Fraud, Mastered by the Criminal Banking Industry

Politics / Credit Crisis Bailouts Mar 09, 2010 - 09:32 AM GMTBy: Mike_Stathis

I have discussed the financial industry on numerous occasions. My sentiment has not changed.

I have discussed the financial industry on numerous occasions. My sentiment has not changed.

Those looking for some kind of investment “payday” should stay clear of the banks as an investment. The risk is still very high.

Unrelated to my prognosis, I can tell you that I have NEVER personally INVESTED in banks and I don't ever plan to because I feel they are parasites.

I could go on and on how criminal this industry is, but I don't have the time to write volumes of books. But let’s have a look at what they’ve been up to lately.

The big banks—the banking cartel, or the banks that own the Federal Reserve—have received almost all of the bailout funds with which to scoop up smaller banks (which in some cases were not insolvent).

Despite raising fees and credit card interest rates while paying out essentially nothing for deposits, these criminals have not been satisfied.

They have made risky gambles in the capital markets with depositors’ assets.

But don’t assume shareholders have benefited because they have not.

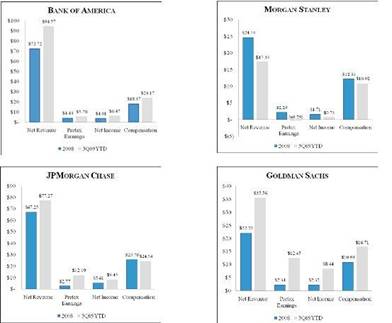

In addition to collapsing share prices and stock dilution, the banks have extorted shareholder equity by issuing employee compensation that in some cases has wiped out TOTAL profits from 2009.

There are instances where compensation has actually exceeded total profits.

Over the past 5 years, the biggest banks have paid out an eye-popping (roughly) $500 BILLION in bonuses for employees. This unbelievably ridiculous sum of money has encouraged them to take excessive risks and engage in fraud, knowing there are no real penalties.

This taxpayer extortion has served to strengthen the moral hazard the industry has enjoyed for decades.

Normal employee compensation is ridiculously high in the financial industry, at around 60% of profits.

But in 2009, compensation soared as high as $1.45 for every $1 of profits for at least one bank!!! I consider this shareholder fraud.

Of course they get away with it for the same reason Washington gets away with its own brand of criminal activity — most Americans have been transformed into compliant zombies.

Even more disgusting is the fact that much of these “reported earnings” are NOT real earnings at all, but have been created by a relaxation of market-to-market accounting and changes implemented in 2009 (with the approval of Washington) as a way to realize short-term profits to justify ridiculous bonuses.

But these tactics are short-term.

And without a real recovery, I can guarantee you these banks will get hit big with losses. This is likely to lead to either more lenient accounting changes or more bailouts, so the banks can repeat the process of extorting funds from shareholders and taxpayers.

I can tell you in advance there will be no real recovery anytime soon.

In fact, I could make a very strong case that ; ever.

Let’s take a look at some of these criminal payouts. there will be no real recovery for most Americans

For 2009, Citigroup “earned” $24.9 billion.

But after paying its greedy, useless, criminal employees, the soon-to-be deceased member of the banking cartel actually reported a NET LOSS of $1.6 billion!!

That means Citi stole every penny of earnings and borrowed money to pay employee bonuses!

Other members of the cartel aren’t far behind Citi, with Bank of America wiping out 88% of its 2009 profits by shuttling these funds to employees.

Morgan Stanley sent 94% of profits to its employees.

JP Morgan (arguably the biggest of all banking criminals) sent 63% of 2009 profits (much of which were based on the world’s two biggest banking heists—WaMu and Bear Stearns, financed by taxpayers) to its employees.

Meanwhile, America’s largest insolvent banks — Citigroup and bank of America — are being kept afloat only by the blank check from the Federal Reserve and U.S. Treasury.

And they collapsed the quarterly dividend to common shareholders. Citi completely eliminated its dividend.

The fact is that these insane “bonuses” are largely responsible for this economic collapse. It’s like rewarding thieves for robbing people. The more they are rewarded, the more they steal. The ONLY difference is that the banking executives are immune from criminal prosecution.

First of all, without any limits on compensation, bank A is free to raise compensation above what bank B has set, and bank C does the same and so forth. This sets off a compensation war paid for by shareholders and taxpayers.

To justify this extortion, banks claim they need to offer “competitive” compensation to attract and retain the “best talent.” The so-called big concern in capping bonuses and other forms of executive compensation is that it will cause a “brain-drain” on Wall Street, as the “geniuses” opt for better positions elsewhere.

First of all, I challenge anyone to show me a company that would line up to hire individuals who destroyed the global economy.

Moreover, the last thing Wall Street has are geniuses. These are mainly guys who have lived an easy life, from the non-rigors of business school, leading them to the path of easy money as a reward for the greed, incompetence and in many cases, their criminal activities.

