SULTANS OF SWAP: Smoking Guns & the Sting!

Stock-Markets / Market Manipulation Mar 12, 2010 - 12:06 PM GMTBy: Gordon_T_Long

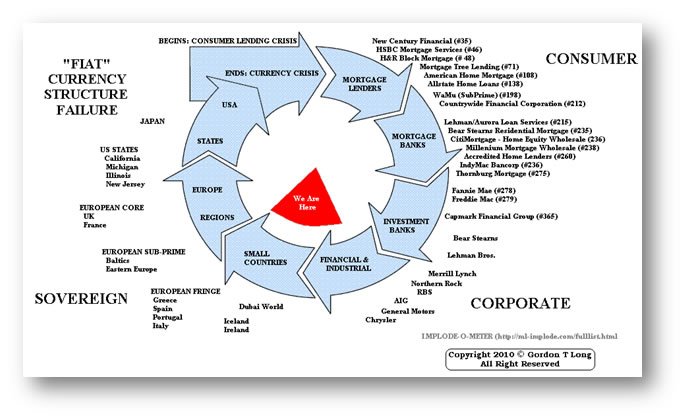

There are 7 stages to executing a successful sting operation. Whether this is the modus operandi behind the Sultans of Swap operating in the $605 Trillion OTC Derivatives market or just simple coincidence, I will leave it to you shrewd reader to determine. The seven stages do however offer us an instructive theater guide to better understanding these murky instruments called Interest Rate Swaps.

There are 7 stages to executing a successful sting operation. Whether this is the modus operandi behind the Sultans of Swap operating in the $605 Trillion OTC Derivatives market or just simple coincidence, I will leave it to you shrewd reader to determine. The seven stages do however offer us an instructive theater guide to better understanding these murky instruments called Interest Rate Swaps.

For our younger readers The Sting is a 1973 American movie set in September 1936 (an era not too dissimilar economically to present day) that involves a complicated plot by two professional grifters (Paul Newman and Robert Redford) to con a mob boss Robert Shaw. The story was inspired by real-life con games documented in “The Big Con: The Story of the Confidence Man”. (Not to be confused with “The Confidence Game” by Stephen Solomon documenting today’s Global Central Banking structure and our own Federal Reserve).

For our younger readers The Sting is a 1973 American movie set in September 1936 (an era not too dissimilar economically to present day) that involves a complicated plot by two professional grifters (Paul Newman and Robert Redford) to con a mob boss Robert Shaw. The story was inspired by real-life con games documented in “The Big Con: The Story of the Confidence Man”. (Not to be confused with “The Confidence Game” by Stephen Solomon documenting today’s Global Central Banking structure and our own Federal Reserve).

The title phrase refers to the moment when a con artist finishes the "play" and takes the mark's money. If a con game is successful, the mark does not realize he has been "taken" (cheated), at least not until the con men are long gone (1)

The 7 steps of a successful Sting normally occur in 3 stages which we will distinguish as Acts in today’s modern ‘play’. Now that you understand the plot line, sit back, tightly hold onto your wallet and enjoy the ‘play’.

ACT I - SMOKING GUNS

Usually a caper or heist film will contain a three-act plot. The first act usually consists of the preparations for the heist: gathering conspirators, learning about the layout of the location to be robbed, learning about the alarm system, revealing innovative technologies to be used, and, most importantly, setting up the plot twists in the final act. (Wikipedia)

1 -THE PLAYERS

Like any play we first need to introduce the actors. Who exactly are the Sultans of Swap who play the $437 Trillion global Interest Rate Swap game? There are many actors involved, all with their own motivations and sub plots. We should pay close attention because like  any good mystery the answers are unravelled in the multitude of sub plots all happening concurrently.

any good mystery the answers are unravelled in the multitude of sub plots all happening concurrently.

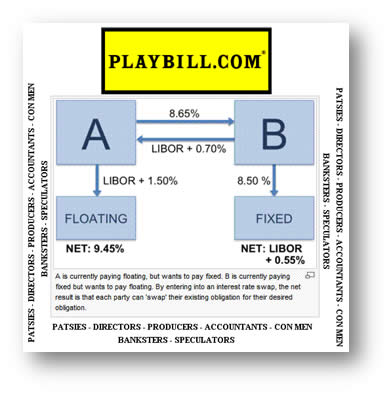

- THE PATSY: The Counterparties A & B (shown to the right in a simple interest rate swap structure) actually hold the OTC (Over-the-Counter) contracts. We will refer to them as the “PATSY” or “PATSIES”. Like all PATSIES they have an angle and think they are smarter than most. They have just enough knowledge to be dangerous.

- THE ACCOUNTANTS: These are the third parties that administer the ongoing interest payment stream exchanges. We include here also the major global law firms making daunting fees for contract writing and consultation. We will refer to them as a group called “THE ACCOUNTANTS”.

