Fed Smoke, Mirrors, SDRs and Gold: Why Central Banks Cannot Tell the Truth

Commodities / Market Manipulation Mar 16, 2010 - 01:45 PM GMTBy: Rob_Kirby

In the following article the term Special Drawing Right [SDR] is used frequently. A brief explanation of an SDR is provided below together with its current value [which floats] in U.S. Dollars.

In the following article the term Special Drawing Right [SDR] is used frequently. A brief explanation of an SDR is provided below together with its current value [which floats] in U.S. Dollars.

According to the IMF:

The currency value of the SDR is determined by summing the values in U.S. dollars, based on market exchange rates, of a basket of major currencies (the U.S. dollar, Euro, Japanese yen, and pound sterling). The SDR currency value is calculated daily and the valuation basket is reviewed and adjusted every five years.

And here’s how SDRs are valued:

Last week, one of my subscribers alerted me to the Q4/09 Federal Reserve Flow of Funds Report, published on Mar. 11, 2010, showing the “back-dating” of gold / SDRs in Q3/09.

To see this, go to the Fed's "flow of funds report" Q4/09 released March 11, 2009 at this link: http://www.federalreserve.gov/releases/z1/Current/z1.pdf

Scroll down to page 24 – Fed’s Flow of Funds with Rest of World: Here, it’s important to understand that the Federal Reserve is no more Federal [dare we say foreign?] than Federal Express. While viewing this chart, consider the following excerpts [minutes] from a 1992 FOMC meeting [hat-tip, Adrian Douglas]:

CHAIRMAN GREENSPAN. Did I hear you correctly when you said that the gold exports in October appear to have come from the coffers of the Federal Reserve Bank of New York? Has anyone looked lately?

MR. TRUMAN. Well, I didn't want to tell too many secrets in this temple!

VICE CHAIRMAN CORRIGAN. Obviously, we knew what happened to the gold, but I don't think we knew what it did to exports.

MR. TRUMAN. What happens in the Census data is that the Federal Reserve Bank of New York is treated as a foreign country. [Laughter] And when a real foreign country takes some of the gold out of New York and ships it abroad, it counts first as imports and then as exports. However, the import side is not picked up in the Census data. So there you get the export side of it.

MR. LAWARE. Great accounting!

MR. BOEHNE. Great confidence building!

MR. TRUMAN. That's because you haven't been filling out your import documents!

MR. ANGELL. Let me run this by again. You mean a country owns gold and has it stored in the Federal Reserve Bank of New York and if they ship it out, that's an export?

MR. TRUMAN. And in the balance of payments accounts it also counts as an import, so it washes out.

CHAIRMAN GREENSPAN. The Federal Reserve Bank's basement is a foreign country. When they move it out of the basement into the United States, it's an import. Then, when they ship it out again, it's an export.

MR. ANGELL. That makes sense!

MR. TRUMAN. And sometimes when they sell the gold, it might be sold into the United States, so it should count as an import. It doesn't necessarily always show up as an export.

MR. BOEHNE. That really clarifies it!

MR. KELLEY. Does it have to get out of your vault at all in order to be considered an import and an export?

VICE CHAIRMAN CORRIGAN. Well, I'm not even going to try to answer that. In this particular case I know what happened, so I think. ...

Scrolling down to line # 14 on page 24 and note the date of the report, that being, March 11, 2010. It states that the U.S. [not the Fed] had “net sales” of 190.9 billion dollars worth of gold / SDRs in Q3/09. 190.9 billion @ 1,000 per ounce would be 5,937 tonnes of gold:

Note the HUGE size of the transaction, which in bullion terms, at 1,000 per ounce would represent ¾ of all sovereign gold alleged to be held by the U.S. Secondly, note that the authors of this report [that being the Fed] did not report this MASSIVE transaction in the quarter which it occurred. Additionally, when this transaction was finally allocated it was not highlighted, asterisked, or footnoted as having occurred in a period other than the current reporting period [most people only look at the current period]. What is one to think of this style of reporting of such a major transaction involving a notional amount representing ¾ of the entire U.S. sovereign gold reserve?

