S&P VIX Ratio Signals Looming Decline for the Stock Market

Stock-Markets / Stock Markets 2010 Mar 09, 2010 - 02:57 AM GMTBy: Ashraf_Laidi

Exactly fifty two weeks after the S&P500 hit its 12-year lows at 666, the index rose 68%, driving down the VIX near January's 19-month lows. Much analysis has been done on equity indices and the VIX on the S&P index options. But the relationship between the two merits closer attention. Neither the S&P500, nor the Dow have yet retested their January highs.

Exactly fifty two weeks after the S&P500 hit its 12-year lows at 666, the index rose 68%, driving down the VIX near January's 19-month lows. Much analysis has been done on equity indices and the VIX on the S&P index options. But the relationship between the two merits closer attention. Neither the S&P500, nor the Dow have yet retested their January highs.

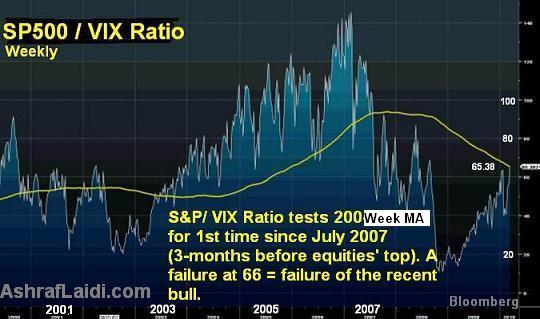

But the technical dynamics of the SP500/VIX ratio can be used as a possible forward-looking signal for a looming decline in the S&P500 index. On Friday, March 5th (52nd Friday of the 666 low in the S&P500), the S&P500/VIX ratio hit a 5-week high at 65.38. This level suggests these key developments:

1. The chart below is the S&P/VIX ratio since July 2009, indicating a possible double top around 65. Note that the first top (first circle) consists of 3 spikes (Jan 11, 14 and 19), followed by a 38% decline in the ratio in 4 days, consistent with a 5% sell-off in the S&P500.

2. The chart below shows the 65.38 level in the SP500/VIX ratio coincides with the trend line resistance extending from the Aug 22, 2008 high through the January 19, 2010 high,

3. Finally, the weekly S&P/VIX chart below shows Fridays high of 65.38 also coinciding with the 200-week moving average; a high profile measure of long term trend. The last time the ratio neared its 200-week MA was in July 2007; 3 months before equities had hit their record highs.

NOTE: The yellow text inside the chart should say 200-WEEK not 200-day MA

Such ratio analysis may not be the most popular approach to discerning market dynamics, but their viability can be just as relevant as price charts or macroeconomic technicals. We have shown on this site how ratio analysis of related markets could offer valuable forward-looking signals; Gold/Oil ratio ; Equities/ Gold ratio and gold/silver ratio

Failure of the SP500/VIX ratio to sustain recent gains would coincide with a clear technical failure and add more conviction to the technically-oriented equity watchers. We have seen S&P500 testing the trend line resistance from the mid Jan highs, while seeing the VIX deepening losses below 17, but it is the topping formation in the S&P 500 / VIX ratio, which could make the case for fresh downside in equities.

Meanwhile in currencies, we reiterate our initial call from March 2nd about the two vital points emerging in Forex confirming the US strength:

1. The daily correlation between USD Index and the SP500 is NO LONGER negative (+0.10) for the first time since August 2008. This is partly explained by the win-win scenario for the USD, whereby rising USD continues to emerge during falling stocks, but is also starting to emerge despite the recent increase in equities.

2. USD-denominated 3-month LIBOR is now equal to its yen counterpart at 0.25% for the first time in 7 months. It was in August 2009 when USD-libor fell below JPY libor for the first time ever, rendering USD the cheapest funding currency in the industrialized world and making it the preferred vehicle for carry trades into higher yielding FX, equities and commodities.

The stabilization process in USD LIBOR began in late November as the Dubai debt revelations caused the first blow to global risk appetite, causing a drying up in liquidity and stabilization in USD-liquidity. The reversal of USD-negativity was extended into early December when an unexpectedly strong US November jobs report (released on December 4th) boosted fed funds futures to expect a rate hike as early as June. The triple downgrade assault of Greeces credit rating (Fitch on Dec 8, S&P on Dec 17 and Moodys on Dec 22) magnified the move out of EUR longs as well as other risk assets to the benefit of fresh longs in USD.

Although USD Libor (0.25%) stands below its EUR counterpart (0.59%), it fared more positively over the last 3 months as it remained near 0.25% since November. That is in contrast to EUR Libor, which fell 15% from its November highs of 0.68%.

The stabilization in USD Libor costs reflects the fading of the USD-carry trade and the greenbacks improved performance regardless of equity performance. In fact, the correlation between USD index and the SP500 has now hit positive territory +0.10 for the first time since August 2008. This is partly explained by the win-win scenario for the USD, whereby rising USD continues to emerge during falling stocks, but is also starting to emerge despite the recent increase in equities.This supports our ongoing call for $1.32 in $EURUSD by end of Q1.

Follow me on twitter http://twitter.com/alaidi for more frequent market updates

By Ashraf Laidi

AshrafLaidi.com

Ashraf Laidi is the Chief FX Analyst at CMC Markets NA. This publication is intended to be used for information purposes only and does not constitute investment advice. CMC Markets (US) LLC is registered as a Futures Commission Merchant with the Commodity Futures Trading Commission and is a member of the National Futures Association.

Ashraf Laidi Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.