- THE SPECULATORS: These are the issuers and holders of CDS’s that protect against or speculate on counterparty failure of the interest rate swap contract OR the PATSY specifically. We will refer to them as “SPECULATORS”. It needs to be fully understood that our SPECULATORS engage in naked shorting of CDS’s in an unregulated OTC where no DTCC exists that acts as a matching inventory custodian. Our SPECULATORS appear as sinister looking characters in our fictional play.

THE PRODUCERS: These are the magicians that put the OTC contract together, take a quick fee and rapidly leave the scene in Act I as an apparent supporting actor. We could call them the “magicians” but we will call them the PRODUCERS after the Broadway play by the same name and possibly with similar motivations. You may recall that the 2005 movie “The Producers” was about two producers pulling a sting where they intentionally produced a play expecting and planning for its failure. The TAKE was in the failure. Broadway is only uptown from Wall Street and in the center of the mid town Investment Banking crowd. Like a chicken & egg it is hard to tell which was devised first – the evening theater entertainment or their daily enterprising activities. (Note: We need to carefully watch the sub plot of the PRODUCERS unfolding or we won’t see the sting coming).

THE PRODUCERS: These are the magicians that put the OTC contract together, take a quick fee and rapidly leave the scene in Act I as an apparent supporting actor. We could call them the “magicians” but we will call them the PRODUCERS after the Broadway play by the same name and possibly with similar motivations. You may recall that the 2005 movie “The Producers” was about two producers pulling a sting where they intentionally produced a play expecting and planning for its failure. The TAKE was in the failure. Broadway is only uptown from Wall Street and in the center of the mid town Investment Banking crowd. Like a chicken & egg it is hard to tell which was devised first – the evening theater entertainment or their daily enterprising activities. (Note: We need to carefully watch the sub plot of the PRODUCERS unfolding or we won’t see the sting coming).

- THE CON MEN: These are the “Confidence Men” or “CONS” for short. Their role is make our PATSIES feel confident. These are the Credit Rating Agencies who have starred in previous plays (i.e. the Toxic Asset ratings associated with the financial crisis) once again doing their mysterious and well disclaimed ratings. In our play they are rating both the credit worthiness of either PATSY and even the SPC (Structured Private Company) involved in certain Sovereign Interest Rate Swaps (more on that later). Their role allows either PATSY to feel comfortable that the other PATSY can pay (we need to immediately recognize the difference between operative words: can and will).

-

THE DIRECTORS: These are the SEC, CFTC & corresponding international regulatory authorities. This group additionally includes Legislative authorities such as the US House Financial Services Committee and the US Senate Banking Committee that somehow are always overlooked but are senior DIRECTORS in this play. All the DIRECTORS in our fictional play are dressed as sleepy eyed police officers with little to no interest in the shenanigans of the other actors throughout all three acts. The DIRECTORS are seen to react to telephone calls that occur throughout our play where there is a brief flurry of disorganized and short lived attention. They are then seen to supervise the fallout of some exploding financial event, before just as quickly returning to their ongoing siesta.

THE DIRECTORS: These are the SEC, CFTC & corresponding international regulatory authorities. This group additionally includes Legislative authorities such as the US House Financial Services Committee and the US Senate Banking Committee that somehow are always overlooked but are senior DIRECTORS in this play. All the DIRECTORS in our fictional play are dressed as sleepy eyed police officers with little to no interest in the shenanigans of the other actors throughout all three acts. The DIRECTORS are seen to react to telephone calls that occur throughout our play where there is a brief flurry of disorganized and short lived attention. They are then seen to supervise the fallout of some exploding financial event, before just as quickly returning to their ongoing siesta.

- THE BANKSTERS: These are the international banks making obscene fees and trading charges. We are talking $35B in 2009 trading fees alone (6) for brokering these swaps from parties desperate to re-align contract bets since the financial tsunami arrived. We will call them the “BANKSTERS”.

As in any mystery thriller the sub plots can make a simple story appear more complex than it really is. We need to remember what the old carnival ‘3 shells & a pea’ game teaches - it is a sleight of hand & deception that allows the trick to work.

Enter stage left our PRODUCERS and PATSIES.

Enter stage left our PRODUCERS and PATSIES.

2- THE SET-UP

The Set-Up must achieve two objectives: Establish the NEED and create CONFIDENCE.

THE NEED – Debt Addiction

The ideal need is one that is addictive. Drugs, Alcohol and Tobacco are three of the clearer examples. Like pushers conning children into using drugs for the first time, the PRODUCERS must convince the PATSIES there is no danger. Everyone is doing it and it will make life better.