All throughout, the culture of these useless parasites has bred a sense of unsubstantiated entitlement. Let them go, as they will join the ranks of the unemployed.

Goldman Sachs has taken a different approach, rewarding its criminals around 60% of 2009 earnings, despite recording its biggest profits in history. It has done this as a PR tool to calm the outrage people have over the many crimes this bank has committed.

As the figures below show, for 2008, compensation was much higher relative to revenues, net income or by virtually any other measure.

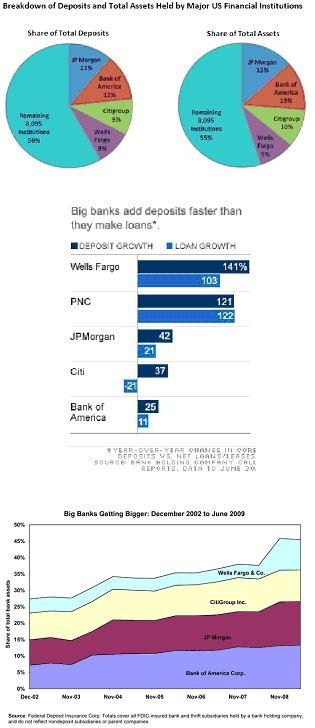

As consumers have become more cautious about their financial uncertainty, deposits at the nation’s largest five banks have soared over the past year (data ending June) by 29%.

But new consumer deposits certainly aren’t the only source of bank deposits. As you will recall, aided by the assistance from the criminal Federal Reserve Bank, FDIC and the U.S. Treasury, members of America’s banking cartel have also added to their deposits and assets via numerous banking heists and taxpayer-funded bailouts.

The five largest U.S. banks added more than $852 billion in deposits over the past year, $100 billion of which came from the TARP.

As you know, TARP was passed by criminal methods of intimidation, coercion and lies as a way to help bolster the economy.

While Washington made no specific requirements as to what to do with this money, politicians continue to insist that it handed over tax dollars to the banks so they would provide more loans to consumers.

This has not happened.

TARP has NOT WORKED.

Banks have held on to funds supplied by taxpayers and the Fed. Credit has continued to contract for nearly 1 year.

And the “too big to fail” banks are now bigger than ever, after having scooped up other banks using taxpayer funds, with very little and in some cases absolutely no risk whatsoever.

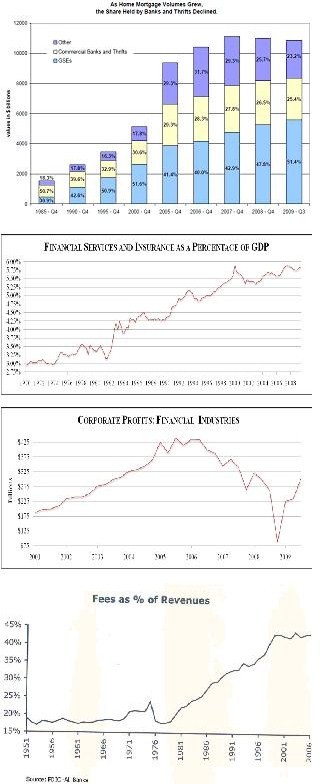

Let’s take a look at the recent past to see what happened. Although there were hundreds of new laws passed that enabled the banks to engage in risky behaviors and exploit consumers, the single most influential bill that contributed to the collapse was the 1999 repeal of the Glass-Steagel Act. This allowed commercial and investment banks to intermingle. Thereafter, the bank megamergers began.

As you will recall, two of the biggest proponents of the repeal of the Glass-Steagal New Deal reform were Alan Greenspan and Larry Summers.

But of course there were others; Rubin, Gramm and many more, many still closely connected to Washington as you would imagine would be the case with any crime syndicate.

As you can see from the first chart, after 2000, the share of mortgages held by the GSEs (Fannie and Freddie) soared relative to the previous decade. Of course, the manner by which the banks and GSEs packaged and shuttled these mortgages around was a bit complex, but I discussed the basic process in America’s Financial Apocalypse.

The next series of charts show how the financial industry grew to comprise a significant share of the economy.

The final chart in this series illustrates how banks made fees a huge part of revenues.

However, you should note that this data is not all-inclusive. Profits soared since 2001, as the real estate bubble was in the early stages of heating up.

You should note that many investors exited the stock market prior to or in the early stages of the dotcom collapse and bought homes.

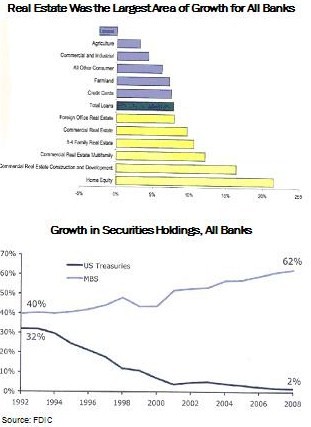

The final two charts illustrate how banking business became dependent on real estate transactions.

