Natural Gas ETF/ETN, A Small Example of Acceptable Fraud

Commodities / Natural Gas Mar 16, 2010 - 11:35 AM GMTBy: Adam_Brochert

I have been keeping an eye on natural gas and I love the way the chart looks right now for a trade. But trying to find a way to play it without going into the futures market exposes the problems with our current financial markets. The fraud is too prevalent and the instruments are too opaque. I don't want to invest in natural gas stocks, but rather I want to invest in natural gas itself as a trade.

I have been keeping an eye on natural gas and I love the way the chart looks right now for a trade. But trying to find a way to play it without going into the futures market exposes the problems with our current financial markets. The fraud is too prevalent and the instruments are too opaque. I don't want to invest in natural gas stocks, but rather I want to invest in natural gas itself as a trade.

For those who don't think it should be easy to trade paper versions of commodities, I don't disagree. It can create dangerous price swings in things vital to the economy and to life itself. But this is a different issue altogether.

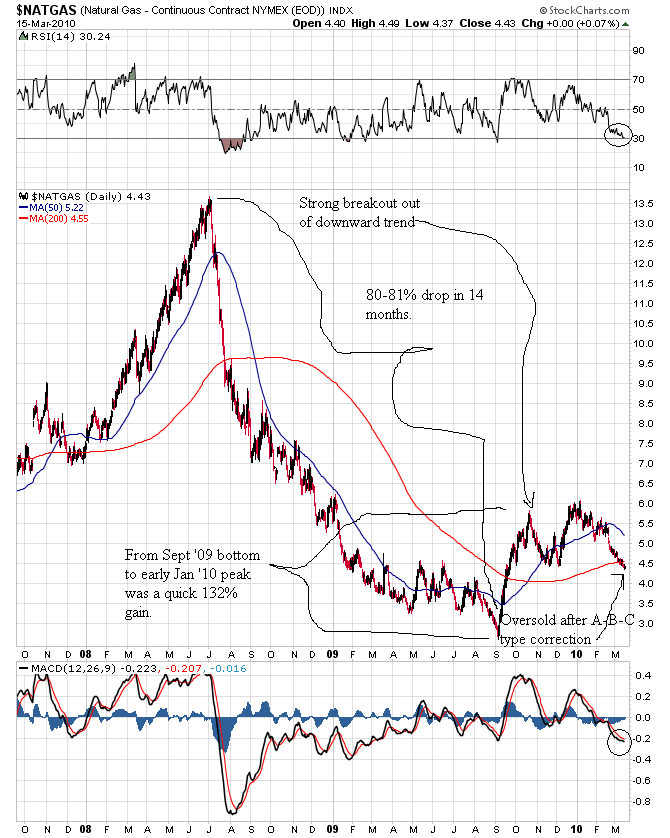

As someone who had a bad experience in the UNG natural gas ETF a few years ago, I decided to look around this morning in the ETF/ETN universe. I wanted to see what was available to retail investors who believed the price of natural gas was heading higher and wanted to make a bullish bet on the natural gas price. First, let me show you a 30 month daily chart of natural gas with my thoughts and comments:

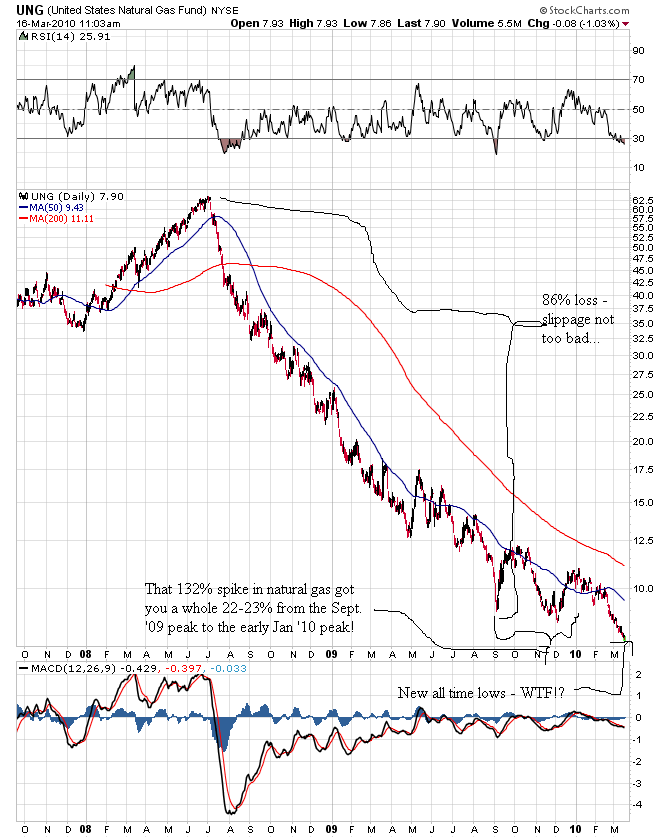

Now, here are the illustrious trading instruments in natural gas for those who want to place bets on the price of natural gas. The following charts are all 30 month daily charts and are plotted using a log scale. First up, the UNG ETF:

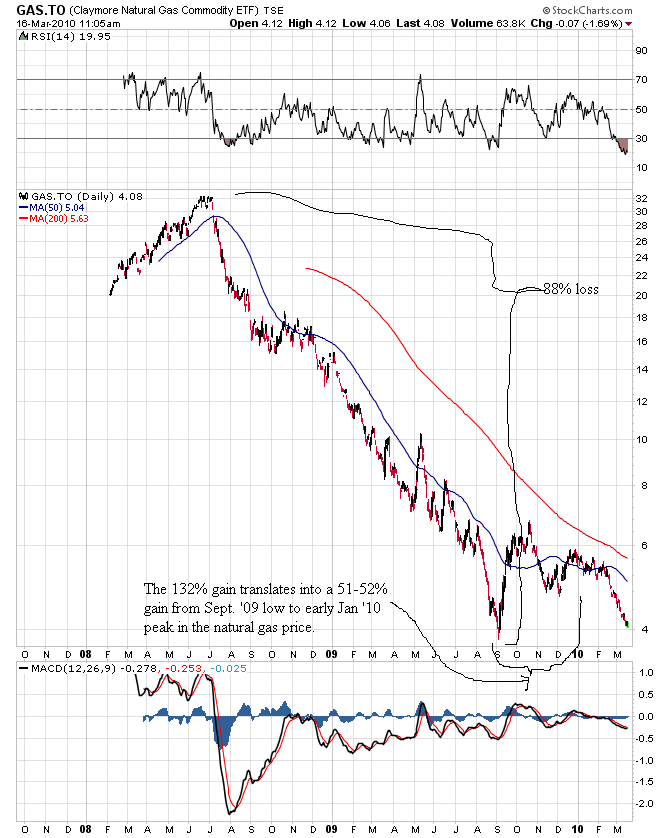

How about the Claymore Canadian Natural Gas ETF (ticker: GAS.TO):

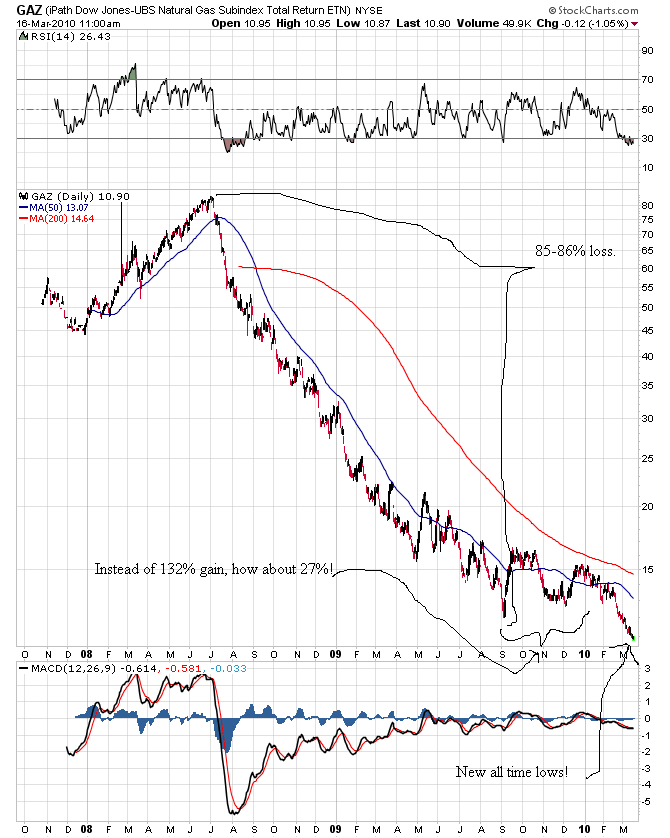

Perhaps the iPath Dow Jones UBS Natural Gas Subindex Total Return ETN (say that ten times fast...) with ticker GAZ will be kinder to retail investors:

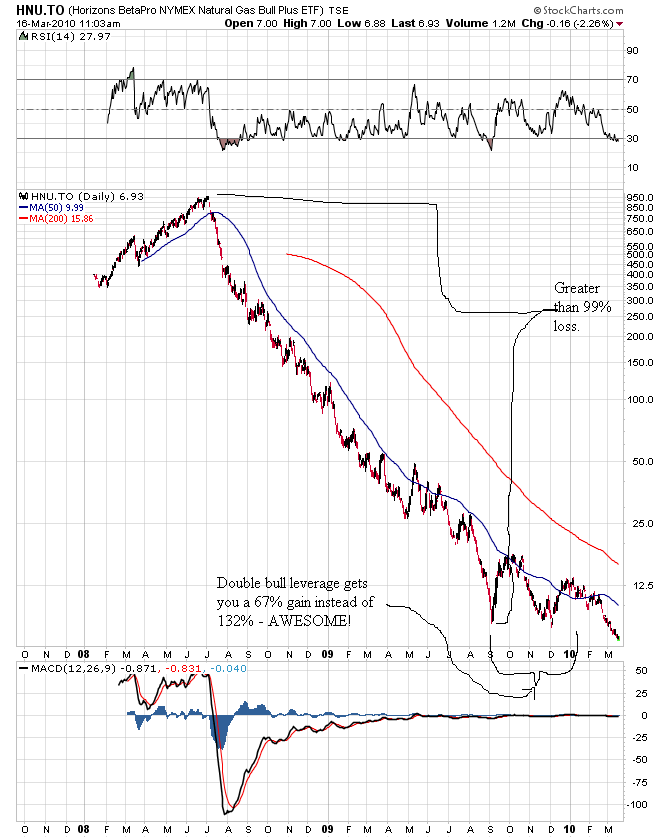

I guess the only way to get around this problem is to use leverage and boost gains. Perhaps the Horizons BetaPro NYMEX Natural Gas Bull Plus ETF with its 2x leverage can overcome the slippage these products have:

Now, let me just preempt all the arguments people will make about these charts and these gains. First, there are issues with the way futures contracts are rolled over, there are issues with expenses, there are issues with the daily tracking method and there are currency-related issues when looking at the Canadian products. The vehicles are for day trading, not investing. Blah, blah, blah.

The bottom line is this: 99% of people who act so smart about these ETF/ETN products were burned by at least one of them at some point. Whether it was due to the leverage, the misunderstanding of how the daily price moves don't track well over a period of more than one day or the futures contract rollover issues in the case of commodity products, it's hard to make money on some of these products even if you guess correctly on what the underlying price will do. Every one of these products screws more than 90% of those who try to use them to bet on higher natural gas prices.

In other words, these products are for sophisticated investors but are marketed to the retail public. This small example in one corner of the investment universe shows how much the odds are stacked against the retail investor. The promise/hope of riches keeps many of us coming back to the casino for more, but the house (in aggregate) always wins in the end.

This is exactly what happened in the housing market. Yes, it takes two to tango and yes, people were trying to get rich by speculating in housing. But who gave them that opportunity and why? Why were down payments waived? Why were mortgages designed to explode after a few years created in the first place? Why were the least sophisticated market participants put into the most exotic products with the least chance of performing? The answer, of course, is greed. When both parties are greedy in a financial transaction but one party is sophisticated and educated and the other isn't, guess who usually wins?

Our federal government not only allowed this fraud to occur while they witnessed it, they actively participated in it. Thru the government-sponsored housing agencies, the housing bubble was made much worse than it should have been and houses were made even more unaffordable for those who didn't want to speculate on home prices. Now, by buying lousy mortgage paper and re-financing loans that should be allowed to fail, the government puts our currency at risk so that private banks can stay afloat. Those who want increased government regulation don't understand that the government aided and abetted the financial fraud and is still doing so to this day. The rules are already there to prevent such idiocracy, so its not a question of passing new laws and bills with expensive pork attached.

Right now, the SEC is intentionally ignoring the fraud in such ETF/ETN instruments as those above related to natural gas. These products are way too sophisticated for retail investors, but man, they sure do make Wall Street a lot of money and we all know who pays the campaign bills. The CFTC is ignoring the manipulative short positions in the Gold and silver markets because it is in collusion with the financial firms engaged in this illegal market manipulation. Don't worry, no one sees it coming so we can all act surprised when it blows up and we give more taxpayer money to our financial masters and government agencies to bail them out.

The fraud is too prevalent to allow a sustained stock market advance from current levels. When you can't believe a balance sheet, how can you invest? When the government is complicit in massive fraud on a scale that makes hardcore cynics blush, how can you trust in the stability of markets? When secretive and opaque markets are allowed to be used to raid entire countries, who is really in control?

The best most retail investors can do is to buy and hold whatever is in a secular bull market. Currently, the only decent looking bull market around with an opportunity for significant long-term gains is in Gold. That's right, a shiny piece of metal that doesn't taste very good when you try to eat it. Gold works when confidence in the paper promises of apparatchiks and teflon Wall Street dons evaporates. The carnival barkers would prefer you stay in the casino so that they can finish their financial rape job on you. The choice is yours. When the Dow to Gold ratio gets back to 2 (or even less than 1), will you have any money left to invest in the sound, cash-producing companies left standing?

Visit Adam Brochert’s blog: http://goldversuspaper.blogspot.com/

Adam Brochert

abrochert@yahoo.com

http://goldversuspaper.blogspot.com

BIO: Markets and cycles are my new hobby. I've seen the writing on the wall for the U.S. and the global economy and I am seeking financial salvation for myself (and anyone else who cares to listen) while Rome burns around us.

© 2010 Copyright Adam Brochert - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.