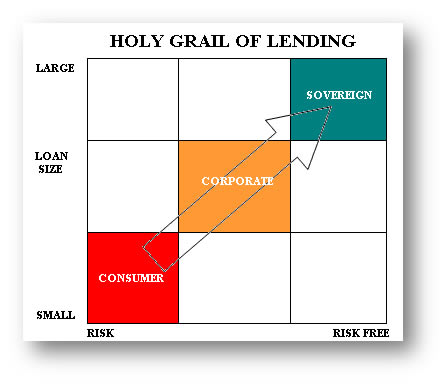

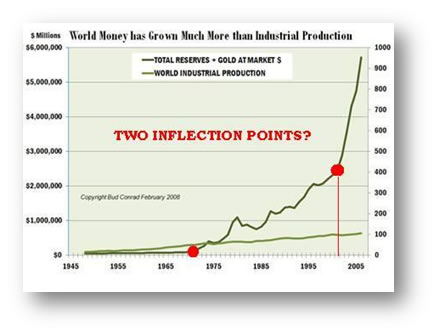

Our addiction of choice in this sting is Debt. Whether Consumer, Corporate or Sovereign Debt, western economies have become addicts over the last 30 years – there can be little disputing this fact. It did not happen by chance. To those trafficking in debt the Holy Grail is Sovereign debt. This is due to both its size and its ability to guarantee debt payments based on a legal authority to tax. It has the law and enforcement powers behind it.

John Perkins has authored a series of books from “Confessions of an Economic Hit Man” in 2004 to “Hoodwinked” in 2009, laying out his personal involvement in intentionally establishing false economic justifications for large sovereign infrastructure projects around the globe. Whether you believe his assertions that it was at the behest of elements within the US government, we can clearly see is he was up front and involved in perpetrating the plans & justifications upon which governments in third world countries could secure massive levels of debt based on fraudulent economic justifications. Even those who weren’t addicted because they didn’t have the ability to borrow were drawn into the game by agents that would free foreign leaders from debt constraint. Debt obligations through the hands of these pushers quickly flowed like drugs to an addict and liquor to an alcoholic.

John Perkins has authored a series of books from “Confessions of an Economic Hit Man” in 2004 to “Hoodwinked” in 2009, laying out his personal involvement in intentionally establishing false economic justifications for large sovereign infrastructure projects around the globe. Whether you believe his assertions that it was at the behest of elements within the US government, we can clearly see is he was up front and involved in perpetrating the plans & justifications upon which governments in third world countries could secure massive levels of debt based on fraudulent economic justifications. Even those who weren’t addicted because they didn’t have the ability to borrow were drawn into the game by agents that would free foreign leaders from debt constraint. Debt obligations through the hands of these pushers quickly flowed like drugs to an addict and liquor to an alcoholic.

In more developed countries with legacy social entitlement programs we are seeing massive social entitlements continuing to only get larger, more generous and more underfunded. None is more obvious than in Greece, Portugal, Italy, Greece, Spain (PIGS) and across Western & Eastern Europe where the unquenchable thirst for more debt has reached the terminal stage that all substance abusers will eventually find them if all restrictions to drugs (lending) are removed.

Enter stage right the CON MEN to join the others on the stage.

CREATING CONFIDENCE – The “AAA”

In “The Swaps that Swallowed Your Town”, the New York Times on 03-05-10 illustrated how Interest Rate Swaps were shrewdly peddled to US municipalities, school districts, sewer systems and other tax-exempt debt issuers. In this world of the intersection of Derivatives and Municipal debt financing, the sales pitch they report “(the peddlers) accentuated the positives in them. “Derivative products are unique in the history of financial innovation,” gushed a pitch from Citigroup in November 2007 about a deal entered into by the Florida Keys Aqueduct Authority. Another selling point: “Swaps have become widely accepted by the rating agencies as an appropriate financial tool.” And, the presentation said, “they can be easily unwound” (1).

In “The Swaps that Swallowed Your Town”, the New York Times on 03-05-10 illustrated how Interest Rate Swaps were shrewdly peddled to US municipalities, school districts, sewer systems and other tax-exempt debt issuers. In this world of the intersection of Derivatives and Municipal debt financing, the sales pitch they report “(the peddlers) accentuated the positives in them. “Derivative products are unique in the history of financial innovation,” gushed a pitch from Citigroup in November 2007 about a deal entered into by the Florida Keys Aqueduct Authority. Another selling point: “Swaps have become widely accepted by the rating agencies as an appropriate financial tool.” And, the presentation said, “they can be easily unwound” (1).

The ratings agencies were at the center of the collapse in the mortgage securitization collapse because of the perceptions that the rating agencies rated CDO (Collateralized Debt Obligations) and all the other toxic waste as AAA. In the interest rate swap play the credit rating agencies rate the sovereign debt based on what the balance sheet shows them. They would likely argue that even if they are fully aware of off balance sheet activities their duties are to appraise only what is before them, what the accounting standards of a particular sovereign outlines and specifically how those standards interpret ‘contingent liabilities’. (More on this subject as our play unfolds). Armed with the newly arrived CON MAN’s credit rating on both PATSIES, with the assurances of the PRODUCERS, and with the help of the now present ACCOUNTANTS, our PATSIES feel confident that risks are manageable based on everything they have heard from the experts present on stage.