These two charts might cause a bit of confusion. As the first chart reveals, over the past several years, real estate expanded to represent the largest area of growth for all banks.

The second chart shows that, since 1992, the banking system gradually decreased its share of mortgage-backed securities, replacing them with U.S. Treasury securities.

Okay, so is anyone confused? While real estate was the largest area of growth for banks, that means they got involved in the mortgage business.

So why didn’t they own much mortgage-back securities?

Well, back in 1992, mortgage-backed securities weren’t nearly as big as they are today. Therefore, most banks held onto most of their mortgages.

By 2000, Fannie and Freddie started to get out of control. They were pushing every piece of mortgage paper they could get their hands on through the securitization process. This began the massive wave of sub-primes and ARMs, which really heated up as home prices soared.

Over the years since the 1980s, as securitization matured, banks began holding fewer loans. Instead of baring the risk of loans, they could flip them to others and receive a fee. This would allow them to initiate even more loans.

In fact, this enabled them to underwrite very risky loans, knowing they would dump them off to other institutions and investors. And that is exactly what they did.

The process went into overdrive. The engine keeping the entire machine going was Fannie and Freddie in the public sector, and Bear Stearns and Lehman in the private sector.

Obvious problems were reported back in 2004 when the FBI issued a report discussed massive mortgage fraud that would lead to big problems.

By 2005, Fannie Mae was found guilty of accounting fraud of nearly $11 billion, but Washington paid no attention. It was business as usual.

Today, Franklin Raines, then CEO at the time the fraud was committed enjoys a nice peaceful life, living off millions he received during his years turning Fannie Mae into a weapon of mass economic destruction.

Alan Greenspan continued to fuel the fire by encouraging homebuyers refinance with ARMs, only to raise interest rates by 400 basis points a few months later.

It was a disaster ready to strike, and could be seen by anyone who actually bothered to sit down and examine the data.

As you know, very few bothered to do that.

The problem was, when the music stopped, most of the big banks were stuck with the trash they had planned to dump off to naïve investors. The rest is history.

What can you do about this?

Those who read America's Financial Apocalypse (2006) and Cashing in on the Real Estate Bubble (2007) were not only alerted to the catastrophe we see today, but were provided with SPECIFIC ways to profit that have yielded over 100% gains since then. See here for some examples.

I can guarantee you the chapter on the real estate bubble alone (chapter 10) serves as the most detailed and comprehensive analysis presented from any book solely dedicated to this bubble.

If you want access to institutional-level research, analysis and investment guidance, subscribe to the AVA Investment Analytics newsletter today. www.avaresearch.com

If you want a chance to make $100,000, check this offer.

By Mike Stathis

www.avaresearch.com

Copyright © 2009. All Rights Reserved. Mike Stathis.

Mike Stathis is the Managing Principal of Apex Venture Advisors , a business and investment intelligence firm serving the needs of venture firms, corporations and hedge funds on a variety of projects. Mike's work in the private markets includes valuation analysis, deal structuring, and business strategy. In the public markets he has assisted hedge funds with investment strategy, valuation analysis, market forecasting, risk management, and distressed securities analysis. Prior to Apex Advisors, Mike worked at UBS and Bear Stearns, focusing on asset management and merchant banking.

The accuracy of his predictions and insights detailed in the 2006 release of America's Financial Apocalypse and Cashing in on the Real Estate Bubble have positioned him as one of America's most insightful and creative financial minds. These books serve as proof that he remains well ahead of the curve, as he continues to position his clients with a unique competitive advantage. His first book, The Startup Company Bible for Entrepreneurs has become required reading for high-tech entrepreneurs, and is used in several business schools as a required text for completion of the MBA program.

Restrictions Against Reproduction: No part of this publication may be reproduced, stored in a retrieval system, or transmitted in any form or by any means, electronic, mechanical, photocopying, recording, scanning, or otherwise, except as permitted under Section 107 or 108 of the 1976 United States Copyright Act, without the prior written permission of the copyright owner and the Publisher. These articles and commentaries cannot be reposted or used in any publications for which there is any revenue generated directly or indirectly. These articles cannot be used to enhance the viewer appeal of any website, including any ad revenue on the website, other than those sites for which specific written permission has been granted. Any such violations are unlawful and violators will be prosecuted in accordance with these laws.

Requests to the Publisher for permission or further information should be sent to info@apexva.com

Books Published

"America's Financial Apocalypse" (Condensed Version) http://www.amazon.com/...

"Cashing in on the Real Estate Bubble" http://www.amazon.com/...

"The Startup Company Bible for Entrepreneurs" http://www.amazon.com...

Disclaimer: All investment commentaries and recommendations herein have been presented for educational purposes, are generic and not meant to serve as individual investment advice, and should not be taken as such. Readers should consult their registered financial representative to determine the suitability of all investment strategies discussed. Without a consideration of each investor's financial profile. The investment strategies herein do not apply to 401(k), IRA or any other tax-deferred retirement accounts due to the limitations of these investment vehicles.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.