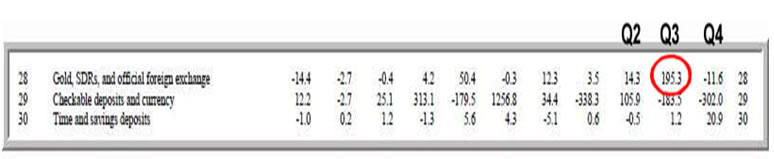

Also take note how, at the same time that the U.S. had “net sales” of SDRs / gold – there appeared in the Fed’s flow of funds – a similar dollar amount being credited [also back-dated] to the U.S. Government [Treasury] – from page 23, line 28 – Federal Government:

The “net sales” of SDRs / gold in the first table above are best described by James Turk:

“New SDRs were created [out of thin air] by the IMF in Aug 2009, some of which were allocated to the US. But the Treasury can't spend SDRs, so it needed to turn them into dollars. In other words, the Treasury needed to monetize these SDRs to make them useful to it. So they sent their SDRs to the Fed, which then credited the equivalent amount of dollars in the Treasury's checking account at the Fed. SDRs are turned into US dollar currency the same way the Fed turned the US Gold Reserve into dollar currency. You can see that the SDRs were turned into dollar currency on the Fed's balance sheet.” http://www.federalreserve.gov/releases/h41/20091001/

The SDRs created by the I.M.F. which Mr. Turk speaks of are explained in this press release by the I.M.F.:

IMF Executive Board Backs US$250 Billion SDR Allocation to Boost Global Liquidity

Press Release No. 09/264

July 20, 2009

The Executive Board of the International Monetary Fund (IMF) has backed an allocation of Special Drawing Rights (SDRs) < http://www.imf.org/external/np/exr/facts/sdr.htm> equivalent to US$250 billion to provide liquidity to the global economic system by supplementing the Fund’s 186 member countries’ foreign exchange reserves. The equivalent of nearly US$100 billion of the new allocation will go to emerging markets and developing countries, of which low-income countries will receive over US$18 billion. The proposal < http://www.imf.org/external/np/exr/faq/sdrallocfaqs.htm> will now be submitted to the IMF’s Board of Governors for final approval.

“The SDR allocation is a key part of the Fund’s response to the global crisis, offering significant support to its members in these difficult times,” IMF Managing Director Dominique Strauss-Kahn said.

The SDR allocation was requested as part of a US$1.1 trillion plan < http://www.imf.org/external/np/exr/faq/sdrfaqs.htm> agreed at the G-20 summit < http://www.londonsummit.gov.uk/en/summit-aims/summit-communique/ > in London in April and endorsed by the International Monetary and Financial Committee (IMFC) to tackle the global financial and economic crisis by restoring credit, growth and jobs in the world economy. If approved by the Board of Governors with an 85 percent majority of the total voting power in a vote scheduled to close on August 7, the SDR allocation will be in effect on August 28.

"The allocation is a prime example of a cooperative monetary response to the global financial crisis," the Managing Director underscored.

The SDR allocation < http://www.imf.org/external/np/tre/sdr/proposal/2009/0709.htm > will be made to IMF members that are participants in the Special Drawing Rights Department < http://www.imf.org/external/pubs/ft/pam/pam45/pdf/chap3.pdf> (currently all members) in proportion to their existing quotas in the Fund, which are based broadly on their relative size in the global economy. The operation will increase each country’s allocation of SDRs by approximately 74 percent of its quota, and Fund members’ total allocation to an amount equivalent to about $283 billion, from about $33 billion (SDR 21.4 billion).

SDRs allocated to members will count toward their reserve assets, acting as a low cost liquidity buffer for low-income countries and emerging markets and reducing the need for excessive self-insurance. Some members may choose to sell part or all of their allocation to other members in exchange for hard currency--for example, to meet balance of payments needs--while other members may choose to buy more SDRs as a means of reallocating their reserves. In supporting the allocation proposal, the Executive Board stressed that it should not weaken the pursuit of prudent macroeconomic policies, and should not substitute for a Fund-supported program or postpone needed policy adjustments.

Bait and Switch

The I.M.F. liquidity injection outlined above was designed to replace the maturing Central Bank Swap Lines – which coincidentally had brought a great deal of scorn on the U.S. Federal Reserve. Do you all remember how the maturity of the Central Bank Swap lines without renewal was sold [as in a bill of goods] in the mainstream financial press as a sign of a global financial recovery?

The reality is that temporary liquidity measures were made permanent – thanks to the benevolence of the I.M.F.

The balance of this article is for subscribers. Rob Kirby is the editor of the Kirby Analytics Bi-weekly Online Newsletter, which provides proprietary Macroeconomic Research. Subscribe here.

By Rob Kirby

http://www.kirbyanalytics.com/

Rob Kirby is proprietor of Kirbyanalytics.com and sales agent for Bullion Custodial Services. Subscribers to the Kirbyanalytics newsletter can look forward to a weekend publication analyzing many recent global geo-political events and more. Subscribe to Kirbyanalytics news letter here. Buy physical gold, silver or platinum bullion here.

Copyright © 2010 Rob Kirby - All rights reserved.

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Rob Kirby Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.