3- THE HOOK

The hook is about the Timing and Rationalization of the Sting.

The BANKSTERS join the large crowd of actors now performing complex magical acts before the PATSIES on stage.

Like any addiction it takes an event to initiate the addiction. The event delivers both Timing & Rationalization.

Whether it is a third world leader clinging to power by offering expensive populist solutions, declining revenue bases due to failing industrial policy, geo-political defense requirements, a natural disaster, economic strategies like Dubai’s opulent extravagances or membership in the European Union with its Maastricht Agreement requirements etc, etc., these are the justifications, excuses or motivations for the loan and expanding debt.

This list and endlessly more justifications have always existed. Getting the money historically has been the constraining element. No more constraints thanks to our Sultans of Swap.

4- THE TALE

The Tale is the presentation of the OFFER.

The Tale is the presentation of the OFFER.

With all our actors seated at the table in the center of the stage we hear the quiet whispers as the plan is secretly divulged.

From the endless list of timing & rationalizations we will select just one to overhear in our fictional play which is garnering a lot of investor & media attention – The European Union Experiment.

According to the Maastricht Agreement and the EU Stability & Growth Pact (SGP) a condition of entry and ongoing membership is the adherence to fiscal deficits of no more than 3% of GDP and total debt of no more than 60% of GDP. It is now emerging that members were creative in their accounting to facilitate membership, and then even more creative to allow for existing debt compounding and the increases due to additional populist programs.

The audience tentatively listens as the whispered plans are unveiled:

GREECE

We form a PPP (Public Private Partnership) under the direction of a PPI (Public Private Initiative). We form a SPC (Special Purpose Company). Through the contractual use of a legal opus magnum called a Novation Agreement the Greek government exchanges fixed interest streams for floating interest rate streams and in so doing receives cash up front with a bubble payment at the termination of the Interest Swap Agreement. Presto, we have an off balance sheet debt without any impact to Greece’s sovereign debt rating. It is much more involved than this and I therefore refer you to: SULTANS OF SWAP: Explaining $605 Trillion in Derivatives! and SULTANS OF SWAP: Fearing the Gearing! which outlines this structure as specifically applied at Kitlos PLC (SPC) in Greece.

Reggie Middleton at the BoomBustBlog.com has done some truly tenacious digging and has unearthed the following further smoking guns:

“According to people familiar with the matter interviewed by China Securities Journal, Goldman Sachs Group Inc. did as many as 12 swaps for Greece from 1998 to 2001, while Credit Suisse was also involved with Athens, crafting a currency swap for Greece in the same time frame. Under its "off-market" swap in 2001, Goldman agreed to convert yen and dollars into euros at an artificially favorable rate in the future. This helped Greece to use that "low favorable rate" when it recorded its debt in the European accounts-pushing down the country's reported debt load.

Moreover, in exchange for the good deal on rates, Greece had to pay Goldman (the amount wasn't revealed). And since the payment would count against Greece's deficit, Goldman and Greece came up with another twist: Goldman effectively loaned Greece the money for the payment, and Greece repaid that loan over time. And the two sides structured the loan as another kind of swap. So, the deal didn't add to Greece's debt under EU rules. Consequently, Greece's total debt as a percentage of GDP fell from 105.3% to 103.7%, and its 2001 deficit was reduced by a tenth of a percentage point in GDP terms, according to people close to Goldman”. (3)

ITALY

“As discussed in a recent ZeroHedge article, a 1996 Italian currency swap, arranged by J.P. Morgan, allowed Italy to receive large payments upfront that helped keep its deficit in line, with the downside of greater payments later. In addition, to curbing their current deficits, countries are now using these swap agreements to push off their loan liabilities (related to swap agreements) to a later date through securitization, and Greece is one such example.

Under the 2001 deal brokered by Goldman, Greece swapped dollar and yen-denominated debt for Euros at below-market exchange rates. The result was that the country got paid €1 billion ($1.35 billion) upfront on the swap in exchange for an obligation to buy the swaps back later. In 2005, this obligation was in turn securitized as part of a 20-year debt issue, further pushing off the day of reckoning.

Moreover, one of the key reasons why such manipulations continued is the apparent ignorance of the EU's Eurostat, which knew enough about these deals to tighten the rules governing their accounting-albeit only after they had served their purpose - the Ponzi! When Italy's then-Prime Minister Romano Prodi miraculously achieved a four-percentage-point improvement in Italy's budget deficit in time to usher the country into the common currency, Italy's use of accounting gimmicks was widely discussed, and then promptly ignored. As at that time, everyone was only too eager to look the other way in the drive to get the single currency up and running.

It wasn't until 2008, a decade after the deals became popular, that Eurostat was able to revise its rules to push countries to include swaps in their debt and deficit calculations. Still, todate too little is known about countries' continued exposure to the deals that are already out there.

