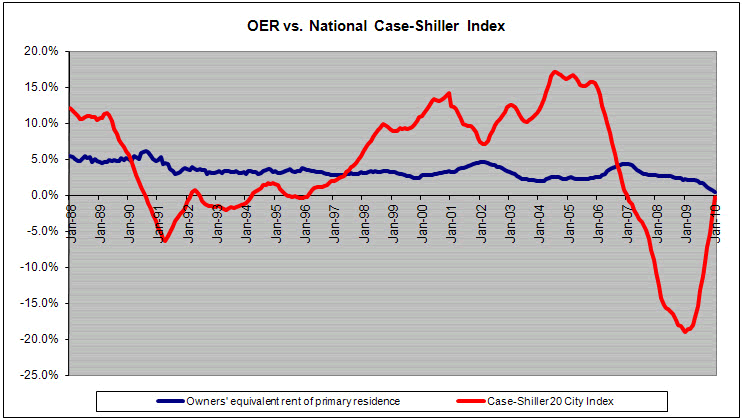

With year-over-year home prices flattening, the effect of substituting the Case-Shiller housing index for Owners' Equivalent Rent in CPI calculations has worn off as the following charts show.

CS-CPI vs. CPI-U

OER vs. Case-Shiller Housing Index

My friend "TC" who produced the charts had this to say...

CS-CPI – January 2010

CS-CPI has risen YOY for the third month in row and measures +2.4% YOY. Meanwhile the government’s CPI-U also has risen YOY three consecutive months and measures +2.6% YOY (see first graph). The divergence between the two is to due to using the Case Shiller 20 city index, rather than the government’s housing metric of Owners’ Equivalent Rent (OER). The OER now makes up an amazing 25.2% of CPI, it's heaviest percentage on record.

While the divergence was huge during the housing boom (due to OER underestimating home prices) and even wider during the housing bust (due to OER overestimating home prices), it is now relatively small.

January 2010 OER is at +0.4% YOY, while the Case-Shiller 20 city index for January will likely read -0.3% YOY for only a 70 basis point divergence as noted in the second chart.

What the charts shows is how low real interest rates were (and thus the Fed Funds Rate was) between 2003 and 2006. Greenspan missed the negative real interests that fueled the housing bubble by focusing on rent as opposed to housing prices.

Likewise, starting in 2007 real interest rates were high, even after Bernanke cut rates to zero.

With home prices stabilizing and OER falling, CS-CPI and CPI-U are tracking together. Moreover, real interest rates which had been positive since mid-2006 (as measured by CS-CPI), are once again negative.

Yet, If housing takes another turn down and OER continues to drop (both of which I suspect will happen), we can easily see the Fed Funds Rate, CPI-U, and Case-Shiller CPI converge towards zero, especially if energy prices drop as well.

That deflationary combination is not what Bernanke is hoping for at all.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.comClick Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2010 Mike Shedlock, All Rights Reserved.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.