It wasn't until 2008, a decade after the deals became popular, that Eurostat was able to revise its rules to push countries to include swaps in their debt and deficit calculations. Still, todate too little is known about countries' continued exposure to the deals that are already out there.

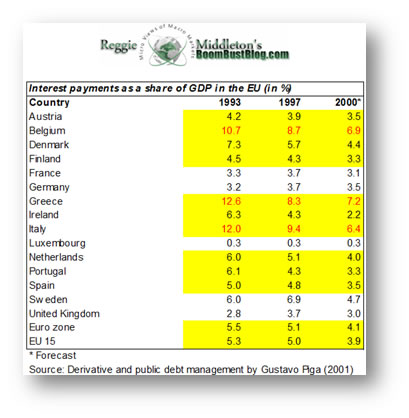

Overall, though there is less evidence to support that there are more such swap deals that happened during the late 90's until early part of this decade, the data to the right showing a sharp decline in interest payments as a percentage of GDP particularly for Belgium (apart from Greece and Italy), hints that there are considerably more of these deals to be discovered. The question is, will they be discovered before or after the respective sovereign issues record debt to the suckers sovereign fixed income investors.

Notice the extremely supercalifragilisticexpealidocious reductions Belgium, Greece and Italy have made in their interest payments from 1993 to 2000 in this graphic made pre-2000. If one didn't know better, one would have thought these countries actually used magic to make such reductions. Italy practically cut their debt service (projected, of course) in half. It really makes one wonder. I'm just saying...

According to DERIVATIVES AND PUBLIC DEBT MANAGEMENT by Gustavo Piga, "The political stakes of the 1997 budget package were enormous. Therefore, it was no surprise that many countries were accused of ‘creative window-dressing' in their budget through the use of accounting tricks to reach the desired goal. One contentious item was interest expenditure, which is the interest expense that governments sustain to finance their deficit and roll over their debt. Interest expenditure represents a high percentage of public spending and GDP in the European Union. It is highly variable over time, especially when compared to other components of the budget. Because of its relevance and because it is subject only to minimal scrutiny during budget law discussions (and many times even after its realization during the fiscal year), interest expenditure is an ideal target for reaching fiscal stabilization goals without incurring excessive political protest or opposition". (3)

Reuters leaves little to speculation when it reported on March 11, 2010:

Forget Greece: Italy derivatives bomb also ticking

Many local governments eager to cut financing costs for years rushed to sign up for complex derivatives contracts, even when the terms were in English. But some cities, facing big losses when interest rates go up, are now trying to pull out of derivatives and suing the international and local banks that arranged the deals.

In a test case, a judge in Milan will decide in coming weeks whether to try 13 people and four banks -- UBS (UBSN.VX), Deutsche Bank (DBKGn.DE), Germany's Depfa and JPMorgan Chase & Co (JPM.N) -- on aggravated fraud charges. The case stems from a derivatives swap over a 1.68 billion euro ($2.28 billion) 30-year bond, the biggest issued by an Italian city.

Milan, Italy's financial capital, is facing a 100 million euro loss on the deal, city officials say. Milan is also suing the banks for 239 million euros in overall liabilities.

In the southern region of Puglia, prosecutors are seeking to bar Merrill Lynch, a unit of Bank of America Corp (BAC.N), from government contracts for two years. The move stems from derivatives losses from 870 million euros in regional bonds.

JPMorgan, UBS and Deutsche have denied wrongdoing, and Depfa has declined comment. Merrill has not commented.

MAKE THE SWITCH

Almost 500 small and large Italian cities are facing mark-to-market losses of 2.5 billion euros on the contracts, according to the Bank of Italy. Analysts say that figure will balloon when interest rates go up.

Most of the contracts involved switching fixed rates on loans to variable ones with banks.

"With the economic crisis, the problem has been lessened a bit (with lower rates) ... But in fact with a rate rise it becomes an even worse problem," said Fabio Amatucci, an expert on local government finances at Milan's Bocconi University.

The European Central Bank is expected to start hiking rates at the end of this year or early next year.

U.S. and European officials are looking into how U.S. investment bank Goldman Sachs Group Inc (GS.N) may have helped Greece disguise the size of its budget deficit through the use of cross-currency derivatives in 2001.

The Italian deals differ somewhat from the Greek case since the instruments were usually for switching rates on loans, but Italy stands out because of the vast number of cities, regions and public entities -- even a theater association -- that turned to them from 2001 to 2008.

The Bank of Italy put the notional value of derivatives contracts at 24.1 billion euros in June 2009. However, Il Sole 24 Ore business newspaper on Thursday cited Treasury data to put the overall figure at 35.5 billion euros -- a third of local governments' debt -- when wider criteria were used.

Although central bank figures show 467 local governments had derivatives contracts at the end of September, Amatucci believes the real number could be around 3,000 as more deals emerge.

The government banned new contracts in 2008 pending new rules. Economy Minister Giulio Tremonti has said there is "no effect" from derivatives held by local governments.

LOOSEN UP

Local governments rushed into derivatives in part because they helped ease the rigidity of a 2001 law that bars taking on new debt except to finance investment.

But another big draw was the upfront payment many cities got in advance for signing revamped agreements, usually done without a bidding process, analysts said.

Renegotiated deals shoved back payment and costs in a "political manipulation" of signings, said Giampaolo Gialazzo with the Tiche consultancy in Treviso.

Revised deals also carried increasingly restrictive terms and higher costs for municipalities and other local governments.

"Greece did nothing more than get itself money right away and then pay it back slowly. Local administrations in Italy did the same thing," said Massimiliano Palumbaro with CFI Advisors in Pescara.

Pescara, a southern Italian city, itself took out a total of 108 million euros in interest rate swaps and is suing UniCredit SpA (CRDI.MI) and BNL, a unit of France's BNP Paribas (BNPP.PA), over them. UniCredit had no comment, while BNL had no immediate comment.

When rates are low, as they were when many contracts were agreed, local authorities using a variable rate could find their costs shrinking. However, when rates rose, officials would find themselves owing more money.

Milan has argued, as have many other local administrations, that the contracts were murky, carried hidden costs and banks had failed to explain them.

However, a source close to the issue said Milan could not argue that it was ignorant about derivatives since the 2005 swap replaced a contract that had been renegotiated repeatedly.

The city also has wide securities markets experience given its joint control of listed utility A2A (A2.MI), the source said.

With banks putting in place a complex deal that had to be overseen for 30 years with hefty back-office costs, "the city could not expect that the banks were going to take that position for free," said the source.

Despite the court cases, Milan is still interested in derivatives. The city council said on Wednesday it was studying a switch from a variable rate on the contract to a fixed one.

PORTUGAL

“Portugal has also been known for years to take advantage of derivatives contracts to dress up its budget numbers in the late 1990s. In a recent press article (Debt Deals Haunt Europe) Deutsche Bank's spokesman Roland Weichert commented that the bank has executed currency swaps on behalf of Portugal between 1998 and 2003. He also said that Deutsche Bank's business with Portugal included "completely normal currency swaps" and other business activity, which he declined to discuss in detail. He also added that the currency swaps on behalf of Portugal were within the "framework of sovereign-debt management," and the trades weren't intended to hide Portugal's national debt position (yeah okay!). Though the Portuguese finance ministry declined to comment on whether Portugal has used currency swaps such as those used by Greece, They said Portugal only uses financial instruments that comply with European Union rules.” (3) The Portugal comment begs the whole issue of “Framework of Sovereign Debt Management “. What it is and how exactly it aligns with standard international accounting practices as it relates specifically to “contingent liabilities” – but we digress and will return to this briefly.

We could go from Spain to France and other EU countries operating under the Eurostat framework guidelines and see the same thing. We could discuss the Millennium Dome Project in the UK. We could discuss Dubai World and the hidden amount of debt recently discovered (and still being discovered), but let’s skip over the pond to the USA to see if this is just an isolated European “TALE” being told.

US - NY STATE MUNICIPALS

In The Swaps That Swallowed Your Town the New York Times shows that there is widespread use of Interest Rates swaps across US Municipalities with extremely negative consequences now showing up that were not understood when the PRODUCERS and BANKSTERS made their presentations. Though I failed to see clear proof in their examples of the adoption of the Novation agreement being used in Europe, this doesn’t necessarily mean it is not being used or there is derivation from being employed in the US. What I found interesting was that the CEO of an advisory firm on this subject is quoted as saying ““We need transparency where Wall Street discloses not only the risks but also calculates the potential costs associated with those risks. If you just ask issuers to disclose, even in a footnote, the maximum possible loss or gain from the swap, they probably wouldn’t do it.” (1) The audience must surely notice that the DIRECTORS in our play are now completely asleep on stage though another frustrated call is heard from Harry Markopolos over the stage loud speaker.

And here ladies and gentleman – watch closely – we have the sleight of hand mentioned earlier.

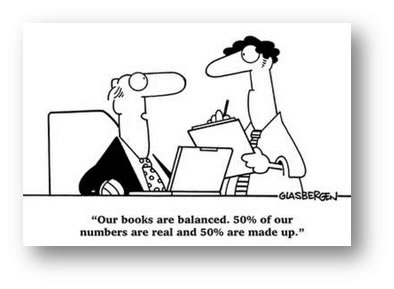

Everything is aimed at getting debt off the balance sheet. Whether through SPE (Special Purpose Entities) of various descriptions or conduits such as SIV (Structured Investment Vehicle) the shell game is all about avoiding the “d” word or Debt.

A LOAN is a debt and must be accounted as A LIABILITY.

A GUARANTEE is not a loan! It is a CONTINGENT Liability.

A Guarantee is something that accountants refer to as a “contingent liability”. The operative word here is “contingent”.

This quickly gets extremely tricky to quantify in its simplest form without adding the complexity of layers of structures and parties around it. It becomes a game of assessed probabilities. The results of the probabilities determine the amount of contingent liabilities to be accrued as a debt liability. Then there is the question of timing. What event might trigger this and when should the liability treatment be reflected.

This quickly gets extremely tricky to quantify in its simplest form without adding the complexity of layers of structures and parties around it. It becomes a game of assessed probabilities. The results of the probabilities determine the amount of contingent liabilities to be accrued as a debt liability. Then there is the question of timing. What event might trigger this and when should the liability treatment be reflected.

As an illustrative example, what were the chances of housing correcting 15% when we hadn’t seen housing go down in neither our lifetime or our possibly our parents? Many considered it unlikely and therefore either minimal or no contingencies were allowed.

Add to this confusion a slew of accounting standards with various interpretations and rulings (ias 37 contingent liabilities, ifrs contingent liabilities , fasb contingent liability, us gaap contingent liabilities, Government Accounting Standards Advisory Board, contingent liabilities disclosure etc.) and you end up in very murky waters - Waters not too dissimilar to those associated with toxic assets in the financial crisis where is was nearly impossible to value Level 1 bank Capital Ratios – Mark-to-Market was Mark-to-Model or more aptly Mark-to-Myth. This is the same problem with a slightly different twist. There is the same consistent concern about debt appearing on an asset / liability ledger.

5- THE WIRE

The bookie operation was a wire service in the movie ‘The Sting’ and it was central in pulling off the story’s heist. In our play we have an electronic wire service but it runs between the BANKSTERS and some of the PRODUCERS. It is called the OTC or Over-the-Counter trading. This is how all $605 Trillion Derivatives, including $437 Trillion in Interest Rate Swaps, are traded. No regulations. No standards. No supervision. No audits. They are completely private, restricted and proprietary. There is no sheriff or watch dog. It is the Wild West without a sheriff in town. The boys can shoot it up all they want. Similar to the DTC & Naked Shorting, Dark Pools, High Frequency Trading etc., it is ripe for creative enterprise. Just the kind of secrecy I believe people serving time at “Sing-Sing” like things.

If you thought the play was getting complicated when we discussed the Novation agreement and assessing Contingent Liabilities, let’s add the twist that all these private contracts are traded. The poor auditors must have their heads spinning. Which auditor in which country you astutely ask? As Johnny Depp famously drawls in the mob crime flick “Donnie Brasco” to explain handling transactions like this – “Forget about it!”

Even an old fashion Bookie wire operation in the 1930’s had more supervision than the modern day OTC.

THE SPREAD or ‘the vig’

The difference between the bid and the ask on an open exchange is the spread. According to Wikipedia the spread or Vigorish, or simply the vig, also known as juice or the take, is the amount charged by a bookmaker, or bookie, for his services. What we have on the closed non transparent OTC is no visibility to either the Bid nor Ask. Only the BANKSTERS trade on this info. Therefore the spread is more accurately called the vig. This is completely different to electronic trades today on the NYSE and Nasdaq where spreads have become negligible with many ‘spread men’ being forced out of the business. So what is the the vig or the take on the trades where the PATSIES are desperate to get out from under trades that have went bad since the financial crisis occurred? According to Bloomberg in a March 1, 2010 report:

“The five largest U.S. derivatives dealers, including JPMorgan Chase & Co., Goldman Sachs Group Inc. and Bank of America Corp., were on pace through the third quarter to record as much as $35 billion in revenue last year from trading unregulated derivatives contracts, according to company reports collected by the Federal Reserve and people familiar with banks’ income sources.” (3)

In our modern day world of Trillions being bantered around daily we need to think about this number. It borders on the completely insane! It is bigger than the GDP of a vast majority of the member countries of the United Nations. It almost makes us feel compassion for our poor desperate duped PATSIES.

“Bookmakers use this (the vig) concept to make money on their wagers regardless of the outcome. Because of the vigorish concept, bookmakers should not have an interest in either side winning in a given sporting event. They are interested, instead, in getting equal action on each side of the event. In this way, the bookmaker minimizes his risk and always collects a small commission from the vigorish. The bookmaker will normally adjust the odds, or line, to attract equal action on each side of an event. - Wkipedia

CDS’s (CREDIT DEFAULT SWAPS)

The OTC also trades CDSs (Credit Default Swaps) which allows our PATSY to feel confidence that they are protected if something should go wrong and the counterparty they are contracted with is unable to pay. CDS’s are thought as insurance but they have none of the protection of insurance where collateral is posted for potential payouts.

What insurance company would allow you to buy fire insurance on someone else’s house? Insurance companies knowing it is their money at risk on a claim would be concerned it might foster bad behavior. Since you look particularly desperate they might suspect you of being what our former Harvard MBA trained President (who stood watch during this era), so eloquently erudiated as an ‘evil doer’. You cannot have an exchange where people know (other than the regulated exchange itself) who is on the other side of a trade. It leads to deviant and unfair behavior. CDS (Credit Default Swaps) are the case in point. These instruments, which former New York Insurance Commissioner Eric Dinallo in testimony before congress, related there was a disagreement about who was the supervisory authority on these instruments when they first surfaced. Both the NY Insurance Commission and the CFTC (Commodities Futures Trading Commission) felt they were not their responsibility and agreed with the NY Gaming Commission who felt they more appropriately fell under their purview. That tells you about all you really need to know about CDSs to understand our play. But there is more – unfortunately.

It needs to be fully appreciated that our SPECULATORS in our play are engaged in naked shorting of CDS’s in this unregulated OTC where no DTCC exists that acts as a matching inventory custodian. There is no limit to the number of short transactions that can be sold. For those familiar with shorting you know you get cash upfront when you short. The cash can then be used to fund buying Option PUTs while additionally selling the PATSIES bonds short. The number of strategy permutations is limitless. In a $605 Trillion pool you can do a lot of splashing around.

It would be remiss of me not to say that CDS’ can have an important role to play, but not without a regulated exchange and capital requirements on those selling these instruments. AIG is your blatant example of what the fall out is!

What has been the reaction by our DIRECTORS? – You guessed it – they are still in the midst of their siesta on the side of our stage!

INTERMISSION

OLD SAYING:

“When you owe the bank $100,000 and can’t pay you have a problem. When you owe the bank 100M ($100,000,000) and can’t pay the bank has a problem”

TODAYS VERSION:

When the banks owe 100B ($100,000,000,000) and can’t pay the banks have a problem. When the Banks owe 1T ($1,000,000,000,000) and can’t pay the taxpayer has a problem”

INTERMISSION

Sign Up for the next release in the Sultans of Swap series: Sultans

To be continued with:

ACT II – THE STING

The second act is the heist itself. With rare exception, the heist will be successful, though some number of unexpected events will occur.

ACT III – THE GET AWAY

The third act is the unraveling of the plot. The characters involved in the heist will be turned against one another or one of the characters will have made arrangements with some outside party, who will interfere. Normally, most of or all the characters involved in the heist will end up dead, captured by the law, or without any of the loot; however, it is becoming increasingly common for the conspirators to be successful, particularly if the target is portrayed as being of low moral standing, such as casinos, corrupt organizations or individuals, or fellow criminals.

SOURCES

(1) 03-05-10 The Swaps that Swallowed Your Town the New York Times

(2) 03-03-10 Smoking Swap Guns Are Beginning to Litter EuroLand, Sovereign Debt Buyer Beware! Reggie Middleton

Reggie Middleton at the BoomBustBlog.com

(3) 03-01-10 Frank, Peterson Vow to Eliminate Provision Keeping Swaps Opaque Bloomberg

(4) 03-08-10 Default Protection Is Lowest in Six Weeks as Greece Calms BL

(5) 02-10-09 CSPAN Rep Paul Kanjorski Reviews the Bailout Situation

Wkipedia: http://en.wikipedia.org/wiki/The_Sting The Sting

Wikipedia: http://en.wikipedia.org/wiki/Heist_film A Heist Film

03-03-10 Smoking Swap Guns Are Beginning to Litter EuroLand, Sovereign Debt Buyer Beware!

Gordon T Long gtlong@comcast.net Web: Tipping Points

Mr. Long is a former executive with IBM & Motorola, a principle in a high tech start-up and founder of a private Venture Capital fund. He is presently involved in Private Equity Placements Internationally in addition to proprietary trading that involves the development & application of Chaos Theory and Mandelbrot Generator algorithms.

Gordon T Long is not a registered advisor and does not give investment advice. His comments are an expression of opinion only and should not be construed in any manner whatsoever as recommendations to buy or sell a stock, option, future, bond, commodity or any other financial instrument at any time. While he believes his statements to be true, they always depend on the reliability of his own credible sources. Of course, he recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction, before making any investment decisions, and barring that, we encourage you confirm the facts on your own before making important investment commitments.

© Copyright 2010 Gordon T Long. The information herein was obtained from sources which Mr. Long believes reliable, but he does not guarantee its accuracy. None of the information, advertisements, website links, or any opinions expressed constitutes a solicitation of the purchase or sale of any securities or commodities. Please note that Mr. Long may already have invested or may from time to time invest in securities that are recommended or otherwise covered on this website. Mr. Long does not intend to disclose the extent of any current holdings or future transactions with respect to any particular security. You should consider this possibility before investing in any security based upon statements and information contained in any report, post, comment or recommendation you receive from him.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.